Business

ComBank posts stellar results in 2024 after absorbing a SLISB restructure loss of Rs 45 bn.

The Commercial Bank of Ceylon Group, comprising of Sri Lanka’s largest private sector bank, its subsidiaries and an associate, in a filing of its annual financial statements with the Colombo Stock Exchange (CSE) has reported an exceptionally strong financial performance in 2024. Prudent provisioning for impairment charges and other losses, effective balance sheet management and strong lending growth helped mitigate a substantial loss materialised from the restructuring of the Sri Lanka International Sovereign Bonds (SLISBs) held by the Bank.

The Group recognised its full net loss of Rs 45.11 Bn., from the restructuring of SLISBs in the final quarter of the year, resulting in gross income for the 12 months ending 31st December 2024 reducing by 19.50% to Rs 274.98 Bn. However, a net impairment reversal of Rs 62.30 Bn., primarily due to provision reversals in respect of SLISBs, significantly cushioned the overall impact. Lower interest rates brought interest income down by 7.54% to Rs 275.22 Bn., further impacting the Group’s topline, the Group said.

Timely repricing of deposits and the strong CASA base of the Bank, resulted in total interest expenses reducing by 25.63% to Rs 157.08 Bn., enabling the Group to record a healthy growth of 36.71% in net interest income to Rs 118.13 Bn., compared to Rs 86.41 Bn. in 2023. In the meantime, net fee and commission income grew by 5.62% to Rs 23.65 Bn.

Notably, a decrease in net other operating income of Rs 12.19 Bn., or 58.93%, was largely offset by a reduction in losses from trading of Rs 10.28 Bn. or 82.37%.

Consequently, the Group’s net operating income surged by 103.61% to Rs 169.35 Bn. for the year under review, with Q4 alone contributing Rs 73.65 Bn., an increase of 227.25%. With operating expenses for the full year growing by a moderate rate of 17.04% to Rs 51.84 Bn., the Group reported an operating profit before taxes on financial services of Rs 117.52 Bn., an increase of 202.21% over the previous year.

Taxes on financial services increased by 297.20% to Rs 19.71 Bn., resulting in profit before income tax of Rs 97.81 Bn., for the 12 months, an improvement of 188.29% over the previous year. The income tax charge for the year increased by 250.22% to Rs 42.12 Bn., leading to a net profit after tax of Rs 55.69 Bn. for 2024, reflecting a growth of 154.28%.

Total tax charges of the Group for the year amounted to Rs 61.83 Bn., well over triple the Rs 16.99 Bn. tax charge in respect of the preceding year.

Taken separately, Commercial Bank of Ceylon PLC reported a profit before tax of Rs 95.53 Bn., and a profit after tax of Rs 54.07 Bn. for the year reviewed, recording growths of 199.67% and 164.28%, respectively. Basic earnings per share rose to Rs 37.74, up from Rs 14.89 for 2023.

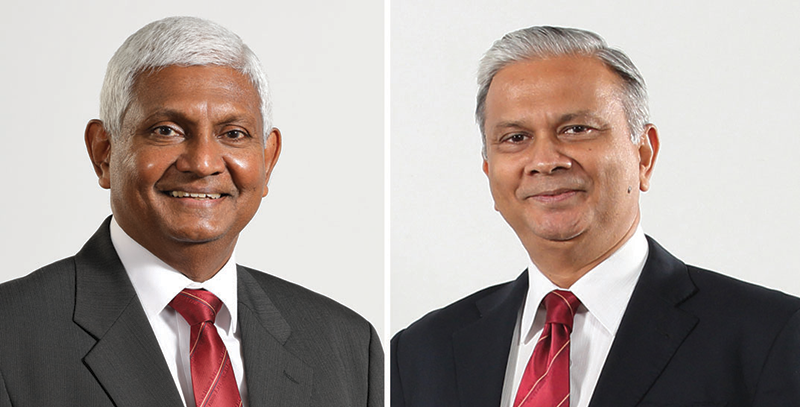

Commenting on these results, Commercial Bank Chairman Mr Sharhan Muhseen said: “While we appreciate that greater stability has been achieved in the country’s macroeconomic environment and that the restructuring of sovereign debt is a positive step, its final outcome is a substantial loss for most banks. In that context, our 2024 results highlight the value of Commercial Bank’s prudential approach to managing external challenges as well as its core banking obligations, and its ability to leverage on operational resilience in difficult times.”

Commercial Bank Managing Director/CEO Mr Sanath Manatunge noted that the Bank had in 2023 proactively increased its provision cover for possible losses from Sri Lanka International Sovereign Bonds from 35% to 52%, and further increased the cover to 54% in the second quarter of 2024, resulting in a cumulative impairment provision of Rs 92.86 Bn. on SLISBs up to the date of derecognition of these bonds. These measures helped the Bank mitigate the net losses sustained on the restructuring of these bonds.

