Business

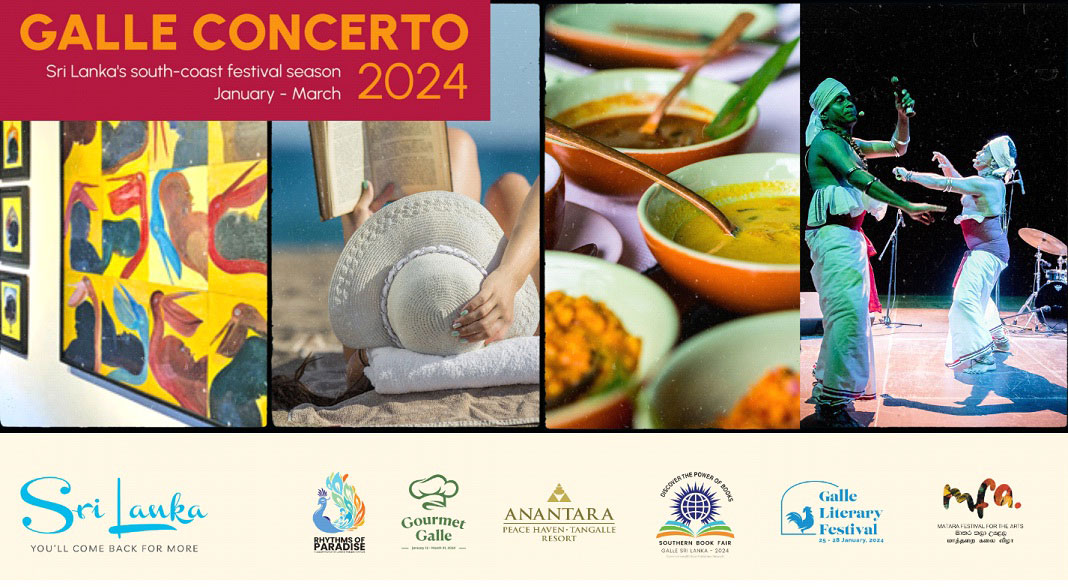

‘GALLE CONCERTO 2024’: 6 Vibrant Festivals In Art, Food, Literature, and Music

Call for Extended Stays on SL’s South Coast

During the South Coast peak season of January through March of 2024, the ‘Galle Concerto’ series gives impetus to a symphony of heritage and contemporary festivals in art, food, literature, and music.

Leading Lankan and international culture makers will be headlining the events – speaking, presenting and creating on topics pertinent and inspiring to Sri Lanka & the global momentum in 2024.

The festivals are independently led, with the coming together of a ‘Concerto’ of events – organized to amplify the positive economic and touristic impact of cultural programming to host communities and the country – being conceived by President Wickremesinghe and supported by the Presidential Secretariat, SLTPB and SLTDA, and other ministries and local governmental bodies.

The full list of festivities, dates, and points for further information are listed below:

Rhythms of Paradise, 12 – 14 January ‘24, Koggala, @rhythmsofparadise & rhythmsofparadise.com

The concerto’s opening programme will highlight Sri Lanka’s rich cultural, maritime and natural heritage focusing on drums, dance, classical and contemporary Sri Lankan literature, and biodiversity programming.

The 3-day programme includes literary explorations, interactive interludes, cultural events, cinematic chronicles, workshops, excursions and exhibitions.The opening celebration and cultural events will be held at the Koggala Air Force Base and literary sessions will be held at the Martin Wickramasinghe Museum.

Gourmet Galle, 13 January – 30 March ‘24, Galle, @gourmetgalle & gourmetgalle.com

From January through March Gorumet Galle will curate exclusive dinners and masterclasses in exotic locations on Sri Lanka’s South Coast. Inspired by locally sourced ingredients, it is a celebration of Sri Lanka food and tourism. Star chefs from London, New York, Sydney, Singapore include: Darina Allen, O Tama Carey, Karan Gokani, Mark Hix, Peter Kuruwita, Jeremy Lee, James Lowe, Rishi Neleendra, Hari Nayak, Nisha Parmar, J Ryall, Cynthia Shanmugalingam, Mandy Yin.

