News

Illicit artificial toddy trade deprives govt. of Rs. 80 billion in revenue annually

State Minister promises remedial action

By Saman Indrajith

One of the topics that kept reverberating throughout the budget debate that ended in parliament last Wednesday was the drain of excise revenue as a result of loopholes in the tax net by artificial toddy manufacturing businessmen.

Various facets of the issue were raised by SJB Matara District MP Buddhika Pathirana during the question time on three separate days highlighting the severity of the damage inflicted on the national economy by tax evading toddy businessmen who deprive the government coffers of a whopping Rs. 80 billion annually.

Following the disclosure by MP Pathriana, State Minister of Money & Capital Market and State Enterprise Reforms Ajith Nivard Cabraal promised remedial action.

Commissioner-General of Excise, Ariyadasa Bodaragama, acknowledged that there exists a tax leakage but he was wary of the figure of Rs. 80 billion.

Bodaragama is due to retire at the end of the month. Deputy Commissioner-General of the Inland Revenue Department, M. J. Gunasiri has been named as his successor.

Challenges before Gunasiri, as the new Excise Commissioner-General, are enormous, and whether he would be able to help Minister Cabraal deliver on his promise remains to be seen.

As Gunasiri earlier served as Deputy Commissioner-General Tax Administration (Corporate Small Entities & Non Corporate Sector) at the Inland Revenue Department, his expertise may be useful to remedy the situation. However, he has only three more months of service before his retirement. Unless he is given a service extension, the task of finding solutions to the tax evasion issue raised by Pathirana will probably have to wait till another Commissioner-General is appointed.

Pathirana told The Sunday Island that the government coffer is bound to lose over Rs. 80 billion a year due to tax evasion by artificial toddy manufacturers and the ramifications to the national economy are more acute if the health cost is also taken into account.

“We have seen many instances of serious health problems that illicit brewers caused to the people. Artificial toddy is produced by mixing urea, ammonia, nickel cadmium of old batteries and sugar. This harmful brew is sold at liquor shops and used for manufacturing ‘coconut arrack’ and vinegar.

“Suppose we overlook tipplers who consume the toxic brew knowingly or unknowingly, what about innocent consumers who buy vinegar? In Sri Lankan food culture, vinegar is an integral part. Imagine the number of people who get ill because they consume vinegar made of artificial toddy,” the MP said.

“The artificial toddy industry is well-rooted in coastal areas in the south. If one checks the number of trees tapped and the number of liters of toddy being sold, it is a very simple calculation to understand how much artificial toddy is being consumed. Only around one and a half litres of toddy could be tapped from a single coconut palm. As per reports of coconut researchers, the amount could vary slightly due to factors such as climate, humidity and season. The amount being sold by license holders varies from the actual amount extracted from palms. A difference is in the region of 60,000-70,000 litres. So, it is obvious that toddy comes from other sources”, he noted.

There have been raids by police and STF but toddy businessmen continue to ply their trade because the police cannot take the culprits before courts as per Sections 49, 50 and 52 of the Excise Ordinance. They have to hand over the suspects and the equipment to excise officers, who most of the time do not produce the suspects in courts but release them after filing a Technical Crime Report (TCR), the parliamentarian further said.

“Under the TCR, the racketeers only have to pay a small sum by way of a composition fee. The TCR is actually one of the loopholes these businessmen get out so easily. I pointed out all these to the government. I hope Minister Cabraal will act as promised. I also pointed out to him that there are not only excise officers but some finance ministry officials who benefit from the artificial toddy business. I hope and pray that the minister will be able to remedy this situation,” Pathirana added.

President of the Nawa Sinhala Rawaya, Ven Magalkande Sudattha Thera said the illicit toddy industry is thriving despite isolated raids. The police and the STF conducted successful raids in many areas in the recent past. Thereafter, the police hand over the suspects and equipment to the Excise Department for legal action. Excise Department officials file a TCR and release them on a composition fee.

Many illicit toddy producers have licences for toddy tapping. So finding sugar, ammonia, yeast, batteries in toddy amounts to only a technical error; it becomes a technical crime if they suspect that the manufacturer had purposefully mixed them with toddy or produced toddy using them as ingredients. During a recent raid, the police found three bags containing 25 kilos of ammonia to be used to produce toddy. How could the government ensure public safety when poison is being sold in bottles in the name of toddy, the prelate asked.

President of the consumer watchdog National Movement for Consumer Rights Protection, Ranjith Withanage said that old mobile phone batteries were also being used in the fermentation process of artificial toddy.

He said a countrywide survey conducted by his organisation revealed that discarded mobile phone batteries and power banks and chemicals such as urea were used to produce artificial toddy.

“We have information that such toddy is being sold to produce coconut arrack and vinegar. Arrack and vinegar made from artificial toddy were sold in the market while those responsible for preventing consumers from such harmful products have done nothing so far to raid shops and places that sold them”, he asserted.

