Business

Export earnings exceed USD 1 billion for second consecutive month

External Sector Performance – June 2023

• Export earnings remained above US dollars 1.0 billion for the second consecutive month in June 2023, while import expenditure declined compared to the previous month.

• Workers’ remittances and earnings from tourism continued to improve notably in June 2023, compared to the corresponding period of the previous year.

• Foreign investment in the government securities market recorded a notable net inflow during June 2023.

• The receipt of around US dollars 250 million from the World Bank for the budgetary support, elevated the gross official reserve level (GOR) to around US dollars 3.7 billion by end June, compared to US dollars 3.5 billion as at end May 2023.

• The Sri Lanka rupee recorded some degree of volatility against the US dollar in June 2023, reflecting the determination of the exchange rate by market forces.

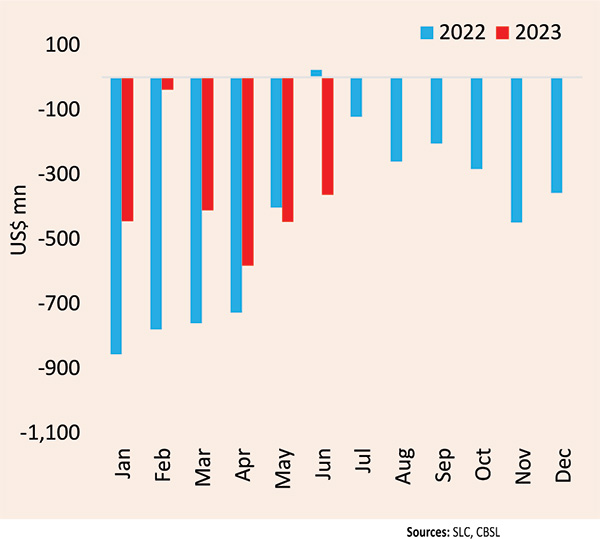

Merchandise Trade Balance

The balance in the merchandise trade account in June 2023 recorded a deficit of US dollars 364 million, compared to the surplus of US dollars 22 million recorded in June 2022. Meanwhile, the cumulative deficit in the trade account during January-June 2023 narrowed to US dollars 2,289 million from US dollars 3,506 million recorded over the same period in 2022. The major contributory factors for this change in the trade balance are shown in Figure 1.

Performance of Merchandise Exports

Overall Exports: Earnings from merchandise exports declined by 19.5 per cent in June 2023, over the corresponding month in 2022, to US dollars 1,005 million. This decline mainly reflected the high base in June 2022, and all major subcategories of merchandise exports recorded a decline in June 2023 compared to year earlier. Cumulative export earnings during January to June 2023 also declined by 10 per cent over the same period in the last year, amounting to US dollars 5,871 million.

Industrial Exports: Earnings from the exports of industrial goods declined in June 2023, compared to June 2022, due to a broad-based decline in earnings from most of the industrial products led mainly by garments. Exports of garments to most of the major markets (the USA, the EU and the UK) continued to record declines, resulting from subdued demand conditions in major markets. Further, a sizable decline was recorded in the exports of rubber products (mainly, tires and gloves); petroleum products (due to lower average export prices); food, beverages and tobacco (mainly, vegetable, fruit and nuts preparations; and milling industry products); printing industry products; and animal fodder

Agricultural Exports: Earnings from the exports of agricultural goods declined in June 2023, compared to a year ago, driven by lower export volumes of sea food (primarily, fresh and frozen fish), and coconut related products (primarily, desiccated coconut, coconut oil and fibres). Earnings from tea exports declined led by lower volumes despite higher export prices. Further, the export subcategories of spices (mainly, pepper and cinnamon), vegetables, natural rubber, and unmanufactured tobacco recorded a decline in June 2023, compared to the previous year. However, earnings from minor agricultural product exports (mainly, arecanuts) improved to some extent.

Monthly trade balance

Mineral Exports: Earnings from mineral exports declined in June 2023, compared to June 2022, mainly due to the decline in exports of earths and stone; and ores, slag, and ash.

Performance of Merchandise Imports

Overall Imports: Expenditure on merchandise imports increased by 11.6 per cent to US dollars 1,369 million in June 2023, compared to US dollars 1,226 million in June 2022. The increase in import expenditure was observed across all main categories of imports, which was supported by the significantly low base in June 2022. Meanwhile, cumulative import expenditure during January to June 2023 declined by 18.6 per cent over the corresponding period in 2022. However, the relaxation of import restrictions, commenced during June and July 2023, could gradually generate higher import expenditure in the period ahead.

(CBSL)

Business

‘Sri Lanka’s forests are undervalued economic assets — and markets are paying the price’

Sri Lanka’s economic strategy continues to focus on exports, productivity and fiscal consolidation.

Yet one of the country’s most valuable assets — its forests and traditional forest-based farming systems — remains largely absent from economic planning. This is no longer an environmental oversight. It is a business risk.

At a recent Dilmah Genesis Thought Leadership Series lecture in Colombo, tropical ecology expert Professor Friedhelm Goeltenboth delivered a clear message: once forests are destroyed, the economic value they provide is lost permanently.

What replaces them — monoculture plantations — may appear efficient, but over time they generate declining yields, rising input costs and growing exposure to climate shocks.

From a financial perspective, this is asset depletion, not development.

Monoculture systems simplify production but externalise costs. Soil erosion, fertiliser dependency, water stress and biodiversity loss eventually hit farmers, banks, insurers and the state.

Sri Lanka is already seeing the consequences through falling productivity and rising agricultural vulnerability.

