Business

Sri Lanka and the SDGs: Impacts of COVID-19 and the Economic Crisis

From IPS’ flagship publication, ‘Sri Lanka: State of the Economy 2022’

COVID-19 reversed Sri Lanka’s progress across several SDGs, particularly on poverty, inequality, and decent work. Similarly, the economic crisis is likely to adversely affect the SDG progress and pose several new challenges to their achievement by 2030.Financing SDGs has become the biggest challenge for Sri Lanka, becoming even tighter following Sri Lanka’s inability to access international bond markets after the sovereign default in April 2022.Given the enormous challenges to achieving the SDGs, those related to poverty and inequality; food security; economic growth and decent work; health and education; and energy must be prioritised.Resource mobilisation to secure both traditional and non-traditional SDG financing, including attracting private investments to SDGs, is vital.

Since adopting the 2030 Agenda for Sustainable Development in 2015, successive Sri Lankan governments have taken measures to achieve the 17 Sustainable Development Goals (SDGs) and 169 targets. Before COVID-19 struck, Sri Lanka recorded progress across several SDG targets, most notably: ending poverty and hunger (SDGs 1 and 2); improving access to health and education (SDGs 3 and 4); promoting gender equality and decent work, and reducing inequalities (SDGs 5, 8 and 10). The pandemic, however, reversed these advances, particularly on the SDGs related to poverty, inequality, and decent work. Similarly, the economic crisis is likely to adversely affect the SDG progress and pose several new challenges to their achievement by 2030. Against this backdrop, this Policy Insight discusses the impacts of the pandemic and the implications of the current financial crisis on SDGs in Sri Lanka, paying special attention to the SDGs related to poverty and inequality.

Impacts of COVID-19 and the Economic Crisis

The COVID-19 pandemic has impacted many of the 17 SDGs, with some goals including SDG 1 on poverty backsliding the progress made over the past decade. As with other countries, Sri Lanka also reported notable adverse effects of the pandemic on the lives and livelihoods of its population, especially the poor and the vulnerable. While the pandemic has impacted many SDGs, and all three dimensions of sustainable development – economic, social, and environmental – the adverse effects on some SDGs, especially those related to poverty, food security, health, education and employment are more prominent.

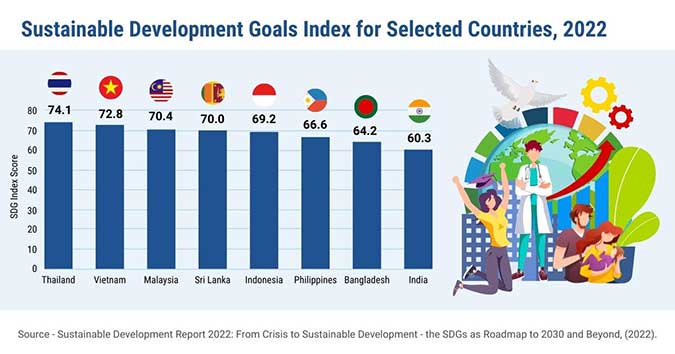

Despite the setbacks during the pandemic (2020-2021), Sri Lanka has improved its overall SDG performance since 2016, as indicated by the SDG Index. As per the Sustainable Development Report 20222, Sri Lanka, with an SDG Index of 70, is ranked 76 among 163 countries. This is close to the overall SDG performance of Malaysia (SDG Index of 70.4) and ahead of countries like the Philippines, India, Bangladesh and Indonesia (see Figure 1). Moreover, the SDG Index for Sri Lanka is only slightly lower than the average for upper-middle countries (71.5%) and considerably higher than the average for lower-middle-income countries (61.8%), as well as the East and South Asian average (65.9%).

