Business

Sri Lanka’s Angel Fund shortlists five startups for investment

The Angel Fund Investment Committee members who unanimously select the startups for investment.

The Angel Fund, the first of its kind in Sri Lanka, has shortlisted its five early-stage startups for potential investment; Niftron, Traccular, Medica, Soulboner Clothing, and Ophir. This follows an intense application and selection process, spanning September, October, and November 2020, which initially attracted 80 applications.

The Angel Fund, launched earlier this year by the Lankan Angel Network (LAN), was established with the support of ecosystem development partner Ford Foundation to catalyze the growth of Sri Lanka’s startup ecosystem. Comprising 100 angel investors, including many high-profile entrepreneurs and corporate leaders, who represent more than a dozen sectors with proven competencies in over 20 functional domains, the Angel Fund is also distinct in that it features 20% of its investment from members based out of Canada, Dubai, Hongkong, Qatar, UK, and the USA.

The process was guided by the Fund’s high-profile Investment Committee (IC) consisting of angel Fund members Dumith Fernando, chairman of Colombo Stock Exchange/chairman of Asia Securities, Dumindra Ratnayaka, Chairman/Senior Consultant at Martin & George. The IC also comprises Nathan Sivagananathan, Co-Founder of Hatch Works; Anarkali Moonesinghe, former CEO of CIMB Sri Lanka; Mangala Karunaratne, Founder/CEO of Calcey Technologies; and Imal Kalutotage, Founder/CEO of NCINGA. Joining them as Independent IC Member is Shiluka Goonewardene, Principal – Deal Advisory – KPMG.

Angel Fund IC member Dumith Fernando stated, “The investment approval process for the Angel Fund was quite robust with seasoned experts from varied backgrounds participating in the Investment Committee. We were encouraged by the quality of the shortlisted startups that presented to us. We set a high bar for investment selection this time. And even among those founders who did not gain funding this quarter, we found several who would be investable with some tweaks to their business models and plan.”

Some shortlisted startups were:

• Niftron – A Blockchain-as-a-Service platform that allows for easy and efficient integration of blockchain with products or projects, enhancing ownership, transparency, and security.

• Traccular – A cloud-based IoT-enabled visitor management system that provides a scalable solution for companies looking for an efficient check-in and verification process to improve efficiency and security.

• Medica – A cloud-based patient and prescription management platform for doctors. From when a patient registers, to when they walk out with their medicines from the pharmacy, the entire process is managed within Medica, which aims to build a digital ecosystem for primary health care for Sri Lanka.

• Soulboner Clothing – A fun, casual Sri-Lankan streetwear line made for GenZ and the young Millennial. The brand focuses on creating a lifestyle and a community and boasts a customer base in many countries.

• Ophir – A brand focusing on a range of chemical and synthetic-free, all-natural body care and spa products, which deliver the rich benefits of Camellia Sinensis, Ceylon Tea. Ophir taps into the skyrocketing global demand for natural skincare products, with the added advantage of Sri Lanka’s millennia-old fame resulting from its cornucopia of botanicals, spices, and herbs, as well as Ayurveda.

Independent IC Member Shiluka Goonewardene said, “The finalists for evaluation by the committee were all startups with good ideas and opportunities. The varied experience of the IC members enabled us to evaluate and shortlist the best participants for the funding stage. Overall, it was a great learning experience for me as well, listening to the presentations of the finalists and the follow-up discussions among the IC members.”

These startups will be featured at the LAN hosted Angel Roundup, an exclusive virtual event to be held in mid-December for the network’s angel investors. The event is partnered with Sri Lanka’s largest private-sector retail bank Hatton National Bank PLC, a long-term strategic partner for LAN

Commenting on behalf of the top five shortlisted startups, Ophir Founder Rohini Nordmann said, “The Angel Fund has been both rigorous and supportive of its participants. A winning combination for the investment seekers as well as the investors.”

Angel Fund IC member Anarkali Moonesinghe added, “The Angel Fund was created to bridge the gaps that exist within the startup ecosystem in terms of opening this alternative asset class to a wider audience as well as connecting these investors with incredible entrepreneurs. It serves as not only an avenue to secure funding at an early stage, but also affords startups access to an amazing group of individuals who can be true mentors while, also, opening doors to international markets and networks.”

The Rs. 100 million Angel Fund has plans to eventually invest in six to 10 high potential startups in total, gearing them up to scale domestically, and even internationally. It is managed by LAN’s fund management team, which continues to identify and evaluate opportunities for investment across the island, including in traditionally underserved regions. The fund is dedicated to investing in, and mentoring and supporting, early-stage startups across multiple sectors; from making investments at the early stages, to even helping startups identify sources for future funding.

