News

Harsha accuses govt. of being secretive about debt negotiations with international commercial creditors

By Saman Indrajith

The Samagi Jana Balawegaya (SJB) is not at all satisfied with the furtive manner in which the government is conducting discussions with Sri Lanka’s commercial creditors to restructure 12 billion dollars of debt, SJB MP and Chairman of the Committee on Public Finance (COPF), Dr. Harsha de Silva said.

The SJB MP added that the country’s international commercial creditors account for a large portion of its domestic debt and they have formed a group, i.e. ‘The Ad Hoc Group of Bondholders’ that has procured the services of two powerful consulting firms.

The Group is advised by Rothschild & Co and White & Case LLP as financial and legal advisors, respectively, he said.

Sri Lanka has made some progress with bilateral creditors including China and India, he said.

“China for the first time since it started lending has agreed to accept the same conditions that the other creditors receive. This is a great victory. However, the stumbling block seems to be our dealings with the commercial creditors and I am not sure if we are doing all we can to get a speedy resolution.”

MP de Silva said that early in 2023, the Ad Hoc Group of Bondholders came up with a “Macro-Linked Bond” (MLB) as a way of restructuring the debt. MLB links payouts to the evolution of Sri Lanka’s gross domestic product. They proposed the government the issuance of 10 bonds linked with the country’s macroeconomic health that will mature between 2027 and 2036, he said.

“They have proposed a 20 percent haircut and an interest rate up to 9.5 percent to be paid in cash and in kind.” But if GDP growth is lower than the bondholders expect the interest rates will drop further. The Sri Lankan government said, in October, it was not too keen on this and I don’t blame them.”

In late 2023, White & Case LLP issued a statement on behalf of the Ad Hoc Group of Bondholders. In this statement they said they have repeatedly tried to engage with the Sri Lankan authorities and its advisors in good faith. They say no substantive engagement has taken place between Sri Lanka and its private creditors by December 2023, de Silva said.

“Now it’s mid- March and no one knows what is going on. We have achieved stability, but we have done so by drastically increasing poverty, significant job losses and the closure of small and medium enterprises. Moreover, Sri Lankan workers sacrificed a lot for the government to restructure domestic debt. So people have sacrificed greatly for stability and therefore they need to know what is going on. But the government is secretive and does not tell us anything that is happening with foreign debt restructuring.”

The SJB MP went on to say that Sri Lanka will be able to dispel the moniker of a bankrupt state when it is able to access international capital markets. For this Sri Lanka’s credit rating must improve.

“President Ranil Wickremesinghe says Sri Lanka will shed the moniker of a bankrupt state by April. I think a lot needs to be done before we reach that stage. We are at the bottom of the ratings, and we need to at least get to where the country was before the Gotabaya Rajapaksa administration.”

MP de Silva said that Sri Lanka needs to grow at double digits to escape the current stagnation and that the best way to do it is to explore how the country can benefit from the fast-growing Indian South.

“This will be the fastest growing area in the world in the coming decades. We need to see how we can link with them and benefit.”

News

PUCSL and Treasury under IMF spotlight as CEB seeks 11.5% power tariff hike

The Public Utilities Commission of Sri Lanka (PUCSL) and the Treasury are facing heightened scrutiny as the Ceylon Electricity Board (CEB) presses for an 11.5 percent electricity tariff increase, a move closely tied to IMF-driven state-owned enterprise (SOE) reforms aimed at curbing losses and easing fiscal pressure on the State.

The proposed hike comes as the Treasury intensifies efforts to reduce the budgetary burden of loss-making SOEs under Sri Lanka’s IMF programme, which places strong emphasis on cost-reflective pricing, improved governance and the elimination of quasi-fiscal deficits.

Power sector sources said the PUCSL has completed its technical evaluation of the CEB proposal and is expected to announce its determination shortly.

The decision is being closely watched not only as a test of regulatory independence, but also as an indicator of how Treasury-backed fiscal discipline is being enforced through independent regulators.Under the IMF agreement, Sri Lanka has committed to restructuring key SOEs, such as, the CEB to prevent recurring losses from spilling over into public finances.

Treasury officials have repeatedly warned that continued operational losses at the utility could ultimately require state intervention, undermining fiscal consolidation targets agreed with the IMF.

The CEB has justified the proposed 11.5 percent hike by citing high generation costs, foreign currency loan repayments and accumulated legacy losses, arguing that further tariff adjustments are necessary to stabilise finances and avoid a return to Treasury support.

However, critics argue that IMF-aligned reforms should not translate into routine tariff hikes without meaningful improvements in efficiency, cost controls and governance within the utility.

Trade unions and consumer groups have urged the PUCSL to resist pressure from both the CEB and fiscal authorities to simply pass costs on to consumers.