Withanage said that local arrack and vinegar made from artificial toddy have been identified as one of the main causes of chronic kidney diseases.

He further said the government loses over Rs 180 billion a year due to the illicit liquor and tobacco (Rs. 100 billion on illicit liquor and tobacco and Rs. 80 billion on illicit toddy).

“We expected the government to present budget proposals to counter the loss of revenue, but there was none”, he added.

Excise Department spokesman, Deputy Commissioner, Kapila Kumarasinghe said there were instances where toddy manufacturers were caught for using illegal methods to increase the volume of alcohol. Water, sugar, urea, yeast and salt are being used to get a high content of ammonia in toddy.

He said that toddy is being sold in taverns as fresh toddy and bottled toddy after pasteurizing so that they could be kept for one to two weeks. Toddy is also being sold for the production of vinegar. If toddy with additives are used to distill arrack, the machines extract only the alcohol and the additives are discarded as ‘spent-wash’. The distilling machines are calibrated only to extract alcohol, and not other elements in the raw materials.

In the most popular brands of arrack sold in the market, there is only three percent toddy and 97 percent water, ethanol and rectified spirits. Adding alien items during production is illegal,” he warned, adding that the Excise Department with its available resources is fighting hard not only against the artificial toddy industry but also other narcotics and drugs, he said.

Excise Commissioner General Bodaragama acknowledged there was a significant loss of excise revenue due to various tactics used by toddy manufacturers.

He said that there is a leakage of tax revenue but assured that he was certain that it could not be Rs. 80 billion.

State Minister of Money & Capital Market and State Enterprise Reforms Ajith Nivard Cabraal told The Sunday Island that Pathirana had raised this issue several times in Parliament and he had already instructed Secretary to the Ministry of Finance and the Excise Department officers to submit a comprehensive report to him on the matter.

The toddy industry extends from Kalutara, Gampaha, Puttalam, Badulla, Moneragala, Hambantota, Anuradhapura to the Northern and Eastern provinces. As at Dec. 31, 2019, there were 3,094 licensed toddy tappers and 32 licensed toddy producers in the country.

“There could be many more engaged in supportive services for their livelihood but we have no exact details on them”, he noted.

“Pathirana made constructive suggestions and we took note of them. We are thankful to his efforts and are determined to remedy the situation. I intend to study this matter first with my officials. I assure you that this would be studied properly and necessary action initiated”, the Minister assured.

Latest News

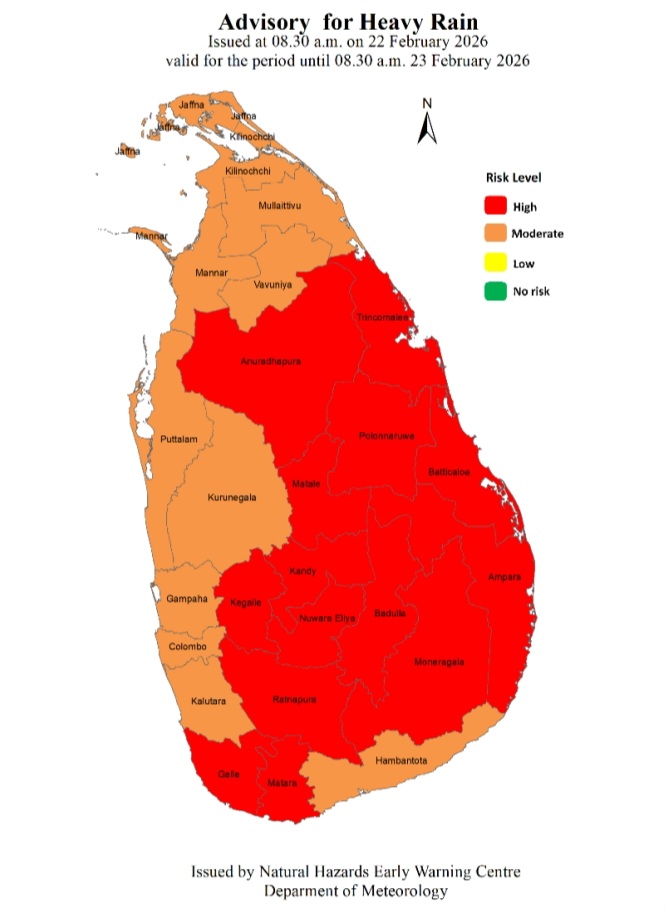

Advisory for Heavy Rain issued for the Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts

Advisory for Heavy Rain Issued by the Natural Hazards Early Warning Centre at 08.30 a.m. on 22 February 2026 valid for the period until 08.30 a.m. 23 February 2026

Due to the influence of the low level atmospheric disturbance in the vicinity of Sri Lanka, Heavy showers above 100 mm are likely at some places in Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts.

