News

Pulling back from the precipice: A Pathfinder perspective

The way out of Sri Lanka’s most challenging external financing crisis is to negotiate an arrangement with the IMF and agree on a preemptive debt restructuring, Pathfinder Foundation has said in a media statement.

An IMF programme could include strengthening the government’s revenue base (widening the tax base and improving tax administration); improving the primary balance in the budget (revenue – (expenditure-interest payments)); proactive, data-driven and non-interventionist monetary policy; a flexible and realistic exchange rate policy to assist in building up external reserves; commercialisation of SOE operations, including full cost-recovery in the pricing of electricity and fuel, restructuring of the CEB and the CPC, the implementation of the Statements of Intent and addressing the losses being incurred by SriLankan Airlines, the Foundation said.

Pathfinder Foundation said that the Gross Official Reserves have declined to USD 1.6 bn as at end-November. Repayments over the subsequent 12 months amount to about USD 7 billion.

“The authorities have responded with import and capital controls as well as a fixed exchange rate based on moral suasion by the CBSL and rationing of foreign exchange by the commercial banks. This has resulted in a scarring of the economy which will inevitably have an adverse impact on growth, employment and incomes. Inflation is rising and is on the verge of reaching double digits and shortages constantly emerge of essential goods and services,” the Foundation said.

The Pathfinder statement in full: “The Road Map, presented by the CBSL, identified a number of potential sources of debt- and non-debt-creating inflows to fill the external financing gap. The securitisation of remittance flows has been added to the menu of options recently. However, to date there has been an alarming depletion of external reserves and an inexorable increase in the external financing gap.

The Pathfinder statement in full: “The Road Map, presented by the CBSL, identified a number of potential sources of debt- and non-debt-creating inflows to fill the external financing gap. The securitisation of remittance flows has been added to the menu of options recently. However, to date there has been an alarming depletion of external reserves and an inexorable increase in the external financing gap.

“If the authorities have clear visibility of sufficient inflows to arrest the steady deterioration in the country’s external position, one can be hopeful of a turnaround to avoid the possibility of a debt default which would greatly amplify problems, such as rising inflation; pressure on exchange and interest rates; losses in the real value of incomes; decline in business confidence; and disruption to the supplies of basic goods and services. If the anticipated inflows are not forthcoming in sufficient quantities to fill the external financing gap, there will be no option but to turn to the IMF to avoid further scarring of the economy and creating greater shortages of essential goods and services.

“It is extremely unlikely that it would be possible to obtain IMF assistance without a debt rescheduling as the Fund does not support countries where the debt is considered unsustainable. Equally, it is not practical to reach agreement on debt restructuring without an IMF programme. So, the twin pillars of the way forward would need to be negotiating an arrangement with the IMF and agreement on a preemptive debt restructuring.

“Attempting to undertake stabilisation of the economy without the cushion of financing that can be mobilised through an IMF programme would be like performing on the high-trapeze without a safety-net. There needs to be a less painful blend of adjustment and financing. However, it must be highlighted that pain cannot be avoided. An IMF programme would impose significant burdens on the people. The main thrust of this article is that this pain would be less than the severe dislocation that is already being caused by squeezing the economy to make up for the dollar illiquidity. The conditionality attached to IMF programmes are intended to stabilise the economy (contain inflation and balance of payment pressure) and improve its creditworthiness.

“An IMF programme could include, inter alia, the following: strengthening the government’s revenue base (widening the tax base and improving tax administration); improving the primary balance in the budget (revenue – (expenditure-interest payments)); proactive, data-driven and non-interventionist monetary policy; a flexible and realistic exchange rate policy to assist in building up external reserves; commercialisation of SOE operations, including full cost-recovery in the pricing of electricity and fuel, restructuring of CEB and CPC, the implementation of the Statements of Intent and addressing the losses being incurred by SriLankan Airlines.

“An IMF Extended Fund Facility can provide balance of payment financing of up to USD 1 bn per year for three years. The amount made available would be calibrated according to the strength of the reforms undertaken. An IMF programme would also unlock direct budgetary support from the World Bank, Asian Development Bank and possibly a few bilateral donors (over and above their usual project loans). Both balance of payments and budgetary support are most urgently required for the twin deficit Sri Lankan economy. Based on indications in 2020, up to USD 2 bn in all can be mobilised through these sources, depending on the strength of the reforms undertaken. Engagement with the IMF will also transmit positive signals to both investors and creditors, both at home and abroad. It can also pave the way for an eventual upgrading of the sovereign rating, which would improve the prospect of attracting foreign investment and credits.

