Business

Between homefront policies and global developments: Sri Lanka’s external sector outlook

By Nilupulee Rathnayake

Having weathered a challenging period marked by a deep economic crisis, Sri Lanka is now demonstrating positive signs of an economic upturn. Still, amidst limited homefront policy alternatives against an unfavourable global backdrop, a critical question arises: how will Sri Lanka’s external sector cope in the face of these challenges?

Having weathered a challenging period marked by a deep economic crisis, Sri Lanka is now demonstrating positive signs of an economic upturn. Still, amidst limited homefront policy alternatives against an unfavourable global backdrop, a critical question arises: how will Sri Lanka’s external sector cope in the face of these challenges?

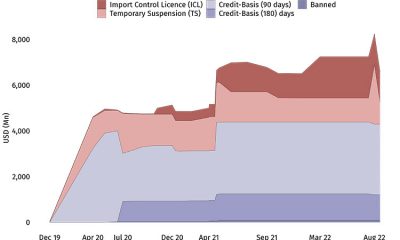

Notably, import controls, initially imposed in response to the dearth of foreign exchange liquidity in the domestic market, are being largely eased. The government is actively seeking to forge partnerships with regional giants, aiming to strengthen trade relations through Free Trade Agreements (FTAs). Nevertheless, in the broader global context, the rise of geopolitical rivalries, slow growth and contracting demand in key markets create multiple uncertainties for Sri Lanka’s external sector recovery.

Global Economic Developments: A Complex Web of Uncertainties

Globally, there are promising signs of economic progress in the near term. Supply chain disruptions, which significantly impacted various industries, have largely returned to pre-pandemic levels. Energy and food prices, having peaked during conflict-induced periods, have substantially subsided, alleviating global inflationary pressures faster than anticipated.

However, the global economic landscape remains overshadowed by a complex web of uncertainties. Political dysfunction in key economies and ongoing geopolitical rivalries present challenges. The United States’ imposition of bans on certain exports to Chinese firms exemplifies the extant geopolitical tensions. This growing inclination towards trade interventions through industrial policies, subsidies, and import restrictions, driven by national security and environmental considerations, has the potential to impact the trajectory of globalisation. These developments carry substantial implications for emerging and developing economies, particularly those deeply reliant on a globally integrated economy, foreign direct investment (FDI), and technology transfers. Economies contending with burgeoning sovereign debt overhangs in particular, are expected to face heightened vulnerabilities. Having defaulted in early 2022, Sri Lanka is among the countries particularly affected by these global economic shifts.

Sri Lanka’s Vulnerable Export Sector

In 2022, Sri Lanka recorded its lowest merchandise trade deficit since 2011, primarily due to reduced imports and an uptick in exports. Merchandise exports expanded by 4.9% in 2022 compared to the previous year, while import expenditure decreased by 11.4% in 2022 relative to 2021. The decrease in import expenditure stems from a combination of import restrictions and foreign exchange liquidity constraints.

However, as import controls ease and the economy gradually improves, a marginal increase in import expenditure is observed from June 2023 onwards. While improving consumer welfare and food security, this move may negatively impact the trade deficit this year, especially as global demand for Sri Lanka’s primary exports, like tea and garments face a downturn – the former triggered by high production costs and the latter by contracting foreign demand.

Sri Lanka’s key export markets for garments, particularly in the US and Europe, are experiencing low growth and weakened demand since the fourth quarter of 2022. Consequently, monthly earnings from garment exports in August 2023 indicates a 26% decline compared to August 2022. Notable decreases in the import of Ceylon tea by prominent Sri Lankan tea importers in 2022 relative to 2021, including Russia (by 9.6%), the UAE (by 2.5%), and Turkey (by 47%), also highlight the vulnerability of Sri Lanka’s export sector to external shocks. The tea market’s condition has seen a modest improvement in 2023, though it has not been entirely resolved.

The concentration of Sri Lanka’s exports in terms of products and markets has long been a source of concern, rendering the economy exceedingly susceptible to sector-specific shocks.