Opera at the Anantara, 19 – 21 January ‘24, Tangalle, @anantaratangalle

Nestled amid the resplendent beauty of pristine beaches at Anantara Peace Haven, the forthcoming art and music weekend promises to curate an indelible ambience of refined creativity and immersive experiences.

This elevated occasion is poised to serve as a distinguished platform, harmonizing the expressions of local artists such as the Gustav Mahler orchestra and Chrisni Mendis, and international musicians such as Jorge Echeagaray, Barbara Segal, and Carlos Conde-González showcasing their artistry and virtuosity.

Southern Book Fair, 19 – 28 January ‘24, Galle, commonwealthpublishersnetwork.com

The inaugural Southern Book Fair marks a vibrant celebration of literature, expressing Sri Lanka’s cultural diversity, nurturing the spirit of creativity and collaboration, and promoting innovation and accessibility.

Located in the heart of iconic Galle, the Southern Book Fair will offer a platform for publishers, editors, aspiring authors, and avid readers to develop new partnerships, fostering opportunities to celebrate our own rich, literary heritage, and introducing contemporary works from diverse voices around the world.

Galle Literary Festival, 25 – 28 January ‘24, Galle, @gallelitfest & galleliteraryfestival.com

This January the centuries-old UNESCO World Heritage Site, Galle Fort will once again come alive with the buzz of literary chatter. Since its launch in 2007, the Galle Literary Festival has become one of South Asia’s most anticipated arts and culture events. A favourite among authors and attendees alike, the Festival hosts a wide variety of talks, workshops and exhibitions in an intimate, historic setting.

2024’s high profile line up, will see the likes of Booker Prize-winning authors, Shehan Karunatilake and DBC Pierre; decorated war correspondent, Christina Lamb, and novelists Alexander McCall Smith and Anthony Horowitz, alongside 65 participants, championing the work of writers and poets, as well as giving space to painters, photographers and cinematographers. Through associated culinary events, the Festival also highlights the excellence of local and international chefs.

Matara Festival for the Arts (MFA), 1 – 4 February ‘24, Matara, @MataraForArts

Matara Festival for the Arts is a coastal celebration of contemporary art & music from Sri Lanka and beyond, curated by leading contemporary artist Prof. Jagath Weerasinghe & music educator Dr. Sumudi Suraweera.

The Matara Fort, the University of Ruhuna, and the Matara River Park will host exhibitions, workshops & talks, a community market, and a film screening by leading artists, notable speakers in arts and culture, and over 30 local vendors & artisans. Evening parties & events extend from Hiriketiya, Madiha, to Mirissa.

Its Independence Day concert will feature 7 performers/bands – Amila Sanduruwan, Baliphonics, Orange Mango, Paloma, SDP ft. Paula, Rolex Rasathy, and The Soul,

The MFA’s programming partners include National Trust Sri Lanka, the George Keyt Foundation, and the Good Market.

Contact:

Public Relations Division

Sri Lanka Tourism Promotion Bureau

80, Galle Road, Colombo 03.

+94 112 426 900 sureshnie@srilanka.travel

Business

NDB reports all-time high earnings; doubles PAT on a normalised basis

National Development Bank PLC (hereinafter ‘the Bank’) announced its results for the financial year ended December 31, 2025 to the Colombo Stock Exchange recently. Full year results tabled by the Bank showcase a strong growth across all business lines with Net Banking Revenue increasing by a 45.2% on a comparable basis.

Like most other peers, the Bank’s 2024 financial performance was positively impacted following the successful conclusion of the ISB debt restructure with a one-off impact on interest income, fee income and net impairments amounting to LKR 1.4 billion, LKR 0.7 billion and LKR 9.4 billion, respectively for the said year.

Fund based income

Net interest income (NII), which accounts for close to 75.0% of Bank’s total operating income, grew by 6.5% on a normalised basis. Despite pressure on interest-earning assets arising from the lower interest rate environment, the Bank’s disciplined margin management helped stabilise Net Interest Margin (NIM) at 4.0% for the year. On a comparable basis, excluding one-off exceptional items, NIM stood at 4.2%, compared to 4.3% for both scenarios in 2024. By the end of the year, the Bank had close to LKR 29.3 billion in Loans and Deposits under a special arrangement with its customer(s) with a netting-off feature (end 2024: LKR 19.6 billion).

