Features

On to the private sector – JKH, Hemas and Schaffter company

Working simultaneously with state and private sectors

(Excerpted from the autobiography of Lalith de Mel)

About the time I joined the SLT Board, Ken Balendra, the Chairman of John Keells Holdings, invited me to join the Board of his company. That was the start of my working simultaneously with the private sector and the State sector. Ken was a strong personality and could by himself enforce the disciplines of good governance. He was due to retire and he felt, and I think correctly, that he should leave JKH with a more formal structure to ensure good governance. He appointed three Independent Directors, S. Easparathasan, Franklyn Amerasinghe and myself, and later Tarun Das.

There was a major issue with the management arrangements at JKH. It had a serious ‘Parents-and-Children’ syndrome. The Executive Directors managed their segments of responsibility, like a chief executive. So they became the children managing the business. But they were also in corporate terms the parent responsible to the Board for this segment’s activity. So in effect they reported to themselves for their area of responsibility. So they were both parents and children.

In management terms this was a bad model and has been extensively discussed in the literature. I found a very good book on the subject and insisted that they all read it. The JKH team comprised nice and intelligent people and they were prepared to think positively about change where it was necessary. It was a pleasure working with this group, and they appreciated what I did for them.

They accepted that the business units should have a head reporting to the Directors – a separation of parents from children. The parents would be accountable to the Board. This is the classic management model and I was glad to take JKH down this road.

JKH had an entrepreneurial culture. I think this heritage came from Mark Bostock’s time. Instinct had played a role in selecting acquisitions. Persuading them to adopt hurdle rates and cash-flow paybacks helped to test acquisitions and to dispose of some bad acquisitions. When I was on the Board, the LMS (Lanka Marine Services) acquisition came up for discussion. The financials were good. I had a Shell background in my youth and knew something about petroleum products and bunkers.

I discreetly asked Susantha Ratnayake (who was promoting the acquisition) whether he or JKH knew anything about the bunker business. He said, `No, but Sir, it is not rocket science and we can learn it.’ He had acquired some of the JKH entrepreneurial culture. It was brave of him to persuade the Board to buy a business without knowing the business. They bought it and it was very profitable.

Ken Balendra knew his team better than anybody else and had selected Lintotawela to succeed him. He was a finance man and perhaps Ken thought it best to have a numbers man to preside over his entrepreneurial troops. I did not think he was quite JKH style and thought that Susantha was the driving force in the business. After I left the Board, whenever I met Susantha I told him that he was developing a stoop by carrying the business on his shoulders (he turned a light shade of pink and hated me for saying it). Subsequently Susantha Ratnayake became the very successful Chairman of JKH.

LEAVING JKH

I met Abbas Esufally, I think it was at the Golf Club, and he said Hemas was debating whether to go public (with a listing on the CSE), and he wanted me to help them to decide, and if they went ahead to help them through the process. I agreed to meet them and talk about it as I held the view, and still do, that a private sector economy would survive best if all the big companies went public, so that the wider public could also benefit from their success, and this would create inclusive growth.

Eventually I agreed to help Hemas, and I told JKH about it. Lintotawela was unhappy and I could not be on the JKH Board and the Hemas Board. He saw a conflict of interest because JKH was in Hotels and Serendib had three hotels, one in Sigiriya and one in Waikkal, where JKH had no hotels, and one three-star in Bentota where JKH had the five-star Bentota Beach Hotel. The JKH team tried to persuade me to dump Hemas and stay with them, but I felt I had done my bit for JKH and it was an interesting challenge to take Hemas public.

I resigned from the JKH Board to join Hemas. The JKH Directors continued as friends and still Susantha very kindly invites me for dinner from time to time.

Investing in Serendib and joining Hemas

Even during the dark days of the war, when tourist arrivals were poor, I believed that in the long-term tourism would be our oil well. To get closer to the industry I wanted to make an investment in a hotel company. Through a mutual friend I met Abbas Esufally and with his help bought the shares of a Director of Serendib Hotels, who was retiring. It was a relatively modest investment but it got me to the top three non-corporate individual shareholders and I was invited to join the Board. I also invested in the quoted Serendib subsidiary companies Sigiriya and Dolphin.

This gave me a good and continuous rolling insight of the tourism industry. I had always been interested in tourism as a good industry for developing countries. This close-up picture of the hotel industry was helpful in developing my knowledge. I was happy to be on the Board.

Serendib was a fairly unstructured business and I endeavoured to help the management develop relevant business processes. I encouraged the management to develop Serendib as a brand and to leverage the Bawa connection.

