Business

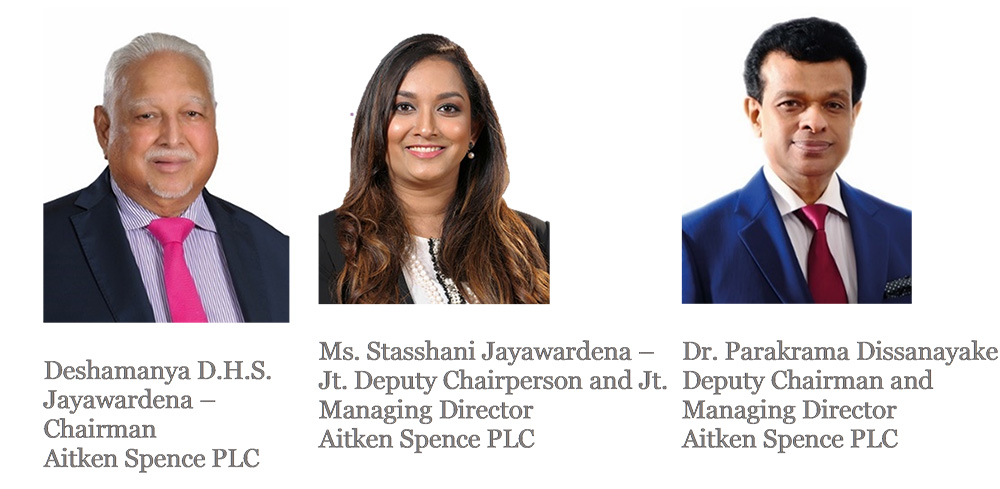

Aitken Spence records strong performance with Profit Before Tax of Rs. 4.3 Bn, an 124% increase in the 9 months ended 31st December 2024/25

Aitken Spence PLC, a leading conglomerate with a diverse regional presence, reported a Profit Before Tax (PBT) of Rs. 4.3 Bn an increase of 124% for the 9 months ended December 31, 2024. For the same period, the PBT excluding forex reached Rs. 4.9 Bn.

The total Group’s revenue in the reporting currency, including equity-accounted investees, increased by 3% over the 9-month period, to reach Rs. 76.3 Bn. Group Revenue of which approx. 65-70% is derived in USD or other foreign currencies directly or indirectly reflects the lower exchange rate that prevailed during the period compared to the previous year. The average exchange rate for Q3 reduced by Rs 34.07 while the average exchange rate for the 9 months reduced by Rs. 20.87.

The Group recorded an EBITDA (excluding impacts from foreign currency exchange gains and losses) of Rs. 16 Bn for the 9 months ended on December 31, 2024, reflecting a growth of 0.3%. EBITDA includes earnings from equity accounted investees; however, excludes interest expenses, tax, depreciation, and amortisation. The Group’s profit from operations (excluding forex) reached Rs. 7.8 Bn, an improvement of 4.6% for the cumulative period ended December 31, 2024.

The Group’s Tourism sector demonstrated a notable improvement with a three-fold increase in profitability, recording a PBT of Rs. 424.2 Mn for the cumulative Q3 ended December 31, 2024. This was driven by the Group’s hospitality sector which experienced increased occupancy rates across all its hotels, and particularly the overseas hotels segment. The Group’s destination management segment was impacted by the 18% VAT on existing contracts and the Red Sea Conflict that has a direct impact on cruise tourism, although we expect a significant improvement in Q4 with an adjustment to contract rates.

The Group’s Maritime & Freight Logistics sector achieved a PBT of Rs. 3.3 Bn for the 9 months ended December 31, 2024, despite the substantial reduction in the exchange rate. The bunkering business and the overseas freight and airline segment were the main contributors towards growth in this sector’s performance.

The Group’s Strategic Investments sector recorded a PBT of Rs. 407.3 Mn and reflected a growth exceeding 100% for the 9 months ended on December 31, 2024. This impressive nine-month performance was primarily driven by the enhanced results of the Waste to Energy Power Plant and the settlement of previously delayed interest payments by CEB received by the Group’s renewable energy segment. Furthermore, the Group’s printing and packaging segment including the plantations segment made a positive contribution to the sector’s performance.