Non-fund based income

Net fee and commission income reached LKR 8.1 billion for the year – representing a growth of 14.3% from LKR 7.1 billion in 2024 excluding ISB restructuring related fees. Key growth drivers for the current year were trade finance, credit and lending, digital banking and credit and debit cards.

Credit and operating costs

Credit costs for the year amounted to LKR 5.7 billion, reflecting a substantial reduction of 57.1% compared to LKR 13.2 billion in 2024, a testament to the Bank’s strong credit underwriting practices and focused efforts on collections and recoveries. The Bank’s success on account of the latter is best reflected in notably improved stage 2 and 3 loan stock which stood at 7.9% and 10.8% respectively at end 2025 as compared with 16.6% and 14.0% at end 2024. Stage 3 provision coverage also saw further improvement to 59.1% from 54.5% during 2024 showcasing the Bank’s prudent management of credit risk.

Operating expenses closed at LKR 19.0 billion for the year, marking a 13.1% YoY increase. This increase was primarily driven by routine staff-related increments and necessary market realignments, along with higher investments in IT infrastructure and business development undertaken during the year.(NDB)

Business

PMF Finance appoints Nishani Perera as Non-Executive Independent Director

PMF Finance PLC has announced the appointment of Ms. Nishani Perera as a Non-Executive Independent Director, further strengthening the Company’s strategic oversight, governance framework, and board-level expertise as it continues to advance its transformation and long-term growth agenda.

Ms. Perera is a Fellow Member of the Institute of Chartered Accountants of Sri Lanka and brings over 19 years of experience across audit, assurance, advisory, risk management, and corporate governance. She currently serves as Partner – Audit & Assurance at Moore Aiyar and as Director of Moore Consulting (Pvt) Ltd.

Over the course of her career, Ms. Perera has gained substantial exposure to listed companies, banks, finance companies, and other regulated entities. Her areas of expertise include financial reporting under SLFRS/LKAS, audit and risk oversight, regulatory compliance, and the implementation of quality management standards. She has worked closely with Boards of Directors and Audit Committees on matters relating to financial reporting integrity, internal control frameworks, enterprise risk governance, and adherence to evolving regulatory requirements.

Ms. Perera holds a Master of Laws (LL.M.) from Cardiff Metropolitan University in the United Kingdom and a Bachelor of Science in Business Administration (Special) from the University of Sri Jayewardenepura. She is also an Associate Member of ACCA and CMA Sri Lanka, and a Fellow Member of AAT Sri Lanka.

Business

Capital Alliance deepens capital market presence with third Closed-End Fund Listing at the CSE

The units of the “CAL Three Year Closed End Fund” were officially listed on the Colombo Stock Exchange (CSE) recently. Accordingly, a total of 841,263,375 units of the ‘CAL Three Year Closed End Fund’ were listed by Capital Alliance Investments Ltd (CALI), a member of the Capital Alliance Ltd Group (CAL Group). The listing was commemorated by way of a special bell ringing ceremony on the CSE trading floor.

CSE CEO Rajeeva Bandaranaike speaking at the occasion remarked upon the rising demand for Unit Trusts: “When you look at funds, particularly unit trusts in today’s active capital market, we see a lot of domestic interest in the market with more investors entering. Funds, not only fixed income funds but also growth and balanced funds, can be the ideal vehicle through which new investors can enter the market. We see this interest reflected in the success of CAL’s Three Year Closed End Fund. More people are seeking to invest their money through professional fund managers.”

-

Features5 days ago

Features5 days agoWhy does the state threaten Its people with yet another anti-terror law?

-

Features5 days ago

Features5 days agoReconciliation, Mood of the Nation and the NPP Government

-

Features5 days ago

Features5 days agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features4 days ago

Features4 days agoLOVEABLE BUT LETHAL: When four-legged stars remind us of a silent killer

-

Features5 days ago

Features5 days agoVictor, the Friend of the Foreign Press

-

Latest News6 days ago

Latest News6 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Latest News6 days ago

Latest News6 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News6 days ago

Latest News6 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction