Business

Decision on vehicle imports helps rally stocks

By Hiran H. Senewiratne

The stock market yesterday slid downwards to 100 points but subsequently moved up due to President Anura Kumara Dissanayake’s statement in Parliament on the lifting of the ban on vehicle imports.

This triggered a rally among stocks in the vehicle imports related companies and banking sector counters, market analysts said.

Amid those developments both indices moved upwards. The All Share Price Index went up by 132.5 points while S and P SL20 rose by 29.5 points. Turnover stood at Rs 6.01 billion with twelve crossings.

Those crossings were reported in Softlogic Life Insurance where 2.2 million shares crossed to the tune of Rs 127.6 million and its shares traded at Rs 58, HNB 400,000 shares crossed for Rs 108.6 million and its shares sold at Rs 272, Hemas 1.08 million shares crossed to the tune of Rs 100 million; its shares traded at Rs 92.50, CIC 650,000 shares crossed to the tune of Rs 58.6 million; its shares traded at Rs 90.50, Dipped Products 1 million shares crossed for Rs 50 million; its shares traded at Rs 50, Vallibel One 1 million shares crossed for Rs 50 million; its shares traded at Rs 50, JKH 2 million shares crossed to the tune of Rs 44.6 million and its shares soldat Rs 22.30, Overseas Realty two million shares crossed to the tune of Rs 39 million; its shares traded at Rs 19.50, RIL Properties 3 million shares crossed to the tune of Rs 35.3 million; its share price traded at Rs 11.70, Commercial Bank 250,000 shares crossed to the tune of Rs 34.2 million and its shares sold at Rs 137, Central Finance 200,000 shares crossed to the tune of Rs 31 million; its shares traded at Rs 155 and NDB 238,000 shares crossed for Rs 21.4 million and its shares traded at Rs 90.

In the retail market top six performing companies that contributed to the turnover were; HNB Rs 562 million (two million shares traded), JKH Rs 245 million (11 million shares traded), Lanka Milk Food Rs 222 million (5.7 million shares traded), CIC Rs 180 million (two million shares traded) CIC (Non- Voting) Rs 172 million (2.6 million shares traded) and Agrapathana Plantation Rs168 million (15.5 million shares traded). During the day 210 million shares volumes changed hands in 34195 transactions.

It is said that banking and finance sector stocks moved upwards and indicated a significant gain while the manufacturing sector became the second largest contributor to the turnover.

Yesterday, the rupee traded weaker at Rs 291.25/50 to the US dollar in the spot market, slightly weaker from Rs 291.15/25 to the US dollar, while bond yields were steady, ahead of a bill auction, dealers said.

A bond maturing on 15.12.2026 was quoted at 9.40/50 percent down from 9.45/50 percent.

A bond maturing on 01.05.2027 was quoted at 9.70/80 percent down from 9.75/85 percent.

A bond maturing on 01.05.2028 was quoted at 10.20/25 percent, up from 10.10/15 percent.

A bond maturing on 15.09.2029 was quoted at 10.65/70 down from 10.67/73 percent.

Business

President announces how JJB govt lowered IMF benchmarks for benefit of people

By Sanath Nanayakkare

President Anura Kumara Dissanayake speaking in parliament yesterday listed the achievements his government made in bringing tax relief to certain sections of the society during the 3rd review of the IMF, under its Extended Fund Faculty programme.

He also said that the JJB government would leave no room for an economic crisis to take place under its watch.

“Some sections are making attempts to fuel fear among the people that an economic crisis would emerge in 2028 when the country starts repaying its loans, plunging the country back into bankruptcy. Keep in mind that our government will be in office in 2028. We will not allow an economic crisis to happen in the future like in 2022, 2023. Our goal is to build reserves up to USD 15.1 billion by 2028. We are working towards it. We have a strong belief that we will have collected USD billion 15.1 billion in foreign reserves by that time.

“Today, USD 12.55 billion is subjected to debt restructuring plus the shirked payment of USD 1.7 billion. We have restructured USD 12.55 billion out of which USD 11.55 billion were loans taken between 2015-2019.I think If instructions had been given those days, the crisis wouldn’t have happened. Keep in mind that the instructions came in too late.”

