Business

VAT increase could cause inflation to hit 7 percent in January – CBSL Governor

By Hiran H.Senewiratne

Sri Lanka’s inflation could rise to 7 percent in January 2024 due to the VAT increase, the Governor of the Central Bank of Sri Lanka (CBSL), Dr. Nandalal Weerasinghe warned.

Speaking at a special press briefing held yesterday, Dr. Weerasinghe explained that an increase in inflation is likely due to the increase in the VAT and other external factors. He was speaking at the CBSL’s first Monetary Policy Review for this year held at Central Bank head office in Colombo.

The VAT was increased by 3 percent, from 15 percent to 18 percent, with effect from January 1, 2024, after the VAT (Amendment) Bill was passed in parliament on December 11, 2023, he said.

The Central Bank kept its policy rates unchanged at 10 percent at this its first monetary policy meeting in 2024. Market rates should fall further.

The Central Bank has operated a largely deflationary policy, selling down its Treasury bills portfolio against dollar inflows, thereby preventing pressure on the currency and building reserves, resulting in a balance of payments surplus.

Dr. Weerasinghe added: ‘Over the past month, the exchange rate has appreciated, which may also help offset a 3 percent hike in value added tax on traded commodities.

‘Headline inflation is projected to record an upward movement in the near term, as expected, driven mainly by domestic price adjustments due to the increase in the VAT and the elimination of certain VAT exemptions effective January 1, 2024, disruptions to the domestic food supply and dissipation of the favourable statistical base effect.

‘However, this acceleration of inflation in the near term is expected to be short-lived and the spillover effects of such one-off adjustments are likely to be muted due to subdued underlying demand conditions. Therefore, over the medium term, headline inflation is expected to gradually stabilise around the targeted level of 5 per cent (year-on-year), supported by appropriate policy measures.

‘Headline inflation, as measured by the year-on-year change in the Colombo Consumer Price Index (CCPI, 2021=100), was recorded at 4.0 per cent in December 2023, compared to 3.4 per cent in November 2023.

‘Following five consecutive months of deflation, the food category recorded inflation (year-on-year) in December 2023, reflecting mainly the weather-related disruptions, while non-food inflation (year-on-year) moderated compared to the previous month.

‘Despite the recent acceleration, headline inflation remains closer to the inflation target of the Central Bank and is in line with the envisaged inflation projections of the Central Bank. Meanwhile, core inflation (year-on-year) continued to moderate in December 2023, compared to the previous month, reflecting the subdued demand pressures in the economy.

‘The Board took note of the effects of the recent developments in taxation and supply-side factors that are likely to pose upside pressures on inflation in the near term.

‘The Board anticipates a broad based reduction in overall market lending interest rates in line with the monetary policy easing measures that have come into effect since June 2023.

‘The Monetary Policy Board will continue to assess risks to inflation projections, among others, and stand ready to take appropriate measures to maintain domestic price stability in the period ahead while supporting the economy to reach its potential.

‘The Central Bank decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 9.00 per cent and 10.00 per cent, respectively.

‘The Board arrived at this decision following a comprehensive assessment of domestic and international macroeconomic developments in order to maintain inflation at the targeted level of 5 per cent over the medium term, while enabling the economy to reach its potential.

‘However, the Board viewed that the impact of these developments would not materially change the medium-term inflation outlook. Further, the Board noted the space created by past monetary policy easing measures and the decline in the risk premia attached to government securities for further downward adjustment in market lending interest rates.

‘The Board underscored that the envisaged benefit of further reduction in market lending interest rates needs to be adequately and swiftly passed on to businesses and individuals by financial institutions.

‘Market interest rates continued to adjust downwards in line with eased monetary policy and administrative measures taken to reduce overall market lending interest rates.

‘The yields on government securities continue to decline, supported by falling risk premia. The Monetary Policy Board of the Central Bank is of the view that there is further space for market interest rates, especially the lending interest rates and yields on government securities, to decline in the period ahead, in line with the reduction in policy interest rates effected in the recent past.

‘The Sri Lankan economy recorded an expansion in the third quarter of 2023, following six consecutive quarters of economic contraction. Accordingly, the economy is estimated to have grown by 1.6 per cent, year-on-year in the third quarter of 2023, as per the GDP estimates published by the Department of Census and Statistics (DCS).

