Business

Income Tax, Professionals and Migration

by Naomal Goonewardena

I am a lawyer by profession who also happens to have an interest in the subject of tax. My tax liability and income tax payments for the year of assessment 2023/2024 would be more than 300% of that in 2021/2022. Not great by any means.

I have been watching in silence the continuous agitation by professionals in particular with regard to the Inland Revenue (Amendment) Act No.45 of 2022 (“2022 Amendment”) and the additional tax which is payable thereunder by individuals. Almost all of the arguments against the increased tax is accompanied by an implied threat that the high tax rates would accelerate the rate of migration of professionals from the country and the dire consequences which would arise therefrom.

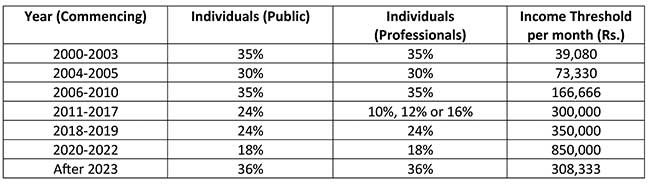

It would be pertinent to analyze the marginal tax rates which have been applicable for individuals from the year 2000 to present and the level of income at which the highest marginal rate would have become applicable. The last column set out above is indicative of the level of income which a person should have on a monthly basis after which he would be liable to pay income tax at the maximum rate specified in the table.

The aforesaid table is clearly indicative that for the period 2000 -2010 the marginal rates of tax were relatively high and therefore, largely comparable to what is going to apply from 2023 onwards. The real problem seems to be that from 2011 onwards, the rate of tax for professionals in particular has fallen down dramatically (other than for 2018/2019) with the result that professionals for all intents and purposes have “forgotten” to pay tax.

The enhanced threshold at which the maximum tax was applicable even at the lower rate increased dramatically from 2020 – 2022 and that seems to be the starting point for any entitlements which are now being spoken of. For example, during this period a person with an income of Rs. 500,000 per month would have only paid about Rs. 10,000 per month as income tax (i.e 2% of income). This is clearly unacceptable. The aforesaid table is clearly indicative that society in general has borne the brunt of this for the benefit of professionals at large very specially between 2011-2017. In my view there is absolutely no justification for professionals to be given any tax concessions which are not available to the other tax paying persons in this country.

I am well aware that in view of inflation in particular, affordability of the tax is in question. The personal reliefs and the level at which the maximum marginal tax rate would apply are also debatable. The real question is as to whether a person having an income of approximately Rs. 300,000 per month should or should not be contributing tax at the rate of 36% on his excess income in the context of large segments of our society being unable to eke out a bare existence for their very survival.

It is easy to say that a large part of government revenue is either wasted or subject to corrupt practices. However, the reality seems to be that major part of government revenue goes towards debt service (i.e interest expenses on borrowing) for which we are all responsible, government salaries and pensions. It is also ironic that persons who are the beneficiaries of these expenses or who have failed miserably in their basic obligation to ensure price stability are also among those who are agitating for a reduction in revenue by way of reduced tax.

It is a fallacy for employees who are subject to Pay-As-You-Earn (PAYE) tax to think that in view of the automatic deduction that they are subject to more tax than others or that other individuals in society who are liable to tax do not pay their tax. The latter pay their tax through the quarterly payment mechanism under the Inland Revenue Act of No.24 of 2017 (“IRA”). The often quoted reason for being reluctant to pay tax is that large parts of society are evading tax and therefore, one should not pay taxes. This in my view is too simple a presumption and it is for any person who says that there are other tax evaders to take the necessary steps to report them specifically to the authorities in a manner that they could share the tax burden of all. However, based on my professional training, pointing to other tax evaders and providing that as a justification for not paying your own taxes is an argument unworthy of a professional.

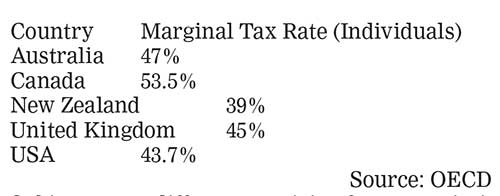

With regard to migration, the following table illustrates the marginal tax rates for individuals in the countries which are often mentioned as being attractive for migration by professionals.