“The second pillar, preemptive restructuring, must also be pursued concurrently with negotiations with the IMF. Not only can this facilitate the obtaining of a Fund programme but it can also create some leeway to stabilise the economy and place it on a path of sustained growth. Debt restructuring can be achieved through: extending maturities; modifying coupon (interest) rates; and hair-cuts on the principal (write-downs). One or more of these modalities can be used to reach an agreement with creditors that places Sri Lanka’s debt servicing on a sustainable path. Ideally, about a 3-year window should be created where debt servicing is suspended. This can release a very substantial amount of scarce foreign exchange to finance imports. The impact on growth, employment and incomes would be materially positive. In considering debt restructuring, it is important to realise that the most significant usual downside is a loss of access to international capital markets. In Sri Lanka’s case, this has already happened with the downgrading of the sovereign rating. So, the most important disadvantage is no longer a factor. Another concern relates to the impact on domestic holders of USD denominated sovereign debt, mainly banks. A mitigating factor is that a significant share of these holdings have been bought at a discount from the secondary markets. In other countries, Central Banks have exercised regulatory forbearance to assist financial institutions which have required such support to repair their balance sheets.

“It must, however, be recognised that it could take 4-6 months to negotiate an IMF programme and a preemptive debt restructuring agreement. The present trends in external reserves on the one hand and net drains on foreign currency on the other indicate that bridging finance is required to meet obligations over the next 6 months to avoid a debt default. The package of assistance offered by India is an encouraging start and needs to be finalised as soon as possible. It has to be supplemented by financing from other friendly countries, like Japan. There is scope for India and Japan to work together to support Sri Lanka at this critical juncture. Their willingness to step forward is likely to be greater, if it is known that Sri Lanka has taken a decision to approach the IMF. While our development partners will be wary of having to make an open-ended commitment, they are likely to find bridging finance more palatable.

Time has almost run out. Urgent, focused and pragmatic attention to these pressing issues is of paramount importance. An IMF programme can be at the heart of a medium-term strategy to overcome the current challenges and give Sri Lankans greater hope about the future prospects of the economy.”

Latest News

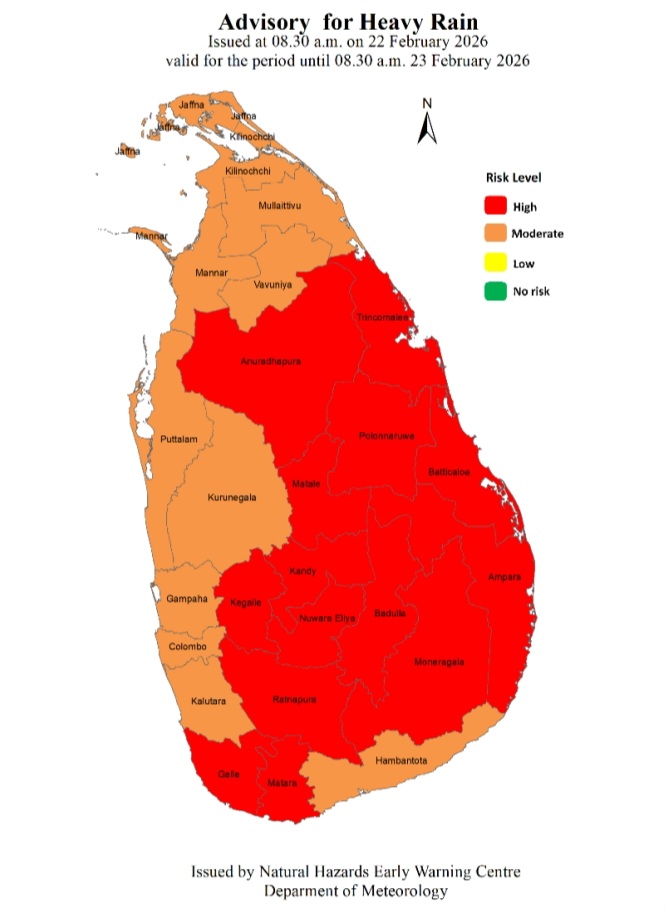

Advisory for Heavy Rain issued for the Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts

Advisory for Heavy Rain Issued by the Natural Hazards Early Warning Centre at 08.30 a.m. on 22 February 2026 valid for the period until 08.30 a.m. 23 February 2026

Due to the influence of the low level atmospheric disturbance in the vicinity of Sri Lanka, Heavy showers above 100 mm are likely at some places in Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts.

Therefore, general public is advised to take adequate precautions to minimize damages caused by heavy rain, strong winds and lightning during thundershowers

News

Matara Festival for the Arts’ inaugurated by the Prime Minister

The inaugural ceremony of the Matara Festival for the Arts, featuring a wide range of creations by local and international artists, was held on February 19 at the Old High Court premises of the Matara Fort, under the patronage of Prime Minister Dr. Harini Amarasuriya.

