News

SJB warns against counting foreign loans as part of forex reserves

The SJB has cautioned the Wickremesinghe-Rajapaksa government against counting loans received from the IMF, World Bank and ADB as external buffers as they have to be paid back.

SJB MP Dr. Harsha de Silva said loans secured from whatever sources weren’t earned reserves. The former UNP State Minister and economist said so when we sought his opinion on the government declaration that with the IMF second tranche amounting to USD 337 mn and WB’s USD 250 mn loan official reserves were expected to pass USD 4 bn by end of next week.

The President’s Media Division (PMD) said that this figure was much higher than expected. The PMD issued the statement hours after SLPP leader Mahinda Rajapaksa, in a statement issued to the media declared that USD 10,000 million in new ISBs borrowed between 2015 and 2019 broke the back of our economy. The former President found fault with the Sirisena-Wickremesinghe administration.

The SJB MP said: “Generally, the net international reserves refers to gross usable reserves less short term drains. Now this is where the lies of the Rajapaksa regime led to a false sense of security on usable reserves. Why did Foreign Minister Ali Sabry, PC, announce on 12 April 2023 that the government was unable to meet two external debt payments amounting to approximately USD 200m even though former CBSL Governor Ajith Nivard Cabraal had claimed we had some USD 1.6 b in reserves?

Truth is the government apparently had only USD 20 m of usable reserves and not USD 1.6b. The USD 1.5b Chinese currency swap was not usable due to restrictions on imports cover. So if usable reserves have now increased due to import cover restrictions being met and the Chinese money is available for then one can say we are in a better place in terms of buffers.”

Commenting on funds received from various sources, the MP questioned the continuing practice of counting loans, whether from World Bank and ADB as external buffers. That is not the ideal. Because these need to be paid back and not earned reserves. Fact is most countries count such long term loans as reserves.

But there again the Rajapaksa was misled that when they lost the election in Jan 2015, USD 2.2b were short-term swaps and another USD 3.5b consisted of ‘hot money’ meaning foreigners investing in Treasury paper having converted USD in to LKR which could be reversed immediately depending on interest rate movements.

So of the then USD 8.2b forex reserves almost USD 6b was not stable. That is why counting short-term swaps and hot money is misleading. In fact, converting these large unstable reserves into long term reserves amounting to close to USD 6b is a major reason beyond rolling over some USD 5 billion during the Yahapalana government that saw large-scale borrowings through ISBs.

At the time Gotabaya Rajapaksa came in reserves consisted of less than USD 1b in such unstable reserves, down from almost USD 6b. Also given 2020 was an election year the CBSL had borrowed an additional USD 2.9b in ISB preparing for any potential market risk. In fact, if not for this move of building external buffers Sri Lanka would have gone bankrupt much earlier after that the government made serious policy blunders. As we all now know, the government kept using the reserves to pay back foreign loans after the country was downgraded by the rating agencies and doors to the international capital market were closed.

On the other side of the equation is the amount in short term drains, meaning the total amount of USD debt that needs to be paid by the government in usually one year.

So, if the government is comfortable on both counts then it’s ok to be a little confident. I don’t have the numbers to make that call. Having said that I must reiterate that ultimately it’s earned dollars not borrowed dollars that really matter.” (SF)

Latest News

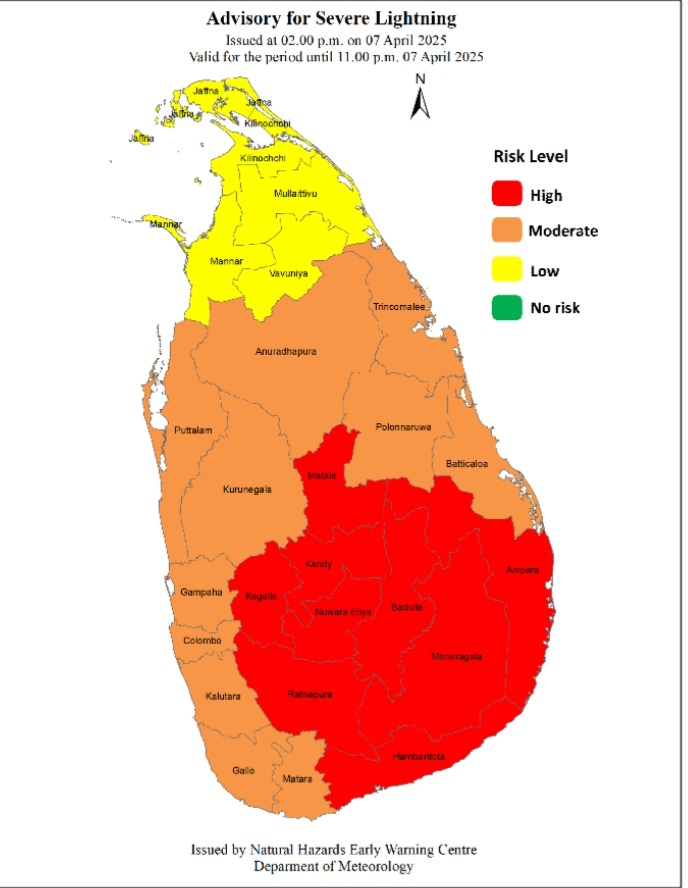

Advisory for severe lightning issued for Sabaragamuwa, Central and Uva provinces and in Hambanthota district

The Natural Hazards Early Warning Centre has issued an Advisory for Severe Lightning for the Sabaragamuwa, Central and Uva provinces and in Hambanthota district.

