Business

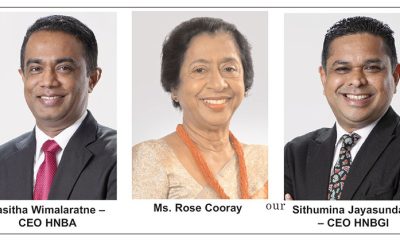

Ideahub drives HNB’s digital strategy

Ideahub completes years as the primary digital partner of HNB, Sri Lanka’s largest private-sector commercial bank. Since its appointment in 2019, ideahub has driven and supported the digital transformation of HNB’s retail business. The appointment in 2019 was the culmination of ideahub’s engagement with HNB since 2018, starting with the implementation of the primary customer touch points of the multi-award-winning bank. Their partnership with ideahub has helped HNB provide a unique and signature service to their customers which won the LankaPay Technnovation Award 2023 for the Bank of the Year for Excellence in Customer

Symphony powers digitalisation of HNB

HNB’s retail banking segment operates on ideahub’s fully integrated, secure and easily customisable Symphony platform that amalgamates the domains of PayTech, Banktech, LifeTech and Reward Tech. The SOLO Digital Wallet, and the Internet and Mobile Banking platforms HNB customers use are all components of Symphony, uniquely tailored and branded for HNB. Now a robust and highly dependable platform, Symphony’s progress spans over 10 years with operational input from industry-leading customers in South Asia region and Australia, including HNB, Dialog Axiata and PiPay of Cambodia going into its development.

Symphony is to HNB digital strategy like the final painting is to the concept in an artist’s mind, It has contributed to the steady growth of HNB’s retail banking business by making its operations faster, more secure, simpler and more reliable. This is clearly evident as more than 50% of Fixed Deposits are opened through the Digital Platform.

A holistic platform for Banks, FinTech and Telcos

The applications in the symphony ecosystem cover primary aspects of business in the financial and telecom industries. The digital touchpoints enable users to access their accounts, purchase products from merchants, pay utility bills and connect to payment gateways such as credit and debit card services. They can chat with friends and send and receive digital gifts. Merchants can feature their product catalogues, and provide offers and discounts. The customer loyalty plugin available on Symphony is a unique and important feature that is not found in its international competition. Financial institutions can deliver line-of-business and added services to their retail customers and partner with Symphony, for a fraction of the cost of competitive products.

ConnectTech – Seamless Integration with SpiderCraft middleware

Symphony has pre-configured connectors to fuse with industry-standard interfaces and systems easily and speedily, providing a seamless user experience for all users on the platform. This is made possible by ideahub’s proprietary state-of-the-art integration middleware, SpiderCraft which helps Symphony Interoperate with business-critical new and legacy payment interfaces used by the client organisation.

SecureTech – Industry-standard security

At the core of the platform are security, identification, authentication, fraud management, role definition and permission management features. Symphony is compliant with the widely accepted PCI DSS security standard in the industry. The platform has been designed and implemented with enterprise-grade security standards in each tier of the architecture. The data at rest and transit are encrypted with the assistance of enterprise-grade Hardware Secure Modules.

Predictive capability and machine learning led revenue opportunities

Symphony’s capabilities of cross-functionality and coordination coupled with data mining and analytical tools help the client organisation garner revenue from multiple channels thereby improving revenue growth

HNB broadening their reach to non-HNB banking customers by separating the banking and non-banking services on Symphony through the “digital layer” or “DL”. It is a great example of cross-functionality coordination. This separation in the architectural layer working between Symphony and the customer interfaces is invisible to the user. Maintaining the two groups on the same platform allows the bank to analyse user data across both groups- an advantage, in addition to cost efficiency and giving a seamless experience to the customers.

The machine learning capability of Symphony enables it to provide its users with an intuitive user-centric experience eliminating the frustrations they might usually encounter with other tech platforms. says Symphony is not just for banks, but for any financial services organisation or telcos looking for their own, branded digital payment platform.

Business

Lanka’s largest solar park set to transform energy landscape and local economy in Hambantota

A new era in Sri Lanka’s renewable energy is unfolding in the Gonnoruwa Division of Hambantota District, where construction has begun on the country’s largest solar power park. Spanning 450 acres and designed to generate 150 megawatts (MW) of electricity, the US$150 million private-sector-led project is poised to become a cornerstone of the nation’s sustainable energy ambitions.

Officials say the solar park, guided by the Sustainable Energy Authority and the Mahaweli Authority, will make its first contribution to the national grid by the end of this year, with full capacity expected by 2026. Once completed, the facility will rank among Sri Lanka’s largest renewable energy installations, second only to the 210 MW Victoria Dam and the 150 MW Upper Kotmale hydropower project.

The initiative is being framed as a strategic response to recurring power cuts in the Southern Province during annual drought periods. With a projected 20% contribution to the country’s daytime electricity demand, the solar park is expected to significantly stabilize the grid, reduce reliance on fossil fuels, and contribute to the country’s renewable energy targets.

Project Engineer Thilanka Bandara confirmed that preliminary land preparation and boundary works have been completed, with 50 MW already feeding into the national grid. The investment, fully funded through foreign direct investment, local bank loans, and equity capital, requires no government funding. Two private firms are sharing the development, contributing 70 MW and 80 MW respectively.

