Business

CEB infrastructure development to be bolstered with USD 150 million ADB loan

By Ifham Nizam

The Asian Development Bank (ADB) yesterday signed an agreement to provide a USD150 million loan to the Ceylon Electricity Board (CEB), marking a significant step forward in Sri Lanka’s energy infrastructure development.The agreement follows extensive evaluations by the ADB on the technical, economic and social merits of CEB’s proposed investment projects.

CEB media spokesperson, Eng. A.D.K. Parakramasinghe, told The Island Financial Review that this loan will enable CEB to implement key projects in the long-term transmission plan from 2025 to 2027, enhancing the reliability and stability of national grid. “Importantly, it supports the integration of large-scale renewable energy projects into the national grid, he said.

He said that the financing will cover the construction of six new grid substations, 87 kilometers of 132 kV transmission lines, 45 kilometers of 220 kV transmission lines and the augmentation of two existing grid substations.

“These developments are expected to significantly bolster the capacity and efficiency of the CEB’s transmission network, which currently spans 3,400 kilometers of high-voltage lines and 90 grid substations, he added.

Parakramasinghe emphasized the broader impact of this initiative: “The improvements funded by this loan align with our commitment to sustainable energy development and ensuring reliable electricity for over 7.5 million customers across Sri Lanka.

“The loan approval in November 2024 highlights ADB’s confidence in CEB’s strategic direction, particularly in integrating renewable energy sources into the country’s power system—a move seen as pivotal for sustainable development in Sri Lanka, he stressed.

Business

NDB Bank triumphs with 8 prestigious awards at National Sales Awards 2024

NDB Bank celebrates a momentous achievement at the National Sales Awards (NSA) 2024, organised by the Sri Lanka Institute of Marketing (SLIM). The Bank’s sales team excelled at this year’s ceremony, securing eight distinguished awards.

The highlight of the evening was Kasun Jayawardana, who claimed the coveted Gold Award for Overall National Sales Manager, underscoring his leadership and remarkable contributions to the sales function. In the Front-Liner Banking category, Nethmi Kumarihami brought home the Gold Award, while Kaveesha Weerarathne secured the Silver Award, reflecting their dedication to delivering exceptional service at the forefront of banking operations.

Further enhancing NDB’s success, Iresha Jayasinghe was honoured with the Gold Award in the Sales Supervisor Banking category, while S. Vasanthan earned the Bronze Award in the same category for outstanding performance and team leadership. Chamil Bandara excelled in the Territory Manager Banking category, earning the Gold Award for his expertise and strategic acumen in regional sales management.

Adding to the Bank’s accolades, Niroshan Gamage received the Merit Award in the Sales Executive Banking category, and Praveen Senevirathne was recognised with the Bronze Award for Regional Sales Manager, further highlighting the strength, consistency, and capability of NDB’s dynamic sales team.

Speaking on the achievement, Sameera Senarath, Assistant Vice President of Sales at NDB, expressed his pride in the team’s continued success, stating, “These awards reflect NDB’s unwavering commitment to developing and recognising our exceptional sales talent. The dedication and hard work demonstrated by our team members continue to inspire confidence among our customers and drive us forward as a leading player in the banking sector.”

Business

CSE energized by government’s decision on withholding tax

By Hiran H. Senewiratne

President Anura Kumara Dissanayake’s statement in parliament on increasing withholding tax on conservative investments, such as fixed deposits and savings, from 5 percent to 10 percent, positively impacted the stock market and attracted more local and foreign investors, market analysts said.

This new withholdings tax increase by the government does not apply to stock market transactions. Amid those developments mixed reactions were noted in both indices yesterday. The All Share Price Index went up by 39.96 points, while S and P SL20 went down by 3.28 points. Turnover stood at Rs 5.8 billion with 12 crossings.

Those crossings were reported in LVL Energy where 68.8 million shares crossed to the tune of Rs 407.2 million; its shares traded at Rs 6, Sunshine Holdings 1 million shares crossed to the tune of Rs 86 million, its shares traded at Rs 86, PickMe 1.19 million shares crossed for Rs 78 million; its shares traded at Rs 5.70, CIC Holdings 802,000 shares crossed for 72.2 million; its shares sold at Rs 90, HNB 200,000 shares crossed for Rs 54.8 million; its shares traded at Rs 274, Commercial Bank 300,000 shares crossed to the tune of Rs 40.8 million; its shares sold at Rs 136, PGP Glass 958,000 shares crossed to the tune of Rs 29.7 million; its shares traded at Rs 31, JKH 1 million shares crossed to the tune of Rs 22.50 million, its shares traded at Rs 22.50, Commercial Bank 200,000 shares crossed for Rs 21.1 million; its shares traded at Rs 105.50, Commercial Credit and Finance 425,000 shares crossed for Rs 20.80 and its shares sold at Rs 49, Vallibel One 400,000 shares crossed for Rs 20.8 million; its shares traded at Rs 52 and Maravila Resorts 3.2 million shares crossed for Rs 20.4 million; its shares fetched Rs 6.40.