The Group’s Services sector recorded a PBT of Rs. 113.8 Mn for the 9 months ended December 31, 2024. The newly launched Port City BPO operation significantly contributed towards this performance. However, the money transfer business was affected by a lower exchange rate on remittances and the additional costs incurred by the elevator segment on the accelerated completion of several high-rise buildings in Colombo.

The Group’s indirect energy consumption per unit revenue increased by 17%, driven by higher operational activity across the Group, particularly in the tourism sector. In contrast, direct energy consumption from non-renewable sources decreased by 3% compared to the third quarter of the 2023–2024 financial year, aligning with the Group’s commitment to reducing emissions. Additionally, the proportion of renewable energy in the Group’s direct energy consumption increased by 104%, reaching 33% of the total—progressing toward the 50% target by 2030—compared to the same period.

Water efficiency also improved, with the Group achieving a 30% reduction in water withdrawal per unit revenue, compared to the third quarter of the previous financial year. This was primarily due to lower withdrawals in the Maldives operations. Meanwhile, the Group’s waste-to-energy power plant repurposed 133,099 metric tons of municipal solid waste from the Colombo district during the first three quarters of the 2024–2025 financial year—a volume that is equivalent in weight to approximately 26,620 Sri Lankan elephants—contributing to a cleaner Colombo through a strategic and sustainable waste management solution.

During the quarter, Group Human Resources organised an Executive Development Programme (EDP) to strengthen the leadership team’s capacity for driving organisational transformation at Aitken Spence, targeting Assistant Vice Presidents and above. Titled “Purposeful Transformation,” the programme was expertly facilitated and conducted in three separate sessions, each tailored to focus on different sectors of the Group. Following the EDP, a workshop was held with members of the Group Supervisory Board (GSB), providing the leadership team with an opportunity to share their insights and ideas, aligning them with the key learnings from the programme.

Business

Tea market grappling with headwinds as 2025 comes to an end

As the curtain prepares to fall on Sri Lanka’s tea trading year, the penultimate auction of 2025 has painted a picture of a market grappling with headwinds. The sale, catalogued in the aftermath of the disruptive Cyclone Ditwah, presented 6.0 million kilograms to the trade, but was met with a predominantly bearish sentiment, casting a reflective shadow over the year’s closing.

The High and Medium Grown offerings, particularly from the Ex-Estate sector, set a cautious tone. With overall quality described as barely maintained, prices faced downward pressure. The better liquoring Western BOP/BOPF varieties, often a market bellwether, declined by up to Rs. 50 per kg. This easing trend rippled through the Below Best and Plainer categories, which were often cheaper by Rs. 20-40 per kg. Regional nuances were evident: Nuwara Eliya teas remained sluggish, Uda Pussellawa listings weakened, and Uva varieties were mostly steady only where quality was exceptionally upheld, with others declining. The CTC segment mirrored this fragility, with PF1s generally easier by Rs. 20 per kg, while the very bottom end of the market faced severe challenges, becoming at times unsellable.

This internal market dynamic was compounded by a notable sluggishness in global demand. The report notes a concerning inactivity from traditional buyers in the UK and the European continent. While shippers to Japan, China, the CIS, and the Middle East continued to operate, they did so at lower levels of engagement. Activity from South Africa was described as virtually absent, underscoring a broader pattern of restrained international participation.

In stark contrast to this overarching bearishness, the Low Growns sector emerged as a relative bastion of stability. With approximately 2.45 million kilograms on offer, this category witnessed fair demand across the board. In the Leafy and Semi-Leafy catalogues, Select Best and Best BOP1s held firm, with others even appreciating. Well-made OP1s also generally maintained their ground, though poorer teas at the bottom saw substantial declines. The Tippy and Premium catalogues told a similar story of selectivity, where well-made FBOPs, Very Tippy teas, and the best varieties either held firm or appreciated, while poorer descriptions faced irregular and easier conditions.

