Business

Ceylinco Life retains No 1 spot in life insurance with premium income of Rs 37.14 bn. In 2024

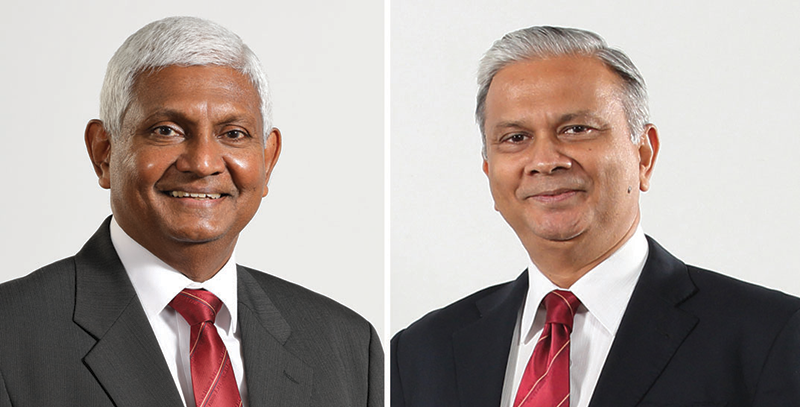

Ceylinco Life has emphatically reaffirmed its continuing supremacy in Sri Lanka’s life insurance industry with gross written premium income of Rs 37.14 billion and total income of Rs 65.54 billion in 2024, the company’s 21st year of unbroken market leadership.

Premium income grew by a healthy 11.16 per cent, while investment income at Rs 28.4 billion reflected growth of 1.5 per cent, resulting in consolidated income for the year improving by 6.7 per cent, according to the company’s audited financial statements for the 12 months ending 31st December 2024.

The growth in life insurance business as represented by gross written premium income confirms that Ceylinco Life retained its position as the largest life insurer in Sri Lanka in 2024, by a margin of more than Rs 5.5 billion over the second-placed life insurance company.

“The figures tell the story,” commented Ceylinco Life Executive Chairman R. Renganathan. “We have completed the first year of our third decade of market leadership in Sri Lanka’s life insurance industry, thanks to the unwavering trust and confidence of the millions of lives we protect and touch. Ceylinco Life’s demonstrated financial strength and stability, its uncompromising adherence to the core values and principles of its business, and its deep-rooted commitment to the community, remain the bedrock of the company’s growth and progress.”

Ceylinco Life paid Rs 25 billion in net claims and benefits to policyholders for the year under review, an increase of 8.2 per cent over the preceding year, and transferred Rs 23 billion to its Life Fund. As a result, the Life Fund grew by a noteworthy 14.8 per cent to Rs 180.89 billion as at 31st December 2024.

The company’s total assets grew by Rs 26.69 billion or 11.8 per cent over the year at a monthly average of more than Rs 2.2 billion to cross the milestone of Rs 250 billion (Rs 251.43 billion) at the end of 2024, while its investment portfolio recorded an increase of 12.32 per cent in value over the 12 months to total Rs 222.5 billion as at 31st December 2024.

Ceylinco Life transferred Rs 3 billion to the shareholders’ fund in respect of the 12 months, and shareholders’ equity grew to Rs 60.74 billion at the end of the year.

The Company posted profit before tax of Rs 10.05 billion for FY 2024, reflecting an increase of 19.1 per cent over the previous year. Net profit after tax for the 12 months reviewed was Rs 7.07 billion, an improvement of 21.88 per cent over 2023.

Ceylinco Life’s basic earnings per share for the year amounted to Rs 141.43, while net assets value per share stood at Rs 1,214.91 as at 31st December 2024, representing growths of 21.8 per cent and 11.7 per cent respectively. Return on assets for the year was 2.81 per cent and return on equity 11.64 per cent.

Significantly, Ceylinco Life’s Risk-based Capital Adequacy Ratio (CAR) improved to 448 per cent at end 2024, more than 3.7 times the minimum CAR of 120 per cent required by the industry regulator.

Business

Salesforce Startup Program targets Sri Lanka’s high-growth tech sector

Salesforce, the world’s leading AI-powered CRM platform, is set to expand its presence in Sri Lanka with the launch of the Salesforce Startup Program by the end of January 2026, signalling growing confidence in the country’s technology-led growth potential.

The move comes as Sri Lanka consolidates its position as the second-largest startup ecosystem in South Asia after India, with software, data and artificial intelligence-driven ventures accounting for nearly 60 per cent of the national startup base.

Industry observers say this concentration places Sri Lanka at a decisive stage where global exposure and enterprise access could unlock the next phase of scale.

Under the programme, Sri Lankan startups will gain access to Salesforce’s global ecosystem, including AI-powered platforms, business and technical mentorship, joint go-to-market opportunities and connections to enterprise customers, enabling founders to build globally competitive solutions from Sri Lanka.

“Sri Lanka has developed a strong base of technical talent and entrepreneurial ambition that is increasingly visible regionally and globally,” said Arundhati Bhattacharya, President and CEO of Salesforce South Asia.

“Through the Salesforce Startup Program, we aim to help startups move beyond early momentum to global relevance while delivering long-term economic impact,” he added.

He also said the initiative builds on the success of its Startup Program in India and Singapore, which today supports over 435 startups, including more than 230 AI-first companies. Several participants have expanded across Asia and beyond by building products natively on the Salesforce platform.

Responding to queries, he said Sri Lanka is also emerging as an important enterprise market for Salesforce, with major corporates such as John Keells Holdings and Cinnamon Hotels adopting the platform to modernise customer engagement, sales, marketing and loyalty management operations.