Bandara highlighted a unique feature of the project: the transmission infrastructure, estimated at US$16 million, is entirely financed by the investors, marking a departure from conventional grid-connected projects. The park will also employ state-of-the-art ground-mounted solar technology, considered the most advanced currently deployed in Sri Lanka.

In a first for Sri Lanka, the solar panels will be installed five feet above the ground, allowing partial-shade crops to be cultivated underneath. Technical Officer Sithmina Bandara explained that this setup will enable the cultivation of food plants such as mushrooms, which thrive in shaded conditions, creating a model for integrated solar-agriculture systems. Agricultural experts have already provided guidance on implementing this initiative, which combines energy production with local food security.

The project is expected to generate 750 to 1,000 direct and indirect jobs, with 400–500 already employed in the initial phase. Long-term maintenance work will provide further employment opportunities, offering a substantial economic boost to the Hambantota region. Environmental management measures are also in place to prevent elephants from entering nearby villages, ensuring harmony between development and wildlife.

All necessary approvals and permits were obtained by February 2025, aligning the project with the Ceylon Electricity Board’s national generation plan. Officials confirmed that upon completion, the total output of the Solar Energy Park will rise to 200 MW, combining existing installations with the new 150 MW facility.

Experts say the Hambantota solar park represents more than just a power generation project. Its innovative design, private-sector financing, and integrated agricultural approach position it as a template for future renewable energy projects in Sri Lanka, reflecting a new model of sustainable development that balances energy, economy, and environment.

By Sirimanta Ratnasekera

Business

ESU Kandy clinches dominant victory at ‘Battle of Esoftians’

The Battle of Esoftians, an annual cricket encounter organized by ESOFT Uni Kandy, concluded with a spectacular display of cricketing prowess as the Kandy team secured a massive 245-run victory over ESOFT Metro Campus, Kurunegala. The match was held on the 15th at the University of Peradeniya Grounds.

Winning the toss and electing to bat first, the ESOFT Uni Kandy batsmen dominated the field from the outset. They showcased an explosive batting performance, posting a formidable total of 280 runs for the loss of 5 wickets in their allotted 20 overs.

In response, the Kurunegala ESOFT Metro team struggled against a disciplined bowling attack. The Kandy bowlers dismantled the opposition’s batting lineup, bowling them all out for a mere 35 runs, sealing a historic win for the Kandy campus.

The event was graced by the presence of key officials from the ESOFT management: Amila Bandara – Chief Operating Officer (ESOFT Uni), Dimuthu Thammitage – General Manager (Central Region), Lakpriya Weerasinghe – Deputy General Manager, ?Lahiru Diyalagoda

Centre Manager-Degree Division, ESOFT Metro Campus Kurunegala and Dushantha Sandaruwan – Master in Charge (ESU Kandy Cricket Club)

Team Lineups

ESOFT Uni Kandy (Winners)

Chamath Ekanayake (Captain), Dinuka Tennakoon (Vice Captain), Dushantha Sandaruwan (MIC), Chalitha Rathnayake, Pulasthi Bandara, Isuru Dehigama, Kesara Nuragoda, Aadhil Sherif, Isuru Pannala, Achintha Medawatta, Ahamed Shukri, Gowtham Hari Dharshan, Danushka Sahan, Eranda Bandara, and Damith Dissanayake.

ESOFT Metro Campus Kurunegala (Runners-up)

Adeesha Samarasekara, Savishan Madusha, Lahiru Diyalagoda, Hirun Damayantha, Naveen Madushanka, Daham Pothuwewa, Senuda Thewnaka, M.R. Abdulla, Arunodya Dasun, Mohamad Afri, Desith Perera, Lasitha Ranawaka, Anton Dilon, Shenuka Thirantha, and Kavindu Bandara.

Text and Pix By S.K. Samaranayake

Business

HNB joins Royal–Thomian “Battle of the Blues” as official banking partner

HNB PLC, Sri Lanka’s leading private sector bank, has joined as the Official Banking Partner for the 147th edition of the historic “Battle of the Blues,” the Royal–Thomian cricket encounter between Royal College, Colombo, and S. Thomas’ College, Mt. Lavinia. Commenting on the partnership, HNB’s Managing Director/CEO Damith Pallewatte highlighted the bank’s long-standing connection with cricket, including sponsorship of Sri Lanka’s first Test match against England in 1982, and emphasized HNB’s commitment to nurturing young talent and promoting school cricket. The three-day clash for the Rt. Hon. D. S. Senanayake Memorial Shield will take place from March 12–14 at the SSC Grounds, with the Mustangs Trophy one-day match following on March 28 under lights. HNB’s inaugural involvement marks a milestone in the bank’s sports marketing journey, strengthening its role in the school cricket ecosystem. The bank will enhance the spectator experience by introducing digital and cashless banking solutions, modernizing the event while preserving its rich heritage and sporting tradition.

-

Features21 hours ago

Features21 hours agoWhy does the state threaten Its people with yet another anti-terror law?

-

Business7 days ago

Business7 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features21 hours ago

Features21 hours agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features21 hours ago

Features21 hours agoReconciliation, Mood of the Nation and the NPP Government

-

Latest News2 days ago

Latest News2 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Features21 hours ago

Features21 hours agoVictor, the Friend of the Foreign Press

-

Latest News2 days ago

Latest News2 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News2 days ago

Latest News2 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction