Business

Inaugural Southern Book Fair 2024 to kick off

Launched by the Commonwealth Book Publishers Network, and in conjunction with the internationally acclaimed Galle Literary Festival, the inaugural Southern Book Fair will be held next year, from January 19th to 28th.

A vibrant celebration of literature, the Southern Book Fair expresses Sri Lanka’s cultural diversity, nurturing the spirit of creativity and collaboration, promoting innovation and accessibility, and igniting a renewed passion for literature among not only our own people, but the wider global community.

Located at the heart of the iconic Galle Fort, the Southern Book Fair will offer a platform for publishers, editors, aspiring authors, and avid readers to develop new partnerships, fostering opportunities to celebrate our own rich, literary heritage, and introducing contemporary works from diverse voices around the world.

The Southern Book Fair is operating this year in partnership with the world-renowned Galle Literary Festival (25th to 28th January), first established in 2005 as a global gathering for literary enthusiasts, poets, musicians, artists and culinary experts from all over the world.

With the return of the internationally acclaimed Galle Literary Festival, between the months of January and April next year, a remarkable confluence of the world’s foremost authors, book publishers, artists, musicians, and gourmet chefs will converge for an unprecedented promotion of Sri Lanka on the international stage. Set against the stunning backdrop of the Galle Fort UNESCO World Heritage Site, the festival features a mix of renowned and emerging writers, poets, and thinkers, and is internationally recognized for its inclusive and diverse programming; an unmissable highlight for both locals and visitors from abroad.

Together, we can bring attention to Galle as a destination for literary and cultural enthusiasts, attracting both local and international visitors, and celebrating Sri Lanka’s vital creative spirit. Never has there been a better time to immerse yourself in a world of creativity, engaging in panel discussions on literary topics, participating in workshops and seminars on writing and publishing, and networking with other literary professionals.

Business

Banking data theft attacks on smartphones triple in 2024, Kaspersky reports

The number of Trojan banker attacks on smartphones surged by 196% in 2024 compared to the previous year, according to a Kaspersky report “The mobile malware threat landscape in 2024” released at Mobile World Congress 2025 in Barcelona. Cybercriminals are shifting tactics, relying on mass malware distribution to steal banking credentials. Over the past year, Kaspersky detected more than 33.3 million attacks on smartphone users globally, involving various types of malware and unwanted software.

The number of Trojan banker attacks on Android smartphones increased from 420,000 in 2023 to 1,242,000 in 2024. Trojan banker malware is designed to steal user credentials for online banking, e-payment services and credit card systems.

Cybercriminals trick victims into downloading Trojan bankers by spreading links via SMS or messaging apps, as well as through malicious attachments in messengers, and by directing users to malicious webpages. They can even send messages from a hacked contact’s account, making the fraud appear more trustworthy. To deceive users, attackers often exploit trending news and hype topics to create a sense of urgency and lower victims’ guard.

“Scammers have started to scale down their efforts to create unique malware packages, focusing instead on distributing the same files to as many victims as possible. It is more important than ever to be cyber-literate and educate your loved ones – from children to the elderly – because no one is completely safe from well-crafted scams and psychological tricks designed to steal banking data,” says Anton Kivva, a security expert at Kaspersky.

Although Trojan bankers are the fastest-growing type of malware, they rank fourth overall in terms of the share of attacked users at 6%. The most widespread category remains AdWare, accounting for 57% of attacked users, followed by general Trojans (25%) and RiskTools (12%). The ranking includes malware, adware and unwanted software.

In 2024, cybercriminals launched an average of 2.8 million malware, adware, and unwanted software attacks on mobile devices each month. Over the year, Kaspersky products blocked a total of 33.3 million attacks.

In 2024, Fakemoney, a group of scam apps designed for fake investments and payouts, was the most active threat. Another major concern was modified versions of WhatsApp that contained the Triada-type Trojan – a malware that can download and execute additional malicious or adware modules, for example, to display advertisements or perform other unwanted actions. These unofficial WhatsApp mods ranked third in activity, just behind a general category of cloud-based generic threats.

Learn more about the mobile malware threat landscape in 2024 on Securelist. To protect yourself from mobile threats, Kaspersky shares the following recommendations.

Downloading apps from official stores like the Apple App Store and Google Play is not always risk-free. Kaspersky recently discovered SparkCat, the first screenshot-stealing malware to bypass the App Store’s security. The malware was also found on Google Play, with a total of 20 infected apps across both platforms, proving that these stores are not 100% foolproof. To stay safe, always check app reviews and download numbers when possible, use only links from official websites, and install reliable security software, like Kaspersky Premium, that can detect and block malicious activity if an app turns out to be fraudulent.

Check the permissions of apps that you use and think carefully before permitting an app, especially when it comes to high-risk permissions such as Accessibility Services. For example, the only permission that a flashlight app needs is the flashlight (which doesn’t even involve camera access). A good piece of advice is to update your operating system and important apps as updates become available. Many safety issues can be solved by installing updated versions of software.

Business

EMSOL wins Best National Industry Brand Award at Brand Excellence Ceremony

Emboldened by its innovation in reducing smoke emissions from diesel, petrol, and kerosene internal combustion engines, Eminent International’s fuel additive EMSOL has been awarded the Best National Industry Brand in the Vehicles, Automobile Assembly, and Automotive-Related Products category for the Small Scale Industry Sector. The prestigious award was presented at the inaugural Brand Excellence Award ceremony held by the Industrial Development Board of Ceylon.

