Business

Innovative pipe borne LPG to Sri Lanka

In the global energy landscape, LPG is considered the safest and the most environmentally sound choice suitable for a variety of functions – from household requirements to industrial consumption, LPG is increasingly emerging as the world’s preferred clean and green energy.

Although in house LPG cylinders have been used in Sri Lanka for a considerable period of time, the safest and the most modern option that is operational worldwide is pipe borne LPG that provides a safe and an easy accessible LPG solution, says Anil Koswatte, chairman & CEO of Litro Gas Lanka Limited & Litro Gas Terminal Lanka (Private) Limited, Sri Lanka’s national LPG provider.

As a measure of upscaling the LPG availability in Sri Lanka, Litro Gas Lanka will be introducing pipe borne LPG supply to households and consumers in Sri Lanka, giving them access to world class energy solutions, he adds.

“Litro Gas Lanka believes in delivering innovative and safe LPG solutions to our customers. Introducing the pipe borne LPG is a step towards ensuring the highest safety protocols in LPG supply – while also ensuring an easy and convenient way of delivery LPG to your home or work place. The LPG provided will be measured in litres, in keeping with global standards.”

Backed by a unique legacy that goes back 150 years, Litro Gas Lanka possesses a heritage that is rich with industry firsts; a part of that legacy was the network of gas pipes that delivered gas to households as far back as a century ago, installed by Ceylon Gas & Water Co, precursor of Litro Gas Lanka.

Today, as energy industry dynamics change with consumer demand, the company remains firmly committed to infusing change and transformation needed to meet changing requirements.

“We are taking the concept of LPG supply beyond that of bringing a cylinder home and stocking it in your kitchen. This will take the LPG availability to the next level, by giving our customers safe & easy accessibility to the energy they need on demand.”

“In keeping with the development goals for the energy sector outlined in H.E The President’s “Vistas of Prosperity & Splendour” economic vision, we believe that the Litro Gas Lanka LPG Pipeline Project would add value to customer proposition and enhance energy efficiency for all”, Koswatte adds.

Commenting on the project, Jayantha Basnayake, Director – Health, Safety & Environment/Professional Business – Litro Gas Lanka Limited says that the new project will optimize safety and improve convenience for the consumers – “LPG supply via a pipeline is the standard procedure for global LPG operations – we are introducing the same safety and ease of operations procedure to Sri Lanka with this.”

“As a Company engaged in the handling highly inflammable LPG as the core product, safety is a key value for us and for our customers. This process will rule out any compromises on safety given the fact that the installation is safely placed outside the living areas. We will be ensuring a 24/7 support service while also ensuring maximum safety levels”, he points out.

Litro Gas Lanka is a member of The World LPG Association (WLPGA); while adhering in all operational protocols to the global standards and parameters stipulated for the LPG industry, the Company will be deploying industry specific equipment, accessories and installations for its pipe line operation.

Litro Gas Lanka has obtained and following local and global standards of ISO (International Organization for Standardization), NFPA (National Fire Protection Association), BS (British Standard), ASTM (American Society for Testing and Materials) and SLS (Sri Lanka Standards Institute) along with other safety protocols required by local authorities.

Janaka Pathirathna, Director – Sales & Marketing at Litro Gas Lanka says that on demand model of LPG supply ensures an uninterrupted supply, while giving customers a hassle free, doorstep service that is convenient and easy to obtain.

“It promises to be a unique and a world class product that comes with international standards in safety and customer experience. There will be several product categories & packages that will offer various benefits to customers, based on their specific needs. We will also introduce attractive payment methods for the convenience of customers, “he adds.

Litro Gas Lanka plays a pivotal role in the country’s energy sector with a 75% market share and a network of 42 distributors, over 14,000 points-of-sale, 1,500 home delivery hubs and a seamless supply of LPG throughout Sri Lanka. The Company maintains a strong market presence with their Litro Gas Home Delivery Mobile App and a dedicated 1311 customer care hotline.

Business

CEB urged to revise Draft Long Term Generation Expansion Plan, in view of renewable energy needs

By Ifham Nizam

The Public Utilities Commission of Sri Lanka (PUCSL) has instructed the Ceylon Electricity Board (CEB) to revise its Draft Long-Term Generation Expansion Plan (LTGEP) 2025-2044, incorporating more robust projections for renewable energy and battery storage, while also reassessing LNG infrastructure and procurement strategies.

The Island Financial Review reliably learns PUCSL Director General Damitha Kumarasinghe emphasized the need for “more robust and realistic cost assumptions for Renewable Technologies and Battery Energy Storage Systems (BESS).”

The Commission stressed that BESS should be valued not just as a renewable integration tool but also for its potential to mitigate power shortages.

The directive also calls for revisions in LNG infrastructure planning, including “a comprehensive analysis covering LNG fuel cost calculation, infrastructure development, procurement contracting options, and risks associated with supply and procurement.” PUCSL has specifically highlighted the importance of evaluating the financial and economic feasibility of a natural gas pipeline from Kerawalapitiya to Kelanitissa.

Kanchana Siriwardena, Deputy Director General – Industry Services, reinforced the Commission’s stance on renewable energy, stating that “further reductions in renewable energy curtailment should be explored by incorporating more BESS.”

