Business

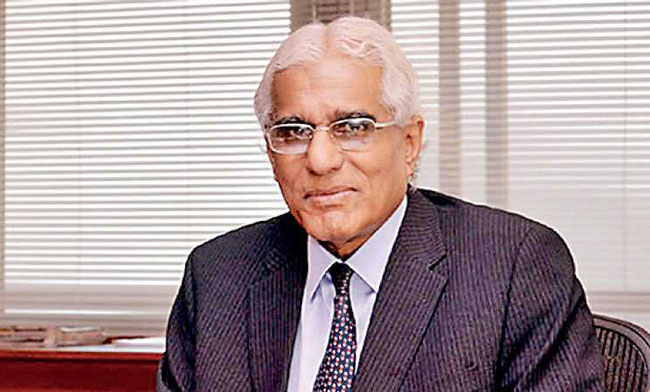

SL needs laser-like focus on IMF programme implementation: Dr. Indrajit Coomaraswamy

‘If it gets suspended, it would have pretty dramatic consequences’

by Sanath Nanayakkare

There are three most important priorities for Sri Lanka in the wake of the IMF Programme; implementation, implementation and implementation of the agreed upon benchmarks of the programme. Last thing we need to suddenly find is that we have gone off the track of the programme and it is suspended, Dr. Indrajit Coomaraswamy, Former Governor, Central Bank of Sri Lanka said on Friday.

He said so while giving the keynote speech at a Central Bank hosted webinar titled “What is next for Sri Lanka in the wake of IMF Programme?”

Deshal De Mel, Economic Advisor, Ministry of Finance, Murtaza Jafferjee, Managing Director, JB Securities, Bingumal Thewarathanthri, Chief Executive Officer, Standard Chartered Bank were the panelists at the forum where the moderator was Shiran Fernando, Chief Economist at the Ceylon Chamber of Commerce

The following are a few comments made by Dr.Coomaraswamy.

The IMF EFF has now been successfully negotiated. This is in some way the beginning. There is lot more to do. It’s time to start thinking about what happens next. A little under a year ago, there were acute shortages of the most essential good. There were long queues and one or two people passed away while in queue. Prices were skyrocketing and exchange rate was collapsing, inflation was spiking and the Central Bank had to push up interest rates. All this happened only a few months from where we are today. The fact that things have stabilized to a significant extent clearly is a very favourable outcome but actually there is no room for complacency because the stabilization has happened at a low-level equilibrium.

It has happened when the economy experienced a 7.6% contraction last year. It was better than what was anticipated by the IMF and the World Bank, but still it is a very sharp contraction. And we need to get to a situation where we have macro-economic stability with a growth rate of about 4%. There is a lot to be done for this. But this is a very commendable place to get to after all. The Paris Club comprising G7 countries has endorsed our efforts to restore debt sustainability. The non-Paris Club creditors such as India and China also have endorsed and supported our efforts too. So the largest countries and creditors are willing to support Sri Lanka to get back on track in terms of debt sustainability. So this is not a bad place to be.”

“IMF programme implementation has always been a weakness on our part. This time we have already done a lot as prior action but there is more as you would have seen from the documentation tabled in parliament including structural reforms and institutional reform. So we have to have laser-like focus on implementation and move forward with the programme. If the programme gets suspended, it would have pretty dramatic consequences. So we need to keep it on track. We can’t give up the absolutely compelling need for fiscal discipline. What is next for us is; discipline and making the needed economic policy and implementing what e have agreed to do. During our past IMF programmes, the issue was lack of implementation by the Sri Lankan authorities.

Earlier this week Dr. Chandranath Amarasekare, Executive Director at the CBSL arranged for the Irish authorities to brief Sri lankan authorities on the implementation unit set up in Ireland when the global financial crisis hit Ireland which led them to go into an IMF programme. Ireland was meticulous in the way they set up the implementation framework. They identified all the action that had to be taken and assigned parts of it to relevant government entities to implement them. Ireland is back on track now. We need to have the same degree of laser-like focus on implementing the benchmarks. We have to figure out what needs to be done and ascribe responsibility for each action and monitor

carefully how we are going about it. We have to make sue we are hitting all the targets and structural benchmarks as we go along. These are embedded in the IMF programme. Last thing we need is to suddenly find that we have gone off the track of the programme and the programme is suspended. That will constrain the inflows to the country and it will affect the confidence beginning to build up now. All that will get undermined if the programme gets suspended because we are not able to keep it on track. So the Implementation Unit will need a very good authority to reach out to any part of government and get things done. We need this Implementation Unit to be well-structured and running well. And it should have the authority of the President behind it,”he said.

Business

‘Sri Lanka’s forests are undervalued economic assets — and markets are paying the price’

Sri Lanka’s economic strategy continues to focus on exports, productivity and fiscal consolidation.

Yet one of the country’s most valuable assets — its forests and traditional forest-based farming systems — remains largely absent from economic planning. This is no longer an environmental oversight. It is a business risk.

At a recent Dilmah Genesis Thought Leadership Series lecture in Colombo, tropical ecology expert Professor Friedhelm Goeltenboth delivered a clear message: once forests are destroyed, the economic value they provide is lost permanently.

What replaces them — monoculture plantations — may appear efficient, but over time they generate declining yields, rising input costs and growing exposure to climate shocks.

From a financial perspective, this is asset depletion, not development.