“Soon after the general election, IMF started the 3rd review on Nov. 16. At the 2nd review , there were a number of benchmarks with the previous government. One of the main proposals as per the 2nd review was the rental tax on property which was to be enforced in 2025. A service export tax of 30% had been agreed. It had been agreed to remove the special trade levy in January 2025 and replace it with a value added tax. The same tax code was to be continued with personal income tax. It had been proposed to remove the SVAT by April 2025. SVAT makes it easier for businesspeople to claim refunds on the VAT they pay and support their cashflow. But it had been proposed to remove it.”

“When the 3rd review started, what did we propose? You know that there was a lot of disappointment over PAYE tax. associations of doctors, bank managers, university lecturers had expressed their dismay at PAYE tax.”

“We negotiated with the International Monetary Fund to raise the income tax threshold to 150,000 rupees a month from the current 100,000 rupees. The wages of a person earning 150,000 rupees will be 100 percent free from tax. The 6 percent tax on the first slab of 500,000 rupees will be raised to one million rupees. The tax on someone earning 200,000 rupees will be 71 percent free of tax. The salary of a person earning 250,000 will be 61 percent free, 300,000 rupees 47 percent free.Rs 350,000 a month will be free by 25 percent. We have been able to revise PAYE tax to give bigger benefits to lower income earnings and lower benefits to higher income earners.”

“We have agreed to raise the withholding tax on bank deposits to be raised from 5 to 10 percent. However, there will be a process where exemptions can be claimed by senior citizens who think that they shouldn’t be liable to this tax even if they earn a monthly interest of Rs. 150,000. A special division will be set up at the Inland Revenue Department to address such concerns.”

“The value added tax the previous government had imposed on local milk and yoghurt will also be removed, Corporate tax on services export which was to be raised to 30 percent will be reduced to 15 percent, as a result of our negotiations with the IMF,” the President said.

Business

Browns recognised as Most Innovative Diversified Conglomerate

Brown & Company PLC, one of Sri Lanka’s leading entities was recently nominated as Most Innovative Diversified Conglomerate, Sri Lanka 2024 by the esteemed Global Economics Awards, a prestigious platform which identifies business enterprises that contribute towards their economies in a significant way.

Browns IT’s in-house Digital Transformation Solutions arm (DTS), has been instrumental in introducing ground-breaking digital innovations across a diverse range of key industry sectors such as automotive, power generation agriculture, pharmaceuticals and manufacturing. Transforming business processes with a portfolio of innovative digital solutions aimed at enhancing efficiency and customer experience, Brown & Company, once renowned for its leading role in mechanisation is now in the process of pioneering industry-based digitalisation across the nation.

Some of Browns IT’s latest solutions include, the Smart Force Sales Automation tool which takes over manual, repetitive tasks, enabling sales teams to focus on building customer relationships and sourcing new business opportunities. Alongside that, the Company recently introduced Sri Lanka’s first paperless warranty app, Browns eCare, replacing a traditional model with a seamless mobile and web interface allowing customers to easily check e-warranty details, locate service agents, access product information and more. Meanwhile, Browns IT’s AI-powered Docit solution simplifies document handling by automating the identification and reading of documents. In terms of service management, Zyra, a customer care interface with inbuilt AI-driven models captures vehicle details in order to provide enhanced service while improving overall efficiency.

The versatile Proyetco platform augments worksite management through its web and mobile applications, while incorporating facial recognition for improved productivity and accessibility. In the agriculture sector, the SMART GoviSaviya mobile application supports field assistants by enabling the collection of real-time farming data thereby leading to better decision-making and support in the field.

Building on its commitment to leveraging IoT technology, Brown & Company offers advanced solutions for industrial monitoring and maintenance. The IGen G500 Generator Monitoring IoT Solution, integrated with the Smartsys platform, allows for remote tracking of essential data required for timely generator maintenance while ensuring operational reliability. Similarly, the Company’s Chiller IoT Solution uses sophisticated IoT technology to monitor key parameters such as pH, EC and salinity, optimise efficiency, reduce energy consumption and enhance the reliability of operations.

