Features

Sri Lanka’s Debt Restructuring Roadmap: Following the Evidence

By Dr Dushni Weerakoon

Debt restructuring is fundamentally about allocating the associated economic costs to someone. The onus is typically on the debtor country to secure participation from its creditors, applying comparable treatment to all. As with all negotiations, the level and modalities of relief will always be subject to some degree of controversy. Sri Lanka’s recently gazetted domestic debt restructuring (DDR) exercise too has drawn expressions of both support and criticism. Overall though, negotiations have to be framed within certain desired outcomes to minimize costs to the economy. To this end, Sri Lanka’s negotiating stance dovetails neatly with crucial research evidence.

A restructuring process, whether pre-emptive or post-default, imposes significant output costs. For a debtor country to minimize these, some notable findings are:

Output losses are higher in post-default restructuring.When defaults are accompanied by a banking crisis, the fall in output is particularly large.

Even in a post-default setting, output costs can be reduced the quicker the debtor country is able to reach an agreement with its creditors.The size of creditor losses (haircuts) is among the best predictors of participation rates on bond restructuring.

To begin with, there was no real appetite to include a DDR in Sri Lanka’s case, especially in view of the substantial real erosion in value to debt holders as inflation spiraled. But, as opening gambits commenced with external creditors, the bondholder group’s request that ‘domestic debt is reorganized in a manner that both ensures debt sustainability and safeguards financial stability’ could not be ignored if only to avoid an impasse. Sri Lanka has limited room to circumvent a DDR altogether. As a middle-income country, the inclusion of domestic debt optimization is implicitly encouraged in the IMF’s debt sustainability framework (DSF) for market-access countries. It focuses on the total stock of public debt but is avoided by low-income countries where the applicable DSF focuses only on external public debt.

Having opened the door to a DDR, there would have been very real concerns that the combination of skyrocketing inflation and financial fragility would test the banking sector’s resilience to deal with a DDR. Figures on capital adequacy and asset quality (with the non-performing loan ratio on stage three loans rising from 5.2% in 2020 to 11.3% in 2022) and exposure to restructuring the country’s international sovereign bonds (ISBs) meant the stakes were high. When times are uncertain, a herd mentality will rule, and this is to be avoided at all costs.

Another element in a DDR is that there are negative externalities that need to be internalised – i.e. there may be direct costs to a country’s financial sector from a DDR, such as recapitalization and these have to be taken on board. This is particularly so where there is a strong link between the sovereign and its financial system. In setting aside resources to ensure financial system stability, the anticipated fiscal benefits of a DDR can potentially reduce. Thus, on both counts, ring-fencing the banking sector to avert a far more damaging economic crisis and deeper output losses has been the first step in Sri Lanka’s approach.

Having left out the banking sector, the economic cost appears to have been disproportionately directed at the savings of workers contributing to pension funds. Private bondholders have been exempted denying ‘comparable treatment’ while the captive nature of the Employees Provident Fund (EPF), managed by the Central Bank of Sri Lanka (CBSL), means there has been no attempt to ‘secure participation’.

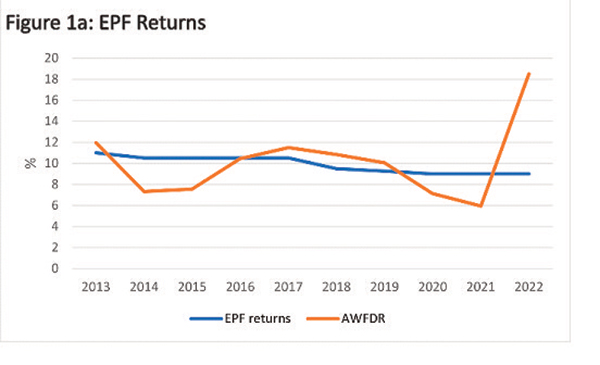

Sri Lanka’s DDR treatment in effect is an example of the considerable degree of influence that a sovereign can exert over domestic legal and regulatory frameworks, unlike that of an external debt restructuring (EDR). Under the terms, pension funds are required to opt for a 30% haircut or be liable for higher taxation at 30% instead of the prevailing 14%. For EPF savers, there is the only assurance of receiving a 9% return in the long-term for a fund that has often performed below par even against the simplest alternative instrument that an average saver may look at, such as one-year fixed deposits (Figure 1a). Where there has been a substantial erosion of real savings from a crisis-induced economic environment, this is scant consolation for workers. The premise of a return to single-digit inflation merely means that price increases have slowed from the previous exorbitant high levels, but the erosion of the value of savings remains very real.