The tale of this penultimate sale, therefore, is one of a stark dichotomy. The market narrative bifurcates into a struggling, quality-sensitive mainstream estate sector weighed down by climatic after-effects and muted Western demand, and a more resilient Low Growns market where quality continues to find its price. This divergence highlights the increasingly selective nature of the global tea trade.

As the industry looks toward the final sale and the year’s reckoning, the events of this penultimate auction offer sobering reflection. The impact of Cyclone Ditwah, both real and psychological, coupled with the cautious stance of key international buyers, has applied palpable pressure. Yet, the enduring firmness for the best Low Grown teas provides a counter-note of confidence, suggesting that in an uncertain global environment, uncompromising quality and specific origin characteristics remain Sri Lanka’s most reliable assets. The challenge heading into the new year will be navigating this two-tiered reality.

By Sanath Nanayakkare ✍️

Business

First Capital to restore 15 acres of forest through partnership with WNPS

First Capital Holdings PLC, a subsidiary of JXG (Janashakthi Group) and Sri Lanka’s pioneering full-service investment institution, announced the signing of a Memorandum of Understanding (MoU) with the Wildlife and Nature Protection Society (WNPS) through its PLANT initiative (Preserving Land and Nature (Guarantee) Limited) to support a large-scale forest restoration initiative in the central highlands of Sri Lanka.

First Capital’s sustainability journey is anchored in the belief that long-term success stems from empowering people through financial literacy and responsible social and environmental practices. At the heart of our agenda is a commitment to advancing financial stability, enabling individuals and communities to make informed financial decisions, build economic strength and contribute meaningfully to national development.

This core focus is complemented by initiatives in community engagement, climate action, and environmental protection, ensuring a balanced approach to sustainable growth. Aligned with SLFRS S2 and global best practices, we champion programmes that promote inclusive progress, sustainable development and long-term wellbeing across Sri Lanka. By embedding financial literacy and sustainability into our core strategies, we aspire to create a financially empowered and environmentally conscious nation.

Business

Access Engineering gets contract for 615-unit housing project in Kirulapone

The Cabinet of Ministers has approved the proposal presented by Transport, Highways and Urban Development Minister Anura Karunathilake on the recommendation of the Cabinet appointed standing procurement committee to award Access Engineering PLC the contract to build 615 housing units at Colombage Mawatha, Kirulapone, which had been stalled.

On 30 December 2024, the Cabinet of Ministers approved following the relevant procurement process to select a contractor for the design and construction of the remaining works of the project.

“Accordingly, the Urban Development Authority (UDA) has invited bids and four bids have been received,” Cabinet Spokesman and Minister Dr. Nalinda Jayatissa said at the weekly post-Cabinet meeting media briefing yesterday.

He said the Cabinet of Ministers approved awarding the relevant contract to Access Engineering PLC based on the recommendations submitted by the High Level Standing Procurement Committee regarding these bids.

-

News3 days ago

News3 days agoMembers of Lankan Community in Washington D.C. donates to ‘Rebuilding Sri Lanka’ Flood Relief Fund

-

Latest News6 days ago

Latest News6 days agoLandslide early warnings issued to the districts of Badulla, Kandy, Kurunegala, Matale and Nuwara-Eliya extended till 8AM on Sunday (21)

-

News4 days ago

News4 days agoAir quality deteriorating in Sri Lanka

-

Business5 days ago

Business5 days agoBrowns Investments sells luxury Maldivian resort for USD 57.5 mn.

-

Editorial6 days ago

Editorial6 days agoCops as whipping boys?

-

Latest News7 days ago

Latest News7 days agoLandslide early warnings issued to the Districts of Badulla, Kandy, Kurunegala, Matale and Nuwara Eliya extended

-

News4 days ago

News4 days agoCardinal urges govt. not to weaken key socio-cultural institutions

-

Features5 days ago

Features5 days agoAnother Christmas, Another Disaster, Another Recovery Mountain to Climb