The advisory issued at 02.00 p.m. today [07 April 2025] is valid for the period until 11.00 p.m. 07 April 2025

The public are warned that thundershowers accompanied by severe lightning are likely to occur at several places in for Sabaragamuwa, Central and Uva provinces and in Hambantota district. There may be temporary localized strong winds during thundershowers. General public is kindly requested to take adequate precautions to minimize damages caused by lightning activity.

ACTION REQUIRED:

The Department of Meteorology advises that people should:

Seek shelter, preferably indoors and never under trees.

• Avoid open areas such as paddy fields, tea plantations and open water bodies during thunderstorms.

• Avoid using wired telephones and connected electric appliances during thunderstorms.

• Avoid using open vehicles, such as bicycles, tractors and boats etc.

• Beware of fallen trees and power lines.

• For emergency assistance contact the local disaster management authorities.

Latest News

“Census of Population and Housing 2024” Report Presented to the President

The report of the “Census of Population and Housing 2024,” conducted by the Department of Census and Statistics, was officially handed over to President Anura Kumara Disanayake this morning (07) at the Presidential Secretariat.

This preliminary report has been prepared based on island wide data collected between October and December 2024.

The report provides details on Sri Lanka’s population, its growth and the distribution of the population across districts.

The information gathered through the census is vital not only for the government but also for other institutions in formulating policies and development plans essential for the country’s progress. Significantly, for the first time in the history of census-collecting in Sri Lanka, data collection was carried out using tablet computers and user-friendly mobile devices.

The event was attended by Deputy Minister of Finance & Planning, Harshana Suriyapperuma, Secretary to the President Dr. Nandika Sanath Kumanayake, Secretary to the Ministry of Finance Mahinda Siriwardana, Director General of the Department of Census and Statistics D.D.G.A. Senevirathne and several other officials.

Business

Central Bank Presents Annual Economic Review 2024 to President

The Central Bank of Sri Lanka today (07) presented its flagship publication, the Annual Economic Review for 2024 (AER 2024), to President and Minister of Finance, Anura Kumara Disanayake, highlighting the steady progress of Sri Lanka’s economic recovery following the country’s most severe downturn in recent history.

The report was officially handed over by Dr. P. Nandalal Weerasinghe, Governor of the Central Bank, during a special ceremony held at the Presidential Secretariat.

AER 2024 comprises four main chapters: Macroeconomic Developments, Conditions of the Financial System, Review of Central Bank’s Policies and Macroeconomic Outlook.

According to the Review, the Sri Lankan economy showed significant signs of recovery in 2024, following the deep economic crisis experienced two years ago. The recovery trajectory, though challenging, has been notably faster than that of many other debt-distressed countries.

Improvements in economic activity, a partial resurgence in purchasing power and reduced uncertainty are among the key positive indicators noted in the report.

The event was attended by Dr. Nandika Sanath Kumanayake, Secretary to the President, K. M. Mahinda Siriwardena, Secretary to the Treasury, Mrs. K. M. A. N. Daulagala, Senior Deputy Governor, Dr. C. Amarasekara, Assistant Governor, Dr. (Mrs.) S. Jegajeevan, Director of Economic Research and Dr. L. R. C. Pathberiya and Additional Director of Economic Research at the Central Bank Dr. V. D. Wickramarachchi.

[PMD]

-

Business16 hours ago

Business16 hours agoColombo Coffee wins coveted management awards

-

Features2 days ago

Features2 days agoStarlink in the Global South

-

Business3 days ago

Business3 days agoDaraz Sri Lanka ushers in the New Year with 4.4 Avurudu Wasi Pro Max – Sri Lanka’s biggest online Avurudu sale

-

Business4 days ago

Business4 days agoStrengthening SDG integration into provincial planning and development process

-

Business3 days ago

Business3 days agoNew SL Sovereign Bonds win foreign investor confidence

-

Sports5 days ago

Sports5 days agoTo play or not to play is Richmond’s decision

-

Features2 days ago

Features2 days agoModi’s Sri Lanka Sojourn

-

Sports4 days ago

Sports4 days agoNew Zealand under 85kg rugby team set for historic tour of Sri Lanka