Business

Special goods and services tax: Issues and concerns

By Dr Roshan Perera & Naqiya Shiraz

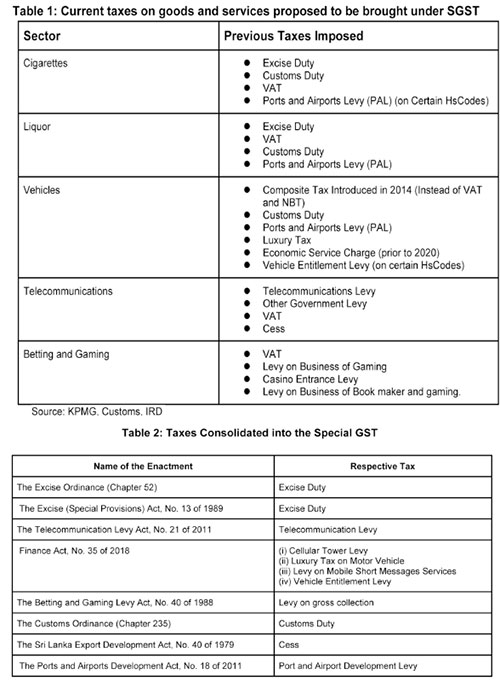

The new bill titled ‘Special Goods and Services Tax’ was published by gazette dated 07 January 2022.1 The Special Goods and Services Tax (SGST) was originally proposed in Budget speech 2021 but was not implemented. It has once again been presented in Budget 2022. The SGST aims to consolidate taxes on manufacturing and importing cigarettes, liquor, vehicles and assembly parts, while also consolidating taxes on telecommunication and betting and gaming (see table 1 for existing taxes on these products and table 2 for taxes consolidated into the SGST as per the schedule in the gazette). The rationale for this new tax as per the bill is “…to promote self-compliance in the payment of taxes in order to ensure greater efficiency in relation to the collection and administration on such taxes by avoiding the complexities associated with the application and administration of a multiple tax regime on specified goods and services.”

Given the multiplicity of taxes and the complexity of the current tax system as a whole, rationalising taxes is necessary to improve collection. However, whether the proposed SGST simplifies the tax system, while ensuring revenue neutrality or even improving revenue collection, needs to be carefully examined.

The SGST Bill is silent on the treatment of the existing VAT on these goods and services. However, according to the Value Added Tax (Amendment) Bill also gazetted on 07 January 2022,1 liquor, cigarettes and motor vehicles will be exempted from VAT while telecommunications and betting and gaming services will still be subject to VAT.

While the gazetted Bill sets out some of the features of the proposed SGST there are many important areas not covered in the Bill. These are expected to be gazetted as and when required by the Minister in charge.

Issues & Concerns

The motivation behind SGST is the simplification of the tax system. Although the objective of introducing the SGST is to improve efficiency by reducing the complexity of the tax system there are many issues and concerns with this proposed tax.

Revenue

Tax revenue which was 13% of GDP in 2010, declined to 8% in 2020. Ad hoc policy changes and weak administration contributed to the decline in tax revenue collection. This continuous decline in tax revenue has led to widening fiscal deficits and increasing debt. One of the main reasons for the current macroeconomic crisis is low tax revenue collection. Hence, any change to the existing tax system should be with the primary objective of raising more revenue.

