Features

Unregulated Cryptocurrency Bubble Could Send the Economy Into a Tailspin

by Selvam Canagaratna

“Bank regulators are rushing to come up with cryptocurrency rules, according to the Federal Reserve official overseeing financial regulation, but many fear the rule-making comes too late, and the unregulated bonanza may already be on the cusp of crashing and causing a broader recession that would hurt the poor most intensely,” wrote Sam Knight in The Week.

Fed Vice Chair of Supervision Randal Quarles said on May 25 that his agency and two others — the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) — are taking the lead in what appears to be a scramble to act amid a period of instability with the potential to do serious damage to the rest of the economy. About one in five financial industry professionals believe that a cryptocurrency downturn could deliver a “salient shock to financial stability” over the next 12 to 18 months, according to conducted between February and April.

Though the rich might lose substantial sums in economic downturns, working-class people invariably suffer the most. The recessions and the sent millions of on the margins into poverty, with people of colour hit the hardest.

“We along with the OCC and the FDIC are engaged right now in what we are calling a ‘sprint’,” Quarles said at a hearing before the Senate Banking Committee. The OCC is the primary regulator of federally chartered banks, and the FDIC is the agency that guarantees customer savings and oversees state-chartered banks. The Fed oversees bank holding companies and non-bank financial firms, and regulates the stability of the financial system as a whole.

Quarles said the three agencies have been working “over a relatively concentrated period of time, to pull together all of our work in digital assets, and to have a joint view, a joint framework for their regulation and supervision practices with regard to them.”

“It would be premature for me to tell you where that’s going to turn out,” , “but this is something that is a high priority not only as a matter of importance, but as a matter of chronology. And we expect to be able to give at least some results from that soon.”

The sudden “sprint” by regulators to examine cryptocurrencies might come too late, with the entire market on the brink of collapse. A sell-off earlier this month saw cryptocurrencies lose some $1 trillion in value in a week, from a peak global market cap of $2.5 trillion on May 11.

Volatility has been fueled by the of cryptocurrency markets. Traders 50-125 times the amount of cryptocurrency that they purchase on popular exchanges. Ownership of cryptocurrencies is highly concentrated in the hands of a relatively small number of owners, with some 42 percent of all Bitcoin owned by 2,155 unique purchasers. The value of cryptocurrencies has also fluctuated wildly in recent weeks in response to restrictions imposed by the Chinese government, and tweets from billionaire Elon Musk.

“While it’s welcome that the Fed, OCC and FDIC are going to be examining regulatory gaps when it comes to crypto, it’s crucial that they also examine any implications for systemic risk,” said Alexis Goldstein, a senior policy analyst at Americans for Financial Reform and a Truthout contributor. “With no cryptocurrency reporting requirements whatsoever for hedge fund or private equity funds, the regulators are in the dark.”

Regulatory agencies had an opportunity to act two and a half years ago, after a previous cryptocurrency crash. Since then, the global market has grown significantly, making the negative consequences of a downturn more severe. The value of the cryptocurrency market’s most recent peak, at $2.5 trillion, was three times the size of its previous peak of $815 billion in January 2018. The most recent market boom has also come at a time of great uncertainty and hardship for many throughout the world amid the COVID-19 pandemic, suggesting that the growth might be driven by irrational optimism.

By comparison, there was roughly in outstanding subprime mortgage debt in March 2007 amid the housing market meltdown that caused the Great Recession. Banks might now be engaged in safer consumer lending practices than they were during the subprime mortgage crisis, but corporations have borrowed heavily in recent years, racking up some $10.5 trillion in debt under relaxed lending standards. Fed Governor Lael Brainard warned on that inflated stock prices and “very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.”

Cryptocurrencies have recovered somewhat since shedding $1 trillion in value earlier this month, but have said the market resembles a bubble. This cohort of skeptics Vitalik Buterin, the 27-year-old who co-founded Ethereum, one of the more popular cryptocurrencies. “It could have ended already. It could end months from now,” Buterin told CNN.

Nouriel Roubini, an economist who became famous in 2008 for predicting the subprime mortgage crisis and the Great Recession, also believes that a cryptocurrency bubble is bursting. Unlike Buterin, he questions whether cryptocurrency has any use-value at all.

“A bubble occurs when the price of something is way above its fundamental value. But we can’t even determine the fundamental value of these cryptocurrencies, and yet their prices have run up dramatically,” Roubini said on . “In that sense, this looks like a bubble to me.”