Monoculture systems simplify production but externalise costs. Soil erosion, fertiliser dependency, water stress and biodiversity loss eventually hit farmers, banks, insurers and the state.

Sri Lanka is already seeing the consequences through falling productivity and rising agricultural vulnerability.

Forest-integrated farming offers a different model — one that treats land as a multi-income asset.

Spices such as cinnamon, pepper, cardamom and nutmeg can be grown under shade alongside fruit, timber and fibre crops, stabilising income while protecting soil and water. For lenders and insurers, diversified systems reduce risk. For exporters, they support traceability, sustainability certification and premium pricing.

The strongest business opportunity lies in carbon markets. Voluntary carbon markets allow companies to offset emissions by funding verified forest conservation and restoration.

Across Southeast Asia, communities now earn income simply by protecting forests that store carbon.

Sri Lanka has the scientific capacity to enter this space. Farmers can collect data; experts can certify it. What is missing is a coordinated national framework that allows communities and corporates to participate efficiently.

Carbon revenue will not replace agriculture, but it can stabilise it — providing income during crop maturation and creating a new form of export: environmental services.

Ignoring this opportunity carries downside risk.

Biodiversity loss, pollinator decline and climate volatility threaten long-term agricultural productivity. Forests are not sentimental assets; they are economic infrastructure.

Sri Lanka’s recovery cannot be built on short-term extraction. If the country wants resilient growth, it must start recognising the real value of what is still standing, he added.

By Ifham Nizam

Business

Pavan Rathnayake earns plaudits of batting coach

Sri Lanka batting coach Vikram Rathour has hailed middle-order batter Pavan Rathnayake as one of the finest players of spin in the modern game, saying the youngster’s nimble footwork and velvet touch were a “breath of fresh air” for a side long troubled by the turning ball.

Drafted in for the second T20I after Sri Lanka’s familiar struggles against spin, Rathnayake looked anything but overawed by England’s seasoned tweakers, skipping down the track with sure feet and working the ball into gaps with soft hands.

“He is one of the better players when it comes to using the feet,” Rathour told reporters. “I haven’t seen too many in this generation do it as well as he does. That is really impressive and a good sign for Sri Lankan cricket.”

Sri Lanka went down in a last-over nail-biter but there were silver linings despite the hosts being a bowler short. Eshan Malinga was forced out after dislocating his left shoulder and has been ruled out for at least four weeks, a blow that ends his World Cup hopes. Dilshan Madushanka, Pramod Madushan and Nuwan Thushara have been placed on standby.

Power hitting remains Sri Lanka’s Achilles’ heel and Rathour, who carries an impressive CV from India’s T20 World Cup triumph two years ago, pointed to a few grey areas in the batting blueprint.

Power hitting remains Sri Lanka’s Achilles’ heel and Rathour, who carries an impressive CV from India’s T20 World Cup triumph two years ago, pointed to a few grey areas in the batting blueprint.

“There are two components to T20 batting,” he said. “One is power hitting, but the surfaces here, especially in Colombo, are not that conducive to clearing the ropes. The wickets are slow and the ball doesn’t come on to the bat. The other component, just as important, is range as a batting unit.”

Even when Sri Lanka lifted the T20 World Cup in 2014 they were not blessed with a dressing room full of big hitters, relying instead on sharp running, clever placement and a mastery of spin. Rathour preached a similar mantra.

“If you are not a team that hits a lot of sixes, you can still find plenty of fours by utilising the whole ground,” he said. “Most of them sweep well, reverse sweep and use their feet. That is encouraging. If you don’t have the brute power, you can make up for it by using angles and scoring square of the wicket.

“These wickets perhaps suit that style more. They are not the easiest surfaces to hit sixes, and I’m okay with that. If they can use their feet and the angles well, that is as good.”

Rex Clementine

at Pallekele

Business

Unlocking Sri Lanka’s dairy potential

Sri Lanka’s dairy and livestock sector is central to food security, rural livelihoods, and national nutrition, yet continues to face challenges related to productivity, climate vulnerability, market access, and financing.

In this context, Connect to Care and DevPro have entered into a formal partnership through a Memorandum of Understanding (MoU) to support Sri Lanka’s journey towards dairy self-sufficiency.

A core objective of DevPro is to strengthen inclusive and resilient dairy value chains by empowering smallholder farmers through technical assistance, capacity building, climate-resilient practices, and market-oriented approaches, building on its extensive field presence across Sri Lanka.

A core objective of Connect to Care is to support the achievement of dairy self-sufficiency by 2033, as outlined in the national development manifesto, with an interim target of 75% self-sufficiency by 2029.

By strengthening local dairy production and value chains, this effort will also help reduce Sri Lanka’s dependence on imported dairy products, while improving farmer incomes and domestic supply resilience.

The partnership will focus on climate-smart dairy development, multi-stakeholder coordination, and exploring blended finance and PPP models—providing a structured platform for development partners and the private sector to engage in scalable action.

-

Opinion4 days ago

Opinion4 days agoSri Lanka, the Stars,and statesmen

-

Business5 days ago

Business5 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Business3 days ago

Business3 days agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Business3 days ago

Business3 days agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business3 days ago

Business3 days agoArpico NextGen Mattress gains recognition for innovation

-

Business2 days ago

Business2 days agoAltair issues over 100+ title deeds post ownership change

-

Business2 days ago

Business2 days agoSri Lanka opens first country pavilion at London exhibition

-

Editorial3 days ago

Editorial3 days agoGovt. provoking TUs