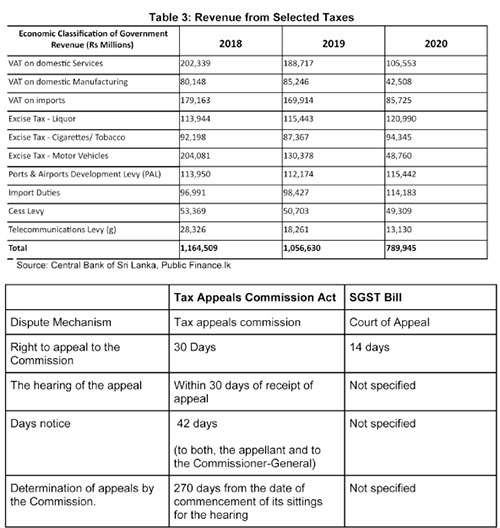

According to the budget speech the SGST is estimated to bring in an additional Rs. 50 billion in revenue in 2022.1 Revenue from taxes proposed to be consolidated under the SGST has significantly declined over the past 3 years. Given the already difficult macroeconomic environment, along with ad hoc tax policy changes raising the additional revenue estimated at Rs. 50 billion seems a difficult task.

Tax Base and Rate

For the SGST to raise taxes in excess of what is already being collected through the existing taxes, the rate and the base for the SGST needs to be carefully and methodically calculated. Further, the existing taxes have different bases of taxation. For instance the basis of taxation of motor vehicles is both on an ad valorem1 basis and a quantity basis while the basis of taxation of cigarettes and liquor is quantity.2 In light of this, the basis of taxation on which SGST isapplied becomes an issue. Having different bases and different rates for various goods and services would complicate the implementation of the tax These issues need to be carefully considered to ensure the new tax is revenue neutral or be able to enhance revenue collection.

Efficiency

One possible revenue benefit of this proposal is the inability to claim input tax credits on the sectors exempted from VAT. However, the issue is the cascading effect that would result where there would be a tax on tax with the end consumer paying taxes on already paid taxes. If the idea was to raise additional revenue by limiting tax credits, it would have been simpler to raise the tax rates on the existing taxes rather than introduce a new tax.

4. Administration

According to the bill, SGST will now be collected through a new unit set up under the General Treasury where a Designated Officer (DO) will be in charge of the administration, collection and accountability of the tax. The existing revenue collection agencies, such as the Inland Revenue Department (IRD) or the Excise Department will not be primarily responsible for the collection of this tax. By removing the IRD and Excise Department, a parallel bureaucracy will be created, at a time when public spending needs to be carefully managed. The General Treasury also has no previous experience and expertise in direct revenue collection. Weak administration is one of the key reasons for the low tax collection and success of this tax would depend on the strength of its administration.

In addition to the above mentioned concerns, as per the Bill the minister in charge of the SGST has been vested with the power to set the rates, the base and grant exemptions. Accordingly, Parliamentary oversight over fiscal matters is weakened under this proposed Bill.

It could also lead to a time lag between the gazetting and implementing of changes to the SGST (such as the rate, base etc) and obtaining Parliamentary approval for those changes.

Dispute resolution

The SGST Bill also focuses on the dispute resolution mechanism. Under the present tax system, with the enactment of the Tax Appeals Commission Act, No. 23 in 2011 the Tax Appeals Commission has the “responsibility of hearing all appeals in respect of matters relating to imposition of any tax, levy or duty”.1 The most recent amendment to the Tax Appeal

Commissions act (2013)1 seeks to address the large number (495) of cases pending before the Tax Appeals Commision2 by increasing the number of panels to hear the appeals.

Under the proposed SGST disputes will be handled through the court of appeal. However, the time period by which specific actions need to be taken is not provided in the bill. In addition, disputes have to be taken to the court of appeal. Hence, the entire process will be more time consuming. This could result in revenue lags and difficulties in revenue estimation until disputes are resolved.

Additionally, in the case that no valid appeal has been lodged within 14 days, any remaining payments would be considered to be in default. Thereafter, the responsibility is shifted to the Commissioner General of the IRD to recover the dues. Given the IRD is completely removed from the normal collection process, the rationale for bringing defaults under the IRD is not clear.

III. Policy Recommendations

As discussed, the SGST Bill has several limitations and much of this is due to the ambiguities in the Bill.

If the tax is implemented, the rate and basis of taxation needs to be revenue neutral to ensure tax collection is maximised and administrative costs minimised.

