Business

HNB Assurance kicks off 2025 with New Year Business Launch celebrating Advisor Distribution Channel

HNB Assurance recently held its New Year Business Launch for 2025, celebrating the outstanding progress of its Advisor Distribution Channel throughout 2024. The event served as a platform to honor high-performing managers while reflecting on key achievements from the past year. Among these notable accomplishments were a remarkable 23% growth in New Business Premiums (NBP) and an exceptional performance in Gross Written Premiums (GWP), which exceeded 6 billion LKR.

Addressing the forum, Lasitha Wimalaratne, CEO of HNB Assurance, stated, “2024 was a fantastic year for us. Our growth in NBP and GWP shows how committed and capable our Advisor Distribution team is. These achievements motivate us to keep pushing boundaries and set new benchmarks in delivering exceptional customer-centric solutions and services.”

Touching upon the company’s goal of reaching a 10% market share by 2026, Wimalaratne urged the team to focus on embracing technology, driving innovation and putting customers at the heart of everything they do. “As we step into 2025, we need to operate with empathy and care, because at the end of the day, we are not just selling a product, we are delivering a promise of protection and peace of mind. This will help us build trust and by earning trust and endorsement through our actions and commitment, we can strengthen our relationship and build long-term loyalty with our policyholders. Let me assure you that this mindset, combined with our ability to adapt and innovate, will enable us to sustain and accelerate the incredible growth we have maintained in recent years.”

The event also celebrated the efforts of the Sales Training and Development team and branch-level managers for helping the company achieve MDRT qualifiers, including Court of the Table (COT) and Top of the Table (TOT) winners.

Harindra Ramasinghe, Chief Business Officer, Advisor Distribution Channel, sharing his thoughts at the forum, opined, “What we have accomplished over the years is not the result of an individual’s effort, but rather a testament to the power of our teamwork. Every step we take and have taken is a combined effort, which includes everyone from our SBU Heads, Zonal Managers, Regional Managers, Branch Managers, Underwriters, Training Staff and our sales team etc. Each of you play an essential role in driving our success. I would like to express my deepest gratitude to every member of the team for their hard work and contribution. As we look ahead to 2025, we are filled with excitement about the new possibilities and opportunities we have in store. A couple of weeks into the year we have already seen what we are capable of and are extremely confident in our collective strength and eager to continue deliver the best for our customers and stakeholders.”

HNB Assurance PLC (HNBA) is one of the fastest growing Insurance Companies in Sri Lanka with a network of 64 branches. HNBA is a Life Insurance company with a rating of ‘A-‘ (lka) by Fitch Ratings Lanka for ‘National Insurer Financial Strength Rating’. Following the introduction of the segregation rules by the Insurance Regulator, HNB General Insurance Limited (HNBGI) was created and commenced its operations in January 2015; HNBGI continues to specialize in motor, non-motor and Takaful insurance solutions and is a fully owned subsidiary of HNB Assurance PLC. HNB General Insurance has been assigned a ‘National Insurer Financial Strength Rating’ of ‘A-‘ (lka) by Fitch Ratings Lanka Limited. HNBA is rated within the Top 100 brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for Brand Excellence, Digital Marketing and HR Excellence including the Great Place To Work® Certification, and won many awards for its Annual Reports at award ceremonies organized by the Institute of Chartered Accountants of Sri Lanka.

Business

Seylan Bank posts a remarkable PAT of LKR 10 Bn for 2024

The Bank recorded a Profit before Income Tax (PBT) of LKR 16.04 Bn for the period under review with a 59% growth over the previous year, while recording a Profit after Tax (PAT) of LKR 10.05 Bn for the year with a 61% growth over the previous year, demonstrating a robust performance despite challenging macro-economic conditions. The reported PAT of LKR 10 Bn is the highest performance in the Bank’s 36 year history.

Net Interest Income of the Bank was reported as LKR 37 Bn in 2024 compared to LKR 40 Bn reported in 2023 with a decline of 8% corresponding to reduction in Net Interest Margins during 2024, due to reduction in market interest rates throughout the year.

Net fee and commission income of the Bank reported a growth of 7% to LKR 8 Bn compared to LKR 7.4 Bn reported in the previous year. The growth in 2024 was mainly due to increase in income from Cards, Remittances and other services relating to Lending.

The Bank’s net gains from trading reported a gain of LKR 0.46 Bn, a decrease of 44% over the gain of LKR 0.82 Bn reported in previous year due to exchange / interest rate changes.

Net gains / (losses) from de-recognition of financial assets reported a loss of LKR 0.26 Bn in 2024, compared to the gain of LKR 0.15 Bn reported in the previous year. The loss due to the restructuring of SLISBs amounted to LKR 2.71 Bn and was recorded in Q4 2024.

Other Operating Income of the Bank was reported as LKR 1 Bn in 2024, a growth of 5% over the previous year. This increase is mainly from foreign exchange income, which represents both revaluation gain/ (loss) on the Bank’s net open position and realized exchange gain/ (loss) on foreign currency transactions.

The Bank’s Total Operating Income decreased by 11.6% to LKR 44 Bn in 2024 compared to LKR 49 Bn in the previous year mainly due to decrease in net interest income and the loss on restructuring of SLISBs.

The Bank made impairment provision to capture the changes in the macro economy, credit risk profile of customers and the credit quality of the Bank’s loan portfolio in order to ensure adequacy of provisions recognized in the financial statements. The impairment charge on Loans and Advances and other credit related commitments amounted to LKR 6.6 Bn (2023 – LKR 15.5 Bn). The impairment reversal due to the SLISBs exchange amounted to LKR 4.9 Bn (2023 – LKR 1.5 Bn charge).