Expanding its suite of solutions, Browns IT offers Load IT, Smart Flow, Smart Assist, Smart Count, MMT and Boiler, Poultry Farm and Fuel Monitoring IoT Solutions, further enhancing operational effectiveness across various sectors through its digital and technology innovations.

Speaking on the accolade Prasanna Ganegoda, Head of IT – Brown & Company PLC said, “Brown & Company is at the forefront of innovation, continually pushing boundaries to integrate cutting-edge digital solutions across diverse industries.

Business

‘SL’s electricity unit cost remaining high compared to regional counterparts’

By Ifham Nizam

Sri Lanka’s electricity unit cost remains high compared to regional counterparts, currently standing at 13 US cents per unit, said Eng. Pubudu Niroshan, the Director General of the Power Sector Reform Task Force under the Ministry of Energy.

Speaking on the government’s plan, he stated the goal is to bring this figure down to 8 US cents within the next five years, ensuring Sri Lanka’s competitiveness in the region.

“Our aim is to reduce generation costs progressively, focusing on renewable energy sources and implementing reforms. Immediate price reductions are impractical without addressing the root causes. A stable reduction in electricity costs requires investments in low-cost power plants, Niroshan explained.

Highlighting the importance of renewable energy, Niroshan stressed that delays in commissioning solar and wind power projects and the absence of LNG-based generation have hindered progress.

“For decades, we discussed coal power plants but failed to implement them when required. Even with tenders for LNG facilities, significant delays were encountered. Competitive pricing and efficient tender processes for renewable projects are key moving forward, he added.

He also said that the government has already embarked on an ambitious plan to add 2,000 MW of solar power to rooftops at a rate of 400 MW annually. Additionally, wind power generation opportunities in the Mannar to Pooneryn belt are being fast-tracked to boost the national grid’s capacity.

While transitioning to solar and wind energy, Niroshan noted that managing day-to-day demand remains critical. “Thermal plants like Kelanitissa and Kerawalapitiya will rely on LNG for the next three years, and we aim to achieve 1,500 MW of production from LNG plants during this period, he revealed.

However, balancing generation costs poses challenges, he said, particularly during the dry season when hydropower output is limited. The estimated generation cost for the first six months of 2025 stands at Rs. 268 billion, while revenue is projected to reach only Rs. 229 billion, leaving a deficit of Rs. 39 billion.

“Despite public perception of profitability, the reported Rs. 140-150 billion ‘profit’ this year was used to settle outstanding debts amounting to Rs. 118 billion. Thus, only Rs. 41 billion remained, and this will be utilized to offset expenses for the first half of next year, Niroshan clarified.

Eng. Niroshan stressed the need for structural reforms in the electricity sector, including the unbundling of generation, transmission, and distribution into separate entities, all fully owned by the government. He explained that the reform plan involves establishing three to four generation companies, two transmission companies, and four distribution companies, overseen by an independent system-operating company.

“This is not privatization but a step towards efficiency, transparency, and sustainability. A restructured power sector will ensure affordable and reliable electricity for the next 30-40 years, he added.

-

Opinion3 days ago

Opinion3 days agoDegree is not a title!

-

Features6 days ago

Features6 days agoEmpowering the next generation: St. Benedict’s College brings STEM education to life

-

Features4 days ago

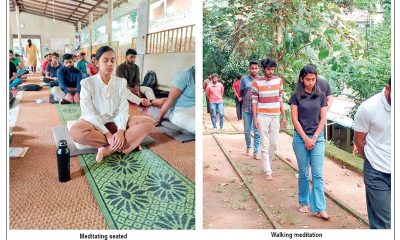

Features4 days agoSpiritual Awakening of a Village

-

News5 days ago

News5 days agoOver 300,000 Sri Lankans leave for overseas jobs this year

-

News2 days ago

News2 days agoInnovative water management techniques revolutionising paddy cultivation in Lanka

-

Latest News5 days ago

Latest News5 days agoIndia’s Gukesh beats China’s Ding to become youngest chess world champion

-

Features4 days ago

Features4 days agoRevisiting the role of education in shaping shared futures

-

Features4 days ago

Features4 days agoThe Silence of the Speaker and other matters