It was one of Geoffrey Bawa’s early hotels. It had been heavily influenced by 18th century Dutch architecture. The facade viewed from the beach had a remarkable resemblance to the well-preserved Dutch building in Pettah.

The hotel put together a Bawa room to illustrate and leverage the Bawa link. After Srilal Miththapala, the enthusiastic Manager in the early phase, we had Ranil De Silva, a very experienced modern Manager. I was happy to be an active and involved member of the Board, and saw the hotel expanding both physically and in quality and as a shareholder I was pleased that it also was a steady, profitable hotel.

Abbas Esufally, one of the four major shareholders of Hemas Holdings, was Chairman of the Company. He was perceptive of the issues relating to tourism, was a pleasure to work with, and I enjoyed working with him, for many years.

The Minor Group, a big international hotel group with a base in Thailand, had expressed an interest in some form of collaboration. This proved to be a distraction. The Serendib management was heavily involved in building its Anantara property in Kalutara and the Hemas Minor Joint Venture hotel in Tangalle. The joint venture with Minor never happened and Serendib had to consider a life without Minor. This was a new strategic challenge. I did not stand for re-election.

Hemas was owned by four Esufally cousins. Each managed a piece of the business, with freedom to do as they pleased. They had the same cars and same salary and lived down the same road. A high comfort zone.

My role was to explain the process, advantages and consequences of becoming a public company. The big concern was whether the public would buy the shares of a firm in Bristol Street owned by four Borah cousins. I was convinced that a properly-constructed public offering would succeed.

The daunting question for them was whether to remain private in their comfort zone or to release the value by going public and accepting all the restrictions on freedom that came with it. The prospect of becoming billionaires won. But it proved to be a hard struggle to get them to keep their part of the bargain and accept the restrictions on their freedom as a public quoted company. I agreed to come on the Board and lend my name to the public issue and the financial advisers were confident that the issue would be fully subscribed. It was.

Public company

It had three Independent Directors, and I was the Independent Chairman. I tried to perform two roles. To give them the benefit of my management experience and be a mentor to develop the management skills of the company and as Chairman to establish the good governance practices of a public company and create the corporate structures that would help optimize shareholder value.

The first problem

To complacently accept less than the best skills available was not compatible with the obligations of a Chairman, the custodian of the public shareholders’ interests. This created problems. The four family shareholders were all intelligent and educated. In the management structure of any good company, that only gets one to the starting gate. What they all, including Hussein, lacked was good business experience gained by working elsewhere under outstanding managers and a high quality management education.

It was a struggle to get them to accept that they should relinquish the Managing Director type of roles they performed, and to bring in first-class management so as to optimize shareholder value and for them to move to a Non-Executive Chairman type of role.

I can well understand that they would have resented me for pushing them to give up their roles, but probably reluctantly accepted that it was in the best interest of protecting the billions of value they owned in shares. Abbas Esufally was charming and gregarious, looked at it all in a very mature fashion, and took it all in his stride in the interests of developing shareholder value. His only concern was fashioning a useful role when he gave up his executive line job.

The biggest block

Hussein Esufally was the biggest block to creating a proper Board-managed company. Transition from a family firm to public company meant the major roles of managing the business, which were all in Hussein’s hand as the CEO of the family business, had to be vested in the Board headed by the Chairman.

He resented it, but had to accept, for example, that there had to be a Remuneration Committee, an Audit Committee, and that annual plans and investment proposals, etc. had to be approved by the Board. Good governance processes remain cosmetic until you give them teeth, and giving them teeth was not easy.

He saw this as a move of authority from him to me and did not like it, as it affected his ego. His reaction was to endeavour to diminish the image of the Chairman. He did not provide the Chairman with an office or a secretary, let alone a company car or entertainment allowance. When I insisted on an office, he gave me a little cubicle behind a secretary.

This undermined my ability to interact with the senior management as I had no proper venue to meet them and it was not in keeping with the image of a chairman of a public company to ask managers to meet the Chairman in his shoebox! When he had decided that he would be the next chairman, a grand office was created. I was like a shadow hovering relentlessly, pursing the reduction of his powers and creating a proper Board-managed public company.

Snakes and ladders

I thought that over the years I had convinced the family that the best method of protecting their wealth was to be a proper public company with an independent chairman and an experienced management team with a good track record managing it.

Steadily over the years we climbed up the ladder, rung by rung. I thought I had convinced them that the two sacred pillars of a good public company were an independent chairman and an excellent and experienced CEO.

When it was time for me to retire, sadly both these pillars were ignored. It was case of whizzing down a snake at the end. Hussein had decided to be Chairman. An end to independent chairmen at Hemas.

