Features

RECOMMENDATIONS FOR SRI LANKA: DEBT RESTRUCTURING AND BRIDGE FINANCING FOR HUMANITARIAN PURPOSES

Grabbing the bull by its horns: Pathfinder route for facing critical economic challenges

Study Group for Tripartite Cooperation (Japan-India-Sri Lanka)

DEBT RESTRUCTURING AND BRIDGE FINANCING FOR HUMANITARIAN PURPOSES

We view that Sri Lanka is at a critical juncture whether it can remain as a potentially growing country with the trust of international community, or otherwise.

Sri Lanka’s foreign exchange reserves are at dangerously low levels ($1.6 billion or less than one month of imports), especially given the $6.9 billion in debt service payments coming due in 20221. The acute shortage of foreign exchange is due to the COVID-19 pandemic, causing a sharp decline in tourism earnings, and reduced overseas worker’s remittances. It has also disrupted Sri Lanka’s own efforts to improve the debt sustainability.

The International Sovereign Bond payment ($500 million) on 18th January 2022 was made possible only through the very timely SWAP ($400 million) from the Reserve Bank of India and the deferral of a payment ($500 million) to India under the Asian Clearing Union (ACU). Both of these are short-term interventions. The former is a three-month facility, which can be renewed twice (i. e. nine months) before the requirement of at least a staff-level agreement with the IMF. The ACU payment has been deferred for two months (now due in March 2022). Without this much needed support from India, Sri Lanka would have defaulted on the recent ISB payment and triggered an economic and humanitarian crisis.

Meanwhile, the low level of reserves is leading to shortages of imports that are causing, on top of the COVID-19 pandemic, additional hardship to everyday Sri Lankans. People stand in long lines for cooking gas; powdered milk is unavailable; power cuts are frequent; medicines are becoming difficult to find, while the cost of staple food items are sky rocketing.

The real problem is that Sri Lanka’s external debt is unsustainable. The revenue that the government will earn, even under the most optimistic scenarios, will be insufficient to cover public expenditures and meet debt service payments over the coming years. Known external debt repayments over the next five years amount to $26 billion, or about $5 billion a year, which is over 80 percent of government revenue in 2020. Market participants recognize this. When in 2019 Sri Lanka cut taxes and experienced a drop in tax revenues, the three major rating agencies downgraded the country to C, which is near-default level. In January of this year, when the Governor of the Central Bank announced that Sri Lanka had secured the funds to meet the $500 million bond payment, S&P downgraded Sri Lanka further.

In this setting, Sri Lanka should avoid a hard default at all costs. Such abrupt actions, when the country stops paying its creditors, lead to a collapse of GDP, hyperinflation, and severe depreciation of the currency. At the same time, Sri Lanka should not continue meeting its debt-service payments in full—and starving its people of essential imports–when everybody, including market participants, knows that the country cannot sustain this strategy.

The only choice is for Sri Lanka to undertake a managed debt restructuring, whereby the country reaches an agreement with its creditors to reduce the overall debt to a sustainable level. The process begins with the appointment of financial and legal advisors. The restructuring is greatly facilitated by approaching the IMF for support on two items. First, the IMF can undertake the analysis to determine the sustainable level of debt. This analysis serves as an anchor for the negotiations with the creditors. Secondly, if Sri Lanka has a program with the IMF, that increases investors’ confidence that the new debt level is sustainable. It could also lead to additional resources from the IMF, the World Bank, Asian Development Bank and other partners.

These negotiations are likely to take about six months. In the meantime, there is urgent need for bridging finance to meet the severe shortfall in USD liquidity over this period. Failure to mobilise this bridging finance will lead to severe shortages of food, fuel and pharmaceuticals, causing a great deal of hardship and possibly social unrest, pushing individuals to leave the country through legal and illegal channels.

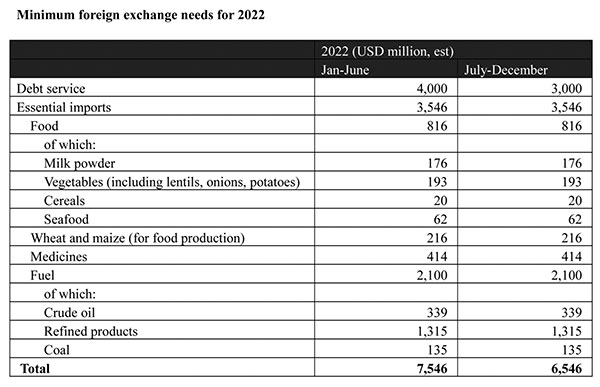

The table below sets out the minimum foreign exchange needs to finance debt service payments and essential imports for 2022.

