Business

Luxury retreats flooded with overseas enquiries as India opens for foreign tourists

BY S VENKAT NARAYAN

Our Special Correspondent

NEW DELHI, March 26: India opened its skies on Sunday (March 27) for foreign tourists after two years of Covid-induced shut-down. Luxury retreats, which have held off challenges faced by a pandemic-crippled industry, are anticipating a rise in demand with the resumption of regular international flights.

Ananda in the Himalayas, a destination spa resort in the foothills close to Rishikesh in Uttarakhand state, has witnessed an all-time high interest from foreigners after the issuing of tourist visas recommenced in December 2021.

Mahesh Natarajan, chief operating officer of IHHR Hospitality Ananda, its owner company, says: “Several of our regular Ananda guests from various countries have written to us describing a void they have experienced these last two years when they could not continue their annual wellness programme.”

The luxury brand has received a glut of enquiries from overseas recently, especially for its panchakarma- (an Ayurvedic technique) and meditation-based programmes, reflecting the twin needs of physical and emotional cleansing and rejuvenation after such a challenging period.

“Starting March-end, we expect a very buoyant demand from clients from the US, Western Europe, West Asia and other regions,” Natarajan adds.

A financial hub like Mumbai is already seeing pent-up demand from foreign business travel, says Amruda Nair, Director of Araiya Hotels & Resorts. However, she believes that the real impact for leisure tourism will be witnessed during the winter season from November to February.

“In long-haul markets such as the US, there is certainly interest in the cultural, heritage, wellness and adventure destinations in India. I am already seeing returning guests from the US in my hospitality business in Europe,” says Nair. Apart from three resorts in India, she also runs operations under Araiya Malta in the European nation.

Allen Machado, CEO, Niraamaya Wellness Retreats, says their overseas clients — particularly from the UK, US and West Asia — are showing willingness to return to India. The war in Ukraine, however, has dimmed interest from CIS (Commonwealth of Independent States) countries, he adds.

“If international flights open up, we will see a good inflow and resurgence July onwards, particularly in the second and third quarters of this financial year,” Machado says.

Niraamaya runs wellness retreats (four in Kerala, one in Bengaluru and another in Kohima) and private residences (in Goa, Kerala and Karnataka). Earlier, 80 per cent of its visitors were from abroad. Post-Covid, that was reversed to more than 90 per cent in favour of domestic clients, who are extremely price-sensitive. Niraamaya had to re-strategize its revenue model, and effect a drop of up to 40-50 percent in tariffs.

There has been a major shift in how people choose their holidays, with hygiene and safety measures, less crowded destinations that are within a driving distance, and healthy cuisine forming a trend that is here to stay, says Machado.

Evolve Back Resorts got in touch with its foreign travel operators and destination management firms after a gap of nearly two years. Its Executive Director Jose Ramapuram expects overseas traffic to pick up only from October “as we now enter an off-season as far as in-bound tourism is concerned.”

“We are, however, experiencing demand from long-distance travellers from within India,” he adds. “During the pandemic, we found a lot of regional travellers from within Karnataka (where Evolve Back has three properties) and nearby states.”

In November 2019, Evolve Back had also acquired its first international property in Central Kalahari. Botswana, where its resort is situated, had no domestic demand and catered only to the international market. Following the pandemic, for two years, it had few guests. But the African nation has now opened up, and Evolve Back is seeing a rise in international demand.

Back in India at Ananda, which offers the luxury of retreating to a secluded 100-acre forest estate reserved only for resident guests, the highlights include personalisation for every guest — be it wellness assessment and guidance, one-on-one sessions of yoga and meditation, or tailor-made gourmet meals.

At Araiya’s 38-room Palampur resort in Himachal, overlooking the Dhauladhar range, its new offerings include walking tours in nearby villages and hikes in the mountains with trained guides from the neighbouring local community.

Apart from those who drive to the hills from places in the North within a four- to six-hour radius, there is an increased willingness to take single flights such as from Delhi to Dharamshala, Amruda Nair points out.

She cites a study by online travel firm Expedia last year, which suggested that the top drivers of value for people when booking hotels are enhanced cleaning measures, flexible cancellation policies and ease of refunds. She expects this trend to continue, even as luxury resorts expect increased demand with Indian tourism finally opening up.