Tourism and Worker Remittances: A Silver Lining

In a positive trajectory, 2023 has witnessed a notable increase in monthly tourist arrivals compared to the previous year, signalling a discernible recovery trend. Cumulative tourist arrivals from January to August 2023 amounted to 904,318, compared to 496,430 arrivals recorded during the corresponding period in 2022. Overcoming the challenges within this sector necessitates a coordinated effort from various stakeholders, including the government and the private sector, as Sri Lanka endeavours to reconstruct its brand identity as a secure and preferred destination.

Worker remittances, representing another crucial source of foreign exchange earnings, have exhibited promise. In the first half of 2023, worker remittances grew to USD 2.8 billion, however it remains below the pre-pandemic level of USD 3.6 billion recorded in the first half of 2018. While the Middle East remains a vital destination for Sri Lankan workers, alternative destinations offering employment across various job categories have emerged, including South Korea, Singapore, Japan, and several European countries. Notably though, the large-scale migration of workers, including white-collar employees, raises concerns regarding long-term economic repercussions due to brain drain.

Challenges in Attracting Foreign Investment

In a fiercely competitive global FDI landscape, political stability and a robust macroeconomic framework are paramount considerations for investors, especially given the numerous countries competing for their attention.

In the post-war period, Sri Lanka experienced its peak FDI inflows in 2018, attracting USD 1.6 billion. However, in 2022, this figure dwindled to USD 898 million, reflecting the adverse impact of the pandemic and economic challenges. Sri Lanka’s economic crisis – and the country’s sovereign default status together with public protests, strikes, and violence – reshaped the country’s perception as a not particularly attractive destination for foreign investors.

As Sri Lanka anticipates modest growth in the coming years, it becomes imperative not only to retain existing investors but also to proactively seek new investments within the current unfavourable climate. The Board of Investment (BOI) has targeted to attract USD 2 billion in FDI in 2023, with a particular focus on the tourism sector. An incentive package, potentially incorporating tax incentives, is being contemplated as a viable policy intervention, aligning with practices observed in peer countries aimed at attracting FDI.

Building Resilience and Diversification

Sri Lanka’s external sector has been susceptible to policy missteps that exposed it heavily to external global shocks. Building the economy’s resilience against external pressures must necessarily be a crucial part of the adjustment and recovery process. As import controls are also eased, to bridge the widening trade deficit, Sri Lanka needs to implement concrete policy measures to diversify its export basket and connect to global value chains.

Several initiatives have already been undertaken, for instance, to pursue fresh trade relationships with neighbouring giants. These trade agreements should be deep trade agreements that target not only merchandise trade but also services, FDI promotion, value addition, trade facilitation, and digitisation. In the near term, negotiations are ongoing on various stalled trade agreements with India, China, and Thailand, amongst others, while expressing interest in joining the RCEP trade bloc in the medium term.

However, notably, Sri Lanka can no longer approach efforts to expand and diversify exports in a piecemeal fashion and FTAs on their own will fail to deliver. High energy costs, labour shortages, and scaling back on infrastructure spending, amongst others, impact the operating environment for businesses. Sri Lanka’s longstanding structural bottlenecks must be overcome by implementing the necessary reforms to raise productivity for sustained growth if the country is to regain lost confidence in its economic prospects.

*This blog is based on the comprehensive chapter on the external environment in IPS’ ‘Sri-Lanka: State of the Economy 2023’ report.

Link to original blog: https://www.ips.lk/talkingeconomics/2023/10/24/between-homefront-policies-and-global-developments-sri-lankas-external-sector-outlook/

Business

eChannelling introduces ‘eHomecare’ as SL’s first doctor-led elderly care service

Supporting families with medically supervised care for elderly individuals in the comfort of their own homes, SLT-MOBITEL and eChannelling PLC, in partnership with medical experts from Golden Years Care, have introduced eHomecare’, Sri Lanka’s first doctor‑led elderly‑care service.