However, the progress of individual SDGs indicates major challenges to achieving several SDGs, including SDG 2 (zero hunger), SDG 3 (health), SDG 6 (water and sanitation), SDG 7 (energy) and SDG 9 (industry, innovation, and infrastructure), despite their moderate performance. Furthermore, SDG 8 on decent work and SDG 5 on gender equity and SDGs 15-17 have been stagnant in their progress, indicating significant challenges to achieve them by 2030. Only a few SDGs, such as those on education (SDG 4) and climate change (SDG 13), are shown to be still on track to achieve the goals on time. Nevertheless, Sri Lanka’s economic crisis will adversely affect the SDG progress and pose several new challenges to their achievement by 2030.

A combination of many factors caused the economic crisis, including the lack of foreign reserves, disruptions to the tourism industry starting from the Easter Sunday attacks in 2019 and the pandemic in 2020, tax cuts that resulted in a significant decline in government revenue and rising crude oil prices partly related to the Russia-Ukraine War and associated sanctions. While the economic crisis has affected the country’s entire population in some way or another, the poor and the ‘near poor’ are the most hit by the crisis. With high inflation, shortage of food and other essentials, and loss of livelihoods, the economic crisis is likely to reverse progress on the SDGs.

Poverty and Inequality

A World Bank study estimates that 500,000 people have fallen into poverty due to the pandemic.3 This has led to an increase in the USD 3.20 poverty rate from 9.2% in 2019 to 11.7% in 2020, implying a reversal in progress made towards poverty reduction in Sri Lanka since 2016. The study further finds that the extreme poverty level nearly doubled in 2020 from its 2019 levels (from 0.7% to 1.2%), and the poverty gap too has increased, indicating that the poor have become even poorer due to the pandemic. The study stresses the impact on employment such as job losses and a fall in earnings as the main contributory factors to the increased poverty rates.

Further, the World Bank’s Macro Poverty Outlook for Sri Lanka (2022) estimates poverty levels to have fallen slightly in 2021 from their 2020 level, but the forecast remains above the 2019 level for the next few years.4 However, the current economic crisis, especially soaring prices of food, fuel and other essential goods, along with adverse impacts on the livelihoods of many workers – particularly, the informal sector workers – means the risks of higher poverty are high. The poverty level can be expected to rise further in 2022, reversing the much-achieved progress in poverty reduction seen over the years.

Financing SDGs is Key Challenge

Financing SDGs has become the biggest challenge for Sri Lanka. On the domestic front, government expenses increased with the pandemic while revenues plummeted, primarily due to tax cuts introduced in 2019. On the external front, foreign income earnings from remittances and tourism dropped. Economic shocks such as the Russia-Ukraine crisis continue to disrupt the global economy, worsening the global macroeconomic climate. Other inflows, such as FDI into the country, have also reduced post-COVID-19 as the economic uncertainties have mounted. Financing has become even tighter following Sri Lanka’s inability to access international bond markets after the selective default of foreign debt payments in April 2022. All these issues have widened the financing gap to achieve SDGs.

Conclusions and Policy Implications

Given the complexity of SDGs and the enormous challenges to achieving them, it is desirable to prioritise the targets that are deemed most important. Prioritisation must be based on the country’s development needs and trade-offs between the targets. Given the enormous financial constraints and adverse implications of the economic crisis, it would be essential to prioritise SDGs related to poverty and inequality (SDG 1 and 10), food security (SDG 2), economic growth and decent work (SDG 8), health (SDG 3) education (SDG 3) and energy (SDG7). While various goal-specific measures are required to accelerate the progress of SDGs, some key steps are:

Securing Financing

Sri Lanka needs to prioritise resource mobilisation for traditional and non-traditional SDG financing.Traditional SDG Financing: Domestic resource mobilisation is essential if Sri Lanka is to progress on SDGs. Generally, traditional SDG financing includes government financing and ODA from foreign governments. In Sri Lanka’s case, ODA has also been on a declining trend as it moved up the income ladder, while foreign aid now rightly focuses on covering the essential needs of the people first (e.g. food security, social protection, healthcare, power/fuel). In the medium term, however, there needs to be more emphasis on financing other SDGs, especially those related to education, employment, industry, innovation, and infrastructure. Attracting private investment to SDGs, too, will be vital.