With the initiation of debt restructuring negotiations, the debt servicing would be suspended, so the requirements would be $3.5 billion per semester. There is a possibility that Sri Lanka will receive a $1 billion SWAP from a national government and an additional $0.5 billion of usable reserves from a private entity but these have not been confirmed. In the absence of these inflows, there is a financing gap of $3.5 billion over the next six months, which should be filled to avert a humanitarian disaster. While the above is admittedly an estimate, the governments of Sri Lanka, Japan and India could agree on a figure that can be reviewed on a quarterly basis.

The government of Sri Lanka, along with Japan and India as major development partners, can collaborate on a program of debt restructuring and bridge financing in the following way:

1. The Government of Sri Lanka initiate a managed debt restructuring by appointing the financial and legal advisors. The Government approaches the IMF for assistance with the debt restructuring.

2. Following the initiation of the debt restructuring, the government of Sri Lanka requests the Governments of Japan and India to provide impetus to the restructuring exercise and develop programs for providing bridge financing to Sri Lanka during the negotiations. The bridging finance could take the form of humanitarian assistance through lines of credit to support essential imports (see Table). These will be one-time financial transfers, which will end with the conclusion of the debt restructuring negotiations.

3. Japan and India will encourage the international community to apply to Sri Lanka’s case the principles of G-20 Common Framework as well as the Debt Service Suspension Initiative (DSSI) for lower income countries.

This collaboration would give the Government of Sri Lanka the assurance that, when they embark on a debt restructuring exercise, the immediate needs for essential imports will be met. It will give the Governments of Japan and India the assurance that the bridge financing will be needed during the transition only, as Sri Lanka, just like other countries that have undergone the same process, will likely be able to meet its needs going forward through additional financing and lower debt service payments.

Study Group for Tripartite Cooperation (Japan-India-Sri Lanka)

Amb. Prof. Nobuhito Hobo

Professor, National Graduate Institute for Policy Studies (GRIPS) & Executive adviser, GRIPS – ALLIANCE – Japan

Prof. Shinji Asanuma

Former Professor, School of International and public Policy, Hitotsubashi University – Japan

Prof. Hirohisa Kohama

Professor Emeritus of Economics, Faculty of International Relations, University of Shizuoka – Japan

Amb. Dr. Mohan Kumar

Chairman, Research and Information System for Developing Countries (RIS) – India

Mr. Bernard Goonetilleke

Chairman, The Pathfinder Foundation – Sri Lanka

Dr. Indrajit Coomaraswamy

Distinguished Fellow, The Pathfinder Foundation – Sri Lanka

Dr. Shanta Devarajan

Professor, The Practice of international development at Georgetown University’s Edmund A. Walsh School of Foreign Service – USA

Features

2025 Budget: Challenges, hopes and concerns

Sri Lanka’s recent government budget has sparked both hope and concern. While some see it as a positive step toward improving the country’s economy, others worry about whether the government’s proposals can be successfully implemented. This analysis explores the budget’s approach and what it could mean for the country’s financial future.

Sri Lanka’s recent government budget has sparked both hope and concern. While some see it as a positive step toward improving the country’s economy, others worry about whether the government’s proposals can be successfully implemented. This analysis explores the budget’s approach and what it could mean for the country’s financial future.

Credit Rating Improvement and What It Means

Fitch Ratings recently upgraded Sri Lanka’s credit rating, moving it from a risky “Restricted Default” (RD) to a “CCC+” rating. This shows that the country’s financial situation is improving, though it still faces a high risk of default. The government aims to increase its revenue, especially through trade taxes and income tax, but experts warn that the success of these plans is uncertain, particularly when it comes to lifting restrictions on imports.

Economic Democracy and Market Regulation

The government claims that this budget is based on the idea of “economic democracy,” aiming to balance market forces with government control. While it promises fairer distribution of wealth, critics argue that it still relies on market-driven policies that may not bring the desired changes. The budget seems to follow similar strategies to past administrations, despite the government’s claim of pursuing a new direction.

The current government, led by a Marxist-influenced party, has shifted its approach by aligning with global economic institutions like the International Monetary Fund (IMF). This represents a departure from its previous, more radical stance. The government’s vision focuses on rural development, support for small businesses, and an export-driven economy, continuing strategies from previous administrations rather than implementing drastic changes.

Stability and Continuity in Policy

One of the more positive aspects of the budget is its consistency with the fiscal policies of the past government. Sri Lanka’s economy has suffered from sudden policy changes in the past, often triggered by political transitions. By maintaining a steady course, the current government seeks to ensure stability in the recovery process, despite criticisms from political opponents.

Sri Lanka continues to face significant financial challenges, including a large budget deficit. The government’s spending in 2025 is expected to exceed its revenue by about LKR 2.2 trillion, leading to a deficit of around 6.7% of GDP. To cover this gap, the government plans to borrow both locally and internationally. However, debt repayment remains a major concern, with billions needed to settle existing obligations.

Tax Revenue and Public Spending Issues

Sri Lanka’s tax collection remains critically low, which worsens the country’s financial troubles. Tax evasion, exemptions, and inefficient administration make it hard to collect sufficient revenue. The government has raised VAT to 18% to boost income, but this could increase inflation, further harming families’ ability to afford basic goods. Additionally, corruption in public institutions continues to drain state resources, preventing effective use of funds for national development.

The Auditor General’s Department recently uncovered financial irregularities in several ministries, reinforcing concerns over systemic corruption.

Sectoral Allocations, Budget Inequities and Falures

Despite claims of prioritizing social welfare, the government’s budget allocation for key sectors remains insufficient. For example, while the government allocated LKR 500 million to improve 379 childcare centers nationwide, this amount pales in comparison to regional standards. In neighboring Bangladesh, the government spends around USD 60 per child annually, while Sri Lanka spends less than USD 25. It’s unclear whether this allocation represents an increase in funding or just a reshuffling of existing resources.

One of the biggest criticisms of the budget is its failure to address the high cost of essential goods, going against promises made during the election. Prices for basic items like rice and coconut are still high, due to supply chain issues, rising fuel costs, and tax policies. The absence of targeted subsidies or price controls has led to growing public dissatisfaction.

Public sector salary adjustments are also a point of contention. The government plans to introduce salary increases in three phases, with the full benefits expected by 2027. However, much of this increase was already granted in previous years through allowances, meaning the adjustment is more about restructuring existing funds than providing real pay increases. This slow approach raises concerns about whether employees’ purchasing power will improve, especially with inflation still a pressing issue.

The government has also urged the private sector to raise wages, but past experiences suggest that private companies often resist such requests. Without formal agreements or laws to enforce wage hikes, there is uncertainty over whether employees will see real wage growth that matches the rising cost of living.

Neglecting Vulnerable Workers and Obstinate Behaviour

Another group left out of the budget’s plans is casual and contract workers, who were expecting improvements in job security and wages, particularly those earning below LKR 1,800 per day. Despite promises made during the election, these workers have not seen any significant changes, which raises doubts about the government’s commitment to improving labor rights and income equality.

The government’s handling of private sector wage increases has also been criticized for a lack of transparency. In a televised discussion, A government representative became visibly agitated when questioned about the date of the agreement with employers, displaying obstinate behavior and refusing to answer the opposition MP’s inquiry.

Review of the Banking Sector’s Role in Govt. Revenue and Economic Growth

The banking sector helps generate national revenue through taxes such as corporate income tax, value-added tax (VAT), and financial transaction levies. However, the claim that it contributed 10% to government revenue in 2024 needs to be understood in context. Past figures have shown fluctuations in financial sector taxes, influenced by economic conditions and fiscal policies. The government’s growing reliance on the banking sector for tax revenue could signal financial stress, and this situation warrants further analysis to understand its long-term sustainability.

While the Sri Lanka Bankers Association (SLBA) emphasizes banks’ support for implementing the government’s budget proposals, their ability to do so effectively depends on broader economic conditions, regulations, and financial stability. Sri Lanka has faced persistent economic issues like high public debt and inflation, which could hamper the ability of banks to help implement fiscal policies effectively. The real impact of the banking sector in driving economic growth remains uncertain, especially given factors like currency instability and a lack of foreign investment.

Digitization and Financial Transparency

The proposal to introduce Point-of-Sale (POS) machines at VAT-registered businesses aligns with global trends in digital financial integration. This move is expected to improve transparency, reduce tax evasion, and increase banking efficiency. Research has shown that digital payments can boost financial inclusion and reduce informal economic activities. However, Sri Lanka faces challenges such as limited digital infrastructure, cybersecurity concerns, and resistance from businesses that still prefer cash transactions.