‘This was a broad-based expansion in economic activity, supported by expansions recorded in Agriculture, Industry and Services sectors, on a year-on-year basis. The rebound in domestic economic activity is expected to be sustained, supported by the faster passthrough of relaxed monetary policy to broader market interest rates and the resultant firming of credit demand, improvements in business and investor sentiments, improvements in supply conditions and the gradual rebound expected in external demand conditions.

‘The merchandise trade deficit is estimated to have moderated during 2023 in comparison to 2022. This, coupled with the notable recovery in trade in services, mainly earnings from tourism, and the strong momentum of workers’ remittances, is expected to have resulted in a surplus in the current account balance of the balance of payments for 2023.

‘Gross official reserves (GOR) improved notably to US dollars 4.4 billion by end December 2023, which include the swap facility from the People’s Bank of China (PBOC). This strong rebound of GOR was supported by the notable net purchases by the Central Bank from the domestic forex market and the proceeds from multilateral agencies. The Sri Lanka rupee, which appreciated by around 12 per cent against the US dollar in 2023, continued to show an appreciation so far in 2024.

‘In consideration of the current and expected macroeconomic developments highlighted above, and in keeping with the forward guidance provided at the last monetary policy review in November 2023, the Monetary Policy Board of the Central Bank of Sri Lanka, at its meeting held on January 22, 2024, decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank at their current levels of 9.00 per cent and 10.00 per cent, respectively.’

Business

Arvind Subramanian: Why hasn’t Sri Lanka’s democracy acted as a hedge against economic chaos?

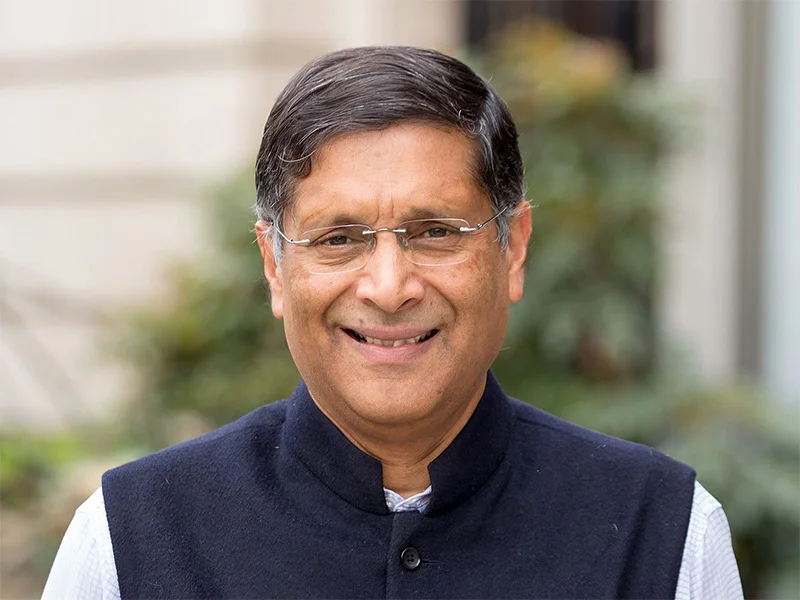

In a sobering and intellectually provocative lecture delivered yesterday at the Central Bank of Sri Lanka, Dr. Arvind Subramanian, former Chief Economic Advisor to the Government of India, posed a “haunting” question to the nation’s policymakers: Why has one of the world’s oldest democracies outside the West failed to leverage its political system to ensure economic stability?

Titled ‘Reviving Growth While Maintaining Stability,’ the lecture moved beyond technical prescriptions. Dr. Subramanian, now a Senior Fellow at the Peterson Institute for International Economics, admitted that his experience with the complexities of the Indian economy had made him “humble and somber,” leading him to focus on the broader socio-political structures that dictate a nation’s fate.

Dr. Subramanian argued that in India, democracy acted as a vital pressure valve that prevented both extreme political violence and economic chaos. He noted that while the process of nation-building is historically violent – citing the West’s decimation of populations and China’s estimated 40–75 million deaths between 1950 and 1976 – India managed to maintain a relatively low degree of mass violence.

“Democracy had a key role to play in that,” he asserted. “It is one of India’s major achievements.”