Despite Quarles’s promise of a “sprint,” recent remarks made by one of his colleagues failed to convey the same sense of urgency. FDIC Chair Jelena McWilliams said on , at the height of the market, that her priorities in examining cryptocurrencies were to “allow entrepreneurship to flourish in the United States,” and that she would be consulting with the banking industry to see “what (if anything) the FDIC should be doing.”

McWilliams made the remarks in a speech to the Federalist Society, a highly ideological right-wing organization known for its embrace of laissez-faire dogma, and for handpicking judicial nominees for the Republican Party. The FDIC a request for information on digital assets the week after giving her speech.

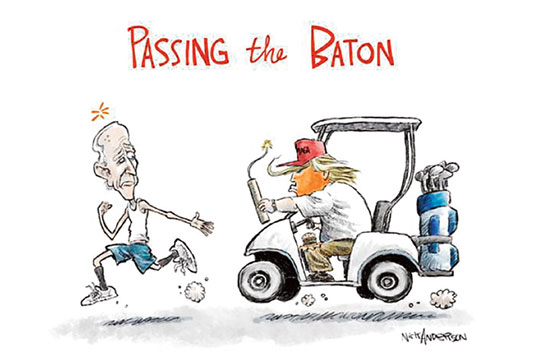

Both McWilliams and Quarles are Republicans who were appointed to their current positions by former President Donald Trump. Quarles’s term as a top Fed official is set to expire in October. McWilliams’s FDIC Chairmanship won’t expire until 2023.

Quarles, in particular, has a reputation for having a rosy view of what will happen if banks are left to do whatever they want. In , while serving as under-secretary of the Treasury, he reacted to predictions of a housing market downturn by remarking: “I have to say that I do not think this is a likely scenario.” About two years later, the collapse of the US housing market brought down the entire global financial system.

The Fed vice chair was criticized at the May 25 Senate Banking Committee hearing for more recent laxness by Democratic Sen. Elizabeth Warren of Massachusetts. Warren berated Quarles for the Fed’s decision to relax its supervision of Credit Suisse before the bank lost $4.7 billion in late March after the collapse of the family fund Archegos — a firm run by Bill Hwang, a man who had been previously banned by US regulators from managing public money after pleading guilty in 2012 to insider trading and wire fraud charges.

Warren for their decision last year to absolve Credit Suisse and other foreign banks from answering to an oversight board called the Large Institution Supervision Co-ordinating Committee. She noted that prior to this decision, Credit Suisse had failed a Fed stress test in 2019 because its models were unrealistic. “Your term as chair is up in five months, and our financial system will be safer when you are gone,” Warren told Quarles.

Though the Credit Suisse debacle involved more conventional forms of assets, there are lessons for those concerned about digital asset markets, Goldstein told Truthout. She noted that family funds like Archegos Capital Management aren’t subject to disclosure requirements like other asset management firms.

It would be one thing if rich asset managers were only harming themselves. But by recklessly playing with huge sums of money, they risk spreading calamity throughout the economy. The Great Recession was caused by predatory lending and complex derivatives leading to systemic failure that spread misery among the working class, starting with the collapse of the investment bank Lehman Brothers in 2008. In the ensuing recession, neighborhoods with more than 40 percent of inhabitants below the poverty line increased their population by five between 2010-2014. A recession could similarly spread should the market for cryptocurrency plummet even further.

“There may be multiple Archegos-sized crypto whales in the shadows,” Goldstein said. “If so, they’d all be invisible to regulators because of the total lack of reporting requirements for cryptocurrency.”

Features

US’ drastic aid cut to UN poses moral challenge to world

‘Adapt, shrink or die’ – thus runs the warning issued by the Trump administration to UN humanitarian agencies with brute insensitivity in the wake of its recent decision to drastically reduce to $2bn its humanitarian aid to the UN system. This is a substantial climb down from the $17bn the US usually provided to the UN for its humanitarian operations.

‘Adapt, shrink or die’ – thus runs the warning issued by the Trump administration to UN humanitarian agencies with brute insensitivity in the wake of its recent decision to drastically reduce to $2bn its humanitarian aid to the UN system. This is a substantial climb down from the $17bn the US usually provided to the UN for its humanitarian operations.