Non-traditional SDG Financing: The Roadmap for Sustainable Finance in Sri Lanka, developed by the Central Bank of Sri Lanka (CBSL), highlights some non-traditional instruments in SDG financing. These include green bonds specific to development projects based on environmental protection and climate change. Capital markets have recently become a driving force towards a sustainable future. Sri Lankan companies can explore the Environmental, Social and Governance (ESG) bonds market. However, green bonds and ESG financing focus on the environment. Sri Lanka needs to expand spending on critical areas such as poverty alleviation (SDG 1), food security (SDG 2) and healthcare (SDG 3). Strengthening multilateral and bilateral partnerships would be crucial, particularly given the lack of fiscal space.

Strengthening Partnerships

Multistakeholder engagement – including government agencies, the private sector, and civil society organisations – is key to achieving SDGs and ensuring an inclusive process. Moreover, enhancing regional and global partnerships to mobilise and share knowledge, expertise, technology, and financial resources is crucial to supporting the achievement of SDGs.

South-South cooperation is also an avenue that needs to be further explored by Sri Lanka. Regional cooperation can help accelerate the progress of several SDGs, in particular, SDGs related to food security (SDG 2), health (SDG 3), energy (SDG 7), decent work (SDG 8) and climate action (SDG 13).5

Addressing Data Deficits

While Sri Lanka has made much progress in terms of liaising with the relevant agencies to compile the required data, the lack of more up-to-date data at regular intervals (e.g. annual basis) and lack of disaggregated data (by gender, location, age, etc.) for many SDGs is a significant drawback for monitoring. Given these data gaps, improving the availability of high-quality, timely, reliable, and appropriately disaggregated data for SDGs is important. This requires enhancing the capacity of relevant agencies as well as strengthening partnerships among various stakeholders. There is also some scope for enhancing regional cooperation to improve statistical capacity in Sri Lanka and share knowledge and experience among these countries.

*This Policy Insight is based on the comprehensive chapter “Crises and Recovery: Meeting the 2030 Agenda on SDGs” in the ‘Sri Lanka: State of the Economy 2022’ report – the annual flagship publication of the Institute of Policy Studies of Sri Lanka (IPS). The complete report can be purchased from the Publications Unit of IPS located at 100/20, Independence Avenue, Colombo 07 and leading bookshops island-wide. For more information, contact 011-2143107 / 077-3737717 or email: publications@ips.lk.To download more POLICY INSIGHTS from IPS, visit: https://www.ips.lk/publications/policy-insights.

Business

JAT Holdings celebrates the 6th Pintharu Abhiman Convocation, uplifting over 800 painters through NVQ certification

JAT Holdings PLC marked a significant milestone with the successful conclusion of the 6th JAT Pintharu Abhiman Convocation, recognising more than 800 painters who have earned their NVQ Level 3 qualification, an internationally recognised professional certification delivered in partnership with the National Apprentice and Industrial Training Authority (NAITA).

JAT Pintharu Abhiman was established to uplift Sri Lanka’s painter community through structured skills development, professional recognition and stronger earning potential. This year’s graduating cohort reflects the programme’s expanding reach and the tangible changes it continues to deliver for individuals, families and communities.JAT in collaboration with NAITA has streamlined the certification process such that what would traditionally take up to six months has been refined into an efficient and high-impact three-day assessment model. This approach ensures painters can obtain their qualification without sacrificing extended periods of work, while JAT fully absorbs the certification cost, removing financial barriers and enabling wider access to formal recognition.

Research conducted amongst NVQ qualified participants shows meaningful improvements in livelihoods, with 90 percent reporting increased personal confidence and 76 percent noting an improvement in their overall standard of living. This uplift demonstrates the long-term value of industry-aligned professional training.

A noteworthy moment at this year’s convocation was the recognition of four female painters who received their NVQ certifications. Their achievement marks an important step in broadening female participation in a field that has historically been male dominated, reinforcing JAT Holdings’ commitment to creating inclusive pathways for technical development and sustainable employment.