In the retail market, companies that mainly contributed to the turnover were; JKH Rs 381 million (16.9 million shares traded), LMF Rs 369 million (89 million shares traded), Kotagala Plantations Rs 218 million (23.3 million shares traded), Lanka IOC Rs 174 million (1.3 million shares traded), LV Energy Rs 107.5 million (26 million shares traded) and Dipped Products Rs 161 million (3.1million shares traded). During the day 365 million share volumes changed hands in 36000 transactions.

It is said that the services sector is leading the market, especially LVL Energy and Pickme. Moreover, the manufacturing sector is also active in the market, especially JKH.

Yesterday the rupee depreciated steeply to Rs 292.70/293.00 to the US dollar in the spot market, from Rs 291.25/50 to the US dollar the previous day, while bond yields were up, dealers said.

Analysts had warned that if excess liquidity was allowed to build up, including from acquisition of dollars, the currency will weaken when they are used for imports as domestic prices are pushed up from higher demand.

If domestic demand and credit is pushed up from liquidity from Central Bank dollar rupee swaps the same consequence will follow as there was no commitment to defend the currency against excess liquidity under a so-called flexible exchange rate.

Flexible exchange rates, coupled with money printed to reach high cost of living targets, have triggered social unrest and also sovereign default in reserve collecting Central Banks.

A bond maturing on 15.09.2027 was quoted at 9.75/80 percent. A bond maturing on 15.02.2028 was quoted at 10.10/15 percent. A bond maturing on 01.05.2028 was quoted stable at 10.20/25 percent. A bond maturing on 15.09.2029 was quoted stable at 10.65/70 percent.

Business

KR Ravindran honoured for DEI by IFC/WIM

One of Sri Lanka respected business leaders and the only Sri Lankan to head the Rotary Global as Rotary International President based in Chicago , US- K R Ravindran was recognized by WIM /IFC ( member of World Bank) in Sri Lanka for his role played in promoting DEI in Rotary and his work place .

Ravindran co-founded Printcare Plc with the late Merrill J Fernando nearly 40 years ago. Printcare is one of South Asia’s highly respected, diversified printing and packaging companies with multiple manufacturing plants in Sri Lanka, India, and Africa. Printcare is also well known in the industry as a sought-after employer. It promotes DEI strongly, offers several worker-friendly schemes, employs physically and mentally challenged people, and works with and supports the schools and community around its plants

Ravindran thanked the Women in Management team, for their unwavering dedication to advancing Diversity, Equity, and Inclusion at a time especially at a time when such values are being questioned and regrettably scaled back in some parts of the world.

“In the U.S., for instance, leading companies like Walmart, John Deere, Ford, and Harley Davidson have recently reduced or halted their DEI initiatives, citing financial pressures and maybe current political trends. In contrast, companies in Sri Lanka remain steadfast in their commitment to creating a genuinely respectful workplace, fostering a space where everyone feels valued, heard, and empowered and where differences are celebrated as strengths, said KR Ravindran who has also been featured on the cover of the worldwide-circulating printing magazine Heidelberg News.

-

Opinion4 days ago

Opinion4 days agoDegree is not a title!

-

Features5 days ago

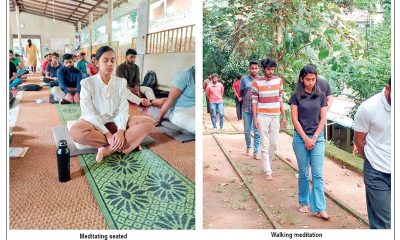

Features5 days agoSpiritual Awakening of a Village

-

News3 days ago

News3 days agoInnovative water management techniques revolutionising paddy cultivation in Lanka

-

News6 days ago

News6 days agoOver 300,000 Sri Lankans leave for overseas jobs this year

-

Latest News6 days ago

Latest News6 days agoIndia’s Gukesh beats China’s Ding to become youngest chess world champion

-

Features5 days ago

Features5 days agoRevisiting the role of education in shaping shared futures

-

Features5 days ago

Features5 days agoThe Silence of the Speaker and other matters

-

Features2 days ago

Features2 days agoThe Degree Circus