Business

Tariff Wars: How will the US Reciprocal Tariff impact Sri Lanka?

By Dr Asanka Wijesinghe

The proposed additional tariffs on the US imports from Canada, China, and Mexico went into effect early Tuesday morning (March 4), paving the way for a trade war between the US and major trade partners. In addition, the Presidential Memorandum on Reciprocal Trade and Tariff of the United States (US) has called for studies on the “unfair trade practices” of US trade partners to determine reciprocal tariff rates as a counter measure. This means that, if the EU has a 10% automobile tariff, the US reciprocal tariff would also be 10%, matching its trade partner’s tariff.

With the US having roughly about 13,000 tariff lines, 200 trading partners, and about 2.6 million individual tariff rates, if the proposed reciprocal tariffs are fully implemented, this complex tariff system may have unprecedented effects on the global economy. This could then potentially lead to retaliation from trade partners.

The threat of reciprocal tariffs could also potentially cause a trade war between the European Union (EU) and the US with the EU likely to decrease imports from countries like Sri Lanka, making sustainable export growth in a more protectionist global economy more difficult for countries like Sri Lanka.

Tariff threats are also being used as a bargaining tool and the US may revise high tariffs in exchange for concessions from major trade partners.

The possible disintegration of the current global free trade system, which may be inevitable if the US implements broad-based tariff hikes, is a great and immediate concern for Sri Lanka, as it is a small economy with limited domestic demand and a high dependency on external value chains.

Given that the US accounts for a quarter of exports from Sri Lanka, if the US government goes ahead with reciprocal tariffs, how would said reciprocal tariffs impact Sri Lanka’s exports?

Reciprocal tariff rates: How will the US determine these rates?

The Office of the US Trade Representative (USTR) lists various policies as “unfair trade practices,” providing flexibility for the US authorities to determine the reciprocal tariff rate. These include high tariffs, value-added taxes, non-tariff barriers, subsidies, burdensome regulatory requirements, exchange rate interventions, and any other practice deemed by the USTR. The US plans to complete all the studies on “unfair trade practices” by April 1, 2025.

Dr Asanka Wijesinghe

The flexible definition of what constitutes unfair practices and the inclusion of domestically applied taxes like value-added tax (VAT) have injected substantial uncertainty into the global trade system. Over 170 economies worldwide have VAT, which is a significant revenue source for their governments. VAT is imposed non-discriminately, regardless of the product’s origin. If VAT is included in the US reciprocal tariff, the tariff hike will be larger for any economy.

Reciprocity of tariffs: How will they affect Sri Lanka?

Ignoring VAT, subsidies, and exchange rate interventions, reciprocity can be simplified to import tariffs and para-tariffs. Sri Lanka has general custom duties, an Export Development Board CESS, Excise Duty, Port and Airport Development (PAL), and Social Security Contribution Levy (SSCL). Once the product level tariff rates are calculated on ad-valorem basis, Sri Lanka has a higher tariff rate than the US for almost all sectors.

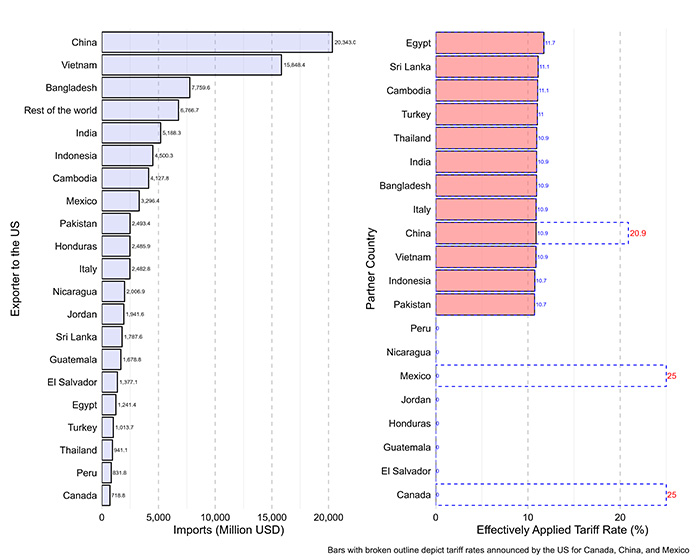

This implies that, if the US raises tariffs reciprocally, Sri Lanka will be affected directly by increased price levels in the US market. As the magnitude of the negative export effect coming from a reciprocal tariff depends on the tariff differential – i.e. percentage points of tariffs Sri Lanka charges more than the US – industries such as wearing apparel, rubber and plastic products, and food products, will be more vulnerable to reciprocal tariffs.

