Business

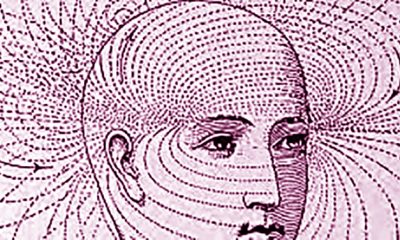

Economic policy choices: From stabilisation to growth

Sri Lanka: State of the Economy 2023

Sri Lanka has faced a turbulent economic journey in recent years, with 2022 witnessing an unprecedented crisis marked by a staggering 8.7% GDP contraction. The economy slowly but steadily pulled back from the abyss over the course of 2023. Notably, the Sri Lankan rupee has stabilised and even appreciated by 12%, inflation has dropped to 1.3%, import restrictions are being eased, and interest rates are on the decline.

These positive developments are a result of the implementation of economic stabilisation measures and groundwork for institutional and regulatory reforms to support future growth. These measures have critics concerned about the intense economic pain that falls on those least able to cope with the fallout. As a country that faces years of weak growth, the Institute of Policy Studies of Sri Lanka’s (IPS’) Sri Lanka: State of the Economy 2023 report, explores the complex policy choices Sri Lanka faces as it navigates the path to economic recovery.

The Rocky Road to Recovery

In 2023, Sri Lanka’s economy is expected to contract further, though at a slower pace compared to the previous year. Differing medium term forecasts from the International Monetary Fund (IMF) and the Central Bank of Sri Lanka (CBSL) point to the complexities of accurately predicting the future of an economy that has suffered a sudden and sharp crisis. In 2023, the IMF predicts a contraction of -3%, while the CBSL holds a more optimistic view at -2%. Both anticipate a return to positive growth in 2024, but uncertainties linger due to social and political opposition to austerity policies, ongoing debt negotiations, and volatile global economic conditions driven by geopolitical tensions.

Following the severe 8.7% GDP contraction in 2022, Sri Lanka embarked on immediate and stringent measures to stabilise its economy. These measures included securing the 17th IMF bailout and implementing substantial increases in value-added taxes (VAT), personal income taxes, energy prices, and a freeze on public sector wages. With shortfalls in anticipated revenue collections, further fiscal tightening measures cannot be ruled out.

Addressing Socioeconomic Challenges

Faced with growth-inhibiting tough austerity measures, concerns persist regarding the potential exacerbation of inequality and poverty. Sri Lanka witnessed a doubling of national poverty rates to 25% and a tripling of urban poverty to 15% in 2022. Escalating inflation has eroded household savings and real wages, prompting many skilled professionals to seek opportunities abroad, potentially resulting in a brain drain and the loss of a generation of young workers.

Sri Lanka’s economic challenges are further compounded by disparities in the education and health sectors, which require substantial resources for meaningful reforms. The delicate task of balancing fiscal constraints with the need for improved social protection programmes looms large.

Paving the Way for

Sustainable Growth

To achieve sustainable economic growth, Sri Lanka must not only stabilise its economy but also address long-standing structural problems. The country’s overemphasis on infrastructure investment with borrowed funds needs to shift towards enhancing global competitiveness in exports. In a world marked by US-China tensions, forging partnerships and aligning industrial and trade policies is vital. Currently, Sri Lanka lags in global value chain (GVC) activity, posing a challenge to economic diversification.

Over-reliance on low-skilled, informal jobs, where more than half of the workforce is engaged in low-skilled jobs, hampers progress towards a competitive and productivity-driven economy. Comprehensive reforms in education, improved access to higher education, and bridging skills gaps in sectors like Science, Technology, Engineering and Mathematics (STEM) are essential to create well-paying jobs and ensure long-term economic resilience. Additionally, addressing corruption, enhancing accountability, and improving public service delivery are vital for building public trust and support for reforms.

Building Consensus

for Transformation

As Sri Lanka grapples with its economic challenges, presidential elections loom on the horizon in 2024. Traditional politics may drive opposition to austerity and reforms in pursuit of votes. However, regardless of the election outcome, the country’s fragile economic situation will likely necessitate continued adherence to fiscal, monetary, and exchange rate policies outlined in the IMF programme. What remains uncertain is the fate of complementary reforms aimed at enhancing economic efficiency and productivity, which might be delayed or abandoned due to political compulsions.

The more contentious reforms may slow down or stall altogether between now and the 2024 elections, to be addressed afterward, depending on electoral outcomes. These possibilities introduce significant uncertainty at a time when economic confidence has already been severely undermined. The solution and best hopes are to build cross-party consensus on areas that do need fixing.

Conclusion

Sri Lanka’s journey from economic turmoil to stability is fraught with challenges, but it also offers opportunities for meaningful reform. While macro-stabilisation measures are laying the foundation, the path to recovery must prioritise quality GDP growth that creates high-quality jobs. Achieving this requires addressing structural issues, strengthening social safety nets, and fostering cross-party consensus. As Sri Lanka navigates its economic challenges, making the right policy choices, coupled with accountable institutions, will be key to transforming its setback into a sustainable success.

These and many other issues are discussed in the IPS’ annual flagship publication Sri Lanka: State of the Economy 2023 under the theme ‘Economic Policy Choices: From Stabilisation to Growth’ which focuses on the policy choices and debates in key areas of reform for a country that is emerging from a deep crisis.

The IPS report will be released on Tuesday, 17th October 2020 and will be available for sale at IPS, No. 100/20, Independence Avenue, Colombo 07, and at leading bookshops island-wide.

