Opinion

Kinder government reaction to economic distress would evoke better public response

by Jehan Perera

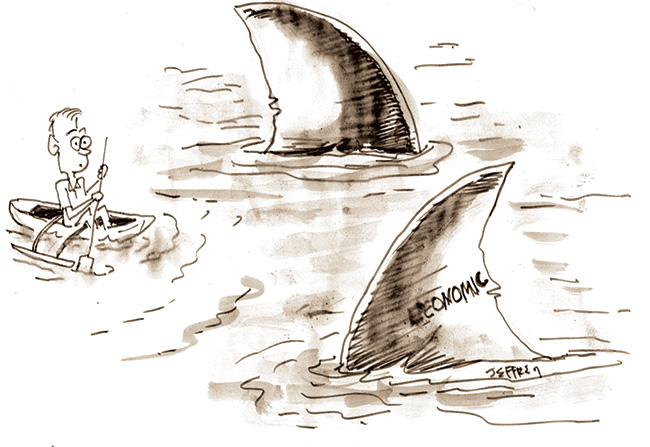

With less than a month before presidential elections are called, President Ranil Wickremesinghe has highlighted the success of his presidency as rescuing Sri Lanka from its international bankruptcy status that prevents it from doing business with the rest of the world. The signing of the agreement on international debt restructuring for USD 5.8 billion with the Official Creditor Committee consisting of several foreign governments that have given bilateral loans to Sri Lanka was celebrated in numerous ways. The president himself made a speech to the nation and firework exhibitions took place in various towns to mark the occasion. The president made it clear that he was the architect of Sri Lanka’s economic recovery. This puts upon him a greater responsibility to engage with the people, listen to them and explain to them what it all means.

President Wickremesinghe said, “I believed in my ability to save our country and its people from the economic abyss. I had a comprehensive work plan and a deep understanding of the strategies that other nations had employed to emerge from similar crises. Furthermore, I had faith that with my planned policies and dedication, the economy could be revitalised.” The signing of the debt restructuring agreement received immediate plaudits from the countries that matter most to Sri Lanka at this time. US Ambassador Julie Chung welcomed the news stating “This is a positive step forward in Sri Lanka’s economic recovery and resilience, helping build more confidence in Sri Lanka’s fiscal environment. The US encourages Sri Lanka to continue the reform process, adopting transparent and sustainable changes that foster long-term prosperity and growth.” Similarly, Japan, India and the IMF also expressed their satisfaction with the progress that Sri Lanka was making.

However, there was also a second agreement that Sri Lanka signed with China’s Exim Bank for USD 4.2 billion which has caused concern among the same parties that congratulated the President and the Sri Lankan negotiating team on reaching agreement with the Official Creditor Committee (OCC) which did not include China. They have demanded “comparability of treatment” with other creditors, including China. In particular, they have requested details of Sri Lanka’s other debt deals, and “all information necessary for the OCC to ensure comparability of treatment”. The details of the negotiations in both cases are not known, but will most probably be revealed as the parliamentary debate takes place this week. This tension reflects the serious problem of lack of transparency in the government’s financial transactions that runs across the board.

No Haircut

President Wickremesinghe was cryptic when he said, “With these agreements, we will be able to defer all bilateral loan instalment payments until 2028. Furthermore, we will have the opportunity to repay all the loans on concessional terms, with an extended period until 2043.” He did not say what these concessional terms were nor did he mention what the “haircut” would be. While the amount that would be subject to concessional repayment is USD 5.8 billion the total foreign debt was in the region of USD 40 billion at the time of the economic collapse in 2022. Last year when the government was negotiating with the creditors there was optimism that a “haircut” in the range of 30 percent would be possible. Specific to debt restructuring, a haircut is the reduction of outstanding interest payments or a portion of a bond payable that will not be repaid.

According to research studies done by international researchers in the field, creditors offering debtors concessional terms in order to facilitate the repayment of loans taken is a common occurrence. In this context, the international support given to the Sri Lankan government seems to be much less than was expected, or even what is fair. A research study published last month in Germany states “We study sovereign external debt crises over the past 200 years, with a focus on creditor losses, or “haircuts”. Our sample covers 327 sovereign debt restructurings with external private creditors over 205 default spells since 1815. Creditor losses vary widely (from none to 100%), but the statistical distribution has remained remarkably stable over two centuries, with an average haircut of around 45 percent.” Graf von Luckner C.M. Meyer J. Reinhart C.M. Trebesch C., Publication Date, 06/2024, https://www.ifw-kiel.de/publications/sovereign-haircuts-200-years-of-creditor-losses-33019/ The expressions of international support would be more meaningful if they contribute to getting Sri Lanka much better terms for its debt restructuring.