The export effect of tariff hikes can be estimated once reciprocal tariff rates are announced, as the magnitude of the effect on Sri Lanka’s exports depends on the relative price change compared to the competitors in the US market. Moreover, a uniform coverage across all products may not happen given the inflationary outcome of a tariff. In the first trade war, although the US announced tariffs on apparel and footwear in August, 2019 it was not implemented.

Reciprocal tariffs, among other policies announced by the US in 2025, should be evaluated under different policy scenarios . For instance, if Sri Lanka’s key export competitors face a higher relative tariff hike, Sri Lanka may benefit. Under the assumption that Sri Lanka will not face a tariff hike, and the US will focus on large trade partners, the likely effect on Sri Lanka due to trade diversion might be positive. For example, apparel exporters to the US, such as China and Mexico, are directly targeted for higher tariffs. Before the tariff hikes enforced on 4th March, Mexico enjoys zero apparel sector tariffs under the United States-Mexico-Canada (USMCA) trade agreement.

However, enforced new tariffs on Canada, China, and Mexico are estimated to cost a typical US household USD 1,200 annually. Higher prices, alongside recessionary impacts from retaliation and supply chain disruption, will negatively impact most US households, reducing import demand. This may dampen positive gains from any anticipated trade diversion. Similarly, an EU-US trade war will affect the EU economy too, dampening import demand, including from countries like Sri Lanka.

US reciprocal tariffs, retaliations, and dysfunctional multilateral organisations will break the post-GATT/WTO liberal trade system. Maintaining sustainable export growth in a more protectionist global economy will be increasingly difficult for a country like Sri Lanka.

Sri Lanka’s options: Phasing out para-tariffs and tightening trade relations

A closer look at Sri Lanka’s tariff data shows a heavy reliance on para-tariffs and special commodity levies (SCL). There are plans to phase out para-tariffs and replace the SCL with VAT. Under the Singapore-Sri Lanka Free Trade Agreement too, Sri Lanka has currently phased out a portion of CESS and PAL.

Under the Sri Lanka-Thailand Free Trade Agreement also, para-tariffs are planned to be phased out. Proceeding with such measures and broadening to all trade partners will reduce the differential tariffs between Sri Lanka and the US. Overall, eliminating para-tariffs in the long run can reduce the anti-export bias in the economy, incentivising production for exports.

A more immediate and greater worry for Sri Lanka is the possible disintegration of the current global free trade system, which may be inevitable if the US implements broad-based tariff hikes. As a small economy with limited domestic demand and dependency on external value chains, Sri Lanka’s future growth will be drastically affected in a world where countries plunge into protectionism and beggar-thy-neighbor tariff practices.

Anticipating such global circumstances, Sri Lanka needs to tighten trade relations with regional partners, particularly with the growing middle-income countries in East Asia. Continuation of negotiations for FTAs with East Asian economies and for a more effective Indo-Sri Lanka FTA are sound strategies Sri Lanka may take. Removing the existing hurdles like quotas for apparel sector in the Indian market will yield benefits from the growing middle-class demand in India.

Business

Dr RAD Jeewantha named most innovative dentist of the year

Dr. R. A. D. Jeewantha was honoured as the Most Innovative Dentist of the Year at the Business World International Awards, 2025. Organised by the Business World International Organisation, the award ceremony was held recently at the Mount Lavinia Hotel. A graduate of the Faculty of Dental Sciences, University of Peradeniya, Dr. Jeewantha has built a reputation as one of Sri Lanka’s most respected and forward-thinking dental surgeons. After gaining vital experience in Government hospitals, including the Teaching Hospital in Karapitiya, he also served at a leading private hospital before launching his own practice—Doctor J Premium Dental Care in Delkanda, Nugegoda.