The rates, basis of taxation, exemptions etc should be specified in the Bill, as done in most other Acts. This would avoid the power for discretionary changes to the tax being placed in the hands of the minister in charge.

Given the already weak tax administration, it would be more sensible to strengthen the existing revenue collecting agencies and address the weaknesses in the existing system without creating a parallel bureaucracy.

In the case where VAT is consolidated into the proposed GST, the issue of cascading effect of input tax credits needs to be addressed. This is relevant particularly in the case of capital expenditure.

Given the critical state of revenue collection in the country the question to ask is whether this is the best time to introduce a new tax. Focus should be on fixing issues in the existing tax system to ensure revenue is maximised. The VAT is the least distortionary tax and it is the easiest to administer. Given these features it can be a very efficient revenue generator for a country. Therefore instead of introducing a new tax, capitalising on systems that are already in place and amending the VAT rate, threshold and exemptions may be a more practical solution to the revenue problem that the country is currently facing.

Dr. Roshan Perera is a Senior Research Fellow at the Advocata Institute and the former Director of the Central Bank of Sri Lanka.

Naqiya Shiraz is a Research Analyst at the Advocata Institute.

The opinions expressed are the author’s own views. They may not necessarily reflect the views of the Advocata Institute, or anyone affiliated with the institute.

Business

Oil prices rise after ships attacked near Strait of Hormuz

Global oil prices have risen after at least three ships were attacked near the Strait of Hormuz, as Iran continues to launch strikes across the Middle East in response to ongoing attacks by the US and Israel.

Two vessels have been struck, and an “unknown projectile” was reported to have “exploded in very close proximity” to a third, the UK Maritime Trade Operations Centre (UKMTO) said.

Iran has warned ships not to pass through the strait, which carries about 20% of the world’s oil and gas.

International shipping has almost come to a standstill at the strait’s entrance, with analysts warning that a prolonged conflict could push energy prices even higher.

In early trade in Asia on Monday, global oil prices jumped by more than 10% before those gains eased during the morning.

At 02:00 GMT, Brent crude was more than 4% higher at $76.16 (£56.53) a barrel, while US-traded oil was also up by around 4% at $69.67.

“The market isn’t panicking”, Saul Kavonic, head of energy research at MST Research told the BBC.

“There is more clarity that so far, oil transport and production infrastructure hasn’t been a primary target by any side,” he added.

“The market will be watching for signs that traffic through the Strait of Hormuz returns, which would see oil prices subside again.”

But some analysts have warned it could go over $100 in the event of a prolonged conflict.

On Sunday, the Opec+ group of oil producing nations – which includes Saudi Arabia and Russia – agreed to increase their output by 206,000 barrels a day to help cushion any price rises, but some experts doubt this would help much.

Edmund King, president of the AA, warned the disruption could drive up petrol prices around the world.

“The turmoil and bombing across the Middle East will surely be a catalyst to disrupt oil distribution globally, which will inevitably lead to price hikes,” he said.

“The magnitude and duration of pump price increases depends on how long the conflict goes on.”

Business

Iran strikes could add external pressure on Sri Lanka’s fragile recovery: Analyst

The U.S. and Israeli strikes on Iran have reignited geopolitical tensions in the Middle East, stoking fears of a broader conflict that could disrupt critical energy supply routes – particularly the Strait of Hormuz, through which roughly one-fifth of the world’s oil supply flows. Brent crude has already edged higher, and global oil markets warn prices could climb toward, or even exceed, US$80–100 a barrel if hostilities escalate.

Against this backdrop, an independent economic analyst told The Island that for Sri Lanka – a small, fuel-importing economy with limited domestic energy resources – the implications could be significant.

“Sri Lanka imports over 90% of its petroleum requirements, and any sustained rise in global crude prices would expand the annual import bill, placing renewed pressure on already tight foreign exchange reserves,” he said.