Sri Lanka: State of the Economy 2023 Economic Policy Choices: From Stabilisation to Growth

Business

Rs. 1 million fine proposed on substandard plastic producers

The government’s proposal to raise fines on manufacturers of substandard plastic products to as much as Rs. 1 million is expected to trigger a major compliance shift within Sri Lanka’s plastics industry, correcting long-standing market distortions caused by weak enforcement.

Environment Deputy Minister Anton Jayakody said the move targets producers who continue to bypass approved standards, undercutting compliant manufacturers and exacerbating environmental damage.

Environment Ministry Advisor Dr. Ravindra Kariyawasam said the initiative represents a structural market correction rather than a purely environmental intervention.

“Non-compliant producers have enjoyed an artificial cost advantage for years, distorting pricing and discouraging legitimate investment,” Kariyawasam told The Island Financial Review. “Meaningful penalties are essential to restore fairness and industry discipline.”

He said the widespread circulation of low-grade plastic products has eroded consumer confidence and delayed the sector’s transition towards higher-value and sustainable manufacturing.

Industry analysts note that a Rs. 1 million fine would significantly alter risk calculations for marginal operators, forcing upgrades in machinery, testing and compliance or pushing weaker players out of the market.

Kariyawasam stressed that the policy is intended to support responsible businesses rather than suppress industry growth.

“Manufacturers investing in recycling, biodegradable alternatives and quality assurance should not be penalised by competing with environmentally damaging, low-cost products,” he said.

The Deputy Minister indicated that tighter enforcement will be paired with policy support for sustainable packaging and circular-economy initiatives, aligning the sector with emerging global trade and environmental standards.

From a business perspective, the proposed regulation is likely to impact pricing, supply chains and capital investment decisions, while improving the long-term credibility of Sri Lanka’s plastics industry in both domestic and export markets.

By Ifham Nizam

Business

First Capital to unveil Sri Lanka’s Economic Outlook and Investment Strategies for 2026

First Capital Holdings PLC (the Group), a subsidiary of JXG (Janashakthi Group) and a pioneering force in Sri Lanka’s investment landscape, is set to host the 12th edition of its renowned ‘First Capital Investor Symposium’ on 22 January 2026 at Cinnamon Life Colombo, starting from 5.30 pm onwards.

The 12th Edition will focus on Sri Lanka’s Economic Outlook for 2026, offering attendees a comprehensive analysis of market forecasts, investment strategies and emerging opportunities in the capital markets. The symposium serves as a crucial gathering for investors seeking insights to navigate the evolving economic landscape and make sound, strategic decisions.

As a leading investment institution, First Capital remains committed to promoting informed decision-making through comprehensive research and market analysis. By hosting this annual symposium, the organisation reinforces its role as a trusted partner in Sri Lanka’s capital markets, providing a premier platform for investors, professionals, and industry leaders to exchange knowledge, explore opportunities and build meaningful connections.

A key highlight of this year’s agenda will be First Capital’s presentation on the Economic and Investment Outlook, outlining market conditions and investment strategies for the period ahead. The presentation will be delivered by Ranjan Ranatunga, Assistant Vice President – Research of First Capital Holdings PLC.

Business

Rivers, Rights, Resilience Forum 2026 begins in Colombo

Oxfam in Asia commenced the Rivers, Rights, Resilience Forum (RRRF) 2026, a three-day regional forum bringing together water experts, policymakers, civil society, researchers, and community leaders from across South Asia and beyond to strengthen cooperation on shared river systems and climate resilience.

The Forum is part of the Transboundary Rivers of South Asia (TROSA) programme, supported by the Government of Sweden, which works on the Ganges–Brahmaputra–Meghna (GBM) river basins, while also encouraging cross-basin learning at the regional and global levels. This year’s theme is “Building Resilient Communities and Ecosystems.” The Forum is co-organised by Oxfam in Asia and Dev Pro, Sri Lanka.

The forum opened with a welcome address by John Samuel, Regional Director, Oxfam in Asia, who highlighted the deep connection between rivers, politics, climate change, and sustainability. He underlined how rivers shape both environmental and social outcomes across South Asia and called for stronger collaboration between governments and civil society.

“Today building resilience is important in terms of climate and politics, and when civic space is shrinking, we should all work in solidarity,” he said.

Speaking at the Forum, Chamindry Saparamadu, Executive Director of DevPro shared examples of how communities in Sri Lanka have taken actions to ensure equitable access to water resources through catchment protection initiatives, community-based water societies etc. She further highlighted that learning exchanges would be useful to further strengthen inter-provincial water governance in Sri Lanka.

The Chief Guest, Syeda Rizwana Hasan, Advisor, Ministry of Environment, Forest and Climate Change and Ministry of Water Resources, Bangladesh, in her video message, emphasised the need for regional cooperation among South Asian countries beyond the upstream–downstream identity.

“Climate change will make water scarce, so South Asian countries have to come together to work on the common interest of their communities. Rivers are not just ecology but economics as well for communities. Forums like this help us to share our experience and learn from each other,” she said.

-

Editorial3 days ago

Editorial3 days agoIllusory rule of law

-

News4 days ago

News4 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Business6 days ago

Business6 days agoKoaloo.Fi and Stredge forge strategic partnership to offer businesses sustainable supply chain solutions

-

Editorial4 days ago

Editorial4 days agoCrime and cops

-

Features3 days ago

Features3 days agoDaydreams on a winter’s day

-

Editorial5 days ago

Editorial5 days agoThe Chakka Clash

-

Features3 days ago

Features3 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features2 days ago

Features2 days agoExtended mind thesis:A Buddhist perspective