Business

Industry and Entrepreneurship Development Minister Handunneththi’s visit to Lumala highlights key industrial concerns

With the aim of assesing the current challenges faced by local industrialists and explore avenues for government support, Minister of Industry and Entrepreneurship Development Hon. Sunil Handunneththi visited City Cycle Industries Manufacturing (Pvt.) Ltd., widely known as Lumala, on March 24 at its factory in Panadura.

During the visit, Minister Handunneththi engaged with senior officials and employees to understand their concerns and operational difficulties. In a statement shared on social media, the Minister acknowledged the pressing challenges affecting Sri Lanka’s manufacturing sector and emphasized the government’s commitment to providing swift and effective solutions.

Minister Handunneththi further reiterated the government’s intent to position local manufacturers as key stakeholders in Sri Lanka’s economy by addressing regulatory hurdles, market imbalances, and supply chain constraints.

The visit comes amid growing concerns from Lumala employees and management regarding the state of Sri Lanka’s bicycle manufacturing industry, in the backdrop of facing significant challenges, including an influx of imported bicycles and components that circumvent regulatory checks. In addition, the high taxes on raw materials used in local manufacturing has further exacerbated production costs, making it difficult for domestic manufacturers to remain competitive.

Earlier this year, Lumala employees called for urgent government intervention to address these challenges, warning that ongoing financial strain could lead to further shutdowns of critical production units, job losses, and setbacks to the broader industrial ecosystem. With a local value addition of 50-70 percent verified by the Ministry, its workforce remains hopeful that government action will help achieve an ethical manufacturing industry.

Lumala, a household name in Sri Lanka’s bicycle industry, has been a key player in sustainable mobility solutions for over 35 years. The company was recently honored with the Best National Industry Brand award under the Large-Scale Other Industry Sector category at the National Industry Brand Excellence Awards 2024.

With a production capacity of 2,000 bicycles per day and a workforce of 200, Lumala continues to cater to both domestic and international markets, producing a diverse range of bicycles, electric bikes and light electric vehicles. In line with Sri Lanka’s goal to expand forest cover to 32 percent by 2030 and cut GHG emissions by 14.5%, Lumala is actively contributing to this mission—both as a company and through its diverse range of products.

As Sri Lanka works towards strengthening its local manufacturing sector, Minister Handunneththi’s visit signals a crucial step toward addressing industrial concerns and reinforcing government support for sustainable and competitive domestic production.

Business

New SL Sovereign Bonds win foreign investor confidence

Sri Lanka’s country rating was upgraded from ‘Restricted Default’ to ‘CCC’ following the successful exchange for the new International Sovreign Bonds (SL ISBs) during December 2024. The three types (03) of exciting new sovereign bonds have restored foreign investor confidence.

The Central Bank of Sri Lanka (CBSL) has performed a remarkable role in guiding the economy out of default status and restored economic stability, and gained Sri Lanka a non-default Country Rating of ‘CCC’. Among the key achievements of CBSL, have been to reduce treasury interest rates under 9% and stabilize the currency while rebuilding foreign reserves to $ 6Bn.

SL offers four Macro Linked Bonds (MLBs) linked to GDP growth, a Governance Linked Bond (GLB) and a short term, Fixed Coupon Bond for unpaid Past Due Interest (PDI). The MLBs offer variable returns depending on SL’s GDP growth from 2024 to 2027, (e.g. haircuts can vary between 16% to 39%). The GLB interest can vary depending on meeting 15.3% and 15.4% of Total Revenue/ GDP thresholds in 2026 and 2027 respectively. The PDI bond offers a fixed coupon of 4% until 2028 and trades at around $94.

This combination of unique, variable returns offers global investors an exciting opportunity to capitalize on SL’s economic revival and US interest rate movements. Sri Lanka’s economic resurgence in 2024 was promising, with a 5% GDP growth rate. With improving investor confidence, SL ISB daily turnover now exceeds $10mn.

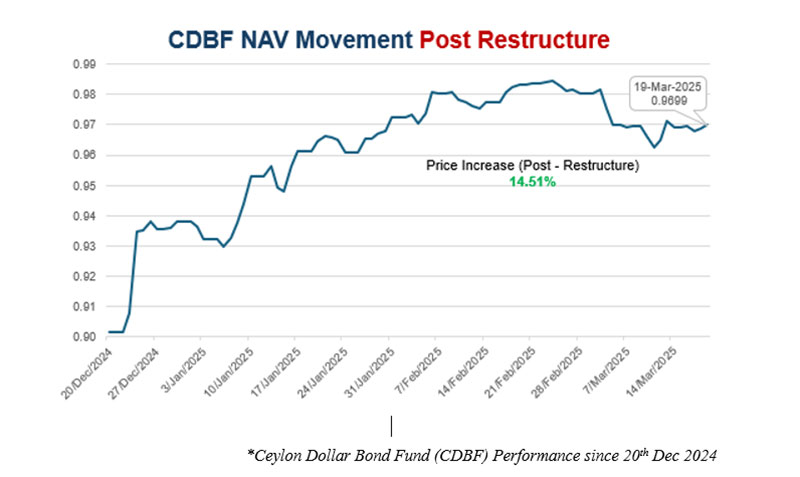

The Ceylon Dollar Bond Fund (CDBF) is the only USD Sovereign Bond Fund that is exclusively invested in SL ISBs with Deutsche Bank acting as the Trustee and Custodian Bank. The Fund reported returns of 53% in 2023 and 39% in 2024.