Considering that the US has hitherto been the UN’s biggest aid provider, it need hardly be said that the US decision would pose a daunting challenge to the UN’s humanitarian operations around the world. This would indeed mean that, among other things, people living in poverty and stifling material hardships, in particularly the Southern hemisphere, could dramatically increase. Coming on top of the US decision to bring to an end USAID operations, the poor of the world could be said to have been left to their devices as a consequence of these morally insensitive policy rethinks of the Trump administration.

Earlier, the UN had warned that it would be compelled to reduce its aid programs in the face of ‘the deepest funding cuts ever.’ In fact the UN is on record as requesting the world for $23bn for its 2026 aid operations.

If this UN appeal happens to go unheeded, the possibilities are that the UN would not be in a position to uphold the status it has hitherto held as the world’s foremost humanitarian aid provider. It would not be incorrect to state that a substantial part of the rationale for the UN’s existence could come in for questioning if its humanitarian identity is thus eroded.

Inherent in these developments is a challenge for those sections of the international community that wish to stand up and be counted as humanists and the ‘Conscience of the World.’ A responsibility is cast on them to not only keep the UN system going but to also ensure its increased efficiency as a humanitarian aid provider to particularly the poorest of the poor.

It is unfortunate that the US is increasingly opting for a position of international isolation. Such a policy position was adopted by it in the decades leading to World War Two and the consequences for the world as a result for this policy posture were most disquieting. For instance, it opened the door to the flourishing of dictatorial regimes in the West, such as that led by Adolph Hitler in Germany, which nearly paved the way for the subjugation of a good part of Europe by the Nazis.

If the US had not intervened militarily in the war on the side of the Allies, the West would have faced the distressing prospect of coming under the sway of the Nazis and as a result earned indefinite political and military repression. By entering World War Two the US helped to ward off these bleak outcomes and indeed helped the major democracies of Western Europe to hold their own and thrive against fascism and dictatorial rule.

Republican administrations in the US in particular have not proved the greatest defenders of democratic rule the world over, but by helping to keep the international power balance in favour of democracy and fundamental human rights they could keep under a tight leash fascism and linked anti-democratic forces even in contemporary times. Russia’s invasion and continued occupation of parts of Ukraine reminds us starkly that the democracy versus fascism battle is far from over.

Right now, the US needs to remain on the side of the rest of the West very firmly, lest fascism enjoys another unfettered lease of life through the absence of countervailing and substantial military and political power.

However, by reducing its financial support for the UN and backing away from sustaining its humanitarian programs the world over the US could be laying the ground work for an aggravation of poverty in the South in particular and its accompaniments, such as, political repression, runaway social discontent and anarchy.

What should not go unnoticed by the US is the fact that peace and social stability in the South and the flourishing of the same conditions in the global North are symbiotically linked, although not so apparent at first blush. For instance, if illegal migration from the South to the US is a major problem for the US today, it is because poor countries are not receiving development assistance from the UN system to the required degree. Such deprivation on the part of the South leads to aggravating social discontent in the latter and consequences such as illegal migratory movements from South to North.

Accordingly, it will be in the North’s best interests to ensure that the South is not deprived of sustained development assistance since the latter is an essential condition for social contentment and stable governance, which factors in turn would guard against the emergence of phenomena such as illegal migration.

Meanwhile, democratic sections of the rest of the world in particular need to consider it a matter of conscience to ensure the sustenance and flourishing of the UN system. To be sure, the UN system is considerably flawed but at present it could be called the most equitable and fair among international development organizations and the most far-flung one. Without it world poverty would have proved unmanageable along with the ills that come along with it.

Dehumanizing poverty is an indictment on humanity. It stands to reason that the world community should rally round the UN and ensure its survival lest the abomination which is poverty flourishes. In this undertaking the world needs to stand united. Ambiguities on this score could be self-defeating for the world community.

For example, all groupings of countries that could demonstrate economic muscle need to figure prominently in this initiative. One such grouping is BRICS. Inasmuch as the US and the West should shrug aside Realpolitik considerations in this enterprise, the same goes for organizations such as BRICS.

The arrival at the above international consensus would be greatly facilitated by stepped up dialogue among states on the continued importance of the UN system. Fresh efforts to speed-up UN reform would prove major catalysts in bringing about these positive changes as well. Also requiring to be shunned is the blind pursuit of narrow national interests.