Forest-integrated farming offers a different model — one that treats land as a multi-income asset.

Spices such as cinnamon, pepper, cardamom and nutmeg can be grown under shade alongside fruit, timber and fibre crops, stabilising income while protecting soil and water. For lenders and insurers, diversified systems reduce risk. For exporters, they support traceability, sustainability certification and premium pricing.

The strongest business opportunity lies in carbon markets. Voluntary carbon markets allow companies to offset emissions by funding verified forest conservation and restoration.

Across Southeast Asia, communities now earn income simply by protecting forests that store carbon.

Sri Lanka has the scientific capacity to enter this space. Farmers can collect data; experts can certify it. What is missing is a coordinated national framework that allows communities and corporates to participate efficiently.

Carbon revenue will not replace agriculture, but it can stabilise it — providing income during crop maturation and creating a new form of export: environmental services.

Ignoring this opportunity carries downside risk.

Biodiversity loss, pollinator decline and climate volatility threaten long-term agricultural productivity. Forests are not sentimental assets; they are economic infrastructure.

Sri Lanka’s recovery cannot be built on short-term extraction. If the country wants resilient growth, it must start recognising the real value of what is still standing, he added.

By Ifham Nizam

Business

Pavan Rathnayake earns plaudits of batting coach

Sri Lanka batting coach Vikram Rathour has hailed middle-order batter Pavan Rathnayake as one of the finest players of spin in the modern game, saying the youngster’s nimble footwork and velvet touch were a “breath of fresh air” for a side long troubled by the turning ball.

Drafted in for the second T20I after Sri Lanka’s familiar struggles against spin, Rathnayake looked anything but overawed by England’s seasoned tweakers, skipping down the track with sure feet and working the ball into gaps with soft hands.

“He is one of the better players when it comes to using the feet,” Rathour told reporters. “I haven’t seen too many in this generation do it as well as he does. That is really impressive and a good sign for Sri Lankan cricket.”

Sri Lanka went down in a last-over nail-biter but there were silver linings despite the hosts being a bowler short. Eshan Malinga was forced out after dislocating his left shoulder and has been ruled out for at least four weeks, a blow that ends his World Cup hopes. Dilshan Madushanka, Pramod Madushan and Nuwan Thushara have been placed on standby.

Power hitting remains Sri Lanka’s Achilles’ heel and Rathour, who carries an impressive CV from India’s T20 World Cup triumph two years ago, pointed to a few grey areas in the batting blueprint.

Power hitting remains Sri Lanka’s Achilles’ heel and Rathour, who carries an impressive CV from India’s T20 World Cup triumph two years ago, pointed to a few grey areas in the batting blueprint.

“There are two components to T20 batting,” he said. “One is power hitting, but the surfaces here, especially in Colombo, are not that conducive to clearing the ropes. The wickets are slow and the ball doesn’t come on to the bat. The other component, just as important, is range as a batting unit.”

Even when Sri Lanka lifted the T20 World Cup in 2014 they were not blessed with a dressing room full of big hitters, relying instead on sharp running, clever placement and a mastery of spin. Rathour preached a similar mantra.

“If you are not a team that hits a lot of sixes, you can still find plenty of fours by utilising the whole ground,” he said. “Most of them sweep well, reverse sweep and use their feet. That is encouraging. If you don’t have the brute power, you can make up for it by using angles and scoring square of the wicket.

“These wickets perhaps suit that style more. They are not the easiest surfaces to hit sixes, and I’m okay with that. If they can use their feet and the angles well, that is as good.”

Rex Clementine

at Pallekele

Business

Unlocking Sri Lanka’s dairy potential

Sri Lanka’s dairy and livestock sector is central to food security, rural livelihoods, and national nutrition, yet continues to face challenges related to productivity, climate vulnerability, market access, and financing.

In this context, Connect to Care and DevPro have entered into a formal partnership through a Memorandum of Understanding (MoU) to support Sri Lanka’s journey towards dairy self-sufficiency.

A core objective of DevPro is to strengthen inclusive and resilient dairy value chains by empowering smallholder farmers through technical assistance, capacity building, climate-resilient practices, and market-oriented approaches, building on its extensive field presence across Sri Lanka.

A core objective of Connect to Care is to support the achievement of dairy self-sufficiency by 2033, as outlined in the national development manifesto, with an interim target of 75% self-sufficiency by 2029.

By strengthening local dairy production and value chains, this effort will also help reduce Sri Lanka’s dependence on imported dairy products, while improving farmer incomes and domestic supply resilience.

The partnership will focus on climate-smart dairy development, multi-stakeholder coordination, and exploring blended finance and PPP models—providing a structured platform for development partners and the private sector to engage in scalable action.

-

Opinion4 days ago

Opinion4 days agoSri Lanka, the Stars,and statesmen

-

Business5 days ago

Business5 days agoClimate risks, poverty, and recovery financing in focus at CEPA policy panel

-

Business3 days ago

Business3 days agoHayleys Mobility ushering in a new era of premium sustainable mobility

-

Business3 days ago

Business3 days agoAdvice Lab unveils new 13,000+ sqft office, marking major expansion in financial services BPO to Australia

-

Business3 days ago

Business3 days agoArpico NextGen Mattress gains recognition for innovation

-

Business2 days ago

Business2 days agoAltair issues over 100+ title deeds post ownership change

-

Business2 days ago

Business2 days agoSri Lanka opens first country pavilion at London exhibition

-

Editorial3 days ago

Editorial3 days agoGovt. provoking TUs