The choice for Chief Executive was Enderby. When I was a Director of CDC Plc in the UK, Donald Peck was Managing Director South Asia and Steven Enderby was a member of his private equity team. Steven Enderby had never managed a business as an executive CEO.

CDC was in private equity operations and Enderby could perhaps use his contacts from private equity days to get some funds to buy Hemas in the market and thereby help the share price. Steven is a friendly, charming and intelligent person but had no general management experience to bring to the party. After a long career of success in my endeavours, this is the one big blot of failure.

Fortunately for shareholders, Hemas had some good people, Malinga Arsakularatne had done an excellent job as Head of Finance. There had been many good marketing men in FMCG. If Hemas was prepared to have a CEO with great potential but no previous CEO experience in a big business, the very talented Kasturi Chellaraja Wilson would have been an excellent choice.

In addition to being appointed, there was also something in the air about Steven Enderby wanting to buy a large block of shares at a discount. I don’t know whether this ever happened. I did not want to be a party to the decisions regarding the Chairman and CEO. I said I must retire from the Board before these decisions were made and did so.I did not leave Hemas with the gratitude of the family but I think it was with their resentment.

Trading in bonds

Dinesh Schaffter wanted my help and guidance on developing a conglomerate of businesses he had put together. I said I would have a good look at his business and see whether I could add value. Ksathriya, as it was called, was managed by a small team of highly-paid managers.

I was appalled by what I saw in the numbers. They had made a number of bad acquisitions and were in the throes of making another, a supermarket chain, which had all the signs of another bad acquisition. Ksathriya was kissing distance away from bankruptcy. The task was not growth but restructuring for survival.

The management team was discontinued. Manjula Mathews, Dinesh’s sister, who also had a financial interest, joined the team to salvage what we could from this business which was in dire straits. This was the beginning of a long association with the Schaffters and their businesses. Ksathriya could not be saved as an ongoing business and all commercial operations dwindled down and were wound up.

Dinesh Schaffter was the eternal entrepreneur and his philosophy was ‘if one failed, look for another’. Ksathriya was reborn as Dunamis. Tucked away within it was a piece of relatively neglected business, which was high risk but interesting. The business called First Capital was a licensed bond trader and could trade in Government securities. So I joined First Capital as a mentor, ended up on the Board, and eventually was Chairman.

Trading in Government securities, to put it very simply, was to buy at the Central Bank auctions with money borrowed from the Banks and sell on at a profit but at very thin margins of profit. It was volume that gave one a meaningful profit, but volume meant high debt. It was a difficult business of predicting trends in interest rates and backing the judgment with high-risk trading.

Good governance was paramount. Processes had to be put in place to ensure good governance of trading and good management and they had to be rigorously enforced. The industry was heavily regulated. Compliance was vital as failure could result in losing the license to trade, which would mean the end of the company.

A compliance team was established but it was necessary for the Board to keep this activity under continuous review. The other area to be managed with utmost care was the management of risk and there was a Risk Management Committee. It was compliance to protect the license and risk to protect the shareholders’ money.

There were the other corporate bells and whistles essential in a public company, like a Remuneration Committee and an Audit Committee, and these were established. Around First Capital, there was another conglomerate developing. Wealth management, investment funds and a stockbroking firm. Good processes were established to facilitate their development.

The Schaffters, Manjula and Dinesh, were delightful people to work with, for many reasons. They were both very bright, there was always a chuckle even when contemplating dire circumstances if things went wrong. Never a risk of rumbling egos. If they had any, they never brought them to work. They always appreciated what I did for them. Whenever I met their father, Chandra Schaffter, he never failed to thank me for helping his children.

The thought of retiring from all work was hovering in my mind. A difficult regulatory development provided the exit. Stringent regulations were introduced about related party transactions. In close-knit conglomerates this was a problem and created the need to unravel them and to create new arrangements that complied with the regulations. At the tail-end of my career I had little appetite to take this on, and I had a good solution.

I had brought two excellent finance people on to the Board, Minette Perera and Nishan Fernando. They had both worked in companies where I was Chairman. Minette at Reckitts and Nishan at SLT. They were appointed to a Related Party Transaction Committee. After watching over it for a few months I knew it was in safe hands, and as I had done my bit for the Schaffters over the years I thought it was in good order not to stand for re-election, and brought the curtain down after a 55-year career.