Therefore, general public is advised to take adequate precautions to minimize damages caused by heavy rain, strong winds and lightning during thundershowers

News

Matara Festival for the Arts’ inaugurated by the Prime Minister

The inaugural ceremony of the Matara Festival for the Arts, featuring a wide range of creations by local and international artists, was held on February 19 at the Old High Court premises of the Matara Fort, under the patronage of Prime Minister Dr. Harini Amarasuriya.

The festival, centred around the Old High Court premises in Matara and the auditorium of the Matara District Secretariat, will be open to the public from 20 to 23 of February. The festival will be featured by visual art exhibitions, short film screenings, Kala Pola, and a series of workshops conducted by experts.

The inaugural event was attended by the Minister of Women and Child Affairs, Ms. Saroja Paulraj, along with artists, guests, and a large number of schoolchildren.

(Prime Minister’s Media Division)

News

Only single MP refuses salary as Parliament details pays and allowances

Only one Member of Parliament has chosen not to receive the salaries and allowances entitled to MPs, Prime Minister Dr. Harini Amarasuriya revealed in Parliament last Thursday, shedding light on the financial perks enjoyed by members of the Tenth Parliament.

Speaking on Thursday (Feb. 19) in response to a question from SJB Badulla District MP Chaminda Wijesiri, the Prime Minister outlined the full range of pay and allowances provided to parliamentarians.

According to Dr. Amarasuriya, MPs receive a monthly allowance of Rs. 54,285, an entertainment allowance of Rs. 1,000, and a driver’s allowance of Rs. 3,500—though MPs provided with a driver through the Ministry of Public Security and Parliamentary Affairs are not eligible for the driver’s allowance.

Additional benefits include a telephone allowance of Rs. 50,000, a transport allowance of Rs. 15,000, and an office allowance of Rs. 100,000. MPs are also paid a daily sitting allowance of Rs. 2,500 for attending parliamentary sessions, with an additional Rs. 2,500 per day for participation in parliamentary sittings and Rs. 2,500 per day as a committee allowance.

Committee meetings held on non-parliament sitting days also attract Rs. 2,500 per day.

Fuel allowances are provided based on the distance between an MP’s electoral district and Parliament. National List MPs are entitled to a monthly allocation equivalent to 419.76 litres of diesel at the market price on the first day of each month.

Despite the comprehensive benefits, only SJB Badulla District MP Nayana Wasalathilaka has opted not to draw a salary or allowances. Dr. Amarasuriya said that in accordance with a written notification submitted by MP Wasalathilaka on August 20, 2025, payments have been suspended since that date.

The Prime Minister also confirmed that she, along with the Speaker, Deputy Speaker, committee chairs, ministers, deputy ministers, the Opposition Leader, and senior opposition whips, have all informed the Secretary-General of Parliament in writing that they will not claim the fuel allowance.

Challenging the ruling party’s voluntary pledge to forgo salaries, MP Wijesiri pointed out that all MPs except Wasalathilaka continue to receive their salaries and allowances. “On one hand you speak about the people’s mandate, which is good. But the mandate also included people who said they would voluntarily serve in this Parliament without salaries. Today we have been able to prove, Hon. Speaker, that except for one SJB MP, the other 224 Members are drawing parliamentary salaries,” he said.

The Prime Minister responded by defending the political culture and practice of allocating portions of MPs’ salaries to party funds. Referring to previous practices by the JVP and NPP, she said: “It is no secret to the country that the JVP has for a long time not personally taken MPs’ salaries or any allowances. I think the entire country knows that these go to a party fund. That is not new, nor is it something special to mention. The NPP operates in the same way. That too is not new; it is the culture of our political movement.”

When MP Wijesiri posed a supplementary question asking whether diverting salaries to party funds was an indirect method of taking care of MPs, Dr. Amarasuriya said: “There is no issue there. No question was raised; the Member made a statement. What we have seen throughout this week is an inability to understand our political culture and practice, and a clash with decisions taken by political movements that misused public funds. What is coming out is a certain mindset. That is why there is such an effort to find fault with the 159. None of these facts are new to people. He did not ask a question, so I have nothing to answer.”

The disclosures come days after the Government moved to abolish the parliamentary pension, a measure that has sparked renewed debate over MP compensation and the transparency of funds allocation.

-

Features22 hours ago

Features22 hours agoWhy does the state threaten Its people with yet another anti-terror law?

-

Business7 days ago

Business7 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features22 hours ago

Features22 hours agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features22 hours ago

Features22 hours agoReconciliation, Mood of the Nation and the NPP Government

-

Latest News2 days ago

Latest News2 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Features22 hours ago

Features22 hours agoVictor, the Friend of the Foreign Press

-

Latest News2 days ago

Latest News2 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News2 days ago

Latest News2 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction