Business

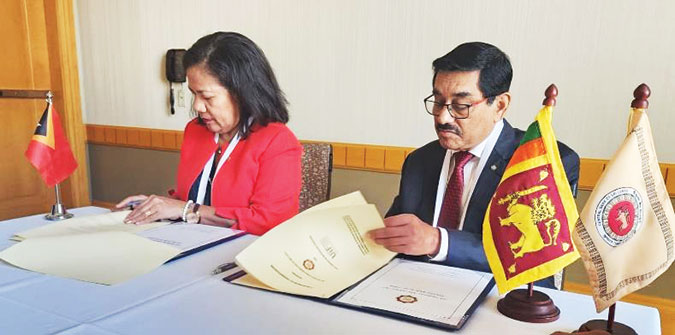

CB Governor attends Asia Pacific Group’s Money Laundering Annual Plenary

Dr. Nandalal Weerasinghe, the Governor of the Central Bank of Sri Lanka in his capacity as the chairman of the National Coordinating Committee (NCC) on Anti Money Laundering/Countering the Financing of Terrorism (AML/CFT), represented the Sri Lankan delegation to the 2023 Annual Plenary of the Asia Pacific Group on Money Laundering (APG) and the ensuing Technical Assistance and Training (TA&T) Forum held in Vancouver, Canada from 11 – 14 July 2023.

The Sri Lankan delegation consisted of the expert assessors participating in the respective Mutual Evaluations of the Peoples’ Democratic Republic of Lao (Lao PDR), Nepal and Brunei. The annual Plenary brought together over 300 delegates from the 42 APG member countries, observer institutions and jurisdictions, and private sector stakeholders to discuss issues concerning countering serious financial crime, including money laundering (ML), terrorist financing (TF), and proliferation financing relating to weapons of mass destruction (PF). The 2023 APG was co-chaired by Julien Brazeau, the Associate Assistant Deputy Minister of Finance from the Department of Finance of Canada, and Ian McCartney, the Deputy Commissioner of the Australian Federal Police, Australia.

Business

Australia’s Qantas to pay $79m over ‘ghost flights’ furore

Australia’s flagship airline Qantas has agreed to pay $120 million Australian dollars ($79m) to settle a lawsuit over the sale of tickets for already cancelled flights.

The airline will pay a fine of 100 million Australian dollars ($66m) and provide compensation of 20 million Australian dollars ($13m) to more than 86,000 customers after advertising seats for thousands of “ghost flights” in 2021 and 2022.

“Qantas’ conduct was egregious and unacceptable. Many consumers will have made holiday, business and travel plans after booking on a phantom flight that had been cancelled,” said Australian Competition and Consumer Commission Chairperson Gina Cass-Gottlieb in a statement on Monday.

“Importantly, it demonstrates that we take action to ensure that companies operating in Australia communicate clearly, accurately and honestly with their customers at all times,” Cass-Gottlieb added.

Qantas Group CEO Vanessa Hudson said the settlement, which is subject to court approval, was an “important step forward as we work towards restoring confidence in the national carrier.”

“When flying resumed after the COVID shutdown, we recognise Qantas let down customers and fell short of our own standards. We know many of our customers were affected by our failure to provide cancellation notifications in a timely manner and we are sincerely sorry,” Hudson said.

“The return to travelling was already stressful for many and we did not deliver enough support for customers and did not have the technology and systems in place to support our people.”

Qantas, which reported an annual profit of $1.1bn last year, has faced a barrage of controversies in recent years over rising ticket prices, claims of poor service standards, and the firing of 1,700 ground staff during the COVID-19 pandemic.

In September, then-CEO Alan Joyce brought forward his retirement by two months after 15 years in the top job amid widespread criticism of the airline.

(Aljazeera)

Business

Sampath PayBand to herald a new era in convenient and secure transactions

A payment choice key to attracting tech-savvy and younger consumers

The innovative product launched in partnership with VISA

As the global trend towards contactless payments continues to surge, Sampath Bank last week unveiled its latest innovation: Sampath PayBand, the versatile Wearable Payment Device.

This groundbreaking solution promises to redefine the transaction landscape in Sri Lanka, catering to the evolving preferences of the younger generation and tech-savvy consumers. Representing a significant milestone as the country’s first of its kind, Sampath PayBand, heralds a new era in convenient and secure transactions.

Designed with a meticulous focus on enhancing the customer experience and streamlining payment processes, Sampath PayBand features a sleek Silicon Wristband embedded with a payment chip. Seamlessly integrated with Sampath Bank Savings accounts, this cutting-edge device empowers users to effortlessly make transactions with a simple tap or wave at any NFC-enabled POS terminal. Gone are the days of cumbersome wallets, forgotten cards, and misplaced phones – Sampath PayBand offers unparalleled convenience at every touchpoint.

“At Sampath Bank, we are dedicated to driving innovation and embracing emerging technologies to meet the evolving needs of our customers,” said Shiran Kossinna – Assistant General Manager Card Centre at Sampath Bank. “With the introduction of Sampath PayBand, a Wearable Payment Device, we aim to provide a seamless and hassle-free shopping experience, empowering our customers with the freedom to make cashless payments effortlessly.”

Sampath PayBand offers the following benefits to users:

Convenient :Seamlessly make payments with a simple tap or wave.

Innovative :Embrace cutting-edge payment technology for seamless transactions.

Swift :Complete transactions swiftly, outpacing traditional methods.

Productive :Leverage wearable technology to boost engagement and productivity.

Lifestyle oriented :Enjoy compatibility with modern payment methods that align seamlessly with customer preferences.

Launched in partnership with VISA, a global payment card services corporation facilitating electronic funds transfers throughout the world, the Sampath PayBand underscores the Bank’s dedication to providing cutting-edge banking solutions that meet the evolving needs of today’s consumers, offering convenience, security, and peace of mind.

Being the first of its kind in Sri Lanka, Sampath PayBand stands as a unique and compelling offering for consumers. Unaffected by rain or shine, work or party, the product is the ideal choice of the Gen Z and tech-savvy generation who look for convenience, versatility and fashion when selecting products for their use.

Sampath PayBand, will be available to all existing and new account holders at select Sampath bank branches from mid-June onwards where interested customers will receive personalized assistance and guidance on setup and usage upon acquiring a device.

Business

BOI clarifies situation on FDI promotion in Sri Lanka

The Board of Investment of Sri Lanka has come forward to clarify recent remarks made by Dhananath Fernando, CEO – Advocata Institute during a program on News First (FACE THE NATION; “Economic Stability: Myth or Reality?”) on 14th February 2024.

During this program, three broad statements were made by Fernando substantiating his opinion that “there is no way we can attract investment for exports”.

The BOI would like to highlight some inaccuracies presented in order to update the public and our stakeholders as follows:

Contrary to the statement made by Fernando that the Board of Investment (BOI) has not established any new projects/zones in the last eight years, it should be noted that BOI has consistently engaged in establishing zones to support investments and economic growth. Currently 15 zones operate under the aegis of BOI with associated infrastructure ensuring smooth operation of investment projects.

Nine of the said BOI Zones are located in the Western Province hosting over 200 export-oriented enterprises – which is testament to the zones’ success and whilst the majority of these zonal lands are thus productively utilized, BOI still has capacity to cater to projects meeting the stipulated investment criteria within these zones.

The BOI wishes to further emphasize that several zones in North Western, Eastern and Southern Provinces have been established as part of an island-wide strategic initiative designed to promote investments into potential sectors and contribute to industrial development throughout the country. Additionally, a further 2,500+ acres have been identified for zone development throughout the island.

Fernando also erroneously stated during the same discussion that over 16 licenses are required for a single project to be mobilized over an alleged expedited period of two years if not, a longer time period of even 3-4 years.

Here, it is essential to understand that the number and nature of approvals required for a BOI project vary significantly based on the specific characteristics of the project. However, licenses are typically required when a project utilizes natural resources or is environmentally sensitive in nature, but in no instance has the BOI recorded a project requiring 16 licenses to be obtained prior to implementation.

Project implementation requires Line Agency approvals which are in place as checks and balances to safeguard significant elements of socio-economic and environmental interest. To help investors navigate this approval process, BOI introduced an Investor Facilitation Center (IFC) in 2022, fast-tracking projects requiring complex approvals. The success rate of IFC interventions is at 80% since inception in November 2022.

The BOI is committed to transparency and openness in all its endeavors and welcomes any queries related to our operations and developments, and remains dedicated to fostering a conducive business environment that supports both local and foreign investors.Based on the above, the BOI opines that Fernando’s statements are not only misleading, but injurious to the purpose of FDI promotion in Sri Lanka.

-

Business5 days ago

Business5 days agoINSEE Ecocycle marks 21 years of environmental excellence with a city cleaning program in Anuradhapura

-

Features3 days ago

Features3 days agoSearching for Dayan Jayatilleka

-

Features6 days ago

Features6 days agoCalling applications for MBBS!

-

Sports5 days ago

Sports5 days agoUS visa issues deny Sri Lanka Olympic qualifying opportunity in Bahamas

-

News1 day ago

News1 day agoLankan wins UK’s prestigious hair and beauty awards 2024

-

News3 days ago

News3 days agoBIA thrown into turmoil as foreign firm handles on-arrival visa counter

-

Features5 days ago

Features5 days agoWhy are SL universities’ positions low in world ranking indices?

-

Business1 day ago

Business1 day agoUSDA Under Secy Taylor visits New Anthoney’s Farms and commends its pursuit towards sustainable poultry practices