The second step of the negotiating process is to bring as many of Sri Lanka’s external creditors on board as quickly as possible. Having complied with the bondholder group’s request on including a DDR, comparable treatment is being offered by way of a 30% haircut on EDR too. As a bilateral creditor, China’s preference globally is for deferral rather than reduction. But merely pushing repayments down the line with maturity extensions (and some coupon adjustments) still leaves Sri Lanka at the risk of being permanently illiquid and, therefore, vulnerable to repeat short-term crises. Clearly, the deeper the haircut, the more sustainable the debt becomes, but negotiations will likely drag on. A complex creditor group and geo-political wrangling add to these risks. Ecuador, a middle-income country, came to an agreement with its bondholders to a haircut of 9% on USD 17.4 billion in 2020, with a high 98% of bondholders agreeing to the deal. China persisted with maturity extensions and coupon adjustments.

Corralling in the bilateral creditors will require more diplomatic persuasion than economic analysis. China’s recently concluded deal with Zambia to restructure USD 4.2 billion of loans under an initiative driven by the G20 Framework for low-income countries pushed back repayments and accommodated interest rate cuts. This follows on from its deal with Ecuador a year earlier that included maturity extensions and interest rate adjustments on debts worth USD 4.4 billion. There are two key arguments put forward by China for not taking losses in debt restructurings: first, that its loans are development-oriented, tied to projects that generate revenues for the recipients, and second, that multilateral banks should also participate, instead of the current preferred status of having their loans repaid in full. In many ways, Sri Lanka will be a test case on these issues.

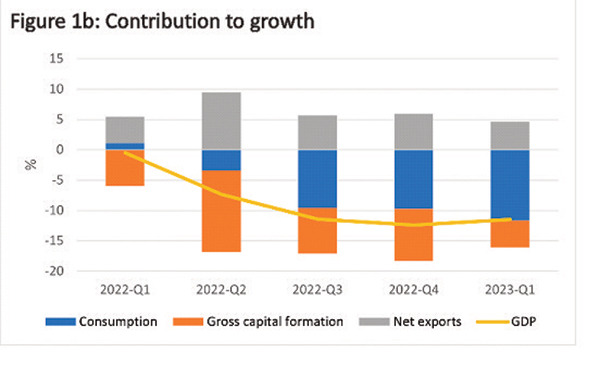

The expected deceleration in the contraction of Sri Lanka’s economic output in the coming months is only the start to claw back lost output. This too is under threat. As domestic consumption faltered, net exports were the only positive driver of growth in recent quarters, but there are concerning signs of a slowdown (Figure 1b). In the event, it is even more probable that the allocation of costs associated with debt negotiations will be weighed and measured against the need to get an overall deal done as quickly as possible to support Sri Lanka’s slow-burn economic recovery.

Link to blog: https://www.ips.lk/talkingeconomics/2023/07/18/sri-lankas-debt-restructuring-roadmap-following-the-evidence/

About the Author:

Dushni Weerakoon is IPS’ Executive Director and Head of its Macroeconomic Policy research. She has nearly three decades of experience at IPS and functioned as its Deputy Director from 2005 to 2017. Since joining IPS in 1994, her research and publications have covered areas related to regional trade integration, macroeconomic policy and international economics. She has extensive experience working in policy development committees and official delegations of the Government of Sri Lanka. She holds a PhD in Economics from the University of Manchester.

Features

Acid test emerges for US-EU ties

European Commission President Ursula von der Leyen addressing the World Economic Forum in Davos, Switzerland on Tuesday put forward the EU’s viewpoint on current questions in international politics with a clarity, coherence and eloquence that was noteworthy. Essentially, she aimed to leave no one in doubt that a ‘new form of European independence’ had emerged and that European solidarity was at a peak.

European Commission President Ursula von der Leyen addressing the World Economic Forum in Davos, Switzerland on Tuesday put forward the EU’s viewpoint on current questions in international politics with a clarity, coherence and eloquence that was noteworthy. Essentially, she aimed to leave no one in doubt that a ‘new form of European independence’ had emerged and that European solidarity was at a peak.

These comments emerge against the backdrop of speculation in some international quarters that the Post-World War Two global political and economic order is unraveling. For example, if there was a general tacit presumption that US- Western European ties in particular were more or less rock-solid, that proposition apparently could no longer be taken for granted.