The speaker extended this logic to the economic sphere, suggesting that Indian democracy created a “societal demand” for low inflation.

In India, he noted, there is a pervasive political belief that if inflation crosses the 5 percent threshold, the government is likely to lose the next election. This political accountability forced the Central Bank and the State to maintain macro-stability.

The crux of Dr. Subramanian’s address was the “intellectual puzzle” of why Sri Lanka, which received universal franchise well before India, did not experience the same stabilising effects of democracy.

He presented two charts that he described as “haunting.” The first revealed that Sri Lanka has spent 60 percent of its time under IMF programmes, indicating a state of “perennial macro-economic stress.” In contrast, India has not sought an IMF programme in the 35 years following its 1991 reforms.

“Why does Indian society demand low inflation and macro-stability, while the same doesn’t happen in Sri Lanka?” he asked. Despite its long democratic tradition, Sri Lanka has consistently seen higher inflation and greater financial instability than its neighbour.

Dr. Subramanian also highlighted a stark difference in how both nations treat foreign capital. Pointing to data on external debt stock as a share of Gross National Income (GNI), he illustrated that Sri Lanka has been consistently and significantly more reliant on foreign capital than India or China.

While some argue that Sri Lanka’s small size necessitates a reliance on foreign capital, Dr. Subramanian remained unconvinced, noting that India also suffered from low domestic savings for decades but chose a more cautious path.

“India has been much more cautious in opening up to foreign capital,” he explained. While foreign capital can drive growth, it brings the “downside of risk and volatility” as capital flows in and out – a reality that came to haunt Sri Lanka in recent years through its high exposure to foreign currency-denominated debt.

The lecture concluded not with a list of “1, 2, 3 points” for recovery as the wider audience had expected, but with a challenge to the Sri Lankan intelligentsia. If democracy is meant to be a safeguard against political and economic disorder, the breakdown of that mechanism in Sri Lanka requires deep introspection.

“Different societies differ,” Dr. Subramanian concluded. “But if democracy had a key role in avoiding volatility in India, why shouldn’t it have been so in such an old democracy as Sri Lanka? It is worth pondering over,” he said.

By Sanath Nanayakkare

Business

HSBC kicks off ‘Clean Waterways’

HSBC will launch ‘Clean Waterways’ in partnership with the Beira Lake Restoration Task Force that was convened by the Governor of the Western Province to restore Beira Lake. HSBC in partnership with Clean Ocean Force will build and operate two solar powered, zero emission, waterway cleaning boats, which are the first of their kind in Sri Lanka. They will be used extensively in support of restoring the Beira Lake ecosystem and its surrounding environment.

Once a picturesque centerpiece in Colombo, Biera Lake is now suffering from significant pollution. Urbanization and lack of effective waste management practices have led to large volumes of plastic and floating organic debris, untreated sewage and industrial effluents contaminating the water. Resultant algal blooms, unchecked hyacinth growth and water stagnation further give the lake a detrimental odour and appearance. The pollution has degraded water quality, harmed aquatic life posing health risks to residents living in proximity by attracting disease-carrying fauna.

The Biera Lake Restoration Task Force was convened by the Governor of the Western Province with the purpose of delivering cleaner waterways in the urban environment. It is vital to educate and support change for communities that reside near the Beira Lake. To achieve this, a dedicated community outreach programme will reach over 5000 wider residents through awareness building and education which is anticipated to reduce ‘waste at source’.

Mark Surgenor, Chief Executive Officer, HSBC Sri Lanka stated “With over 130 years presence in Sri Lanka, HSBC understands the importance of Beira Lake to Colombo’s urban environment. Supporting cleaner waterways is a vital step towards restoration of that environment. Through this first ever public-private partnership, multiple stakeholders are coming together to work towards restoring this iconic lake. We have committed to support the Beira Lake Restoration Task force, not just with the much-needed funding, but also bringing best practices through our experience with similar projects in other markets that we operate in. The community outreach programme planned alongside the project is a critical step towards making this impact sustainable. HSBC has always been at the forefront of innovation in Sri Lanka and we look forward to continuing that for our next 130 years here”

Business

CORALL Conservation Trust Fund – a historic first for SL

Sri Lanka has moved to strengthen the financial backbone of its marine conservation efforts with the establishment of the country’s first CORALL Conservation Trust Fund, a landmark initiative that positions coral reef protection firmly within the framework of sustainable finance and long-term economic value creation.

The Trust Deed establishing the CORALL (Conservation of Reefs for All Lives and Livelihoods) Conservation Trust Fund was signed on December 31, 2025, by Environment Foundation (Guarantee) Limited (EFL) as Settlor together with the inaugural Board of Trustees. The Fund is designed to support the conservation of Pigeon Island National Park, Bar Reef Marine Sanctuary and Kayankerni Marine Sanctuary, along with their associated seascapes—areas that are central not only to marine biodiversity but also to fisheries, tourism and coastal protection.

From a business and policy perspective, the Trust Fund represents a decisive shift away from short-term, donor-driven conservation projects towards a structured and enduring financing mechanism. It is a key component of the Sri Lanka Coral Reef Initiative (SLCRI), a six-year national programme funded by the Global Fund for Coral Reefs and implemented by the International Union for Conservation of Nature (IUCN), but critically, the Trust itself is structured to continue well beyond the project’s lifespan, offering a permanent vehicle for mobilising state, private sector and international sustainability-linked funding.

Coral reefs within the three targeted seascapes have been increasingly degraded by destructive fishing methods such as blast fishing, overfishing, coastal pollution, unregulated tourism and unplanned coastal development. These pressures carry significant economic consequences, undermining fish stocks, tourism revenues and the natural coastal protection that reefs provide. Project partners note that a major driver of this degradation is the limited understanding among communities and institutions of the true economic value of coral reefs as natural capital that underpins livelihoods and resilience.

EFL, as an implementing partner to IUCN, played a central role in shaping the Trust’s institutional and financial architecture. It carried out a comprehensive legal, policy and institutional review, provided recommendations on the structure of Conservation Trust Funds, and drafted both the Trust Deed and an operational manual embedding governance, accountability and transparency safeguards. These features are seen as critical in building investor and donor confidence, particularly at a time when environmental, social and governance (ESG) considerations are increasingly influencing capital flows.

The Board of Trustees, selected by IUCN and the SLCRI National Steering Committee following a public call for applications, brings together expertise from investment banking, commercial banking and marine science. The Trustees—Palitha Gamage, Prof. (Ms.) Sevvandi Jayakody, Nalin Karunatileka, Dr. (Ms.) Nishanthi Perera, Chanaka Wickramasuriya and Nishad Wijetunga—will oversee grant funding for conservation and restoration proposals submitted by Special Management Area Coordinating Committees, while also ensuring robust monitoring and evaluation to safeguard long-term financial and ecological sustainability.

“This marks a significant step in sustainable financing to conserve coral reef ecosystems which are critical for marine biodiversity conservation, coastal protection, climate resilience, and the livelihoods of coastal communities, said Dr. Shamen Widanage, Country Representative of IUCN Sri Lanka, highlighting the wider economic and social returns expected from the initiative.

EFL chairperson Deshini Abeyewardena said the Trust Fund reflects a broader shift towards innovative financing models for environmental protection.

“EFL is honoured to have been selected by IUCN to implement this landmark initiative. The establishment of the CORALL Conservation Trust Fund reflects EFL’s long-standing commitment to advancing environmental justice through strong governance, legal safeguards and innovative financing mechanisms. As Sri Lanka faces increasing pressures on its marine ecosystems, this Trust provides a credible and transparent platform to secure sustained investment for coral reef conservation, she said.

By Ifham Nizam

-

Editorial4 days ago

Editorial4 days agoIllusory rule of law

-

News5 days ago

News5 days agoUNDP’s assessment confirms widespread economic fallout from Cyclone Ditwah

-

Editorial5 days ago

Editorial5 days agoCrime and cops

-

Features4 days ago

Features4 days agoDaydreams on a winter’s day

-

Editorial6 days ago

Editorial6 days agoThe Chakka Clash

-

Features4 days ago

Features4 days agoSurprise move of both the Minister and myself from Agriculture to Education

-

Features3 days ago

Features3 days agoExtended mind thesis:A Buddhist perspective

-

Features4 days ago

Features4 days agoThe Story of Furniture in Sri Lanka