(Seylan Bank)

Business

An initiative to bring light into the lives of Galle residents

By Ifham Nizam

For decades, many rural communities in Sri Lanka have struggled with an unreliable power supply, outdated infrastructure, and slow responses from authorities. However, a new initiative aims to change this narrative, bringing hope to thousands in the Galle District who have long been in the dark—both literally and figuratively.

Speaking to The Island Financial Review, Dr. Chathura Welivitiya, CEO of HELP-O, an expert in infrastructure development, emphasizes the importance of this project, stating, “Access to reliable electricity is not just about lighting homes; it is about empowering communities, enabling education, fostering business opportunities, and ensuring overall development.”

He said in many villages, the lack of a stable electricity supply has hindered progress. Residents report frequent power outages, damaged lines left unattended for weeks, and new connections taking months—if not years—to be processed. Such issues have not only inconvenienced households but have also impacted local businesses, schools, and healthcare facilities.

According to a Weligama Municipal Council official: “Our children cannot study at night due to power failures. Businesses suffer because they cannot store perishable goods properly. We have raised complaints multiple times, but the response has been slow.”

Recognizing these challenges, a new project has been launched to address the inefficiencies in power distribution. The initiative includes:

Expansion of the Electrification Network: Efforts to extend power lines to remote areas that still rely on kerosene lamps or battery-operated sources.

Upgrading Infrastructure: Replacement of outdated transformers, damaged poles and weak wiring systems to ensure a stable and safe electricity supply.

Community Engagement: A digital reporting system that allows residents to highlight issues in real time, ensuring faster response and accountability from relevant authorities.

Sustainability Measures: Exploration of renewable energy options, such as solar power, to complement the grid and provide backup solutions for power outages.

Dr. Chathura explains, “This project is not just about fixing wires and poles; it is about creating a sustainable and efficient system that meets the growing energy demands of rural areas. Transparency and community participation are key to its success.”

The Southern Province Governor Bandula Haischandra has voiced strong support for the initiative, recognizing its potential to transform rural communities.

“Ensuring a stable electricity supply is a fundamental responsibility of the government, the Governor told The Island Financial Review. “For too long, these communities have been neglected. We are committed to fast-tracking infrastructure improvements and working closely with relevant authorities to resolve longstanding issues.”

The Governor further emphasized the role of accountability and efficiency in the implementation process. “We cannot afford delays and inefficiencies. With the use of modern technology, we are ensuring that complaints are addressed swiftly and that no village is left behind in development.”

Business

Elpitiya Plantations clinches fourth consecutive victory at Inter Plantation Cricket Tournament

Elpitiya Plantations emerged victorious at the 22nd Inter Plantation Cricket Tournament, organised by the Dimbula Athletic and Cricket Club, held on the 21st and 22nd of February 2025 at the Radella Cricket Ground.

The tournament saw participation from 11 plantation companies, showcasing exceptional talent and sportsmanship. Elpitiya Plantations, led by their dynamic captain Wajira Mannapperuma, demonstrated outstanding performance throughout the tournament.

The winning team from Elpitiya Plantations consisted of Wajira Mannapperuma, Asela Udumulla, Dilukshan Neshan, Lakshan Thenabadu, Kavinda Sulochana, Yasitha Koswaththa, Anushka Baddevithana, Kanishka Ranchagoda, Pramoth Bandara, and Sajith Edirisinghe.

In the semi-final match, Elpitiya faced Horana Plantations PLC and secured a decisive victory by bowling out the Horana team for just 20 runs within 4 overs, paving their way to the finals. The final match was a thrilling encounter against Talawakelle Tea Estates PLC, where Elpitiya’s formidable bowling lineup made it challenging for Talawakelle to score. Within the first four overs, Talawakelle’s top batsmen were back in the pavilion, allowing Elpitiya to clinch the championship title with ease.

This victory marks Elpitiya Plantations’ fifth overall win in the history of the tournament and their fourth consecutive triumph, having previously won in 2022, 2023, and 2024. The team’s consistent performance and dedication have solidified their reputation as a formidable force in plantation cricket.

The management of Elpitiya Plantations extends heartfelt congratulations to the team and expresses gratitude to all the supporters and organisers who made this event a grand success.

-

Business3 days ago

Business3 days agoSri Lanka’s 1st Culinary Studio opened by The Hungryislander

-

Sports4 days ago

Sports4 days agoHow Sri Lanka fumbled their Champions Trophy spot

-

News6 days ago

News6 days agoKiller made three overseas calls while fleeing

-

News5 days ago

News5 days agoSC notices Power Minister and several others over FR petition alleging govt. set to incur loss exceeding Rs 3bn due to irregular tender

-

Features4 days ago

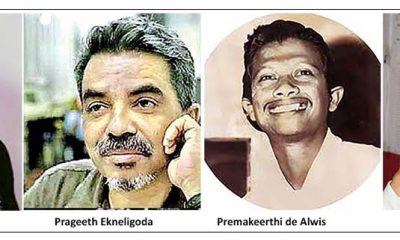

Features4 days agoThe Murder of a Journalist

-

Features4 days ago

Features4 days agoExcellent Budget by AKD, NPP Inexperience is the Government’s Enemy

-

Sports4 days ago

Sports4 days agoMahinda earn long awaited Tier ‘A’ promotion

-

News5 days ago

News5 days agoMobile number portability to be introduced in June