Features

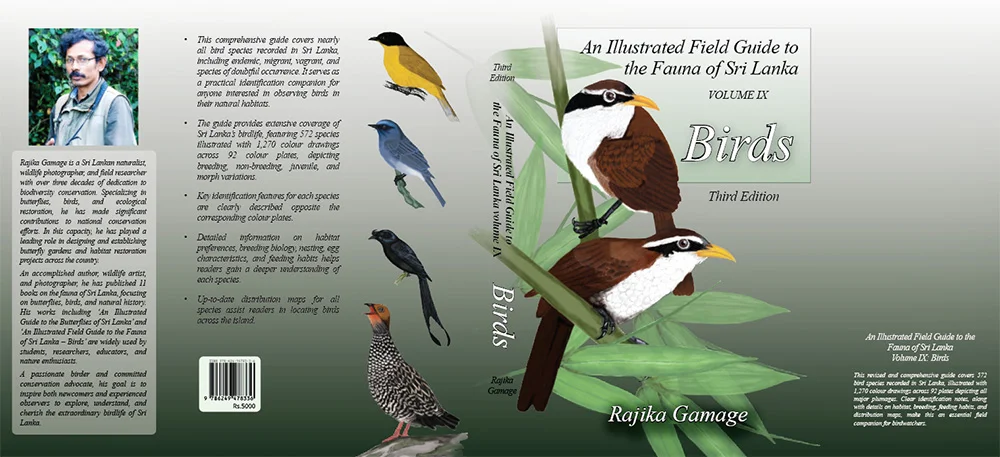

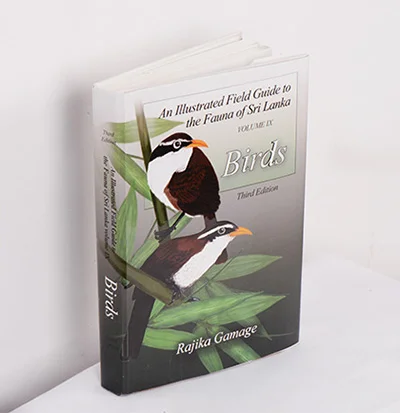

A life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul

Sri Lanka wakes each morning to wings.

From the liquid whistle of a magpie robin in a garden hedge to the distant circling silhouette of an eagle above a forest canopy, birds define the rhythm of the island’s days.

Their colours ignite the imagination; their calls stir memory; their presence offers reassurance that nature still breathes alongside humanity. For conservation biologist Rajika Gamage, these winged lives are more than fleeting beauty—they are a lifelong calling.

Now, after years of patient observation, artistic collaboration, and scientific dedication, Gamage’s latest book, An Illustrated Field Guide to the Fauna of Sri Lanka – Birds, is set to reach readers when it hits the market on March 6.

The new edition promises to become one of the most comprehensive and visually rich bird guides ever produced for Sri Lanka.

Speaking to The Island, Gamage reflected on the inspiration behind his work and the enduring fascination birds hold for people across the country.

“Birds are an incredibly diverse group,” he said. “Their bright colours, distinct songs and calls, and showy displays contribute to their uniqueness, which is appreciated by all bird-loving individuals.”

Birds, he explained, occupy a special place in the natural world because they are among the most visible forms of wildlife. Unlike elusive mammals or secretive reptiles, birds share human spaces openly.

“Birds are widely distributed in all parts of the globe in large enough populations, making them the most common wildlife around human habitations,” Gamage said. “This offers a unique opportunity for observing and monitoring their diverse plumage and behaviours for conservation and recreational purposes.”

This accessibility has made birdwatching one of the most popular forms of wildlife observation in Sri Lanka, attracting everyone from seasoned scientists to curious schoolchildren.

A remarkable island of avian diversity

Despite its small size, Sri Lanka possesses extraordinary bird diversity.

According to Gamage, the country’s geographic position, varied climate, and diverse habitats—from coastal wetlands and rainforests to montane cloud forests and dry-zone scrublands—have created ideal conditions for birdlife.

“Sri Lanka is home to a rich diversity of birdlife, with a total of 522 bird species recorded in the country,” he said. “These species are spread across 23 orders, 89 families, and 267 genera.”

Of these, 478 species have been fully confirmed. Among them, 209 are breeding residents, meaning they live and reproduce on the island throughout the year.

Even more remarkable is Sri Lanka’s high level of endemism.

“Thirty-five of these breeding resident species are endemic to Sri Lanka,” Gamage noted. “They are confined entirely to the island, making them globally significant.”

These endemic species—from forest-dwelling flycatchers to vividly coloured barbets—represent evolutionary lineages shaped by Sri Lanka’s long geological isolation and ecological uniqueness.

In addition to resident birds, Sri Lanka also serves as a seasonal refuge for migratory species traveling thousands of kilometres.

“There are regular migrants that arrive annually, as well as irregular migrants that visit less predictably,” Gamage explained. “Vagrants, birds that appear outside their typical migratory routes, have also been spotted occasionally.”