The pioneering initiative is designed to address a growing societal need. The service launched by eChannelling, Sri Lanka’s leading digital healthcare solutions provider, brings together the technological capabilities of SLT-MOBITEL with eChannelling’s healthcare expertise and Golden Years Care’s extensive experience in compassionate home-based support, ensuring quality standards throughout the program.

With increasing migration, many adult children are now living or working abroad, leaving their elderly parents alone in Sri Lanka. For many seniors, mobility challenges make it difficult to access hospitals for routine checkups, medication, or urgent medical attention. eHomecare seeks to fill this critical gap, offering a structured, reliable, and compassionate solution for families navigating these challenges.

The purpose of eHomecare is to support families in assuring their elderly loved ones receive the medical care they need, even when children are living overseas or occupied with demanding careers, guaranteeing elderly individuals are supported with dignity.

eHomecare provides families with a safe and trustworthy platform to arrange professional doctor‑led home visits, benefit from real‑time assessments and guidance from qualified healthcare professionals and ensure the elderly are supported with holistic care.

More than a convenience, eHomecare is a vital solution to a pressing social concern, offering peace of mind to families and guaranteeing seniors receive the respect, and medical attention they deserve.

Key features of the service include doctor-led home visits providing personalized care tailored to individual health needs, continuous assessment and recommendations for ongoing care for optimal health management, prompt medical attention during emergencies, with qualified healthcare professionals available when needed and a comprehensive, professional, and trustworthy approach to elderly care that prioritizes dignity and wellbeing.

Through eHomecare, families gain access to a reliable network of medical professionals who understand the unique needs of elderly individuals. The service bridges the distance between overseas children and their aging parents, with medical support, and emotional reassurance that loved ones are being cared for with compassion and expertise.

Business

NDB shows strong growth, rising investment potential

In a striking testament to both corporate resilience and a recovering macroeconomic environment, the National Development Bank (NDB) has delivered a set of third-quarter results for 2025 that far exceed market expectations. The figures, detailed in a recent analysis by First Capital Research (FCR), paint a picture of a financial institution leveraging favourable conditions to accelerate growth, justify upward revisions in valuation, and present a compelling case to investors for long-term value creation.

The headline figure is arresting: a 145.6% year-on-year surge in earnings for 3Q2025. This explosive growth was primarily engineered by a dual engine of stronger net interest income, which grew 13.8% YoY to LKR 9.1 billion, and a significant 24.3% rise in net fee and commission income. The former benefits directly from the prevailing low-interest-rate environment, which has helped margins and stimulated borrowing, while the latter points to broad-based business momentum across the bank’s operations, from trade finance to its digital platforms. A remarkable leap in other income – to LKR 1.04 billion from a mere LKR 27.7 million a year earlier – further bolstered the bottom line.

Perhaps as encouraging as the income growth is the notable improvement in credit quality. Impairment charges declined by a substantial 46.9% year-on-year, a clear signal of improving macroeconomic conditions and a healthier loan book. This trend underscores a banking sector that is emerging from the shadows of past economic stress with greater stability.

Buoyed by this outperformance, FCR has significantly revised its earnings forecasts upward. Their 2025 estimate has been lifted by 33.5% to LKR 11.6 billion, and the 2026 forecast by 26.1% to LKR 13.2 billion. This positive reassessment flows directly into the bank’s perceived fair value. FCR now assigns a fair value of LKR 180.0 per share for 2025, implying a 27% potential upside, and LKR 200.0 for 2026, suggesting a 42% increase from current levels. When expected dividend per share (DPS) returns are included, the total return projections become even more attractive, estimated at 33% for 2025 and 48% for 2026.

First Capital maintains a “BUY” recommendation on NDB, citing a constructive outlook founded on a favourable macro backdrop and stable interest-rate trends. These factors are expected to continue fuelling loan book expansion. Furthermore, growth in trade finance and an accelerating adoption of digital banking services are anticipated to provide sustained momentum to fee-based earnings, diversifying the bank’s revenue streams.