For instance, while US President Donald Trump is on record that he would bring Greenland under US administrative control even by using force against any opposition, if necessary, the EU Commission President was forthright that the EU stood for Greenland’s continued sovereignty and independence.

In fact at the time of writing, small military contingents from France, Germany, Sweden, Norway and the Netherlands are reportedly already in Greenland’s capital of Nook for what are described as limited reconnaissance operations. Such moves acquire added importance in view of a further comment by von der Leyen to the effect that the EU would be acting ‘in full solidarity with Greenland and Denmark’; the latter being the current governing entity of Greenland.

It is also of note that the EU Commission President went on to say that the ‘EU has an unwavering commitment to UK’s independence.’ The immediate backdrop to this observation was a UK decision to hand over administrative control over the strategically important Indian Ocean island of Diego Garcia to Mauritius in the face of opposition by the Trump administration. That is, European unity in the face of present controversial moves by the US with regard to Greenland and other matters of contention is an unshakable ‘given’.

It is probably the fact that some prominent EU members, who also hold membership of NATO, are firmly behind the EU in its current stand-offs with the US that is prompting the view that the Post-World War Two order is beginning to unravel. This is, however, a matter for the future. It will be in the interests of the contending quarters concerned and probably the world to ensure that the present tensions do not degenerate into an armed confrontation which would have implications for world peace.

However, it is quite some time since the Post-World War Two order began to face challenges. Observers need to take their minds back to the Balkan crisis and the subsequent US invasions of Afghanistan and Iraq in the immediate Post-Cold War years, for example, to trace the basic historic contours of how the challenges emerged. In the above developments the seeds of global ‘disorder’ were sown.

Such ‘disorder’ was further aggravated by the Russian invasion of Ukraine four years ago. Now it may seem that the world is reaping the proverbial whirlwind. It is relevant to also note that the EU Commission President was on record as pledging to extend material and financial support to Ukraine in its travails.

Currently, the international law and order situation is such that sections of the world cannot be faulted for seeing the Post World War Two international order as relentlessly unraveling, as it were. It will be in the interests of all concerned for negotiated solutions to be found to these global tangles. In fact von der Leyen has committed the EU to finding diplomatic solutions to the issues at hand, including the US-inspired tariff-related squabbles.

Given the apparent helplessness of the UN system, a pre-World War Two situation seems to be unfolding, with those states wielding the most armed might trying to mould international power relations in their favour. In the lead-up to the Second World War, the Hitlerian regime in Germany invaded unopposed one Eastern European country after another as the League of Nations stood idly by. World War Two was the result of the Allied Powers finally jerking themselves out of their complacency and taking on Germany and its allies in a full-blown world war.

However, unlike in the late thirties of the last century, the seeming number one aggressor, which is the US this time around, is not going unchallenged. The EU which has within its fold the foremost of Western democracies has done well to indicate to the US that its power games in Europe are not going unmonitored and unchecked. If the US’ designs to take control of Greenland and Denmark, for instance, are not defeated the world could very well be having on its hands, sooner rather than later, a pre-World War Two type situation.

Ironically, it is the ‘World’s Mightiest Democracy’ which is today allowing itself to be seen as the prime aggressor in the present round of global tensions. In the current confrontations, democratic opinion the world over is obliged to back the EU, since it has emerged as the principal opponent of the US, which is allowing itself to be seen as a fascist power.

Hopefully sane counsel would prevail among the chief antagonists in the present standoff growing, once again, out of uncontainable territorial ambitions. The EU is obliged to lead from the front in resolving the current crisis by diplomatic means since a region-wide armed conflict, for instance, could lead to unbearable ill-consequences for the world.

It does not follow that the UN has no role to play currently. Given the existing power realities within the UN Security Council, the UN cannot be faulted for coming to be seen as helpless in the face of the present tensions. However, it will need to continue with and build on its worldwide development activities since the global South in particular needs them very badly.

The UN needs to strive in the latter directions more than ever before since multi-billionaires are now in the seats of power in the principle state of the global North, the US. As the charity Oxfam has pointed out, such financially all-powerful persons and allied institutions are multiplying virtually incalculably. It follows from these realities that the poor of the world would suffer continuous neglect. The UN would need to redouble its efforts to help these needy sections before widespread poverty leads to hemispheric discontent.

Features

Brighten up your skin …

Hi! This week I’ve come up with tips to brighten up your skin.