Due to the lack of information about the benefits to Sri Lanka of a reduction in the debt burden that would make an immediate impact on their lives, the president’s victory speech did not gain much traction among the general public. The public displays of celebratory fireworks in many parts of the country did not obtain any significant public participation. The fact is that the economic life of the people will not change either immediately or even in the short term, except marginally through changes in the controlled price of some commodities such as occurred with petrol. Those whose salaries have remained stagnant over the past two years have to cope with basic costs of living that have increased two to three-fold. Unlike Kenya where mobs went on to the streets to protest against the increases in the cost of living and high taxes, the vast majority of Sri Lankan people have borne their difficulties in silence and in the privacy of their homes.

Stock Answer

Organised groups such as student unions and trade unions, however, are bringing the grievances of people out into the open. The teachers protest which was ended by tear gas and water cannons fired upon them by the police was an example. Dr Ahilan Kadirgamar, who teaches economics at the University of Jaffna has written, in his Kuppi Talk column in The Island of 25 June)” “The IMF-led austerity programme, despite many promises to preserve social spending, inevitably leads to cuts in the real value of social spending, as reflected in the recently released Finance Ministry Annual Report for 2023. Between 2021 and 2023 the cost of living in Sri Lanka increased by 100 percent, or if we look at it in dollar terms, the value of the Sri Lankan rupee declined by fifty percent from Rs 200 to Rs 300 per dollar. However, during this period the nominal spending increase for general education was only 22.5 percent and for higher education was a mere 13.1 percent” as against the 100 percent inflation.

In simple terms, there is no money left in this depleted education budget for salary increases to be made, or for the government to even keep to the commitments it made to teachers in the past. Dr Kadigamar further notes that “For decades, Sri Lanka has been reducing its spending on education. In fact, expenditure on education has spiraled downwards over the decades from close to 5 percent of GDP in 1970 to 1.2 percent in 2022, one of the lowest today in the world.” The government’s current approach to education, as spelled out by the president, is to hand it over to the private sector. However, the withdrawal of the state from the provision of education services will be injurious to those from less well-off families in the context of the commercialisation of education as a profit making business and not a social service. In a general context of grave economic hardship there is a need for more government investment in education for the economically disadvantaged and not less.

Teachers came out onto the streets in their thousands to protest last week against the government’s failure to address their concerns. There is no question that teachers are today a grossly underpaid sector though tasked with educating the younger generations to meet the challenges of the future. They were dispersed by the security forces with tear gas and water cannons. This harsh treatment of protestors has become the stock answer of the government to those who wish to make use of their democratic rights to question the government and to gather together to do so. It would be better if the president, as the key person behind the economic transformation of the country, were to talk to the protestors or at least to their leaders, hear them out and let them vent their grievances. When signing agreements that will bind the country for the future it is important for the government to take the people, and the opposition political parties, into its confidence and seek to obtain their support as well. This is the only way that solutions will last the test of time and be sustainable.

Opinion

English as used in scientific report writing

The scientific community in the English-speaking world publishes its research findings using technical and scientific English (naturally!). It has its own particular vocabulary. Many words are exclusive for a particular technology as they are specialised technical terms. Also, the inclusion in research papers of mathematical and statistical terms and calculations is important where they support the overall findings.

There is a whole array of specialist publications, journals, papers and letters serving the scientific community world-wide. These publications are by subscription only but can easily be found in university libraries upon request.

Academics quote the number of their research papers published with pride. They are the status symbols of personal achievement par excellence! And most importantly, these are used to help justify the continuation of funding for the upcoming academic year.

Such writings are carefully crafted works of precision and clarity. Not a word is out of place. All words used are nuanced to fit exactly the meaning of what the authors of the paper wish to convey. No word is superfluous (= extra, not needed); all is well manicured to convey the message accurately to a knowledgeable, receptive reader. As a result, people from all around the world are using the Internet to access these research findings thus establishing the English language as a major form of information dissemination.

Reporting is best when it is measurable and can be quantified. Figures mean a lot in the scientific world. Sizes, quantities, ranges of acceptance, figures of probability, etc., all are used to lend authority to the research findings.

Before a paper can be accepted for publication it must be submitted to a panel for peer review. This is where several experts in the subject or speciality form a panel to assess the work and approve or reject it. Careers depend on well-presented reports.