Such unexpected visitors often generate excitement among birdwatchers and scientists alike, providing valuable insights into migration patterns and environmental change.

Rajika Gamage

A guide born from passion and necessity

The new field guide represents the culmination of years of research and builds upon Gamage’s earlier publication, which was released in 2017.

“The stimulus for this bird guide was due to the success of my first book,” he said. “This new edition aims to facilitate identification and provide an idea of what to look for in observed habitats or regions.”

The book is designed not merely as a scientific reference but as an accessible companion for anyone interested in birds. Its structure reflects this dual purpose.

“The first section is dedicated to the introduction, geography, and life history of Sri Lankan birds,” Gamage explained. “The second section is the main body of the guide, which illustrates 532 species of birds.”

Each illustration has been carefully crafted in colour to capture the distinctive plumage of each species.

“All illustrations are designed to show each bird’s significant and distinct plumage,” he said. “Where possible, the breeding, non-breeding, and juvenile plumages are provided.”

This attention to detail is especially important because many birds change appearance as they mature.

“Some groups, especially gulls, display many plumages between juveniles and adults,” Gamage noted. “Many take several years to develop full adult plumage and pass through semi-adult stages.”

By illustrating these stages, the guide helps birdwatchers avoid misidentification and deepen their understanding of avian development.

New discoveries and evolving science

One of the most exciting aspects of the new edition is its inclusion of newly recorded species and updated scientific classifications.

“Changes in the bird list of Sri Lanka, especially newly added endemic birds such as the Sri Lankan Shama, Sri Lanka Lesser Flameback, and Greater Flameback, are now included,” Gamage said.

Scientific names and classifications are not static; they evolve as researchers learn more about genetic relationships and species boundaries. The guide reflects these changes, ensuring it remains scientifically current.

The book also incorporates conservation status information based on the latest National Red Data Report and global assessments.

“The conservation status of Sri Lankan birds, as listed in the 2022 National Red Data Report and the global Red Data Report, are included,” Gamage said.

This information is vital for conservation planning and public awareness, highlighting which species face the greatest risk of extinction.

The guide also documents rare and accidental visitors, including species such as the Blue-and-white Flycatcher, Rufous-tailed Rock-thrush, and European Honey-buzzard.

“These represent accidental visitors and newly recorded vagrants,” Gamage said. “Altogether, the first edition offers some 25 additional species, all illustrated.”

Art and science in harmony

Unlike many field guides that rely heavily on photographs, Gamage’s book emphasises detailed illustrations. This choice reflects the unique advantages of scientific art.

Illustrations can emphasise diagnostic features, eliminate distracting backgrounds, and present birds in standardised poses, making identification easier.

“The principal birds on each page are painted to a standard scale,” Gamage explained. “Flight and behavioural sketches are shown at smaller scales.”

The guide also includes descriptions of habitats, distribution, nesting behaviour, and alternative names in English, Sinhala, and Tamil.

“The majority of birds have more than one English, Sinhala, and Tamil name,” he said. “All of these are included.”

This multilingual approach reflects Sri Lanka’s cultural diversity and ensures the guide is accessible to a wider audience.

A tool for conservation and connection

Beyond its scientific value, Gamage believes the book serves a deeper purpose: strengthening the bond between people and nature.

By helping readers identify birds and understand their lives, the guide fosters appreciation and responsibility.

“This field guide aims to facilitate identification and provide a general introduction to birds,” he said.

In an era of rapid environmental change, such knowledge is essential. Habitat loss, climate change, and human activity continue to threaten bird populations worldwide, including in Sri Lanka.

Yet birds also offer hope.

Their presence in gardens, wetlands, and forests reminds people of nature’s resilience—and their own role in protecting it.

Gamage hopes the guide will inspire both seasoned ornithologists and beginners alike.

“All these changes will make An Illustrated Field Guide to the Fauna of Sri Lanka – Birds one of the most comprehensive and accurate guides available within Sri Lanka,” he said.

A lifelong devotion takes flight

For Rajika Gamage, birds are not merely subjects of study—they are companions in a lifelong journey of discovery.

Each call heard at dawn, each silhouette glimpsed against the sky, each feathered visitor from distant lands reinforces the wonder that first drew him to ornithology.

With the release of his new book on March 6, that wonder will now be shared more widely than ever before.

In its pages, readers will find not only identification keys and scientific facts, but also something more enduring—the story of an island, told through wings, colour, and song.

