News

Human Rights Watch calls for systemic reforms at IMF, World Bank

Releases globally new video featuring Sri Lanka’s poor to illustrate impact of flawed approach on rights

Discussions at the International Monetary Fund (IMF) and World Bank Annual Meetings that open in Marrakesh, Morocco, on 9 October 2023, should prioritise systemic reforms to align policies with human rights, Human Rights Watch said yesterday, releasing a video to illustrate the concerns. The changes are needed because current policies are compounding poverty and inequality.

The five-minute video (Sri Lanka: IMF loan programs makes life harder – YouTube) features Shanthi, a woman living in Sri Lanka, struggling to cope with both the economic crisis in the country and the loan conditions attached to a $3 billion bailout from the IMF that increased the cost of fuel and electricity and doubled value-added taxes. Sri Lanka, which defaulted on its debt in 2022, is the canary in the coal mine as dozens of governments are in or near debt distress, the IMF has said.

“Millions upon millions of people around the world have stories like Shanthi,” said Sarah Saadoun, senior economic justice researcher and advocate at Human Rights Watch. “IMF bailout conditions make lives already upended by global inflation and other economic challenges even harder.”

Shanthi’s electricity was cut when she was no longer able to pay her bill and she now relies entirely on others for food and basic necessities. She lost critical income from a government social protection program that had been providing benefits since 1994 after the government overhauled it in line with a requirement in the IMF program, with World Bank support. She has yet to receive a response to her application for the new program that she submitted in July.

Shanthi’s story is an example of how IMF loans to dozens of countries, affecting over one billion people, frequently push governments to cut spending and raise regressive taxes in ways that harm rights, as a new Human Rights Watch report has documented. Human Rights Watch also found that the IMF’s efforts to address these impacts are largely ineffective.

To ensure economic recovery that best advances rights in the short and long term, the IMF and governments should halt austerity policies that threaten rights. They should ensure that spending on health, education, and social security meet, at a minimum international benchmarks as a percentage of GDP and national budgets.

The video also demonstrates the shortcomings of the World Bank’s approach to social security, which in many cases, including Sri Lanka, works in tandem with IMF programs with the intention of cushioning their impact. Despite a commitment to promote universal social protection, the World Bank often funds programs that are means-tested, for which eligibility hinges on income, assets, or narrow poverty indicators. Research shows that these programs suffer from high error rates, corruption, and social mistrust, while missing the chance to build social cohesion and new social contracts anchored in solidarity and rights.

On 4 October, 43 human rights and economic justice organisations began an initiative, under the hashtags #RightToSocialSecurity and #UniversalSocialSecurity, urging governments and international financial institutions to commit to universal social security, which provides benefits to everyone at various times in their life course as part of a human rights approach to the economy, and end policies that have been failing hundreds of millions of people.

“The IMF and World Bank recognise that people need support, but then they promote narrow means-tested programs that, both by design and due to chronically high error rates, exclude many people who are struggling,” Saadoun said. “The IMF and World Bank need to revise their policies to support universal social security,” she added.