Preparation Before Starting Research

There is a standard procedure for a researcher to follow before any practical work is done. It is necessary to evaluate the current status of work in this subject. This requires reading all the relevant, available literature, books, papers, etc., on this subject. This is done for the student to get ‘up to speed’ and in tune with the preceding research work in this field. During this process new avenues for research and investigation may open up for investigation.

Much research is done incorporating the ‘design of experiments’ statistical approach. Research these days rely heavily on statistics to prove an argument and the researcher has to be familiar and conversant with these statistical techniques of inquiry and evaluation to add weight to his or her findings.

We are all much richer due to the investigations done in the English-speaking world by the investigative scientific community using English as a tool of communication. In scientific research, the best progress in innovation, it seems, is when students can all collaborate. Then the best ideas develop and come out.

Sri Lankans should not exclude themselves from this process of knowledge creation and dissemination. Sri Lanka needs to enter this scientific world and issue its own publications in good English. Sri Lanka needs experts who have mastered this form of scientific communication and who can participate in the progress of science!

The most wonderful opportunities open up from time to time for graduates of the STEM subjects (science, technology, engineering and mathematics) mainly in companies using modern technology. The reputation of Sri Lanka depends on having a horse in this race – quite apart from the need to provide suitable careers for its own population. People have ambitions and need to be able rise up intellectually and get ahead. Therefore, students in the STEM subjects need to be able to read, analyse and compare several different research papers, i.e., students need to have critical thinking skills – in English. Often, these skills have to be communicated. Students need to be able to write to this high standard of English.

Students need to be able to put their thoughts on paper in a logical, meaningful way, their thoughts backed up by facts and figures according to the principles of the academic, research world. But natural speakers of English have difficulties in mastering this type of English and doing analyses and critical thinking – therefore, it must be multiple times more difficult for Sri Lankans to master this specialised form if English. Therefore, special attention needs to be paid to overcoming this disadvantage.

In addition, the researcher needs to have knowledge of the “design of experiments,” and be familiar with everyday statistics, e.g., the bell curve, ranges of probability, etc.

How can this high-quality English (and basic stats) possibly be taught in Sri Lanka when most campuses focus on the simple passing of grammar exams?

Sri Lanka needs teachers with knowledge of this advanced, specialist form of English supported with statistical “design of experiments” knowledge. Secondly, this knowledge has to be organised and systematized and imparted over a sufficient time period to students with ability and maturity. Over to you NIE, Maharagama!

by Priyantha Hettige

Opinion

Sri Lanka, the Stars,and statesmen

When President J. R. Jayewardene stood at the White House in 1981 at the invitation of U.S. President Ronald Reagan, he did more than conduct diplomacy; he reminded his audience that Sri Lanka’s engagement with the wider world stretches back nearly two thousand years. In his remarks, Jayewardene referred to ancient explorers and scholars who had written about the island, noting that figures such as Pliny the Elder had already described Sri Lanka, then known as Taprobane, in the first century AD.

Pliny the Elder (c. AD 23–79), writing his Naturalis Historia around AD 77, drew on accounts from Indo-Roman trade during the reign of Emperor Claudius (AD 41–54) and recorded observations about Sri Lanka’s stars, shadows, and natural wealth, making his work one of the earliest Roman sources to place the island clearly within the tropical world. About a century later, Claudius Ptolemy (c. AD 100–170), working in Alexandria, transformed such descriptive knowledge into mathematical geography in his Geographia (c. AD 150), assigning latitudes and longitudes to Taprobane and firmly embedding Sri Lanka within a global coordinate system, even if his estimates exaggerated the island’s size.

These early timelines matter because they show continuity rather than coincidence: Sri Lanka was already known to the classical world when much of Europe remained unmapped. The data preserved by Pliny and systematised by Ptolemy did not fade with the Roman Empire; from the seventh century onward, Arab and Persian geographers, who knew the island as Serendib, refined these earlier measurements using stellar altitudes and navigational instruments such as the astrolabe, passing this accumulated knowledge to later European explorers. By the time the Portuguese reached Sri Lanka in the early sixteenth century, they sailed not into ignorance but into a space long defined by ancient texts, stars, winds, and inherited coordinates.

