Business

Priorities in Focus: Will Budget 2025 address Sri Lanka’s agricultural challenges?

Manoj Thibbotuwawa is a Research Fellow at the Institute of Policy Studies of Sri Lanka (IPS) with

research interests in agriculture, agribusiness value chains, food security, climate change and environmental and natural resource economics. He has more than 19 years of research experience at IPS. . Dr Thibbotuwawa holds a BSc (Agriculture) with Honours from the University of Peradeniya, an MSc (Agricultural Economics) from the Post-Graduate Institute of Agriculture at the University of Peradeniya, and a PhD from the University of Western Australia. He has also obtained a Post-Graduate Diploma in Modelling and Accounting for Sustainable Development from the International Institute of Social Studies (ISS) in The Hague. Dr Thibbotuwawa is a recipient of the prestigious Nuffic Fellowship from the Government of the Netherlands and the Endeavour Award from the Government of Australia.

Lakmini Fernando is a Research Fellow at IPS with primary research interest in Development Economics, Public Finance and Climate Change. She has expertise in econometric data analysis, research design and causal methodologies. Dr Fernando holds a BSc in Agriculture from the University of Peradeniya, a Master of Development Economics (Advanced) from the University of Queensland, Australia and a PhD in Economics from the University of Adelaide, Australia. She was awarded the Dean’s Honour Roll from the University of Queensland for Outstanding Academic Excellence in 2015 and the Dean’s Commendation for Doctoral Thesis Excellence from the University of Adelaide in 2021.

By Dr Manoj Thibbotuwawa and Dr Lakmini Fernando

Public expenditure on agriculture as a share of total government spending has decreased from 6.4% to 2% between 2014 and 2023.

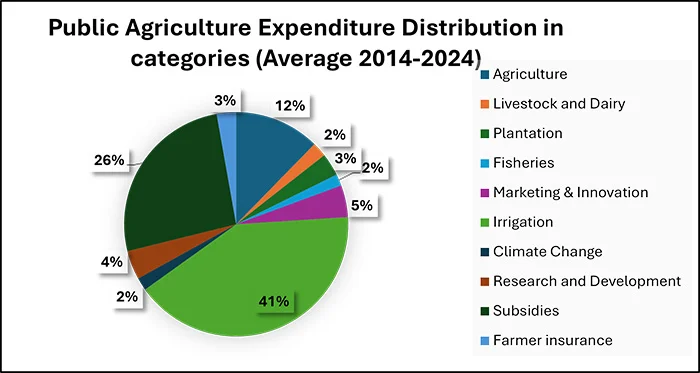

The irrigation subsector receives most of the agricultural spending (41%), with subsidies accounting for a high 26%.

Change to funding priorities necessary to address critical concerns.

The agricultural sector in Sri Lanka has long been a pillar of the nation’s economy, yet its decline reflects a complex interplay of economic shifts, policy decisions, and underutilised potential. Agriculture’s contribution to the overall economy in Sri Lanka has gradually diminished over time, while the agricultural labour force has shrunk at a slower rate. This disparity between a declining sector and a stagnant workforce, coupled with the failure to address structural changes by improving land and labour productivity, has led to poor sector performance, particularly in terms of food security and farm income.

The agricultural sector in Sri Lanka has long been a pillar of the nation’s economy, yet its decline reflects a complex interplay of economic shifts, policy decisions, and underutilised potential. Agriculture’s contribution to the overall economy in Sri Lanka has gradually diminished over time, while the agricultural labour force has shrunk at a slower rate. This disparity between a declining sector and a stagnant workforce, coupled with the failure to address structural changes by improving land and labour productivity, has led to poor sector performance, particularly in terms of food security and farm income.

Additionally, unproductive public spending in the form of inefficient allocation, short-term concentration, and neglect of crucial areas is an important contributory factor. In this context, it is crucial to assess whether public expenditure allocation in Sri Lanka has undergone significant shifts aimed at unlocking the agriculture sector’s potential while advancing food security and fostering rural development.

Tracking the Shift: Trends in Public Spending on Agriculture

Over the last decade, Sri Lanka has struggled to spend adequately on agriculture due to competing fiscal concerns. Before COVID-19, total agricultural investment was around LKR 112 billion in real terms between 2014 and 2020. However, due to the impact of COVID-19, it sharply declined to LKR 88 billion in 2021. Since then, agricultural investment has slightly increased, averaging LKR 97 billion in the past two years (2022-2023). Despite an increase in absolute public expenditure on agriculture (PEA), both the GDP share and the percentage of the total budget allocated to agriculture have been declining.