More digital services could strengthen anti-money laundering (AML) controls, improve transaction monitoring, and reduce cyber threats. However, shifting to a fully digital banking system requires substantial investments in technology, regulatory alignment, and digital literacy among consumers.

Support for SMEs and Development Banking Initiatives

The creation of a Credit Guarantee Institute for SMEs is a significant step. Research shows that credit guarantees can reduce lending risks and improve SME access to financing. However, past state-managed financial programs in Sri Lanka have been inefficient, often involving politicized lending practices.

For these new initiatives to succeed, they will need transparent governance, careful credit risk management, and strong regulations….

Conclusion

Sri Lanka’s banking sector is crucial for economic stability and revenue generation, but the increasing fiscal demands and the push for digital transformation present both significant opportunities and risks. Policymakers need to avoid over-taxation that could stifle credit expansion and investment while addressing digital finance challenges like cybersecurity and infrastructure gaps. The 2025 budget underscores the nation’s vulnerable fiscal situation, where efforts for economic stabilization are hampered by public debt, corruption, and welfare constraints. Achieving sustainability requires comprehensive tax reforms, better public expenditure management, and stronger anti-corruption measures. Without these reforms, Sri Lanka faces prolonged economic hardship, rising inequalities, and diminishing trust in governance. The budget also reflects a blend of ideological transformation and economic pragmatism, with policies largely aligning with past approaches. Fitch Ratings’ cautious optimism signals the potential for recovery, contingent on successful policy implementation. Ultimately, policy continuity is seen as Sri Lanka’s best bet for navigating fiscal uncertainty and achieving economic stability.

(The writer, a senior Chartered Accountant and professional banker, is Professor at SLIIT University, Malabe. He is also the author of the “Doing Social Research and Publishing Results”, a Springer publication (Singapore), and “Samaja Gaveshakaya (in Sinhala). The views and opinions expressed in this article are solely those of the author and do not necessarily reflect the official policy or position of the institution he works for. He can be contacted at saliya.a@slit.lk and www.researcher.com)

Features

Rethinking cities – Sustainable urban innovation

by Ifham Nizam

Dr. Nadeesha Chandrasena is an urban innovator reshaping the landscape of sustainable development. With a background that spans journalism, banking, and military engineering, she brings a unique perspective to urban planning and environmental resilience.

Her work integrates cutting-edge technology with human-centered design, ensuring that cities of the future are not only livable but also adaptive to climate change and rapid urbanisation.

In this interview with The Island, Dr. Chandrasena shares insights into her journey—from her early days in journalism to pioneering the Smart Drain Initiative, a groundbreaking infrastructure project addressing urban drainage inefficiencies. She discusses the critical role of community engagement, the challenges of balancing innovation with political realities, and the urgent need for sustainable urban solutions in Sri Lanka and beyond.

Her story is one of relentless curiosity, problem-solving, and a deep commitment to building better cities. As she puts it, “Urbanisation is inevitable; our challenge is to shape it in ways that are inclusive, sustainable, and forward-thinking.”

Urbanisation is one of the defining challenges of the 21st century, and few understand its complexities better than Dr. Chandrasena. A trailblazer in sustainable urban development, she has dedicated her career to bridging the gap between technological innovation and environmental sustainability. Through her work, she emphasises a crucial message: cities must evolve—not just grow.

From Journalism to Urban Innovation

Dr. Chandrasena’s career path is anything but conventional. Beginning as a journalist, she honed her skills in field research and community engagement, which later became instrumental in her work as an urban planner. “Journalism taught me how to listen to people’s stories and understand the realities on the ground,” she explains. This background helped her develop urban solutions rooted in real-world insights rather than abstract theories.

Her transition into urban innovation was fueled by a deep-seated passion for environmental resilience. After a stint in banking and serving in the Sri Lanka Army Corps of Engineers, she pursued town and country planning, ultimately integrating her diverse experiences to address urban challenges holistically.

The Smart Drain Initiative: A Game Changer in Urban Infrastructure

One of Dr. Chandrasena’s most groundbreaking contributions is the Smart Drain Initiative—a next-generation urban drainage system designed to combat flooding and waste accumulation. Implemented in areas like Balapola and Ambalangoda, this technology incorporates IoT-based monitoring, predictive maintenance, and automated waste filtration to enhance resilience against climate change.