Jayewardene, widely regarded as a walking library, understood this intellectual inheritance instinctively; his reading spanned Sri Lankan chronicles, British constitutional history, and American political traditions, allowing him to speak of his country not as a small postcolonial state but as a civilisation long present in global history. The contrast with the present is difficult to ignore. In an era when leadership is often reduced to sound bites, the absence of such historically grounded voices is keenly felt. Jayewardene’s 1981 remarks stand as a reminder that knowledge of history, especially deep, comparative history, is not an academic indulgence but a source of authority, confidence, and national dignity on the world stage. Ultimately, the absence of such leaders today underscores the importance of teaching our youth history deeply and critically, for without historical understanding, both leadership and citizenship are reduced to the present moment alone.

Anura Samantilleke

Opinion

General Educational Reforms: To what purpose? A statement by state university teachers

One of the major initiatives of the NPP government is reforming the country’s education system. Immediately after coming to power, the government started the process of bringing about “transformational” changes to general education. The budgetary allocation to education has been increased to 2% of GDP (from 1.8% in 2023). Although this increase is not sufficient, the government has pledged to build infrastructure, recruit more teachers, increase facilities at schools and identified education reforms as an urgent need. These are all welcome moves. However, it is with deep concern that we express our views on the general education reforms that are currently underway.

The government’s approach to education reform has been hasty and lacking in transparency and public consultation. Announcements regarding the reforms planned for January 2026 were made in July 2025. In August, 2025, a set of slides was circulated, initially through unofficial sources. It was only in November 2025, just three months ahead of implementation, that an official policy document, Transforming General Education in Sri Lanka 2025, was released. The Ministry of Education held a series of meetings about the reforms. However, by this time the modules had already been written, published, and teacher training commenced.

The new general education policy shows a discrepancy between its conceptual approach and content. The objectives of the curriculum reforms include: to promote “critical thinking”, “multiple intelligences”, “a deeper understanding of the social and political value of the humanities and social sciences” and embed the “values of equity, inclusivity and social justice” (p. 9). Yet, the new curriculum places minimal emphasis on social sciences and humanities, and leaves little time for critical thinking or for molding social justice-oriented citizens. Subjects such as environment, history and civics, are left out at the primary level, while at the junior secondary level, civics and history are allocated only 10 and 20 hours per term. The increase in the number of “essential subjects” to 15 restricts the hours available for fundamentals like mathematics and language; only 30 hours are allocated to mathematics and the mother tongue, per term, at junior secondary level. Learning the second national language and about our conflict-ridden history are still not priorities despite the government’s pledge to address ethnic cohesion. The time allocation for Entrepreneurship and Financial Literacy, now an essential subject, is on par with the second national language, geography and civics. At the senior secondary level (O/L), social sciences and humanities are only electives. If the government is committed to the objectives that it has laid out, there should be a serious re-think of what subjects will be taught at each grade, the time allocated to each, their progress across different levels, and their weight in the overall curriculum.

A positive aspect of the reforms is the importance given to vocational training. A curriculum that recognises differences in students, whether in terms of their interest in subject matter, styles of learning, or their respective needs, and caters to those diverse needs, would make education more pluralistic and therefore democratic. However, there must be some caution placed on how difference is treated, and this should not be reflected in vocational training alone, but in all aspects of the curriculum. For instance, will the history curriculum account for different narratives of history, including the recent history of Sri Lanka and the histories of minorities and marginalised communities? Will the family structures depicted in textbooks go beyond conventional conceptions of the nuclear family? Addressing these areas too would allow students to feel more represented in curricula and enable them to move through their years of schooling in ways that are unconstrained by stereotypes and unjust barriers.

The textbooks for the Grade 6 modules on the National Institute of Education (NIE) website appear to have not gone through rigorous review. They contain rampant typographical errors and include (some undeclared) AI-generated content, including images that seem distant from the student experience. Some textbooks contain incorrect or misleading information. The Global Studies textbook associates specific facial features, hair colour, and skin colour, with particular countries and regions, and refers to Indigenous peoples in offensive terms long rejected by these communities (e.g. “Pygmies”, “Eskimos”). Nigerians are portrayed as poor/agricultural and with no electricity. The Entrepreneurship and Financial Literacy textbook introduces students to “world famous entrepreneurs”, mostly men, and equates success with business acumen. Such content contradicts the policy’s stated commitment to “values of equity, inclusivity and social justice” (p. 9). Is this the kind of content we want in our textbooks?

The “career interest test” proposed at the end of Grade 9 is deeply troubling. It is inappropriate to direct children to choose their career paths at the age of fourteen, when the vocational pathways, beyond secondary education, remain underdeveloped. Students should be provided adequate time to explore what interests them before they are asked to make educational choices that have a bearing on career paths, especially when we consider the highly stratified nature of occupations in Sri Lanka. Furthermore, the curriculum must counter the stereotyping of jobs and vocations to ensure that students from certain backgrounds are not intentionally placed in paths of study simply because of what their parents’ vocations or economic conditions are; they must also not be constrained by gendered understandings of career pathways.