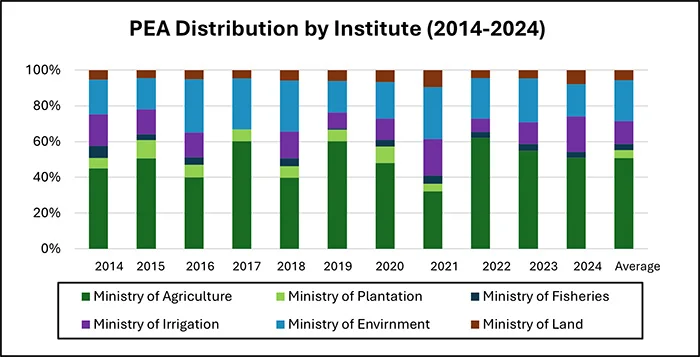

PEA as a percentage of GDP has fallen from 1.1% in 2014 to 0.8% by 2023. Similarly, PEA as a percentage of total government spending has decreased from 6.4% to 2% throughout the same period. Notably, the balance between capital and recurring expenditures has shifted dramatically in favour of more recurrent expenditures during institutional structure changes linked to changes of government, as shown in 2015, 2019, and 2020.

Guiding the Budget: Who Shapes Agricultural Investments?

The agriculture sector in Sri Lanka is primarily managed by the Ministry of Agriculture (MOA), the Ministry of Plantation Industries (MOP) and the Ministry of Fisheries (MOF), as outlined in the Public Investment Programme (PIP). While the land and irrigation sectors are closely linked to agriculture, they fall under the jurisdiction of separate ministries: the Ministry of Lands (MOL) and the Ministry of Irrigation (MOI), respectively. In terms of budgetary allocations, MOA historically receives the largest share, accounting for 51% of agriculture-related expenditures.

The agriculture sector in Sri Lanka is primarily managed by the Ministry of Agriculture (MOA), the Ministry of Plantation Industries (MOP) and the Ministry of Fisheries (MOF), as outlined in the Public Investment Programme (PIP). While the land and irrigation sectors are closely linked to agriculture, they fall under the jurisdiction of separate ministries: the Ministry of Lands (MOL) and the Ministry of Irrigation (MOI), respectively. In terms of budgetary allocations, MOA historically receives the largest share, accounting for 51% of agriculture-related expenditures.

This is followed by the Ministry of Mahaweli Development and Environment (MOE) with 23%, and MOI with 13%. MOF and MOP receive smaller allocations, at 3% and 4% respectively. While the nominal PEA has been on the rise, real-term PEA has either declined or remained largely unchanged across all ministries.. However, this does not necessarily indicate whether agricultural expenditures are aligned with sectoral policies, making it challenging to evaluate the effectiveness of spending in addressing critical concerns within the sector.

Business

New policy framework for stock market deposits seen as a boon for companies

The government’s new policy framework to allocate a maximum interest rate for stock market deposits would pave the way for companies and investors to plan their future business activities, a senior stockbroker said.

‘Accordingly, the Colombo Stock Exchange (CSE) has entered a period of strong revival, supported by economic stabilization and rising investor confidence while significant market reforms would support the new policy framework on interest, Assistant Vice President Softlogic Stockbrokers, Eardly Kern, told The Island Financial Review.

He said that the imposition of maximum interest rates for stock market deposits would prevent the interest rates from moving upwards, thus paving the way for investors to invest in stocks with a lot of confidence.

Kern added: ‘The CSE outlook would provide expanding opportunities for investors as Sri Lanka positions itself for market-led investor platforms.

‘Improving macro fundamentals, such as lower interest rates, rising corporate earnings and historically attractive valuations, have been key catalysts in driving investment into the equities market.

‘These tailwinds, together with ongoing economic reforms, have helped re-establish confidence among both local and foreign investors.

‘Over the past two years, the number of CDS accounts has surpassed 949,000, with digital on-boarding through the CSE mobile app driving the latest surge.

‘Further, foreign inflows for 2024 amounted to USD 66.5 million, while Rs 175 billion was raised through capital market activity, including 16 new listings. With a target of 20 IPOs on the horizon, the CSE anticipates several new companies entering the market by early 2026.

‘The All Share Price Index (ASPI) delivered an impressive 49.7 percent return in 2024, ranking the CSE as the second-best performing market in Asia for the year. By November 2025, the index had risen a further 45.65 percent amounting to an extraordinary two-year return of approximately 95 percent.

‘The S&P SL20 Index recorded a parallel recovery, gaining 58.5 percent in 2024 and 31.84 percent so far in 2025.

‘ Despite the rally, the CSE continues to trade below its 10-year average PER and valuations remain significantly more attractive than in regional markets, such as, India, Malaysia, Vietnam, and China.

‘ Turnover has surged to Rs 1.06 trillion in 2025 (as of mid-November), nearly doubling the figure recorded in 2024. Market capitalization grew 34 percent n 2024, despite only around 40,000 active investors capturing most of the gains—highlighting the potential for broader participation.

‘ Corporate earnings have also strengthened markedly. After generating Rs 686 billion in earnings during 2024—a 50% year-on-year increase—listed entities are projected to deliver between Rs 775–800 billion in 2025. Earnings for the first half of 2025 have already grown 57 percent year-on-year.’