Subject to any differences arising from permissibility of expenses in computing the taxable income, it is clear that any migrant would walk into higher taxes. The migrant would not dare to evade tax in those countries either since the migrant will be summarily thrown out or put behind bars. If a professional wishes to migrate, please do so but do not cite excessive tax in your home country or insufficiency of personal reliefs in computing your taxable income, since any reasonable man in those countries would think that such arguments are hollow to say the least.

We are a Highly Indebted Poor Country (HIPC) and each of us must understand the implications of this. Whichever political party is in power, the government needs revenue. We have exercised our franchise and elected idiots in the past. In 2015 we voted for public sector salary increases which were totally unrealistic which drained the public coffers. In 2019, we the professionals voted for tax cuts, pocketed the additional monies and deprived the State of its due share of revenue. It is now pay-back time for the professionals. In the short term, the increased tax rates should be bearable and in the medium and long term will become palatable.

Increased government revenue is a necessity with current VAT rate of 15% and the marginal income tax rates for individuals and corporates of 36% and 30% being reasonable in a global sense. If any politicians seek your vote or mine on the basis of reducing these tax rates in the absence of alternative concrete revenue generating proposals, let us classify them appropriately as mentioned above and treat them with the contempt which they deserve.

Business

Salesforce Startup Program targets Sri Lanka’s high-growth tech sector

Salesforce, the world’s leading AI-powered CRM platform, is set to expand its presence in Sri Lanka with the launch of the Salesforce Startup Program by the end of January 2026, signalling growing confidence in the country’s technology-led growth potential.

The move comes as Sri Lanka consolidates its position as the second-largest startup ecosystem in South Asia after India, with software, data and artificial intelligence-driven ventures accounting for nearly 60 per cent of the national startup base.

Industry observers say this concentration places Sri Lanka at a decisive stage where global exposure and enterprise access could unlock the next phase of scale.

Under the programme, Sri Lankan startups will gain access to Salesforce’s global ecosystem, including AI-powered platforms, business and technical mentorship, joint go-to-market opportunities and connections to enterprise customers, enabling founders to build globally competitive solutions from Sri Lanka.

“Sri Lanka has developed a strong base of technical talent and entrepreneurial ambition that is increasingly visible regionally and globally,” said Arundhati Bhattacharya, President and CEO of Salesforce South Asia.

“Through the Salesforce Startup Program, we aim to help startups move beyond early momentum to global relevance while delivering long-term economic impact,” he added.

He also said the initiative builds on the success of its Startup Program in India and Singapore, which today supports over 435 startups, including more than 230 AI-first companies. Several participants have expanded across Asia and beyond by building products natively on the Salesforce platform.

Responding to queries, he said Sri Lanka is also emerging as an important enterprise market for Salesforce, with major corporates such as John Keells Holdings and Cinnamon Hotels adopting the platform to modernise customer engagement, sales, marketing and loyalty management operations.

In parallel, Salesforce is strengthening the country’s digital talent pipeline through its Trailhead learning ecosystem, with plans to skill nearly 1,000 learners over the next year via local workforce development partners and community-led cohorts.

Chamil Madusanka, Head of Salesforce Practice and Salesforce Architect, said the programme arrives at a critical juncture for Sri Lanka’s startup ecosystem.

“Sri Lankan founders are increasingly building AI, data and enterprise software solutions with global relevance,” Madusanka told The Island Financial Review.

“What many startups need is structured access to enterprise customers, global mentorship and market exposure. This initiative creates that bridge, enabling local companies to scale faster while remaining rooted in Sri Lanka.”

He said the Startup Program is designed to act as a connective platform, bringing together startups, enterprises, technology partners, universities and developer communities to accelerate collaboration and innovation.

By Ifham Nizam ✍️

Business

Good news on risen foreign reserves exerts buoyant impact on bourse

CSE activities were extremely bullish yesterday following Central Bank Governor Dr Nandalal Weerasinghe’s announcement that Sri Lanka’s foreign reserves had risen to US $ 6.8 billion in December 2025, up US$ 791 million from November 2025.

The Governor provided the estimated economic growth while announcing the Central Bank’s policy agenda for this year.