The festival, centred around the Old High Court premises in Matara and the auditorium of the Matara District Secretariat, will be open to the public from 20 to 23 of February. The festival will be featured by visual art exhibitions, short film screenings, Kala Pola, and a series of workshops conducted by experts.

The inaugural event was attended by the Minister of Women and Child Affairs, Ms. Saroja Paulraj, along with artists, guests, and a large number of schoolchildren.

(Prime Minister’s Media Division)

News

Only single MP refuses salary as Parliament details pays and allowances

Only one Member of Parliament has chosen not to receive the salaries and allowances entitled to MPs, Prime Minister Dr. Harini Amarasuriya revealed in Parliament last Thursday, shedding light on the financial perks enjoyed by members of the Tenth Parliament.

Speaking on Thursday (Feb. 19) in response to a question from SJB Badulla District MP Chaminda Wijesiri, the Prime Minister outlined the full range of pay and allowances provided to parliamentarians.

According to Dr. Amarasuriya, MPs receive a monthly allowance of Rs. 54,285, an entertainment allowance of Rs. 1,000, and a driver’s allowance of Rs. 3,500—though MPs provided with a driver through the Ministry of Public Security and Parliamentary Affairs are not eligible for the driver’s allowance.

Additional benefits include a telephone allowance of Rs. 50,000, a transport allowance of Rs. 15,000, and an office allowance of Rs. 100,000. MPs are also paid a daily sitting allowance of Rs. 2,500 for attending parliamentary sessions, with an additional Rs. 2,500 per day for participation in parliamentary sittings and Rs. 2,500 per day as a committee allowance.

Committee meetings held on non-parliament sitting days also attract Rs. 2,500 per day.

Fuel allowances are provided based on the distance between an MP’s electoral district and Parliament. National List MPs are entitled to a monthly allocation equivalent to 419.76 litres of diesel at the market price on the first day of each month.

Despite the comprehensive benefits, only SJB Badulla District MP Nayana Wasalathilaka has opted not to draw a salary or allowances. Dr. Amarasuriya said that in accordance with a written notification submitted by MP Wasalathilaka on August 20, 2025, payments have been suspended since that date.

The Prime Minister also confirmed that she, along with the Speaker, Deputy Speaker, committee chairs, ministers, deputy ministers, the Opposition Leader, and senior opposition whips, have all informed the Secretary-General of Parliament in writing that they will not claim the fuel allowance.

Challenging the ruling party’s voluntary pledge to forgo salaries, MP Wijesiri pointed out that all MPs except Wasalathilaka continue to receive their salaries and allowances. “On one hand you speak about the people’s mandate, which is good. But the mandate also included people who said they would voluntarily serve in this Parliament without salaries. Today we have been able to prove, Hon. Speaker, that except for one SJB MP, the other 224 Members are drawing parliamentary salaries,” he said.

The Prime Minister responded by defending the political culture and practice of allocating portions of MPs’ salaries to party funds. Referring to previous practices by the JVP and NPP, she said: “It is no secret to the country that the JVP has for a long time not personally taken MPs’ salaries or any allowances. I think the entire country knows that these go to a party fund. That is not new, nor is it something special to mention. The NPP operates in the same way. That too is not new; it is the culture of our political movement.”

When MP Wijesiri posed a supplementary question asking whether diverting salaries to party funds was an indirect method of taking care of MPs, Dr. Amarasuriya said: “There is no issue there. No question was raised; the Member made a statement. What we have seen throughout this week is an inability to understand our political culture and practice, and a clash with decisions taken by political movements that misused public funds. What is coming out is a certain mindset. That is why there is such an effort to find fault with the 159. None of these facts are new to people. He did not ask a question, so I have nothing to answer.”

The disclosures come days after the Government moved to abolish the parliamentary pension, a measure that has sparked renewed debate over MP compensation and the transparency of funds allocation.

-

Business6 days ago

Business6 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features10 hours ago

Features10 hours agoWhy does the state threaten Its people with yet another anti-terror law?

-

Latest News2 days ago

Latest News2 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Latest News2 days ago

Latest News2 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News2 days ago

Latest News2 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction

-

Features6 days ago

Features6 days agoGiants in our backyard: Why Sri Lanka’s Blue Whales matter to the world

-

Sports3 days ago

Sports3 days agoOld and new at the SSC, just like Pakistan

-

News2 days ago

News2 days agoConstruction begins on country’s largest solar power project in Hambantota