In parallel, Salesforce is strengthening the country’s digital talent pipeline through its Trailhead learning ecosystem, with plans to skill nearly 1,000 learners over the next year via local workforce development partners and community-led cohorts.

Chamil Madusanka, Head of Salesforce Practice and Salesforce Architect, said the programme arrives at a critical juncture for Sri Lanka’s startup ecosystem.

“Sri Lankan founders are increasingly building AI, data and enterprise software solutions with global relevance,” Madusanka told The Island Financial Review.

“What many startups need is structured access to enterprise customers, global mentorship and market exposure. This initiative creates that bridge, enabling local companies to scale faster while remaining rooted in Sri Lanka.”

He said the Startup Program is designed to act as a connective platform, bringing together startups, enterprises, technology partners, universities and developer communities to accelerate collaboration and innovation.

By Ifham Nizam ✍️

Business

Good news on risen foreign reserves exerts buoyant impact on bourse

CSE activities were extremely bullish yesterday following Central Bank Governor Dr Nandalal Weerasinghe’s announcement that Sri Lanka’s foreign reserves had risen to US $ 6.8 billion in December 2025, up US$ 791 million from November 2025.

The Governor provided the estimated economic growth while announcing the Central Bank’s policy agenda for this year.

In December Sri Lanka received budget support loans from the Asian Development Bank and the International Monetary Fund.

Amid these developments both CSE indices moved upwards. The All Share Price Index went up by 226.81 points, while the S and P SL20 rose by 100.01 points. Turnover stood at Rs 12.3 billion with 12 crossings.

Top seven crossings that mainly contributed to the turnover were: Lee Hedges 18.2 million shares crossed to the tune of Rs 3.9 billion; its shares traded at Rs 416, Commercial Bank 2.1 million shares crossed for Rs 467.6 million; its shares traded at Rs 215, Ceylon Hotels 429,000 shares crossed for Rs 128.7 million; its shares traded at Rs 300, LB Finance 650,000 shares crossed for Rs 105 million; its shares sold at Rs 152.50, Ceylinco Holdings 31000 shares crossed for Rs 104.5 million; its shares traded at Rs 3400, Melstacorp 200,000 shares crossed tfor Rs 35.7 million; its shares sold at Rs 178.50 and Three Acres Farm 400,000 shares crossed to the tune of Rs 29.6 million; its shares fetched Rs 740.

In the retail market top seven companies that mainly contributed to the turnover were; Wealth Trust Securities Rs 1.17 billion (55.8 million shares traded), Commercial Bank Rs 509 million (2.4 million shares traded), HNB Rs 370 million (870,000 shares traded), ACL Cables Rs 303 million (three million shares traded), Prime Lands Residencies Rs 283 million (7.9 million shares traded), Lanka Realty Rs 227.5 million (4.7 million shares traded) and HNB Rs 218 million (332,000 shares traded). During the day 223.7 million share volumes changed hands in 55116 transactions.

Yesterday, investor interest in Wealth Trust and banking stocks led to higher activity levels, brokers said. Further, the real estate sector also performed well. Lanka Realty Investments PLC acquired 51 percent of the total number of shares in issue of Lee Hedges, CSE sources said. 13,057,595 ordinary voting shares were bought at Rs 216 each.

Yesterday the rupee opened at Rs 310.12/18 to the US dollar in the spot market, weaker from Rs 310.05/15 the previous day, dealers said, while bond yields opened marginally high.

By Hiran H Senewiratne ✍️

Business

Launch of monograph ‘Development: Not By Economics Alone’

The Gamani Corea Foundation (GCF) is pleased to announce the launch of the monograph Development: Not By Economics Alone by Dr. Nimal Sanderatne, Emeritus Chairperson of the Foundation. The foreword to the publication has been written by Dr. Godfrey Gunatilleke, one of Sri Lanka’s most eminent development economists. The launch ceremony will be held on Friday, 9th January 2026, at 4.00 p.m. at the Horton Lodge.

In this monograph, Dr. Sanderatne argues that development cannot be understood through economic indicators alone. He emphasizes that the quality of human capital depends not only on knowledge and skills acquired through formal education, but also on deeper, non-formal processes embedded in a society’s culture and value systems. These influence human behaviour, shaping work ethics, attitudes to work and leisure, capacity for teamwork, preferences between short- and long-term goals, and patterns of saving and consumption.

Dr. Sanderatne is a distinguished economist and academic, holding degrees from the Universities of London, Saskatchewan, and Wisconsin, and was conferred the Doctor of Science (Honoris Causa) by the University of Peradeniya in 2004.

-

News3 days ago

News3 days agoInterception of SL fishing craft by Seychelles: Trawler owners demand international investigation

-

News3 days ago

News3 days agoBroad support emerges for Faiszer’s sweeping proposals on long- delayed divorce and personal law reforms

-

News4 days ago

News4 days agoPrivate airline crew member nabbed with contraband gold

-

News2 days ago

News2 days agoPrez seeks Harsha’s help to address CC’s concerns over appointment of AG

-

News2 days ago

News2 days agoGovt. exploring possibility of converting EPF benefits into private sector pensions

-

Latest News22 hours ago

Latest News22 hours agoWarning for deep depression over South-east Bay of Bengal Sea area

-

Features3 days ago

Features3 days agoEducational reforms under the NPP government

-

News6 days ago

News6 days agoHealth Minister sends letter of demand for one billion rupees in damages