They also note that improved hydropower availability should reduce dependence on expensive thermal generation, easing cost pressures and giving the regulator room to moderate any tariff increase.

Energy analysts say the PUCSL’s ruling will reflect how effectively the Treasury’s fiscal objectives are being balanced against the regulator’s statutory duty to protect consumers, warning that over-reliance on tariff increases could erode public support for IMF-backed reforms.

Business chambers have cautioned that another electricity price hike could weaken industrial competitiveness and slow economic recovery, particularly in export-oriented and energy-intensive sectors already grappling with elevated costs.

Electricity tariffs remain one of the most politically sensitive aspects of IMF-linked restructuring, with previous hikes triggering widespread public discontent and raising concerns over social impact.

The PUCSL is expected to outline the basis of its decision, including whether the proposed 11.5 percent increase will be approved in full, scaled down, or restructured through slab-based mechanisms to cushion low-income households.

An energy expert stressed that Sri Lanka navigates IMF-mandated fiscal and SOE reforms, the forthcoming ruling is widely seen as a defining moment—testing not only the independence of the regulator, but also the Treasury’s ability to pursue reform without deepening the burden on consumers.

By Ifham Nizam ✍️

News

Bellana says Rs 900 mn fraud at NHSL cannot be suppressed by moving CID against him

Massive waste, corruption, irregularities and mismanagement at laboratories of the country’s premier hospital, revealed by the National Audit Office (NAO), couldn’t be suppressed by sacking or accusing him of issuing death threats to Health Secretary Dr. Anil Jasinghe, recently sacked Director of the National Hospital of Sri Lanka (NHSL) Dr. Rukshan Bellana told The Island.

Dr. Bellana said so responding to Dr. Jasinghe’s request for police protection claiming that he (Bellana) was directly responsible for threatening him.

The NPP government owed an explanation without further delay as the queries raised by NAO pertained to Rs 900 mn fraud/loss caused as a result of procurement of chemical reagents for the 2022 to 2024 period remained unanswered, Dr. Bellana said, pointing out that NAO raised the issue in June last year.

Having accused all other political parties of corruption at all levels, the NPP couldn’t under any circumstances remain mum on NAO’s audit query, DR. Bellana said, claiming that he heard of attempts by certain interested parties to settle the matter outside legal procedures.

The former GMOA official said that the NPP’s reputation was at stake. Perhaps President Anura Kumara Dissanayake should look into this matter and ensure proper investigation. Dr. Bellana alleged that those who had been implicated in the NAO inquiry were making an attempt to depict procurement of shelf time expired chemical reagents as a minor matter.

By Shamindra Ferdinando ✍️

News

First harvest of rice offered to Dalada Maligawa

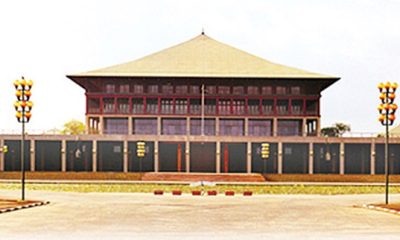

Continuing a centuries-old tradition, dating back to the era of ancient kings, the annual ‘Aluth Sahal Mangalya’—the offering of alms prepared from the maiden harvest of rice—was ceremonially observed at the Sri Dalada Maligawa on Duruthu Full Moon Poya Day, 03rd January.

The religious observances were conducted with the participation of Ven. Thibbatuwawe Sri Medhankara Thera, a member of the Thevava (officiating clergy) of the Sacred Tooth Relic, and Diyawadana Nilame Pradeep Nilanga Dela.

In keeping with long-established customs, paddy harvested from lands belonging to the Sri Dalada Maligawa was brought from the Atuwa (granary) in Pallekele. The newly harvested rice was subsequently prepared and offered as Buddha Pooja to the Sacred Tooth Relic.

Text and Pic by SK Samarnayake ✍️

-

News2 days ago

News2 days agoHealth Minister sends letter of demand for one billion rupees in damages

-

News5 days ago

News5 days agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges

-

Features6 days ago

Features6 days agoIt’s all over for Maxi Rozairo

-

Opinion4 days ago

Opinion4 days agoRemembering Douglas Devananda on New Year’s Day 2026

-

News6 days ago

News6 days agoDr. Bellana: “I was removed as NHSL Deputy Director for exposing Rs. 900 mn fraud”

-

News5 days ago

News5 days agoDons on warpath over alleged undue interference in university governance

-

Features6 days ago

Features6 days agoRebuilding Sri Lanka Through Inclusive Governance

-

Business5 days ago

Business5 days agoSri Lanka Tourism surpasses historic milestone with record tourist arrivals in 2025