Business

ADB approves support to strengthen power sector reforms in Sri Lanka

The Asian Development Bank (ADB) has approved a $100 million policy-based loan to further support Sri Lanka in strengthening its power sector. This financing builds on earlier initiatives to establish a more stable and financially sustainable power sector.

This second subprogram of ADB’s Power Sector Reforms and Financial Sustainability Program will accelerate the unbundling of the Ceylon Electricity Board (CEB) into independent successor companies for generation, transmission, system operation, and distribution, as mandated by the Electricity Act of 2024 and its 2025 amendment. The phased approach ensures a structured transition, ensuring progress in reform actions and prioritizing financial sustainability.

“Sri Lanka has made important progress in stabilizing its economy and strengthening its fiscal position. A well-functioning power sector is vital for the country’s continued recovery and sustainable growth,” said ADB Country Director for Sri Lanka Takafumi Kadono. “ADB is committed to supporting Sri Lanka’s long-term development and advancing key reforms in the power sector. This initiative will enhance power sector governance, foster private sector participation, and accelerate renewable energy development to drive sustainable recovery, resilience, and inclusive growth.”

To improve financial sustainability, the program will help implement cost-reflective tariffs and a comprehensive debt restructuring plan for the CEB. It will support the new independent successor companies in transparent allocation of existing debts. This will continue to strengthen their financial viability, enhance creditworthiness, and enable these companies to operate on a more sustainable footing.

The program also aims to strengthen renewable energy development and private sector participation by enhancing transparency and supporting power sector entities that are financially sustainable. It will enable competitive procurement for large-scale renewable energy projects and identified priority generation schemes, while upholding strong environmental standards.

Promoting gender equality and social inclusion is integral to the program. Energy sector agencies have implemented annual women’s leadership programs, adopted inclusive policies, and launched feedback mechanisms to ensure equitable participation of female consumers and entrepreneurs. The program includes targeted support for vulnerable groups, such as maintaining lifeline tariffs and implementing measures to soften the impact of tariff adjustments and sector reforms.

ADB will provide an additional $2.5 million technical assistance grant from its Technical Assistance Special Fund to support program implementation, build the capacity of successor companies, and help develop their business plans and power system development plans.

Business

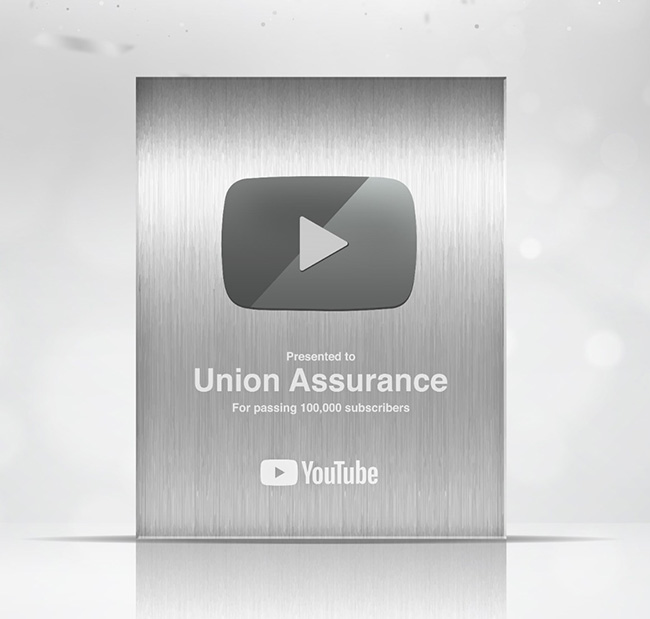

Union Assurance becomes first insurer to earn the YouTube Silver Play Button

Union Assurance, Sri Lanka’s longest-standing private Life Insurer, has achieved a milestone in its digitalisation journey by being awarded the YouTube Silver Play Button, recognising the Company for surpassing 100,000 subscribers on its official channel. This achievement marks a first in Sri Lanka’s Insurance industry, across both Life and General Insurance, and underscores Union Assurance’s pioneering role in digital engagement.

This accomplishment reflects the Company’s unwavering commitment to making Life Insurance accessible, simplified, and engaging for all Sri Lankans. Through innovative content strategies, Union Assurance has successfully transformed complex Insurance concepts into relatable, informative, and inspiring narratives that empower individuals to protect what matters most; health, wealth, family, and future.