His dental clinic is known for offering advanced, patient-focused treatments in restorative dentistry, cosmetic procedures, and implantology, using state-of-the-art technology. Dr. Jeewantha is especially skilled in dental implants, having completed the American Residency Course in Dental Implantology at Roseman University, accredited by the American Academy of Implant Dentistry. Dr. Jeewantha holds fellowships from the International College of Continuing Dental Education (FICCDE) and the Pierre Fauchard Academy (USA). His advanced skills include modern root canal treatments using Mineral Trioxide Aggregate (MTA) for both surgical and non-surgical procedures.

He has completed international trainings in digital dentistry, full-arch implantology techniques like All-on-Four and Zygomatic Systems, and smile design using digital 3D scans. He has participated in global dental events such as the Asia-Pacific Dental Congress and completed training at institutions including the University of Manchester and North Western State Medical University in Russia. His courses have covered everything from intraoral scanning to managing tooth wear. He has previously received many local and international awards. Dr. Jeewantha also serves the community as a Justice of the Peace for All Island.

Business

IIHS Foundation in Biological Studies offers fast-track route to global health careers

The Foundation in Biological Studies at IIHS provides a unique alternative for students looking to fast-track their health careers after their Ordinary Level (O/L) exams. This programme offers a direct route to global health careers, bypassing traditional A/Ls. With over 1,000 students already advancing to universities in Australia, the UK, and Finland, IIHS has positioned the course as a reliable launchpad for careers in fields like medicine, nursing, biomedical sciences, and digital health. “This programme is a game-changer, offering a transformative journey into global healthcare education,” said IIHS CEO Dr. Kithsiri Edirisinghe.

Business

Seylan Bank Reports Strong Growth in Q1 2025 Financials

Seylan Bank has recorded a Profit before Tax (PBT) of LKR 4,199 million in Q1 2025, marking a 13.36% growth compared to LKR 3,704 million in Q1 2024. Profit after Tax (PAT) rose by 20.29%, reaching LKR 2,761 million, up from LKR 2,295 million in the corresponding period of 2024.

Despite a decrease in net interest income by 8.37% due to market interest rate reductions, the bank’s net fee-based income grew by 13.83%, driven by fees from loans, cards, remittances, and other services. Total operating income for the quarter was LKR 11,258 million, a 3.83% decrease from the previous year, while operating expenses rose by 4.62%, largely due to increased personnel and other operating costs.

Impairment charges were significantly reduced by 83.17%, totaling LKR 262 million, reflecting the bank’s solid credit quality and proactive provisions. The bank’s impaired loan ratio improved to 1.98% from 2.10% in Q1 2024, with a provision cover ratio of 80.74%.

Seylan Bank’s total assets grew to LKR 785 billion, with loans and advances reaching LKR 469 billion and deposits totaling LKR 647 billion. The bank’s capital adequacy ratios remained strong, with the Common Equity Tier 1 Capital Ratio at 13.67% and Total Capital Ratio at 17.64%.

In addition to its financial performance, Seylan Bank continued its commitment to education, opening 16 more “Seylan Pahasara Libraries,” bringing the total to 281 libraries across the island.Fitch Ratings upgraded Seylan Bank’s National Long-Term Rating to ‘A+(lka)’ with a Stable Outlook in January 2025, further underscoring the bank’s financial stability and growth trajectory.

-

Features5 days ago

Features5 days agoRuGoesWild: Taking science into the wild — and into the hearts of Sri Lankans

-

News5 days ago

News5 days agoOrders under the provisions of the Prevention of Corruptions Act No. 9 of 2023 for concurrence of parliament

-

Features6 days ago

Features6 days agoNew species of Bronzeback snake, discovered in Sri Lanka

-

News4 days ago

News4 days agoProf. Rambukwella passes away

-

News6 days ago

News6 days agoPhoto of Sacred tooth relic: CID launches probe

-

Opinion5 days ago

Opinion5 days agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part IX

-

Features6 days ago

Features6 days agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part VIII

-

Features2 days ago

Features2 days agoThe Truth will set us free – I