The event, organized under the Ministry of Industries and Entrepreneurship Development, took place at Eagles’ Lakeside in Attidiya. Key attendees included Prime Minister Dr. Harini Amarasooriya, Minister Sunil Handunnetti, and Deputy Minister Chathuranga Abeysinghe.

Business

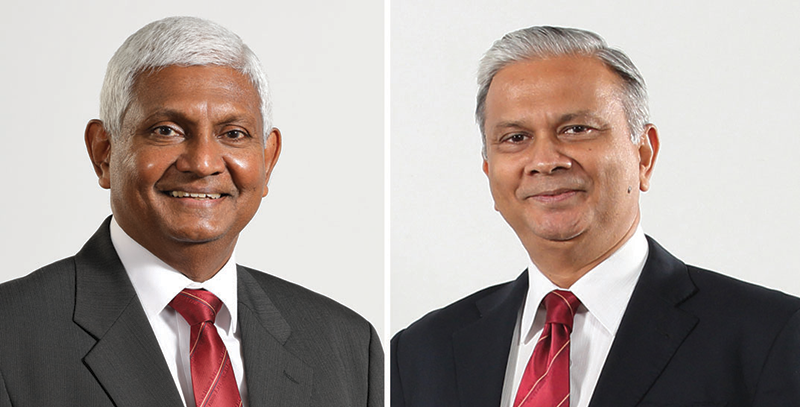

Ceylinco Life retains No 1 spot in life insurance with premium income of Rs 37.14 bn. In 2024

Ceylinco Life has emphatically reaffirmed its continuing supremacy in Sri Lanka’s life insurance industry with gross written premium income of Rs 37.14 billion and total income of Rs 65.54 billion in 2024, the company’s 21st year of unbroken market leadership.

Premium income grew by a healthy 11.16 per cent, while investment income at Rs 28.4 billion reflected growth of 1.5 per cent, resulting in consolidated income for the year improving by 6.7 per cent, according to the company’s audited financial statements for the 12 months ending 31st December 2024.

The growth in life insurance business as represented by gross written premium income confirms that Ceylinco Life retained its position as the largest life insurer in Sri Lanka in 2024, by a margin of more than Rs 5.5 billion over the second-placed life insurance company.

“The figures tell the story,” commented Ceylinco Life Executive Chairman R. Renganathan. “We have completed the first year of our third decade of market leadership in Sri Lanka’s life insurance industry, thanks to the unwavering trust and confidence of the millions of lives we protect and touch. Ceylinco Life’s demonstrated financial strength and stability, its uncompromising adherence to the core values and principles of its business, and its deep-rooted commitment to the community, remain the bedrock of the company’s growth and progress.”

Ceylinco Life paid Rs 25 billion in net claims and benefits to policyholders for the year under review, an increase of 8.2 per cent over the preceding year, and transferred Rs 23 billion to its Life Fund. As a result, the Life Fund grew by a noteworthy 14.8 per cent to Rs 180.89 billion as at 31st December 2024.

The company’s total assets grew by Rs 26.69 billion or 11.8 per cent over the year at a monthly average of more than Rs 2.2 billion to cross the milestone of Rs 250 billion (Rs 251.43 billion) at the end of 2024, while its investment portfolio recorded an increase of 12.32 per cent in value over the 12 months to total Rs 222.5 billion as at 31st December 2024.

Ceylinco Life transferred Rs 3 billion to the shareholders’ fund in respect of the 12 months, and shareholders’ equity grew to Rs 60.74 billion at the end of the year.

The Company posted profit before tax of Rs 10.05 billion for FY 2024, reflecting an increase of 19.1 per cent over the previous year. Net profit after tax for the 12 months reviewed was Rs 7.07 billion, an improvement of 21.88 per cent over 2023.

Ceylinco Life’s basic earnings per share for the year amounted to Rs 141.43, while net assets value per share stood at Rs 1,214.91 as at 31st December 2024, representing growths of 21.8 per cent and 11.7 per cent respectively. Return on assets for the year was 2.81 per cent and return on equity 11.64 per cent.

Significantly, Ceylinco Life’s Risk-based Capital Adequacy Ratio (CAR) improved to 448 per cent at end 2024, more than 3.7 times the minimum CAR of 120 per cent required by the industry regulator.

-

News2 days ago

News2 days agoPrivate tuition, etc., for O/L students suspended until the end of exam

-

News7 days ago

News7 days agoLawyers’ Collective raises concerns over post-retirement appointments of judges

-

Sports5 days ago

Sports5 days agoThomians drop wicket taking coloursman for promising young batsman

-

Editorial4 days ago

Editorial4 days agoCooking oil frauds

-

Features6 days ago

Features6 days agoBassist Benjy…no more with Mirage

-

Features3 days ago

Features3 days agoShyam Selvadurai and his exploration of Yasodhara’s story

-

Editorial7 days ago

Editorial7 days agoHobson’s choice for Zelensky?

-

Features6 days ago

Features6 days agoNawaz Commission report holds key to government response at UNHRC