Speaking at the ceremony, Mr. Wasantha Gunaratne, Director Sales and Technical (South Asia) of JAT Holdings PLC, said:

“Pintharu Abhiman is fundamentally about development, giving painters the knowledge, structure and recognition they need to progress in their careers. By equipping over 800 painters with an internationally recognised NVQ qualification, we are not only strengthening the technical standards of the industry but also creating real pathways for entrepreneurship and financial independence. It is especially encouraging to see that one in five certified painters have already begun building their own businesses. These are the outcomes that matter because they show that when we invest in skills, we unlock opportunity. JAT remains committed to expanding these avenues so every painter has the chance to grow, lead and build a sustainable future.”

The 6th JAT Pintharu Abhiman Convocation underscores JAT’s continued dedication to uplifting the painter community, enhancing industry standards and supporting national skills development through accessible, professionally recognised qualifications.

Business

Industry bodies flag gaps in Draft National Electricity Policy

The Ceylon Chamber of Commerce, together with the American Chamber of Commerce, Exporters Association of Sri Lanka, Federation of Renewable Energy Developers, Joint Apparel Association Forum, National Chamber of Commerce of Sri Lanka and Sri Lanka Association for Software and Services Companies, has submitted joint observations on the Draft National Electricity Policy, highlighting that several key issues have not been adequately addressed.

Whilst recognizing the need for reform in the electricity sector, the submission flags several gaps in the draft policy that require closer attention. Key areas such as affordability, decarbonisation commitments, incentives for renewable energy, competition, and the long-term financial health of the sector are either missing or not addressed in sufficient depth.

The proposed tariff revisions outlined in the draft energy policy raise concerns, particularly regarding the removal of cross-subsidies and the proposal to restrict subsidies exclusively to households consuming less than 30 kWh per month. Without detailed analysis, these measures could weaken access to sustainable and affordable energy and potentially lead to fiscal risks.

The provisions allowing uncompensated curtailment, removing feed-in tariffs, and imposing mandatory time-of-use tariffs on rooftop solar users could make renewable energy projects un-bankable for international lenders, thereby increasing the cost of capital for Sri Lanka.

Calling for a more future-focused approach, the submission stresses the need for a policy that reflects modern electricity systems, including planning for the energy transition, energy storage, market competition, cross-border electricity trading, and emerging technologies.

The Chambers and Associations request a comprehensive revision of the Draft National Electricity Policy, alignment with the Electricity Act, and resubmission following substantive consultation, and reiterate support to engage constructively with policymakers to shape a policy that supports affordability, investment confidence, and Sri Lanka’s long-term energy security.

Business

Bank of Ceylon partners with 36th APB Sri Lanka Convention

Bank of Ceylon (BOC) partnered with the 36th Annual Convention of the Association of Professional Bankers (APB) Sri Lanka, reaffirming its commitment to promoting professional excellence and knowledge sharing within the banking sector. The partnership was officially handed over by Sameera D. Liyanage, Chief Marketing Officer of Bank of Ceylon and M. R. N. Rohana Kumara, Deputy General Manager Business Revival Unit of Bank of Ceylon, reflecting BOC’s focus on empowering banking professionals and supporting the sustainable growth of Sri Lanka’s financial services industry.

-

Business1 day ago

Business1 day agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Business5 days ago

Business5 days agoDialog and UnionPay International Join Forces to Elevate Sri Lanka’s Digital Payment Landscape

-

News5 days ago

News5 days agoSajith: Ashoka Chakra replaces Dharmachakra in Buddhism textbook

-

Features5 days ago

Features5 days agoThe Paradox of Trump Power: Contested Authoritarian at Home, Uncontested Bully Abroad

-

Features5 days ago

Features5 days agoSubject:Whatever happened to (my) three million dollars?

-

Business1 day ago

Business1 day agoSLT MOBITEL and Fintelex empower farmers with the launch of Yaya Agro App

-

Business1 day ago

Business1 day agoHayleys Mobility unveils Premium Delivery Centre

-

News5 days ago

News5 days agoLevel I landslide early warnings issued to the Districts of Badulla, Kandy, Matale and Nuwara-Eliya extended