By Ifham Nizam

Features

Letting go: A Buddhist perspective

Buddhism, one of the world’s oldest religions, offers profound insights into the nature of existence and the ways we can alleviate our suffering. As one of the world’s most profound spiritual traditions, it offers a transformative solution: the art of letting go. Unlike simply losing interest in things or giving up, letting go in Buddhism is about liberation, releasing ourselves from the chain of attachment that prevents us from experiencing true peace and happiness. Letting go is a profound philosophical concept in Buddhism, deeply intertwined with an understanding of suffering, attachment, and the nature of reality. This philosophy encourages us to release our grip on desires, attachments, and on what we hold dear- whether relationships, material goods, or even their identities, ultimately leading to greater peace and enlightenment. Our tendency to cling tightly to the various aspects of life leads to a significant source of stress. We tend to grasp at things, perceiving them as solid and permanent, yet much of what we hold onto is transient and subject to change. This mistaken belief in permanence can trap us in cycles of worry, fear, and anxiety.

The challenge of letting go is especially evident during difficult periods in life. We may find ourselves ruminating over lost opportunities, failed relationships, and unmet expectations. Such thoughts can keep us ensnared in emotions like hurt, guilt, and shame, hindering our ability to move forward. By holding onto the past, we often prevent ourselves from embracing the present and future.

At the heart of Buddhist practice lies the concept of letting go, often encapsulated in the term “non-attachment.” Letting go is a crucial concept in both Buddhism and Christianity, emphasising the release of attachments that bind us and contribute to our suffering. At its core, letting go is about finding freedom from desires and acknowledging that both relationships and material possessions are fleeting and transient.

In Buddhism, letting go, or non-attachment, is fundamental for achieving inner peace. The First Noble Truth acknowledges that life is filled with suffering, often rooted in our cravings and attachment to things. The Second Noble Truth teaches that by letting go of this craving, we can transcend the cycles of life and attain enlightenment.

Spiritually, Buddhism emphasises the impermanence of all things (annica). We tend to cling to people, experiences, and even our identities, but everything is fleeting. Recogniing this helps us appreciate the present moment and fosters compassion. Instead of allowing attachments to cloud our relationships, letting go encourages us to engage with others without judgment or expectation, fostering deeper connections.

Philosophically, Buddhism challenges the notion of a permanent self (anatta) that is often the focus of human attachment. It teaches that our identity is not a fixed entity but a collection of experiences and perceptions in constant flux. Understanding this can help us see the futility of clinging to desires and identities, paving the way for a liberated state of being built on wisdom cultivated through meditation and mindfulness.

From a psychological standpoint, letting go can significantly improve our emotional health and well-being. Attachment often breeds fear, anxiety, and stress, while non-attachment promotes resilience and adaptability. When we embrace the idea of impermanence, we become more capable of handling life’s challenges without being overwhelmed. Mindfulness—being present and accepting our emotions without judgment—allows us to process difficult feelings constructively, making it easier to let go of what we cannot control.

Letting go is also an essential concept in Christianity, which emphasises surrender and trust in God. Biblical teachings encourage believers to let go of worries and anxieties, placing their faith in divine providence. For instance, verses like Matthew 6:34 remind individuals not to be anxious about tomorrow, but to focus on the present. By surrendering our burdens to God, we find peace and freedom from the weight of excessive attachment.

Moreover, both traditions highlight the importance of community. In Buddhism, the sangha, or community of practitioners, supports individuals on their journeys toward non-attachment. Similarly, the Christian community encourages believers to lean on one another for support, fostering a sense of belonging and shared faith that helps mitigate the loneliness that comes with attachment.

Ultimately, the concept of letting go serves as a powerful antidote to suffering in both Buddhism and Christianity. By embracing impermanence, cultivating wisdom, and practising mindfulness or faith, individuals can experience profound liberation. In our chaotic world, the principles of letting go offer a clear path toward inner peace, fulfilment, and deeper connections with ourselves, others, and the divine.

Buddhism explores the profound concept of letting go, providing valuable insights into the human experience and pathways to alleviating suffering. Rooted in one of the world’s oldest spiritual traditions, Buddhism presents letting go as a transformative practice, distinct from mere disengagement or giving up. Instead, it encompasses liberation from the chains of attachment that hinder us from experiencing genuine peace and happiness. Christianity too explore this profound concept in its teachings

At the core of Buddhist philosophy lies the idea of non-attachment, which encourages individuals to free themselves from desires and possessions, ultimately leading to tranquility and enlightenment. Letting go is intertwined with an understanding of suffering, attachment, and the transient nature of existence. This philosophy instructs us to relinquish our grip on what we hold dear—whether relationships, material goods, or even our identities—recognising that these are impermanent.