News

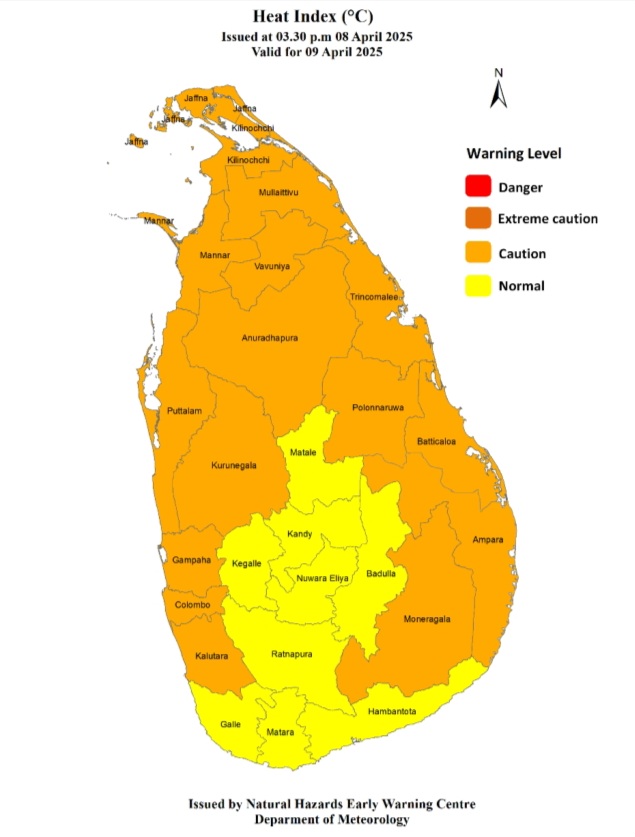

Heat index at ‘Caution level’ in Northern, North-central, Eastern, North-western, Western provinces and Monaragala district today [09]

The Natural Hazards Early Warning Centre of the Department of Meteorology has issued a Warm Weather Advisory for 09 April 2025

The public are warned that the Heat index, the temperature felt on human body is likely to increase up to ‘Caution level’ at some places in Northern, North-central, Eastern, North-western, and Western provinces and in Monaragala district.

The Heat Index Forecast is calculated by using relative humidity and maximum temperature and this is the condition that is felt on your body. This is not the forecast of maximum temperature. It is generated by the Department of Meteorology for the next day period and prepared by using global numerical weather prediction model data.

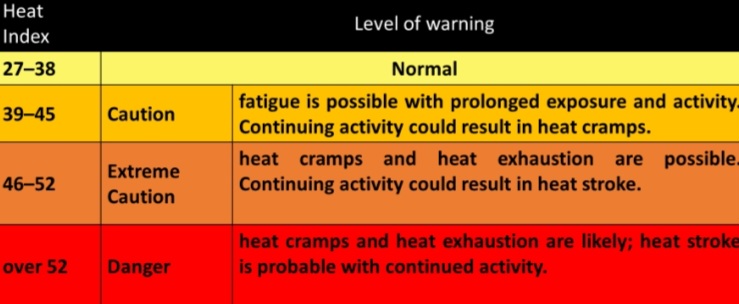

Effect of the heat index on human body is mentioned below is prepared on the advice of the Ministry of Health and Indigenous Medical Services.

ACTION REQUIRED

Job sites: Stay hydrated and takes breaks in the shade as often as possible.

Indoors: Check up on the elderly and the sick.

Vehicles: Never leave children unattended.

Outdoors: Limit strenuous outdoor activities, find shade and stay hydrated. Dress: Wear lightweight and white or light-colored clothing.

Note:

In addition, please refer to advisories issued by the Disaster Preparedness & Response Division, Ministry of Health in this regard as well. For further clarifications please contact 011-7446491.

News

Sajith asks govt. to submit its MoUs with India to Parliament

Prof. Jayasumana raises possibility of Lanka ending up with “Quad’

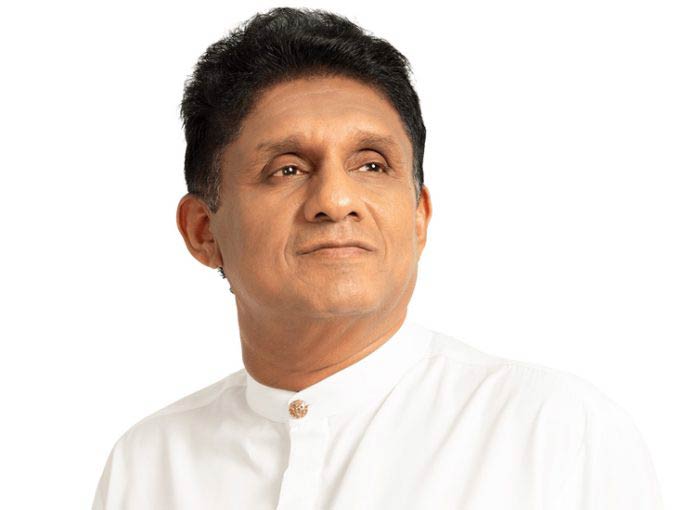

Opposition and SJB Leader Sajith Premadasa has said it is the responsibility of the NPP government to submit the MoUs/agreements that were recently signed with India to the respective Sectoral Oversight Committees (SOCs).