Features

Egg white scene …

Hi! Great to be back after my Christmas break.

Hi! Great to be back after my Christmas break.

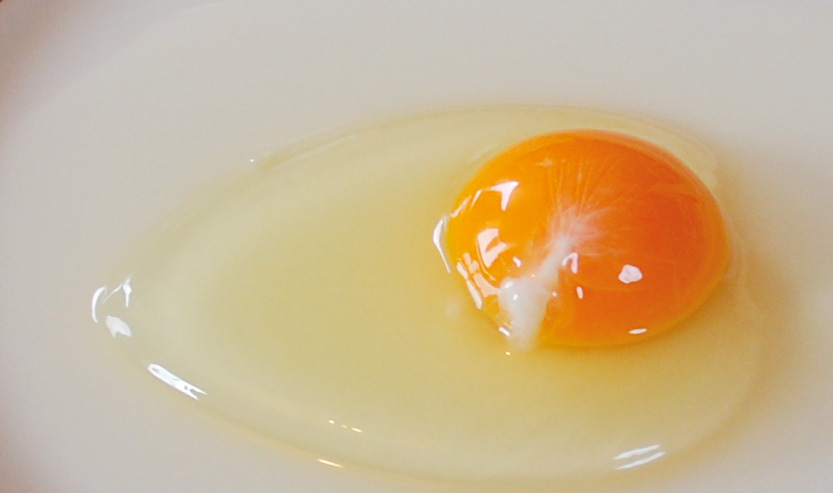

Thought of starting this week with egg white.

Yes, eggs are brimming with nutrients beneficial for your overall health and wellness, but did you know that eggs, especially the whites, are excellent for your complexion?

OK, if you have no idea about how to use egg whites for your face, read on.

Egg White, Lemon, Honey:

Separate the yolk from the egg white and add about a teaspoon of freshly squeezed lemon juice and about one and a half teaspoons of organic honey. Whisk all the ingredients together until they are mixed well.

Apply this mixture to your face and allow it to rest for about 15 minutes before cleansing your face with a gentle face wash.

Don’t forget to apply your favourite moisturiser, after using this face mask, to help seal in all the goodness.

Egg White, Avocado:

In a clean mixing bowl, start by mashing the avocado, until it turns into a soft, lump-free paste, and then add the whites of one egg, a teaspoon of yoghurt and mix everything together until it looks like a creamy paste.

Apply this mixture all over your face and neck area, and leave it on for about 20 to 30 minutes before washing it off with cold water and a gentle face wash.

Egg White, Cucumber, Yoghurt:

In a bowl, add one egg white, one teaspoon each of yoghurt, fresh cucumber juice and organic honey. Mix all the ingredients together until it forms a thick paste.

Apply this paste all over your face and neck area and leave it on for at least 20 minutes and then gently rinse off this face mask with lukewarm water and immediately follow it up with a gentle and nourishing moisturiser.

Egg White, Aloe Vera, Castor Oil:

To the egg white, add about a teaspoon each of aloe vera gel and castor oil and then mix all the ingredients together and apply it all over your face and neck area in a thin, even layer.

Leave it on for about 20 minutes and wash it off with a gentle face wash and some cold water. Follow it up with your favourite moisturiser.

Features

Confusion cropping up with Ne-Yo in the spotlight

Superlatives galore were used, especially on social media, to highlight R&B singer Ne-Yo’s trip to Sri Lanka: Global superstar Ne-Yo to perform live in Colombo this December; Ne-Yo concert puts Sri Lanka back on the global entertainment map; A global music sensation is coming to Sri Lanka … and there were lots more!

Superlatives galore were used, especially on social media, to highlight R&B singer Ne-Yo’s trip to Sri Lanka: Global superstar Ne-Yo to perform live in Colombo this December; Ne-Yo concert puts Sri Lanka back on the global entertainment map; A global music sensation is coming to Sri Lanka … and there were lots more!

At an official press conference, held at a five-star venue, in Colombo, it was indicated that the gathering marked a defining moment for Sri Lanka’s entertainment industry as international R&B powerhouse and three-time Grammy Award winner Ne-Yo prepares to take the stage in Colombo this December.

What’s more, the occasion was graced by the presence of Sunil Kumara Gamage, Minister of Sports & Youth Affairs of Sri Lanka, and Professor Ruwan Ranasinghe, Deputy Minister of Tourism, alongside distinguished dignitaries, sponsors, and members of the media.