Buddhism’s First Noble Truth acknowledges that life inherently involves suffering, often stemming from our cravings and attachments. The Second Noble Truth reveals that overcoming this craving is key to transcending the cycles of life and achieving enlightenment. Emphasising the impermanence of all things, Buddhism invites us to appreciate the present moment and fosters compassion by helping us detach from fixed identities and experiences. This awareness enriches our relationships, allowing us to connect with others free from judgment or expectation.

Philosophically, Buddhism challenges the notion of a static self (anatta), asserting that our identity is not a fixed concept but rather a fluid collection of experiences. Recognising this notion helps highlight the futility of clinging to desires and identities, opening the door to a liberated existence founded on wisdom cultivated through meditation and mindfulness practices.

From a psychological perspective, the act of letting go can significantly enhance emotional health and well-being. Attachment often fuels fear, anxiety, and stress, while embracing non-attachment cultivates resilience and adaptability. By accepting impermanence, we equip ourselves to face life’s challenges with greater ease. Practicing mindfulness—being present and accepting emotions without judgment—further facilitates the process of releasing what is beyond our control.

In Christianity, the theme of letting go is also prominent, emphasizing surrender and trust in God. Scripture encourages believers to release their worries and anxieties by placing their faith in divine providence. For example, Matthew 6:34 advises individuals to focus on the present rather than fret over the future. By surrendering our burdens to God, we can experience relief from the weight of excessive attachment.

Both traditions underscore the significance of community in supporting the journey of letting go. In Buddhism, the sangha, or community of practitioners, encourages the pursuit of non-attachment. Likewise, Christian fellowship fosters belonging and shared faith, helping believers lean on one another for strength and mitigating the loneliness that can arise from attachment.

Ultimately, the concept of letting go serves as a powerful antidote to suffering in both Buddhism and Christianity. Embracing impermanence, nurturing wisdom, and practising mindfulness or trust can lead individuals toward profound liberation. In an increasingly chaotic world, the principles of letting go illuminate a pathway to inner peace, fulfilment, and deeper connections with ourselves, others, and the divine. By understanding and embodying this philosophy, we can navigate life’s complexities with grace and openness.////Buddhism delves into the profound concept of letting go, offering valuable insights into the human experience and pathways to alleviating suffering. As one of the world’s oldest spiritual traditions, Buddhism presents letting go as a transformative practice that goes beyond mere disengagement or resignation. It represents liberation from the chains of attachment that prevent us from experiencing true peace and happiness. Similarly, Christianity explores this profound concept in its teachings.

At the heart of Buddhist philosophy is the idea of non-attachment, which encourages individuals to free themselves from desires and possessions, ultimately leading to tranquility and enlightenment. Letting go is closely related to an understanding of suffering, attachment, and the impermanent nature of existence. This philosophy guides us to loosen our hold on what we cherish—be it relationships, material possessions, or even our own identities—recognizing that everything is transient. Through this understanding, we can cultivate a deeper sense of peace and fulfillment in our lives.

BY Dr. Justice Chandradasa Nanayakkara

BY Dr. Justice Chandradasa Nanayakkara

Features

Brilliant Navy officer no more

Rear Admiral Udaya Bandara, VSV, USP (retired)

This incident happened in 2006 when I was the Director Naval Operations, Special Forces and Maritime Surveillance under then Commander of the Navy Vice Admiral Wasantha Karannagoda. Udaya (fondly known as Bandi) was a trusted Naval Assistant (NA) to the Commander.

We were going through a very hard time fighting the LTTE Sea Tigers’ explosive-laden suicide boats that our Fast Attack Craft (s) and elite SBS’ Arrow Boats encountered in our littoral sea battles.

Brilliant Marine Engineer Commander (then) Chaminda Dissanayake, who was known for his “out of the box” thinking and superior technical skills on research and development, met me at my office at Naval Headquarters and showed me a blueprint of an explosive- laden remotely controlled small boat.

Udaya’s Naval Assistant’s office was next to mine, the Director Naval Operations office. Both places are very close to the Navy Commander’s office. I walked into Bandi’s office with Commander Dissa and showed this blueprint a brilliant idea. Being a Marine Engineer “par excellence”, Bandi immediately understood the great design. I urged him to brief the Commander of the Navy with Commander Dissa.

My burden was over! Bandi took over the project and within a few weeks we tested our first prototype “Explosive-laden Remotely Controlled arrow boat “at sea off Coral Cove in the Naval Base Trincomalee. It was a complete success.

This remotely controlled boats went out to sea with our SBS arrow boats fleet and had devastating effects against LTTE suicide boats and their small boats fleet. Thanks, Bandi, for your contribution. The present-day Admiral of the Fleet used to tell us during those days “you cannot buy a Navy – you have to build one”!