The modules encourage digital literacy and exposure to new communication technologies. On the surface, this initiative seems progressive and timely. However, there are multiple aspects such as access, quality of content and age-appropriateness that need consideration before uncritical acceptance of digitality. Not all teachers will know how to use communication technologies ethically and responsibly. Given that many schools lack even basic infrastructure, the digital divide will be stark. There is the question of how to provide digital devices to all students, which will surely fall on the shoulders of parents. These problems will widen the gap in access to digital literacy, as well as education, between well-resourced and other schools.

The NIE is responsible for conceptualising, developing, writing and reviewing the general education curriculum. Although the Institution was established for the worthy cause of supporting the country’s general education system, currently the NIE appears to be ill-equipped and under-staffed, and seems to lack the experience and expertise required for writing, developing and reviewing curricula and textbooks. It is clear by now that the NIE’s structure and mandate need to be reviewed and re-invigorated.

In light of these issues, the recent Cabinet decision to postpone implementation of the reforms for Grade 6 to 2027 is welcome. The proposed general education reforms have resulted in a backlash from opposition parties and teachers’ and student unions, much of it, legitimately, focusing on the lack of transparency and consultation in the process and some of it on the quality and substance of the content. Embedded within this pushback are highly problematic gendered and misogynistic attacks on the Minister of Education. However, we understand the problems in the new curriculum as reflecting long standing and systemic issues plaguing the education sector and the state apparatus. They cannot be seen apart from the errors and highly questionable content in the old curriculum, itself a product of years of reduced state funding for education, conditionalities imposed by external funding agencies, and the consequent erosion of state institutions. With the NPP government in charge of educational reforms, we had expectations of a stronger democratic process underpinning the reforms to education, and attention to issues that have been neglected in previous reform efforts.

With these considerations in mind, we, the undersigned, urgently request the Government to consider the following:

* postpone implementation and holistically review the new curriculum, including at primary level.

* adopt a consultative process on educational reforms by holding public sittings across the country .

* review the larger institutional structure of the educational apparatus of the state and bring greater coordination within its constituent parts

* review the NIE’s mandate and strengthen its capacity to develop curricula, such as through appointexternal scholars an open and transparent process, to advise and review curriculum content and textbooks.

* consider the new policy and curriculum to be live documents and make space for building consensus in policy formulation and curriculum development to ensure alignment of the curriculum with policy.

* ensure textbooks (other than in language subjects) appear in draft form in both Sinhala and Tamil at an early stage so that writers and reviewers from all communities can participate in the process of scrutiny and revision from the very beginning.

* formulate a plan for addressing difficulties in implementation and future development of the sector, such as resource disparities, teacher training needs, and student needs.

A.M. Navaratna Bandara,

formerly, University of Peradeniya

Ahilan Kadirgamar,

University of Jaffna

Ahilan Packiyanathan,

University of Jaffna

Arumugam Saravanabawan,

University of Jaffna

Aruni Samarakoon,

University of Ruhuna

Ayomi Irugalbandara,

The Open University of Sri Lanka.