Premadasa said so when The Island raised the issue with him. He said that during his meeting with Premier Modi his focus had been on opening the Indian market for Sri Lankan garment exports.

The seven MoUs/agreements signed on 05 April included defence cooperation, energy, Eastern Province development and digitalisation.

Meanwhile, the Vice President of Sarvajana Balaya and former lawmaker Prof. Channa Jayasumana said that the government owed an explanation whether the recently signed MoU on defence cooperation directly or indirectly attached Sri Lanka to the Quad security alliance, consisting of the US, Australia, Japan and India.

The former SLPPer raised the issue at a meeting held at Boralesgamuwa on Monday (07) in support of Sarvajana Balaya candidates contesting the May 6 LG polls.

The former SLPPer raised the issue at a meeting held at Boralesgamuwa on Monday (07) in support of Sarvajana Balaya candidates contesting the May 6 LG polls.

Prof. Jayasumana urged that the MoU on Defence Cooperation be placed before Parliament, and the people, without further delay. The academic who served as State Health Minister during President Gotabaya Rajapaksa’s tenure said that President Anura Kumara Dissanayake’s foreign policy direction should be dealt with.

By Shamindra Ferdinando

News

Govt. won’t extend suspension of ‘parate executions’

The government would not extend the suspension of ‘parate executions’ that was now effective, Deputy Minister of Finance Harshana Suriyapperuma told Parliament yesterday.

Suriyapperuma said so in response to a question raised by Opposition Leader Sajith Premadasa, who asked about the government’s plans regarding a relief package to assist small and medium-scale enterprises (SMEs) struggling to repay loans.

Pointing out that about 263,000 SMEs had closed down, Premadasa asked what action the government would take to address the grievances of these SMEs.

He said that from 01 Jan., 2019, to 01 Dec., 31, 2023, licensed banks had collected Rs. 113.7 billion through 2,263 parate executions. As of 31 Dec., 2024, Rs. 1,380 billion had been recovered from Stage III defaulters.

The government has introduced loan schemes to assist SMEs impacted by the economic crisis. They included capital loans of up to Rs. 10 million, with a six-month grace period and a three-year repayment term at 8% interest, Suriyapperuma said. Additionally, another loan scheme under the consolidated fund aimed to help SMEs that werecurrently paying their loans. That scheme offered loans of up to Rs. 15 million, which must be repaid over ten years with a one-year grace period and a 7% interest rate. For SMEs that had defaulted on their loans, a loan of up to Rs. 5 million is available at 8% interest, with a six-month grace period and a five-year repayment term, Suriyapperuma said.

By Saman Indrajith

-

Business2 days ago

Business2 days agoColombo Coffee wins coveted management awards

-

Business4 days ago

Business4 days agoDaraz Sri Lanka ushers in the New Year with 4.4 Avurudu Wasi Pro Max – Sri Lanka’s biggest online Avurudu sale

-

Features3 days ago

Features3 days agoStarlink in the Global South

-

Business5 days ago

Business5 days agoStrengthening SDG integration into provincial planning and development process

-

Business4 days ago

Business4 days agoNew SL Sovereign Bonds win foreign investor confidence

-

Sports6 days ago

Sports6 days agoTo play or not to play is Richmond’s decision

-

Features3 days ago

Features3 days agoModi’s Sri Lanka Sojourn

-

Sports5 days ago

Sports5 days agoNew Zealand under 85kg rugby team set for historic tour of Sri Lanka