Lending reached an all-time high in the final quarter of the year reviewed, during which the loan book grew by a noteworthy Rs 108.69 Bn. at a monthly average of Rs 36.23 Bn. This drove the gross loans and advances to Rs 1.53 Tn., an improvement of 17.73%. Deposit growth also accelerated, increasing by Rs 79.56 Bn. in Q4 alone at a monthly average of Rs 26.52 Bn., bringing the total deposits to Rs 2.31 Tn., with a YOY increase of 7.36%. As a result, total assets of the Group increased by Rs 220.39 Bn. over the 12 months to Rs 2.876 Tn. as at 31st December 2024, reflecting a healthy growth of 8.30%.

The CASA ratio of the Bank stood at 38.07% as at 31st December 2024, a marginal drop compared to 39.23% at end December 2023, but remains one of the best in the industry, the Bank said.

The Bank’s cost to income ratio excluding taxes on financial services stood at 48.88%, while the figure inclusive of taxes on financial services was 68.18% for 2024. Notably, these ratios improved to 33.85% and 41.89% respectively when the effect of the net loss on restructuring of SLISBs is discounted.

In terms of asset quality, the Bank’s impaired loans (Stage 3) ratio improved to 2.76% compared to 5.85% at end 2023, while its impairment (Stage 3) to Stage 3 loans ratio reached 64.61% from 43.22% a year ago, consequent to a decision to improve provision cover on a prudent basis.

Meanwhile, the Bank’s liquidity coverage ratio for the year reviewed stood at 529.20% for Rupees and 454.36% for all currencies, both more than four times the statutory minimum ratios of 100%. The Bank’s net stable funding ratio stood at 187.29% as at 31st December 2024, nearly double the minimum statutory requirement of 100%.

The Bank reported its Tier 1 and Total Capital Ratios at 14.227% and 18.142% respectively as at 31st December 2024, both comfortably above the regulatory minimum ratios of 10% and 14% respectively. The Bank’s net interest margin increased to 4.27% for the year under review compared to 3.32% reported for 2023. The Bank’s return on assets (before tax) improved to 3.56% from 1.27% for 2023 while the return on equity too improved to 22.06% for the year, from 9.78% for 2023.

Business

Banking data theft attacks on smartphones triple in 2024, Kaspersky reports

The number of Trojan banker attacks on smartphones surged by 196% in 2024 compared to the previous year, according to a Kaspersky report “The mobile malware threat landscape in 2024” released at Mobile World Congress 2025 in Barcelona. Cybercriminals are shifting tactics, relying on mass malware distribution to steal banking credentials. Over the past year, Kaspersky detected more than 33.3 million attacks on smartphone users globally, involving various types of malware and unwanted software.

The number of Trojan banker attacks on Android smartphones increased from 420,000 in 2023 to 1,242,000 in 2024. Trojan banker malware is designed to steal user credentials for online banking, e-payment services and credit card systems.

Cybercriminals trick victims into downloading Trojan bankers by spreading links via SMS or messaging apps, as well as through malicious attachments in messengers, and by directing users to malicious webpages. They can even send messages from a hacked contact’s account, making the fraud appear more trustworthy. To deceive users, attackers often exploit trending news and hype topics to create a sense of urgency and lower victims’ guard.

“Scammers have started to scale down their efforts to create unique malware packages, focusing instead on distributing the same files to as many victims as possible. It is more important than ever to be cyber-literate and educate your loved ones – from children to the elderly – because no one is completely safe from well-crafted scams and psychological tricks designed to steal banking data,” says Anton Kivva, a security expert at Kaspersky.

Although Trojan bankers are the fastest-growing type of malware, they rank fourth overall in terms of the share of attacked users at 6%. The most widespread category remains AdWare, accounting for 57% of attacked users, followed by general Trojans (25%) and RiskTools (12%). The ranking includes malware, adware and unwanted software.

In 2024, cybercriminals launched an average of 2.8 million malware, adware, and unwanted software attacks on mobile devices each month. Over the year, Kaspersky products blocked a total of 33.3 million attacks.

In 2024, Fakemoney, a group of scam apps designed for fake investments and payouts, was the most active threat. Another major concern was modified versions of WhatsApp that contained the Triada-type Trojan – a malware that can download and execute additional malicious or adware modules, for example, to display advertisements or perform other unwanted actions. These unofficial WhatsApp mods ranked third in activity, just behind a general category of cloud-based generic threats.

Learn more about the mobile malware threat landscape in 2024 on Securelist. To protect yourself from mobile threats, Kaspersky shares the following recommendations.

Downloading apps from official stores like the Apple App Store and Google Play is not always risk-free. Kaspersky recently discovered SparkCat, the first screenshot-stealing malware to bypass the App Store’s security. The malware was also found on Google Play, with a total of 20 infected apps across both platforms, proving that these stores are not 100% foolproof. To stay safe, always check app reviews and download numbers when possible, use only links from official websites, and install reliable security software, like Kaspersky Premium, that can detect and block malicious activity if an app turns out to be fraudulent.