Hi! This week I’ve come up with tips to brighten up your skin.

* Turmeric and Yoghurt Face Pack:

You will need 01 teaspoon of turmeric powder and 02 tablespoons of fresh yoghurt.

Mix the turmeric and yoghurt into a smooth paste and apply evenly on clean skin. Leave it for 15–20 minutes and then rinse with lukewarm water

Benefits:

Reduces pigmentation, brightens dull skin and fights acne-causing bacteria.

* Lemon and Honey Glow Pack:

Mix 01teaspoon lemon juice and 01 tablespoon honey and apply it gently to the face. Leave for 10–15 minutes and then wash off with cool water.

Benefits:

Lightens dark spots, improves skin tone and deeply moisturises. By the way, use only 01–02 times a week and avoid sun exposure after use.

* Aloe Vera Gel Treatment:

All you need is fresh aloe vera gel which you can extract from an aloe leaf. Apply a thin layer, before bedtime, leave it overnight, and then wash face in the morning.

Benefits:

Repairs damaged skin, lightens pigmentation and adds natural glow.

* Rice Flour and Milk Scrub:

You will need 01 tablespoon rice flour and 02 tablespoons fresh milk.

Mix the rice flour and milk into a thick paste and then massage gently in circular motions. Leave for 10 minutes and then rinse with water.

Benefits:

Removes dead skin cells, improves complexion, and smoothens skin.

* Tomato Pulp Mask:

Apply the tomato pulp directly, leave for 15 minutes, and then rinse with cool water

Benefits:

Controls excess oil, reduces tan, and brightens skin naturally.

Features

Shooting for the stars …

That’s precisely what 25-year-old Hansana Balasuriya has in mind – shooting for the stars – when she was selected to represent Sri Lanka on the international stage at Miss Intercontinental 2025, in Sahl Hasheesh, Egypt.

That’s precisely what 25-year-old Hansana Balasuriya has in mind – shooting for the stars – when she was selected to represent Sri Lanka on the international stage at Miss Intercontinental 2025, in Sahl Hasheesh, Egypt.

The grand finale is next Thursday, 29th January, and Hansana is all geared up to make her presence felt in a big way.

Her journey is a testament to her fearless spirit and multifaceted talents … yes, her life is a whirlwind of passion, purpose, and pageantry.

Raised in a family of water babies (Director of The Deep End and Glory Swim Shop), Hansana’s love affair with swimming began in childhood and then she branched out to master the “art of 8 limbs” as a Muay Thai fighter, nailed Karate and Kickboxing (3-time black belt holder), and even threw herself into athletics (literally!), especially throwing events, and netball, as well.

A proud Bishop’s College alumna, Hansana’s leadership skills also shone bright as Senior Choir Leader.

She earned a BA (Hons) in Business Administration from Esoft Metropolitan University, and then the world became her playground.

Before long, modelling and pageantry also came into her scene.

She says she took to part-time modelling, as a hobby, and that led to pageants, grabbing 2nd Runner-up titles at Miss Nature Queen and Miss World Sri Lanka 2025.

When she’s not ruling the stage, or pool, Hansana’s belting tunes with Soul Sounds, Sri Lanka’s largest female ensemble.

What’s more, her artistry extends to drawing, and she loves hitting the open road for long drives, she says.

This water warrior is also on a mission – as Founder of Wave of Safety,

Hansana happens to be the youngest Executive Committee Member of the Sri Lanka Aquatic Sports Union (SLASU) and, as founder of Wave of Safety, she’s spreading water safety awareness and saving lives.

Today is Hansana’s ninth day in Egypt and the itinerary for today, says National Director for Sri Lanka, Brian Kerkoven, is ‘Jeep Safari and Sunset at the Desert.’

And … the all-important day at Miss Intercontinental 2025 is next Thursday, 29th January.

Well, good luck to Hansana.

-

Editorial4 days ago

Editorial4 days agoIllusory rule of law

-

News5 days ago

News5 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Editorial5 days ago

Editorial5 days agoCrime and cops

-

Features4 days ago

Features4 days agoDaydreams on a winter’s day

-

Editorial6 days ago

Editorial6 days agoThe Chakka Clash

-

Features4 days ago

Features4 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features3 days ago

Features3 days agoExtended mind thesis:A Buddhist perspective

-

Features4 days ago

Features4 days agoThe Story of Furniture in Sri Lanka