According to reports, the concert had received the official endorsement of the Sri Lanka Tourism Promotion Bureau, recognising it as a flagship initiative in developing the country’s concert economy by attracting fans, and media, from all over South Asia.

However, I had that strange feeling that this concert would not become a reality, keeping in mind what happened to Nick Carter’s Colombo concert – cancelled at the very last moment.

Carter issued a video message announcing he had to return to the USA due to “unforeseen circumstances” and a “family emergency”.

Though “unforeseen circumstances” was the official reason provided by Carter and the local organisers, there was speculation that low ticket sales may also have been a factor in the cancellation.

Well, “Unforeseen Circumstances” has cropped up again!

In a brief statement, via social media, the organisers of the Ne-Yo concert said the decision was taken due to “unforeseen circumstances and factors beyond their control.”

Ne-Yo, too, subsequently made an announcement, citing “Unforeseen circumstances.”

The public has a right to know what these “unforeseen circumstances” are, and who is to be blamed – the organisers or Ne-Yo!

Ne-Yo’s management certainly need to come out with the truth.

However, those who are aware of some of the happenings in the setup here put it down to poor ticket sales, mentioning that the tickets for the concert, and a meet-and-greet event, were exorbitantly high, considering that Ne-Yo is not a current mega star.

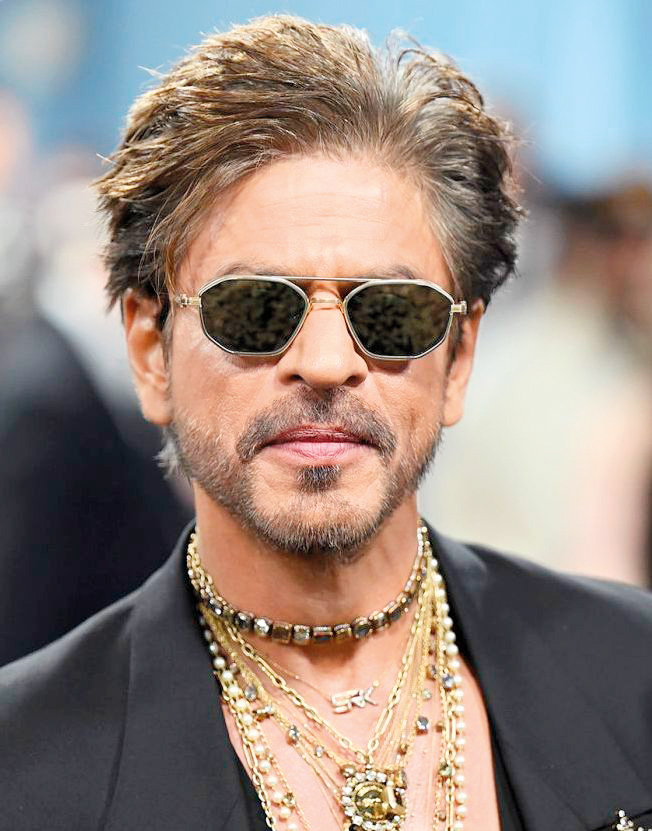

We also had a cancellation coming our way from Shah Rukh Khan, who was scheduled to visit Sri Lanka for the City of Dreams resort launch, and then this was received: “Unfortunately due to unforeseen personal reasons beyond his control, Mr. Khan is no longer able to attend.”

Referring to this kind of mess up, a leading showbiz personality said that it will only make people reluctant to buy their tickets, online.

“Tickets will go mostly at the gate and it will be very bad for the industry,” he added.

-

News6 days ago

News6 days agoStreet vendors banned from Kandy City

-

Sports3 days ago

Sports3 days agoGurusinha’s Boxing Day hundred celebrated in Melbourne

-

News6 days ago

News6 days agoLankan aircrew fly daring UN Medevac in hostile conditions in Africa

-

News1 day ago

News1 day agoLeading the Nation’s Connectivity Recovery Amid Unprecedented Challenges

-

Sports4 days ago

Sports4 days agoTime to close the Dickwella chapter

-

Features2 days ago

Features2 days agoIt’s all over for Maxi Rozairo

-

Features6 days ago

Features6 days agoRethinking post-disaster urban planning: Lessons from Peradeniya

-

Opinion6 days ago

Opinion6 days agoAre we reading the sky wrong?