Check the permissions of apps that you use and think carefully before permitting an app, especially when it comes to high-risk permissions such as Accessibility Services. For example, the only permission that a flashlight app needs is the flashlight (which doesn’t even involve camera access). A good piece of advice is to update your operating system and important apps as updates become available. Many safety issues can be solved by installing updated versions of software.

Business

EMSOL wins Best National Industry Brand Award at Brand Excellence Ceremony

Emboldened by its innovation in reducing smoke emissions from diesel, petrol, and kerosene internal combustion engines, Eminent International’s fuel additive EMSOL has been awarded the Best National Industry Brand in the Vehicles, Automobile Assembly, and Automotive-Related Products category for the Small Scale Industry Sector. The prestigious award was presented at the inaugural Brand Excellence Award ceremony held by the Industrial Development Board of Ceylon.

The event, organized under the Ministry of Industries and Entrepreneurship Development, took place at Eagles’ Lakeside in Attidiya. Key attendees included Prime Minister Dr. Harini Amarasooriya, Minister Sunil Handunnetti, and Deputy Minister Chathuranga Abeysinghe.

Business

Ceylinco Life retains No 1 spot in life insurance with premium income of Rs 37.14 bn. In 2024

Ceylinco Life has emphatically reaffirmed its continuing supremacy in Sri Lanka’s life insurance industry with gross written premium income of Rs 37.14 billion and total income of Rs 65.54 billion in 2024, the company’s 21st year of unbroken market leadership.

Premium income grew by a healthy 11.16 per cent, while investment income at Rs 28.4 billion reflected growth of 1.5 per cent, resulting in consolidated income for the year improving by 6.7 per cent, according to the company’s audited financial statements for the 12 months ending 31st December 2024.

The growth in life insurance business as represented by gross written premium income confirms that Ceylinco Life retained its position as the largest life insurer in Sri Lanka in 2024, by a margin of more than Rs 5.5 billion over the second-placed life insurance company.

“The figures tell the story,” commented Ceylinco Life Executive Chairman R. Renganathan. “We have completed the first year of our third decade of market leadership in Sri Lanka’s life insurance industry, thanks to the unwavering trust and confidence of the millions of lives we protect and touch. Ceylinco Life’s demonstrated financial strength and stability, its uncompromising adherence to the core values and principles of its business, and its deep-rooted commitment to the community, remain the bedrock of the company’s growth and progress.”

Ceylinco Life paid Rs 25 billion in net claims and benefits to policyholders for the year under review, an increase of 8.2 per cent over the preceding year, and transferred Rs 23 billion to its Life Fund. As a result, the Life Fund grew by a noteworthy 14.8 per cent to Rs 180.89 billion as at 31st December 2024.

The company’s total assets grew by Rs 26.69 billion or 11.8 per cent over the year at a monthly average of more than Rs 2.2 billion to cross the milestone of Rs 250 billion (Rs 251.43 billion) at the end of 2024, while its investment portfolio recorded an increase of 12.32 per cent in value over the 12 months to total Rs 222.5 billion as at 31st December 2024.

Ceylinco Life transferred Rs 3 billion to the shareholders’ fund in respect of the 12 months, and shareholders’ equity grew to Rs 60.74 billion at the end of the year.

The Company posted profit before tax of Rs 10.05 billion for FY 2024, reflecting an increase of 19.1 per cent over the previous year. Net profit after tax for the 12 months reviewed was Rs 7.07 billion, an improvement of 21.88 per cent over 2023.

Ceylinco Life’s basic earnings per share for the year amounted to Rs 141.43, while net assets value per share stood at Rs 1,214.91 as at 31st December 2024, representing growths of 21.8 per cent and 11.7 per cent respectively. Return on assets for the year was 2.81 per cent and return on equity 11.64 per cent.

Significantly, Ceylinco Life’s Risk-based Capital Adequacy Ratio (CAR) improved to 448 per cent at end 2024, more than 3.7 times the minimum CAR of 120 per cent required by the industry regulator.

-

News1 day ago

News1 day agoPrivate tuition, etc., for O/L students suspended until the end of exam

-

News6 days ago

News6 days agoLawyers’ Collective raises concerns over post-retirement appointments of judges

-

Sports4 days ago

Sports4 days agoThomians drop wicket taking coloursman for promising young batsman

-

Editorial3 days ago

Editorial3 days agoCooking oil frauds

-

Features5 days ago

Features5 days agoBassist Benjy…no more with Mirage

-

Editorial6 days ago

Editorial6 days agoHobson’s choice for Zelensky?

-

Features5 days ago

Features5 days agoNawaz Commission report holds key to government response at UNHRC

-

Features2 days ago

Features2 days agoShyam Selvadurai and his exploration of Yasodhara’s story