“Storm drains are often neglected, but they are the foundation of a city’s flood resilience,” she says. By modernising drainage infrastructure, her initiative is setting a precedent for cities worldwide to rethink their approach to urban water management.

Livability as the Core Urban Challenge

For Dr. Chandrasena, urban planning is not just about infrastructure—it’s about people. She identifies livability as the root problem that must be addressed in city planning. “Congestion, pollution, lack of green spaces, and inefficient waste management are all symptoms of poor urban planning,” she explains. Her work focuses on designing cities that prioritise well-being, accessibility, and sustainability.

Sri Lanka, in particular, faces unique challenges due to rapid urbanisation. With cities like Colombo struggling to accommodate a massive influx of commuters, Dr. Chandrasena advocates for affordable housing solutions near economic hubs and improvements in public transportation. “A city’s economic success should not come at the cost of its residents’ quality of life,” she insists.

Technology and Community Engagement: The Future of Urban Development

Dr. Chandrasena sees technology as a powerful tool for fostering inclusive urban development. From using social media for community consultations to deploying smart infrastructure, she believes digital solutions can democratise urban planning. “We need to move beyond traditional engagement methods and empower people through accessible technology,” she says.

Her leadership philosophy reflects this inclusive approach. Through initiatives like the MyTurn Internship Platform, she mentors young professionals, encouraging them to take an active role in shaping the future of cities. “Leadership is not about authority—it’s about creating opportunities for collaboration,” she adds.

Global Urban Challenges and the Need for Collaboration

Urban issues are not confined to national borders. Dr. Chandrasena highlights the importance of global partnerships, citing the twin-city concept as a model for knowledge exchange. By pairing cities with similar challenges—such as Galle, Sri Lanka, and Penang, Malaysia—municipalities can co-create solutions that address both local and global urban challenges.

Her work has not gone unnoticed. She recently won Australia’s Good Design Award for Best in Class Engineering Design, a testament to the impact of her innovative approaches.

Call to Action for Sustainable Cities

Dr. Chandrasena’s vision for the future is clear: cities must be designed to be resilient, inclusive, and sustainable. While challenges like climate change and urban congestion persist, she remains optimistic. “There are no perfect cities—just as there are no perfect people. But by striving for practical solutions, we can make cities better for everyone.”

Her journey—from journalist to urban innovator—demonstrates that change begins with a vision and the determination to act on it. As urbanisation accelerates, her work serves as a blueprint for how cities can not only survive but thrive in an ever-evolving world.

Features

Need to appreciate SL’s moderate politics despite govt.’s massive mandate

by Jehan Perera

President Donald Trump in the United States is showing how, in a democratic polity, the winner of the people’s mandate can become an unstoppable extreme force. Critics of the NPP government frequently jibe at the government’s economic policy as being a mere continuation of the essential features of the economic policy of former president, Ranil Wickremesinghe. The criticism is that despite the resounding electoral mandates it received, the government is following the IMF prescriptions negotiated by the former president instead of making radical departures from it as promised prior to the elections. The critics themselves do not have alternatives to offer except to assert that during the election campaign the NPP speakers pledged to renegotiate the IMF agreement which they have done only on a very limited basis since coming to power.

There is also another area in which the NPP government is following the example of former President Ranil Wickremesinghe. During his terms of office, both as prime minister and president, Ranil Wickremesinghe ruled with a light touch. He did not utilise the might of the state to intimidate the larger population. During the post-Aragalaya period he did not permit street protests and arrested and detained those who engaged in such protests. At the same time with a minimal use of state power he brought stability to an unstable society. The same rule-with-a-light touch approach holds true of the NPP government that has succeeded the Wickremesinghe government. The difference is that President Anura Kumara Dissanayake has an electoral mandate that President Wickremesinghe did not have in his final stint in power and could use his power to the full like President Trump, but has chosen not to.

At two successive national elections, the NPP obtained the people’s mandate, and at the second one in particular, the parliamentary elections, they won an overwhelming 2/3 majority of seats. With this mandate they could have followed the “shock and awe” tactics that are being seen in the U.S. today under President Donald Trump whose party has won majorities in both the Senate and House of Representatives. The U.S. president has become an unstoppable force and is using his powers to make dramatic changes both within the country and in terms of foreign relations, possibly irreversibly. He wants to make the U.S. as strong, safe and prosperous as possible and with the help of the world’s richest man, Elon Musk, the duo has become seemingly unstoppable in forging ahead at all costs.