Buddhima Padmasiri,

The Open University of Sri Lanka

Camena Guneratne,

The Open University of Sri Lanka

Charudaththe B.Illangasinghe,

University of the Visual & Performing Arts

Chulani Kodikara,

formerly, University of Colombo

Chulantha Jayawardena,

University of Moratuwa

Dayani Gunathilaka,

formerly, Uva Wellassa University of Sri Lanka

Dayapala Thiranagama,

formerly, University of Kelaniya

Dhanuka Bandara,

University of Jaffna

Dinali Fernando,

University of Kelaniya

Erandika de Silva,

formerly, University of Jaffna

G.Thirukkumaran,

University of Jaffna

Gameela Samarasinghe,

University of Colombo

Gayathri M. Hewagama,

University of Peradeniya

Geethika Dharmasinghe,

University of Colombo

F. H. Abdul Rauf,

South Eastern University of Sri Lanka

H. Sriyananda,

Emeritus Professor, The Open University of Sri Lanka

Hasini Lecamwasam,

University of Peradeniya

(Rev.) J.C. Paul Rohan,

University of Jaffna

James Robinson,

University of Jaffna

Kanapathy Gajapathy,

University of Jaffna

Kanishka Werawella,

University of Colombo

Kasun Gajasinghe, formerly,

University of Peradeniya

Kaushalya Herath,

formerly, University of Moratuwa

Kaushalya Perera,

University of Colombo

Kethakie Nagahawatte,

formerly, University of Colombo

Krishan Siriwardhana,

University of Colombo

Krishmi Abesinghe Mallawa Arachchige,

formerly, University of Peradeniya

L. Raguram,

University of Jaffna

Liyanage Amarakeerthi,

University of Peradeniya

Madhara Karunarathne,

University of Peradeniya

Madushani Randeniya,

University of Peradeniya

Mahendran Thiruvarangan,

University of Jaffna

Manikya Kodithuwakku,

The Open University of Sri Lanka

Muttukrishna Sarvananthan,

University of Jaffna

Nadeesh de Silva,

The Open University of Sri Lanka

Nath Gunawardena,

University of Colombo

Nicola Perera,

University of Colombo

Nimal Savitri Kumar,

Emeritus Professor, University of Peradeniya

Nira Wickramasinghe,

formerly, University of Colombo

Nirmal Ranjith Dewasiri,

University of Colombo

P. Iyngaran,

University of Jaffna

Pathujan Srinagaruban,

University of Jaffna

Pavithra Ekanayake,

University of Peradeniya

Piyanjali de Zoysa,

University of Colombo

Prabha Manuratne,

University of Kelaniya

Pradeep Peiris,

University of Colombo

Pradeepa Korale-Gedara,

formerly, University of Peradeniya

Prageeth R. Weerathunga,

Rajarata University of Sri Lanka

Priyantha Fonseka,

University of Peradeniya

Rajendra Surenthirakumaran,

University of Jaffna

Ramesh Ramasamy,

University of Peradeniya

Ramila Usoof,

University of Peradeniya

Ramya Kumar,

University of Jaffna

Rivindu de Zoysa,

University of Colombo

Rukshaan Ibrahim,

formerly, University of Jaffna

Rumala Morel,

University of Peradeniya

Rupika S. Rajakaruna,

University of Peradeniya

S. Jeevasuthan,

University of Jaffna

S. Rajashanthan,

University of Jaffna

S. Vijayakumar,

University of Jaffna

Sabreena Niles,

University of Kelaniya

Sanjayan Rajasingham,

University of Jaffna

Sarala Emmanuel,

The Open University of Sri Lanka

Sasinindu Patabendige,

formerly, University of Jaffna

Savitri Goonesekere,

Emeritus Professor, University of Colombo

Selvaraj Vishvika,

University of Peradeniya

Shamala Kumar,

University of Peradeniya

Sivamohan Sumathy,

formerly, University of Peradeniya

Sivagnanam Jeyasankar,

Eastern University Sri Lanka

Sivanandam Sivasegaram,

formerly, University of Peradeniya

Sudesh Mantillake,

University of Peradeniya

Suhanya Aravinthon,

University of Jaffna

Sumedha Madawala,

University of Peradeniya

Tasneem Hamead,

formerly, University of Colombo.

Thamotharampillai Sanathanan,

University of Jaffna

Tharakabhanu de Alwis,

University of Peradeniya

Tharmarajah Manoranjan,

University of Jaffna

Thavachchelvi Rasan,

University of Jaffna

Thirunavukkarasu Vigneswaran,

University of Jaffna

Timaandra Wijesuriya,

University of Jaffna

Udari Abeyasinghe,

University of Peradeniya

Unnathi Samaraweera,

University of Colombo

Vasanthi Thevanesam,

Professor Emeritus, University of Peradeniya

Vathilingam Vijayabaskar,

University of Jaffna

Vihanga Perera,

University of Sri Jayewardenepura

Vijaya Kumar,

Emeritus Professor, University of Peradeniya

Viraji Jayaweera,

University of Peradeniya

Yathursha Ulakentheran,

formerly, University of Jaffna.

-

Business4 days ago

Business4 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Opinion3 days ago

Opinion3 days agoSri Lanka, the Stars,and statesmen

-

Business2 days ago

Business2 days agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Business2 days ago

Business2 days agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business2 days ago

Business2 days agoArpico NextGen Mattress gains recognition for innovation

-

Business1 day ago

Business1 day agoAltair issues over 100+ title deeds post ownership change

-

Business1 day ago

Business1 day agoSri Lanka opens first country pavilion at London exhibition

-

Editorial2 days ago

Editorial2 days agoGovt. provoking TUs