Even moderate spikes in oil prices, he noted, tend to filter quickly through the domestic economy. “Higher fuel costs translate into increased transport and production expenses, which feed into inflation and erode household purchasing power. Freight charges for essential goods – from food items to industrial inputs – would also rise.”

“The Middle East remains a key source of remittances and export demand,” the analyst explained. “A large share of Sri Lankan migrant workers are employed in Gulf economies, while regional markets absorb tea and other exports. Heightened instability could weaken remittance inflows and soften demand, further straining the balance of payments.”

When asked whether the Central Bank of Sri Lanka (CBSL) might be compelled to shift policy in response, the analyst said the monetary authority faces a delicate balancing act.

“Rising import inflation stemming from higher global energy prices could push the Central Bank to maintain – or even tighten – its monetary policy stance in order to safeguard price stability and support the rupee. A firmer stance may be deemed necessary to anchor inflation expectations and preserve market confidence. The Central Bank is therefore likely to monitor inflation data closely in the coming weeks to assess whether energy-driven price pressures prove temporary or more entrenched,” he said.

Meanwhile, Ceylon Petroleum Corporation (CPC) Chairman S. Rajakaruna said that Sri Lanka’s fuel imports – sourced primarily from Singapore and India – reduce immediate exposure to supply disruptions directly linked to Middle Eastern routes. He also sought to allay public concerns, noting that the country currently maintains sufficient fuel stocks for approximately one month and that there need not be any queueing up by the public to hoard supplies.

However, the analyst cautioned that while physical supply may remain stable, global price pass-through effects are an unavoidable risk.

Meanwhile, Opposition politician Wimal Weerawansa said that official assurances of “one month’s stock” tend to unsettle the public, arguing that such statements evoke memories of past shortages and public distress.

By Sanath Nanayakkare

Business

Ministry of Education recognises LOLC Divi Saviya for restoring 200 schools

The Ministry of Education officially recognised LOLC Holdings PLC for its flagship humanitarian initiative, Divi Saviya, at a special ceremony held on 27th February 2026 in Battaramulla. The event marked the second time the Ministry has acknowledged the programme’s contribution to the nation’s education sector.

Group Managing Director/CEO Kapila Jayawardena presented a project update to Prime Minister and Education Minister Dr. Harini Amarasuriya, highlighting the rapid restoration of 200 schools under Phase 02 of ‘Obai, Mamai, Ape Ratai’. The schools were repaired and handed over within just 45 days, enabling students displaced by Cyclone Ditwah to safely resume learning.

Phase 02 follows a needs assessment that identified 200 damaged schools and 4,000 displaced families. Implemented with Divisional Secretariats and Disaster Management Centres, the Rs. 500 million programme has delivered Family Super Packs and school renovations across six districts.

Kapila Jayawardena stated, “It was a privilege to share these outcomes with the Prime Minister. This recognition reflects how private sector collaboration can complement government efforts during national challenges.” Plans are underway to fully rebuild select schools destroyed by the cyclone.

-

Opinion4 days ago

Opinion4 days agoJamming and re-setting the world: What is the role of Donald Trump?

-

Features4 days ago

Features4 days agoAn innocent bystander or a passive onlooker?

-

Features6 days ago

Features6 days agoBuilding on Sand: The Indian market trap

-

Opinion6 days ago

Opinion6 days agoFuture must be won

-

Features5 days ago

Features5 days agoRatmalana Airport: The Truth, The Whole Truth, And Nothing But The Truth

-

Business6 days ago

Business6 days agoDialog partners with Xiaomi to introduce Redmi Note 15 5G Series in Sri Lanka

-

Business5 days ago

Business5 days agoIRCSL transforms Sri Lanka’s insurance industry with first-ever Centralized Insurance Data Repository

-

Sports7 days ago

Sports7 days agoCEA halts development at Mandativu grounds until EIA completion