The PUCSL’s instructions also mandate incorporating clauses from the Memorandum of Understanding (MoU) with Petronet India, which includes a temporary LNG supply for the Sobadhanavi Plant. The revised LTGEP must also factor in infrastructure costs related to the Floating Storage Regasification Unit (FSRU) and pipeline networks as part of the overall LNG cost calculation.

The CEB is expected to resubmit the revised plan for PUCSL’s approval, ensuring alignment with Sri Lanka’s long-term energy security and sustainability goals.

The PUCSL directive also calls for a comprehensive evaluation of various LNG procurement options and associated risks. These include:

LNG infrastructure development and expansion

Contracting options for LNG procurement

Risks related to LNG supply and procurement stability

Robustness of natural gas demand calculations

Economic feasibility of the proposed natural gas pipeline from Kerawalapitiya to Kelanitissa, given the low plant factors of power stations at Kelanitissa.

Business

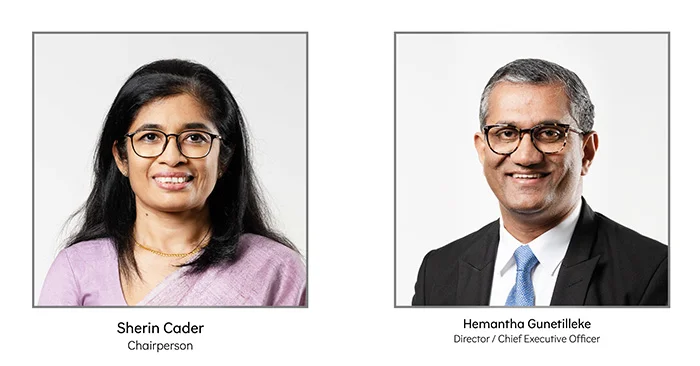

Nations Trust Bank ends 2024 with strong performance, achieving 24% ROE

Nations Trust Bank PLC reported strong financial results for the twelve months ending 31st December 2024, achieving a Profit After Tax (PAT) of LKR 17 Bn, up 46% YoY.

Nations Trust Bank, Director & Chief Executive Officer, Hemantha Gunetilleke, stated, “The Bank’s performance for the twelve months ending 31st December 2024 showcases our continued growth and expansion across diverse customer segments. Our solid capital position, strong liquidity buffers, effective risk management frameworks, and steadfast commitment to service excellence and digital empowerment remain the key drivers of our success.”

Improvements in the macro-economic environment and successful management of the Bank’s credit portfolio resulted in total impairment charges decreasing by 69% and the Net Stage 3 ratio reducing to 1.6%.

The Bank’s financial performance is supported by its strong capital buffers, with Tier I Capital at 21.47% and a Total Capital Adequacy Ratio of 22.66%, well above the regulatory requirements of 8.5% and 12.5%, respectively.

A strong liquidity buffer was maintained with a Liquidity Coverage Ratio of 320.56% against the regulatory requirement of 100%.

The Bank reported a Return on Equity (ROE) of 24.22%, while its Earnings Per Share for the twelve months ending 31st December 2024 increased to LKR 50.82, against LKR 34.70 recorded during the same period last year.

Nations Trust Bank PLC serves a diverse range of customers across Consumer, Commercial and Corporate segments through multi-channel customer touch points spanning both physical and digital. The Bank is focused on digital empowerment through cutting-edge digital banking technologies, and pioneered FriMi, Sri Lanka’s leading digital banking experience. Nations Trust Bank PLC is an issuer and sole acquirer of American Express Cards in Sri Lanka with market leadership in the premium segments.

Business

Modern Challenges and Opportunities for the Apparel Industry: JAAF drives industry dialogue

The Joint Apparel Association Forum (JAAF), in collaboration with Monash Business School and the Postgraduate Institute of Management (PIM) successfully hosted the International Conference on the Apparel Industry 2025 recently in Colombo. This was the second time the event was held, following its inaugural edition in 2018, as part of JAAF’s commitment to fostering dialogue and collaboration within the global apparel sector.

Themed “Modern Challenges and Opportunities for the Apparel Industry”, the three-day event brought together industry leaders, academics, and sustainability experts to discuss pressing issues such as ESG (Environmental, Social, and Governance) compliance, circular economy strategies, technological advancements, and workforce transformation.

A key highlight of the event was the panel discussion on “Current Actions and Their Impact on ESG-Related Outcomes in the Apparel Industry,” featuring:

Felix A. Fernando – CEO, Omega Line Ltd.

Nemanthie Kooragamage – Director Group Sustainable Business, MAS Holdings

Gayan Ranasinghe – Control Union,

Chamindry Saparamadu – Director General/CEO, Sustainable Development Council

Pyumi Sumanasekara – Principal Partner, KPMG Sri Lanka

Discussions emphasized how Sri Lanka’s apparel industry is adapting to global ESG standards, incorporating sustainable production methods, and aligning with evolving regulatory frameworks.

-

Business3 days ago

Business3 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports4 days ago

Sports4 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

Sports7 days ago

Sports7 days agoSri Lanka face Australia in Masters World Cup semi-final today

-

News7 days ago

News7 days agoCourtroom shooting: Police admit serious security lapses

-

News7 days ago

News7 days agoUnderworld figure ‘Middeniye Kajja’ and daughter shot dead in contract killing

-

News6 days ago

News6 days agoKiller made three overseas calls while fleeing

-

News5 days ago

News5 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features4 days ago

Features4 days agoThe Murder of a Journalist