In December Sri Lanka received budget support loans from the Asian Development Bank and the International Monetary Fund.

Amid these developments both CSE indices moved upwards. The All Share Price Index went up by 226.81 points, while the S and P SL20 rose by 100.01 points. Turnover stood at Rs 12.3 billion with 12 crossings.

Top seven crossings that mainly contributed to the turnover were: Lee Hedges 18.2 million shares crossed to the tune of Rs 3.9 billion; its shares traded at Rs 416, Commercial Bank 2.1 million shares crossed for Rs 467.6 million; its shares traded at Rs 215, Ceylon Hotels 429,000 shares crossed for Rs 128.7 million; its shares traded at Rs 300, LB Finance 650,000 shares crossed for Rs 105 million; its shares sold at Rs 152.50, Ceylinco Holdings 31000 shares crossed for Rs 104.5 million; its shares traded at Rs 3400, Melstacorp 200,000 shares crossed tfor Rs 35.7 million; its shares sold at Rs 178.50 and Three Acres Farm 400,000 shares crossed to the tune of Rs 29.6 million; its shares fetched Rs 740.

In the retail market top seven companies that mainly contributed to the turnover were; Wealth Trust Securities Rs 1.17 billion (55.8 million shares traded), Commercial Bank Rs 509 million (2.4 million shares traded), HNB Rs 370 million (870,000 shares traded), ACL Cables Rs 303 million (three million shares traded), Prime Lands Residencies Rs 283 million (7.9 million shares traded), Lanka Realty Rs 227.5 million (4.7 million shares traded) and HNB Rs 218 million (332,000 shares traded). During the day 223.7 million share volumes changed hands in 55116 transactions.

Yesterday, investor interest in Wealth Trust and banking stocks led to higher activity levels, brokers said. Further, the real estate sector also performed well. Lanka Realty Investments PLC acquired 51 percent of the total number of shares in issue of Lee Hedges, CSE sources said. 13,057,595 ordinary voting shares were bought at Rs 216 each.

Yesterday the rupee opened at Rs 310.12/18 to the US dollar in the spot market, weaker from Rs 310.05/15 the previous day, dealers said, while bond yields opened marginally high.

By Hiran H Senewiratne ✍️

Business

Launch of monograph ‘Development: Not By Economics Alone’

The Gamani Corea Foundation (GCF) is pleased to announce the launch of the monograph Development: Not By Economics Alone by Dr. Nimal Sanderatne, Emeritus Chairperson of the Foundation. The foreword to the publication has been written by Dr. Godfrey Gunatilleke, one of Sri Lanka’s most eminent development economists. The launch ceremony will be held on Friday, 9th January 2026, at 4.00 p.m. at the Horton Lodge.

In this monograph, Dr. Sanderatne argues that development cannot be understood through economic indicators alone. He emphasizes that the quality of human capital depends not only on knowledge and skills acquired through formal education, but also on deeper, non-formal processes embedded in a society’s culture and value systems. These influence human behaviour, shaping work ethics, attitudes to work and leisure, capacity for teamwork, preferences between short- and long-term goals, and patterns of saving and consumption.

Dr. Sanderatne is a distinguished economist and academic, holding degrees from the Universities of London, Saskatchewan, and Wisconsin, and was conferred the Doctor of Science (Honoris Causa) by the University of Peradeniya in 2004.

-

News4 days ago

News4 days agoInterception of SL fishing craft by Seychelles: Trawler owners demand international investigation

-

News4 days ago

News4 days agoBroad support emerges for Faiszer’s sweeping proposals on long- delayed divorce and personal law reforms

-

Opinion14 hours ago

Opinion14 hours agoThe minstrel monk and Rafiki, the old mandrill in The Lion King – II

-

News5 days ago

News5 days agoPrivate airline crew member nabbed with contraband gold

-

News3 days ago

News3 days agoPrez seeks Harsha’s help to address CC’s concerns over appointment of AG

-

Features14 hours ago

Features14 hours agoThe Venezuela Model:The new ugly and dangerous world order

-

Latest News1 day ago

Latest News1 day agoWarning for deep depression over South-east Bay of Bengal Sea area

-

News3 days ago

News3 days agoGovt. exploring possibility of converting EPF benefits into private sector pensions