We built our own small boats squadrons at our boat yards in Welisara and Trincomalee to bring LTTE Sea Tigers. The Special Boats Squadron (SBS) and rapid action boats squadron (RABS) being so useful with remotely controlled explosive-laden arrow boats to win sea battles convincingly.

Bandi used to say, “Navy is a technical service and we should give ALL SRI LANKA NAVY OFFICERS FIRST A TECHNICAL DEGREE AT OUR ACADEMY (BTec degree).” That idea did not receive much attention here, but the Indian Navy—Bandi graduated as a Marine Engineer- at Indian Navy Engineering College SLNS Shivaji in Lonavala, Pune, India— understood this idea well over two decades ago. Indian Navy Commissioned their new Naval Academy at Ezhimala (in Kerala State) which is the largest Naval Academy in Asia (Campus covers area of 2,452 acres) starts its Naval officers training with a BTech degree, regardless of what branch of the navy one joined.

Bandi’s technical expertise was not limited to SLN. He was the pioneer of “Mini – Hydro Power projects” in Sri Lanka. When I was a young officer, he urged me to invest some money in one of these projects and advised me “Sir! as long as water flows through turbines, you will get money from the CEB, which is always short of electricity”. I regret that I did not heed Bandi’s advice.

When he worked under me when I was Commander Southern Naval Area, as my senior Technical Officer, I observed pencil marks on walls of his chalet and I inquired from him what they were. He said it was the result of his “pencil shooting training”, a drill Practical Pistol Firers do to improve their skills. He used to practice “draw and fire” drills and pencil shooting drills late into nights to be a good Practical Pistol firer in Sri Lanka Navy team. He didn’t stop at that. He represented Sri Lanka National Practical Pistol Firing team and won International Championships.

As the Officer in charge of Technical Training in the Navy, he worked as Training Commander to train Royal Oman Navy Engineering Artificers in Sri Lanka, especially on Fast Attack Craft Main Engine Overhauls. The Royal Oman Navy Commander was so impressed with the knowledge acquired by Artificers that he donated money for the construction of a four-storey accommodation building for Sri Lanka Navy Naval and Maritime Academy, Trincomalee now known as “Oman Building”. The credit for this project should go to Bandi.

Bandi’s wife was a senior Judge of Kegalle High Court, and she retired a few years ago. Their only child, a son studied at the British School, Colombo and followed in his mother’s footsteps became a lawyer. Bandi was so much attached to his family and very proud of his son’s accomplishments.

When Bandi was due to retire in 2016 as a Rear Admiral and Director General Training, after distinguished service of 34 years, and reaching retirement age of 55 years, I requested him to serve for some more years after mobilising him into our Naval Reserve Force. He had other plans. He wanted to take his mini-Hydro Power projects to East African countries.

His demise after a very brief illness at age of 64 years was a shock to his family and friends. His funeral was held on Feb. 27 with Full Military Honors befitting a Rear Admiral at his home town Aranayake.

Dear Bandi, the beautiful Sri Lanka Navy, Naval and Maritime Academy in Trincomalee, which was built with your efforts will serve for Sri Lanka Navy Officer Trainees and sailors for a very long time and remember you forever.

May dear Bandi attain the supreme bliss of Nirvana!

Naval and Maritime Academy, Trincomalee

By Admiral Ravindra C Wijegunaratne

WV, RWP and Bar, RSP, VSV, USP, NI (M) (Pakistan), ndc, psn, Bsc

(Hons) (War Studies) (Karachi) MPhil (Madras)

Former Navy Commander and Former Chief of Defence Staff

Former Chairman, Trincomalee Petroleum Terminals Ltd,

Former Managing Director Ceylon Petroleum Corporation,

Former High Commissioner to Pakistan

-

Opinion4 days ago

Opinion4 days agoJamming and re-setting the world: What is the role of Donald Trump?

-

Features4 days ago

Features4 days agoAn innocent bystander or a passive onlooker?

-

Features6 days ago

Features6 days agoBuilding on Sand: The Indian market trap

-

Features5 days ago

Features5 days agoRatmalana Airport: The Truth, The Whole Truth, And Nothing But The Truth

-

Opinion6 days ago

Opinion6 days agoFuture must be won

-

Business6 days ago

Business6 days agoDialog partners with Xiaomi to introduce Redmi Note 15 5G Series in Sri Lanka

-

Business5 days ago

Business5 days agoIRCSL transforms Sri Lanka’s insurance industry with first-ever Centralized Insurance Data Repository

-

Sports7 days ago

Sports7 days agoCEA halts development at Mandativu grounds until EIA completion