EXTREME POWER

The U.S. has rightly been admired in many parts of the world, and especially in democratic countries, for being a model of democratic governance. The concepts of “checks and balances” and “separation of powers” by which one branch of the government restricts the power of the other branches appeared to have reached their highest point in the U.S. But this system does not seem to be working, at least at the present time, due to the popularity of President Trump and his belief in the rightness of his ideas and Elon Musk. The extreme power that can accrue to political leaders who obtain the people’s mandate can best be seen at the present time in the United States. The Trump administration is using the president’s democratic mandate in full measure, though for how long is the question. They have strong popular support within the country, but the problem is they are generating very strong opposition as well, which is dividing the U.S. rather than unifying it.

The challenge for those in the U.S. who think differently, and there are many of them at every level of society, is to find ways to address President Trump’s conviction that he has the right answers to the problems faced by the U.S. which also appears to have convinced the majority of American voters to believe in him. The decisions that President Trump and his team have been making to make the U.S. strong, safe and prosperous include eliminating entire government departments and dismissing employees at the Consumer Financial Protection Bureau (CFPB), Centers for Disease Control and Prevention (CDC) and the Food and Drug Administration (FDA) which were established to protect the more disadvantaged sectors of society. The targets have included USAID which has had consequences for Sri Lanka and many other disadvantaged parts of the world.

Data obtained from the Department of External Resources (ERD) reveal that since 2019, USAID has financed Sri Lankan government projects amounting to Rs. 31 billion. This was done under different presidents and political parties. Projects costing USD 20.4 million were signed during the last year (2019) of the Maithripala Sirisena government. USD 41.9 million was signed during the Gotabaya Rajapaksa government, USD 26 million during the Ranil Wickremesinghe government, and USD 18.1 million so far during the Anura Kumara Dissanayake government. At the time of the funding freeze, there were projects with the Justice Ministry, Finance Ministry, Environment Ministry and the Energy Ministry. This is apart from the support that was being provided to the private sector for business development and to NGOs for social development and good governance work including systems of checks and balances and separation of powers.

MODERATE POLITICS

The challenge for those in Sri Lanka who were beneficiaries of USAID is to find alternative sources of financing for the necessary work they were doing with the USAID funding. Among these was funding in support of improving the legal system, making digital technology available to the court system to improve case management, provision of IT equipment, and training of judges, court staff and members of the Bar Association of Sri Lanka. It also included creating awareness about the importance of government departments delivering their services in an inclusive manner to all citizens requiring their services, and providing opportunities for inter-ethnic business collaboration to strengthen the economy. The government’s NGO Secretariat which has been asked to submit a report on USAID funding needs to find alternative sources of funding for these and give support to those who have lost their USAID funding.

Despite obtaining a mandate that is more impressive at the parliamentary elections than that obtained by President Trump, the government of President Anura Kumara Dissanayake has been more moderate in its efforts to deal with Sri Lanka’s problems, whether in regard to the economy or foreign relations. The NPP government is trying to meet the interests of all sections of society, be they the business community, the impoverished masses, the civil society or the majority and minority ethnic and religious communities. They are trying to balance the needs of the people with the scarce economic resources at their disposal. The NPP government has demanded sacrifice of its own members, in terms of the benefits they receive from their positions, to correspond to the economic hardships that the majority of people face at this time.

The contrast between the governance styles of President Trump in the U.S. and President Dissanayake in Sri Lanka highlights the different paths democratic leaders can take. President Trump is attempting to decisively reshape the U.S. foreign policy, eliminating entire government departments and overwhelming traditional governance structures. The NPP government under President Dissanayake has sought a more balanced, inclusive path by taking steps to address economic challenges and governance issues while maintaining stability. They are being tough where they need to be, such as on the corruption and criminality of the past. They need to be supported as they are showing Sri Lankans and the international community how a government can use its mandate without polarising society and thereby securing the consensus necessary for sustainable change.

-

Business2 days ago

Business2 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports6 days ago

Sports6 days agoSri Lanka face Australia in Masters World Cup semi-final today

-

Sports3 days ago

Sports3 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

News6 days ago

News6 days agoCourtroom shooting: Police admit serious security lapses

-

News6 days ago

News6 days agoUnderworld figure ‘Middeniye Kajja’ and daughter shot dead in contract killing

-

News5 days ago

News5 days agoKiller made three overseas calls while fleeing

-

News4 days ago

News4 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features3 days ago

Features3 days agoThe Murder of a Journalist