We invite foreign investors to enter CDBF while Sri Lanka is rated at ‘CCC’ and consider realizing their investment upon SL reaching a Country Rating of ‘B- ‘. Other advantages of CDBF are, the ability to withdraw anytime and being tax exempted.

Ceylon Asset Management (CAM), the Fund Manager, has commenced an advertising campaign to promote the CDBF to the Sri Lankan Diaspora, South Asian, Middle Eastern and Australian Investors. CAM is an Associate Company of Sri Lanka Insurance Corporation (SLIC) and licensed under the Securities and Exchange Commission of Sri Lanka Act, No. 19 of 2021.

Meanwhile, the Ceylon Financial Sector Fund managed by CAM emerged as the top performing rupee fund in Sri Lanka during 2024, with a return of 64%. Investors can find out more on www.ceylonassetmanagement.com or write to us on info@ceylonam.com.

Past performance is not an indicator of the future performance. Investors are advised to read and understand the contents of the KIID on www.ceylonam.com before investing. Among others investors shall consider the fees and charges involved.(CAM)

Business

Share market plunges steeply for second consecutive day in reaction to US tariffs

CSE plunged at open, falling for the second consecutive day yesterday, down over 300 points in mid- morning trade.US President Donald Trump has imposed a 44 percent tax on Sri Lanka’s exports in an executive order which he claimed, spelt out discounted reciprocal rates for about half the taxes and barriers imposed by the island on America.

As a result both indices showed a downward trend. The All Share Price Index dropped 300 points, or 2.32 percent, to 15,294.94, while the S&P SL20 dropped 101 points, or 2.71 percent, to 4,517.37.

Turnover stood at Rs 3.1 billion with six crossings. Those crossings were reported in Sampath Bank which crossed 1.6 million shares to the tune of Rs 181 million and its shares traded at 109, JKH 4.1 million shares crossed to the tune of 80.5 million and its shares sold at Rs 19.5.

Hemas Holdings 400,000 shares crossed for Rs 45.6 million; its shares traded at Rs 114, CTC 25000 shares crossed to the tune of Rs 32.2 million; its shares traded at Rs 1330, Commercial Bank 200,000 shares crossed for 27 million; its shares traded at Rs 135 and TJ Lanka 157,000 shares crossed for Rs 20 million; its shares traded at Rs 46.

In the retail market top six companies that have mainly contributed to the turnover were; Sampath Bank Rs 296 million (2.9 million shares traded), JKH Rs 220 million (11.2 million shares traded), Haylays Rs 195 million (142,000 shares traded), HNB Rs 151 million (519,000 shares traded), Commercial Bank Rs 138 million (1 million shares traded) and Central Finance Rs 129 million (735,000 shares traded). During the day 218 million shares volumes changed hands in 22000 transactions.

It is said the banking sector was the main contributor to the turnover, especially Sampath Bank, while manufacturing sector, especially JKH, was the second largest contributor.

Yesterday, the rupee opened at Rs 296.75/90 to the US dollar in the spot market, stronger from Rs 296.90/297.20 on the previous day, dealers said, while bond yields were up.

A bond maturing on 15.10.2028 was quoted at 10.35/40 percent, up from 10.25/30 percent.

A bond maturing on 15.09.2029 was quoted at 10.50/60 percent, up from 10.45/55 percent.

A bond maturing on 15.10.2030 was quoted at 10.60/70 percent, up from 10.30/65 percent.

By Hiran H Senewiratne

-

Business2 days ago

Business2 days agoStrengthening SDG integration into provincial planning and development process

-

News6 days ago

News6 days agoBid to include genocide allegation against Sri Lanka in Canada’s school curriculum thwarted

-

Sports7 days ago

Sports7 days agoSri Lanka’s eternal search for the elusive all-rounder

-

Sports3 days ago

Sports3 days agoTo play or not to play is Richmond’s decision

-

Business13 hours ago

Business13 hours agoNew SL Sovereign Bonds win foreign investor confidence

-

News7 days ago

News7 days agoComBank crowned Global Finance Best SME Bank in Sri Lanka for 3rd successive year

-

Features7 days ago

Features7 days agoSanctions by The Unpunished

-

Features7 days ago

Features7 days agoMore parliamentary giants I was privileged to know