Receiving the Silver Play Button is more than a symbolic accolade; it is a testament to the strength and credibility of Union Assurance’s digital presence. In an era where trust and transparency define brand loyalty, this recognition validates the company’s ability to create content that resonates deeply with a growing audience. It enhances the brand’s authority, reinforces its visibility across digital platforms, and further solidifies Union Assurance as a leader in customer engagement.

Celebrating this achievement, Mahen Gunarathna, the Chief Marketing Officer at Union Assurance stated: “This milestone is a testament to the trust and engagement of our audience and reflects our dedication to innovation, transparency, and customer-centric communication.

Business

LOLC Finance Factoring powers business growth

LOLC Finance PLC, the largest non-banking financial institution in Sri Lanka, brings to light the significant role of its Factoring Business Unit in providing indispensable financial solutions to businesses across the country. With a robust network of over 200 branches, LOLC Finance Factoring offers distinctive support to enterprises, ranging from small-scale entrepreneurs to corporate giants.

In light of the recent economic challenges, LOLC Finance Factoring emerged as a lifeline for most businesses, ensuring continuous liquidity to navigate through turbulent times. By facilitating seamless transactions through online platforms and expediting payments, the company played a pivotal role in sustaining essential services, including supermarkets and pharmaceuticals.

Deepamalie Abhaywardane, Head of Factoring at LOLC Finance PLC, emphasized the increasing relevance of factoring in today’s economy. “As economic conditions become more stringent, factoring emerges as the most sought-after financial product for businesses across various sectors. It offers a win-win solution by providing upfront cash up to 85% of the credit sale to suppliers while allowing end-users/buyers better settlement period.”

One of the standout features of LOLC Finance Factoring is its hassle-free application process. Unlike traditional bank loans that require collateral, LOLC Factoring extends credit facilities without such obligations. Furthermore, LOLC Finance Factoring relieves business entities of the burden of receivable management and debt collection. Through nominal service fees, businesses can outsource these tasks, allowing them to focus on core operations while ensuring efficient cash flow management.

For businesses seeking Shariah-compliant factoring solutions, LOLC Al-Falaah’s Wakalah Future-Cash Today offers an efficient and participatory financing model that meets both financial needs and ethical principles. Understanding the diverse challenges faced by businesses, LOLC Finance Factoring deliver tailored solutions that enhance cash flow, reduce credit risk, and support sustainable growth. Working together with LOLC Al-Falaah ensures access to a transparent, well-structured receivable management solution strengthened by the credibility and trust of Sri Lanka’s largest NBFI, LOLC Finance.

The clientele of LOLC Finance Factoring spans into various industries, including manufacturing, trading, transportation, healthcare, textiles, plantations, and other services, all contributing significantly to Sri Lanka’s economic growth. By empowering businesses with accessible and convenient working capital solutions, LOLC Finance’s Factoring arm plays a vital role in fostering economic development and prosperity of the country.

In the upcoming quarter, LOLC Finance Factoring remains committed to delivering innovative financial solutions tailored to meet the evolving needs of businesses. As Sri Lanka’s economic landscape continues to develop, LOLC Finance Factoring stands ready to support enterprises on their journey towards growth and success.

-

News7 days ago

News7 days agoWeather disasters: Sri Lanka flooded by policy blunders, weak enforcement and environmental crime – Climate Expert

-

News4 days ago

Lunuwila tragedy not caused by those videoing Bell 212: SLAF

-

News3 days ago

News3 days agoLevel III landslide early warning continue to be in force in the districts of Kandy, Kegalle, Kurunegala and Matale

-

Latest News5 days ago

Latest News5 days agoLevel III landslide early warnings issued to the districts of Badulla, Kandy, Kegalle, Kurunegala, Matale and Nuwara-Eliya

-

Features5 days ago

Features5 days agoDitwah: An unusual cyclone

-

Latest News6 days ago

Latest News6 days agoUpdated Payment Instructions for Disaster Relief Contributions

-

News20 hours ago

News20 hours agoA 6th Year Accolade: The Eternal Opulence of My Fair Lady

-

Latest News6 days ago

Latest News6 days agoLandslide Early Warnings issued to the Districts of Badulla, Colombo, Gampaha, Kalutara, Kandy, Kegalle, Kurunegala, Matale, Moneragala, Nuwara Eliya and Ratnapura