However, the report does not ignore the clouds on the horizon. It highlights near-term risks to asset quality, particularly stemming from recent adverse weather events. Given NDB’s sizable exposure to the Small and Medium Enterprise (SME) sector, which is often vulnerable to such disruptions, the analysis expects a possible uptick in non-performing loans (NPLs) in the coming quarters. This is a prudent note of caution for investors, emphasizing that the recovery path may not be entirely smooth.

Nevertheless, the overarching narrative from these results is one of a bank positioned at the confluence of economic recovery and strategic execution. NDB appears to be translating improved national economic indicators into robust financial performance. Its “resilient base,” demonstrated by strengthening fundamentals and declining impairments, provides the foundation for “rising potential,” captured in the revised earnings and fair value estimates.

For the investing public, the message from this analysis is clear: NDB is presented as a institution harnessing the winds of economic change to propel itself forward. While mindful of sector-specific risks, the data suggests a strong trajectory for growth and value appreciation, making it a standout candidate for potential investors.

By Sanath Nanayakkare

Business

Sri Lankan tea sees a week of robust activity

The Colombo tea auctions witnessed a week of robust activity and generally firm prices, as total offerings rose significantly to 6.0 million kilograms, according to the latest market commentary from leading brokers Forbes & Walker. This marks a notable increase from the 5.2 million kilograms on offer the previous week.

The market was characterized by good general demand, with an encouraging overall price structure attributed to seasonal interest. The report indicates a nuanced picture across different elevations and tea types.

Offerings from Ex-Estate gardens increased marginally to 0.79 M/Kgs. The sector saw good demand, with prices maintaining a firm to marginally dearer trend. However, within the Western High-Grown region, teas in the Best category were marginally weaker, while improved and brighter sorts in the Below Best category appreciated. The Nuwara Eliya region remained sluggish, while the Uva/Uda Pussellawa regions sold at levels consistent with the previous week.

The High and Medium Grown CTC market saw firm conditions for PF1 grades, which gained by Rs. 20 per kg or more. In contrast, the corresponding Low Grown PF1 varieties weakened by a similar margin. BP1 grades were scarcely available.

The Low Grown segment, comprising approximately 2.4 M/Kgs, met with fair to good demand. The Premium category, in particular, witnessed good interest.

BOP1 grades were fully firm. OP1 varieties saw Best and Below Best types appreciate, while high-priced OPs were easier. OPAs saw high-priced teas become dearer.

FBOPs were generally firm, and Select Best FF1s were firm to selectively dearer.

Very Tippy teas met with good, firm demand, with Best and Below Best varieties appreciating.

The broker report noted that shippers to traditional markets like the United Kingdom, the European continent, and South Africa continued to be selective in their purchases. Meanwhile, there was fair activity from buyers representing China, Japan, the Commonwealth of Independent States (CIS), and the Middle East.

Forbes & Walker concluded that the overall price picture is encouraging, driven by a combination of selective international demand and seasonal factors. The firm to dearer trend at the lower end of the market and for specific grades indicates a solid underlying demand, despite some regional and qualitative weaknesses. The trade will be watching closely to see if this firm trend holds as new seasonal crops come to market.

-

News5 days ago

News5 days agoMembers of Lankan Community in Washington D.C. donates to ‘Rebuilding Sri Lanka’ Flood Relief Fund

-

News3 days ago

News3 days agoBritish MP calls on Foreign Secretary to expand sanction package against ‘Sri Lankan war criminals’

-

Business7 days ago

Business7 days agoBrowns Investments sells luxury Maldivian resort for USD 57.5 mn.

-

News6 days ago

News6 days agoAir quality deteriorating in Sri Lanka

-

News6 days ago

News6 days agoCardinal urges govt. not to weaken key socio-cultural institutions

-

Features7 days ago

Features7 days agoHatton Plantations and WNPS PLANT Launch 24 km Riparian Forest Corridor

-

Features7 days ago

Features7 days agoAnother Christmas, Another Disaster, Another Recovery Mountain to Climb

-

Features5 days ago

Features5 days agoGeneral education reforms: What about language and ethnicity?