By Hiran H Senewiratne

Business

Dialog reinforces commitment to heritage through Kelaniya Duruthu Festival

Dialog Axiata PLC, Sri Lanka’s #1 connectivity provider, has reinforced its enduring commitment to preserving national culture by sponsoring the Kelaniya Duruthu Festival, aligning long standing patronage with purposeful community engagement to honour religious heritage, support cultural continuity, and strengthen shared values.

The annual Kelaniya Duruthu Festival, one of Sri Lanka’s most significant religious and cultural observances, was held on 8th, 9th and 11th January 2026, marking a congregation of thousands of devotees and visitors at the historic Kelaniya Raja Maha Vihara. As a long-term patron, Dialog continues to provide sponsorship support, enabling the seamless organisation of the festival while uplifting traditions deeply rooted in the nation’s cultural identity.

Through its continued support of the Kelaniya Duruthu Festival, Dialog underscores its role as a responsible corporate citizen dedicated to safeguarding Sri Lanka’s cultural and religious heritage for future generations. This commitment is further reflected in Dialog’s long-term patronage of national events such as the Kandy Esala Perahara, Nawam Maha Perahara at Gangaramaya, Katharagama Esala Perahara and Gatabaru Esala Perahara. Complementing these efforts, Dialog has also undertaken heritage preservation initiatives including the construction of the vestibule at Dimbulagala Aranya Senasanaya, the launch of a website and directory of Amarapura Maha Nikaya Temples, and the restoration of the Anuradhapura Maha Vihara Sannipatha Shalawa.

Business

Sri Lanka launches its first-ever Smart Bus Ticketing System

A National Breakthrough in Public Transport Digitalization Powered by Ceylon Business Appliances with Nimbus Ventures.

Sri Lanka has taken a historic step forward with the launch of its first Smart Bus Ticketing System, enabling passengers to pay fares using contactless cards, digital wallets, and QR payments. This advancement places the country among global leaders in smart mobility.

The initiative was made possible through collaboration with the Government of Sri Lanka, leading banking partners, and the technology leadership of Ceylon Business Appliances (CBA) and Nimbus Ventures, who serve as the Technology, Software, Hardware, and Operational Partners behind the nation’s first Open Loop Transit Payment System.

For decades, CBA has been at the forefront of Sri Lanka’s digital transformation efforts—bringing modern, global-standard technologies that have strengthened the nation’s digital infrastructure.

Speaking to the media at the launch, Sardha Fernando, Managing Director of CBA, stated:

“This is not just a ticketing upgrade—it is a complete digital evolution of public transport in Sri Lanka. For years, CBA has been committed to introducing advanced technologies to the country, and today, we are proud to bring a globally recognized, secure, and seamless smart transit solution to our people. With every tap, we are enabling convenience, transparency, and a more connected future for all Sri Lankans.”

He added:

“This milestone reflects our ongoing mission: to help build a digitally empowered Sri Lanka that is ready to embrace the technologies shaping the world.”

‘Ruwath Fernando, CEO/Director of CBA, highlighted:

“This project demonstrates that Sri Lanka is ready to adopt and operate on par with global smart mobility technologies. Our commitment has always been to bring the world’s best software systems and innovations into Sri Lanka—solutions that are secure, scalable, and built to international standards.”

He continued:

“By introducing a state-of-the-art open-loop transit payment platform, we are proving that Sri Lanka can not only embrace but also successfully operate advanced digital ecosystems. This is a defining moment in positioning the country as a technology-proof nation prepared to trial and adopt global digital advancements.”

CBA extends heartfelt congratulations to the banking partners who trusted this vision—

Sampath Bank, Commercial Bank, Bank of Ceylon, People’s Bank, and DFCC Bank— on the successful launch of their new ticketing application.

This application integrates seamlessly with the PAX A910S ticketing device, powered by a robust CBA– Nimbus ventures software solution, engineered for scale, reliability, and national deployment..

-

Business4 days ago

Business4 days agoDialog and UnionPay International Join Forces to Elevate Sri Lanka’s Digital Payment Landscape

-

News4 days ago

News4 days agoSajith: Ashoka Chakra replaces Dharmachakra in Buddhism textbook

-

Features4 days ago

Features4 days agoThe Paradox of Trump Power: Contested Authoritarian at Home, Uncontested Bully Abroad

-

Features4 days ago

Features4 days agoSubject:Whatever happened to (my) three million dollars?

-

News4 days ago

News4 days agoLevel I landslide early warnings issued to the Districts of Badulla, Kandy, Matale and Nuwara-Eliya extended

-

News4 days ago

News4 days ago65 withdrawn cases re-filed by Govt, PM tells Parliament

-

Opinion6 days ago

Opinion6 days agoThe minstrel monk and Rafiki, the old mandrill in The Lion King – II

-

News4 days ago

News4 days agoNational Communication Programme for Child Health Promotion (SBCC) has been launched. – PM