Business

Understanding informal remittances during a crisis: Experience from Sri Lanka

IPS Policy Insights

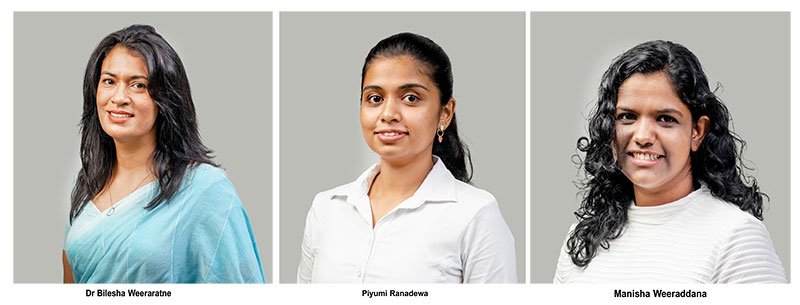

by Dr Bilesha Weeraratne, Piyumi Ranadewa and Manisha Weeraddana, January 2024

Remittances carry vast economic implications for recipient countries at both macro and micro levels. The choice to send remittances through formal channels such as banks, registered money transfer operators, and online platforms, as opposed to informal avenues like Hawala/Undiyal operators or family networks, plays a pivotal role in achieving positive outcomes for migrants, their families, and the broader society of these nations.

The recent foreign currency crisis and subsequent economic downturn in Sri Lanka, partly linked to the decrease in remittance inflows, underscore the increased importance of understanding remittance channels, especially during crises. However, gaining an understanding of the market for informal remittances is hampered by the intrinsically hidden nature of such activities, which has led towards limited data availability. By recognising these gaps in the existing literature, this study aims to bridge the knowledge deficit by delving into the realm of informal remittances, focusing on the use of informal remitting channels in Sri Lanka during an economic crisis. The study relies on qualitative data while utilising a thematic approach towards data analysis in presenting empirical evidence addressing two specific research:

1) What are the characteristics of the informal remittance channels used by Sri Lankans?

2) What are the implications of informal remittances on the economic crisis in Sri Lanka?

The study derives information from a range of sources, such as extensive desk research and qualitative data collected via 19 key Informant Interviews. The interviewees represent migration-related stakeholders (the IOM, State Ministry of Foreign Employment Promotions & Market Diversification and Sri Lanka Bureau of Foreign Employment), five remittance-related stakeholders (the Central Bank, private and public sector banks and financial institutions), three researchers, seven migrant workers ( three low skilled and four high skilled) currently working in the UAE, Japan, Malaysia, and Saudi Arabia, engaged in domestic work, technical, government or banking sector etc. Qualitative data were also collected from respondents with experience regarding outward informal remittances. The determination of the sample size was based on reaching the point of saturation, where no new information emerged in subsequent interviews. Furthermore, the sample composition was guided by employing the maximum variation sampling technique. To focus on remitting behaviours surrounding informal channels during times of crisis, data were collected between May and August 2022.

Findings

Prior to the economic crisis, formal channels effectively channelled remittances, but the widening cost disparity amid the crisis drew more workers towards informal sectors.

While using informal channels raises concerns such as potential misuse for criminal activities and economic penalties, individual risks are overrated, with a low likelihood of negative outcomes.

The regulatory framework for remittances varies across countries, reflecting local needs and conceptualisations.

Factors influencing channel choice include cost, transaction speed, and no transaction limitations, convenience, accessibility, and anonymity.

Hawala/Undiyal systems emerged as widely used informal channels, especially among low-skilled migrants. Trust and confidence in these unregulated systems minimised the perceived risks.

For irregular migrants, the added benefit of anonymity in informal channels has shown to be particularly advantageous.

During the economic downturn, trust in the regulatory framework diminished due to new policies, pushing workers towards informal channels.

Using formal channels persisted among those aware of legal requirements and with access to digital platforms.

Some high-skilled workers explored alternatives like cryptocurrencies.

Exchange rate volatility, rupee depreciation, and increased control over remittances steer migrants towards informal channels during crises.

Recommendations

As informal channels gain widespread popularity, controlling their usage becomes a considerable challenge. The study outlined the following recommendations to provide a comprehensive understanding of the intricate dynamics associated with informal remittances and contribute to effective measures for managing their impact.

Enhancing awareness:

About personal and national consequences of informal channels.

How to distinguish between formal and informal operators.

Enforcement of regulations pertaining to informal remittances.

Lowering the cost of remittances through formal channels and aligning exchange rates with market rates.

Shifting formal channels from rules-based to risk-based approaches in implementing documentary and identification requirements within KYC policies.

Tailoring incentives for formal channels to cater to the specific needs of migrant groups and ensuring that migrants are well-informed about potential benefits of formal channels.

Removing national and international barriers hindering access to formal channels.

This policy insight was prepared by IPS researchers Dr Bilesha Weeraratne (bilesha@ips.lk), Piyumi Ranadewa and Manisha Weeraddana based on findings from a study on ‘Understanding Informal Remittances During a Crisis: Experience from Sri Lanka’ authored by Dr Bilesha Weeraratne, Thilini Bandara & Thisuri Ekanayake under The South Asia Centre for Labour Mobility and Migrants (SALAM) project conducted by IPS. For more policy insights from IPS, visit: https://www.ips.lk/publications/policy-insights/.

Business

A Historic Hat-Trick: Home Lands Crowned Best Developer Sri Lanka for Third Consecutive Year, Also Wins Best Lifestyle Developer Asia

Home Lands has once again solidified its position as Sri Lanka’s number one and most trusted real estate developer, achieving a historic milestone at the PropertyGuru Asia Property Awards 2025, held in Bangkok, Thailand on 12th December 2025. The company was crowned “Best Developer, Sri Lanka” for the third consecutive year, reaffirming its unmatched leadership in the nation’s real estate sector. Adding to the prestige, Home Lands was also honoured with the highly coveted “Best Lifestyle Developer, Asia” award, an extraordinary achievement for any Sri Lankan developer on the global stage.

The prestigious PropertyGuru Asia Property Awards, the ultimate hallmark of excellence in the Asian property sector was established in 2005 to recognise the region’s finest real estate. Over the years, the programme has become the most trusted and most sought-after awards platform in Asia. Upholding the highest levels of integrity, the Awards follow a professionally supervised, independent judging system, setting the gold standard for real estate recognition in the region.

In addition to its developer accolades, Home Lands’s landmark projects shone across multiple categories, bringing home several top honours:

-

Best Luxury Condo Development (Colombo) – Pentara Residencies, Thummulla Handiya – “The Address in Colombo”

-

Best Completed Condo Development – Santorini Resort Apartments & Residencies, Negombo

-

Best Waterfront Condo Development – Bayfonte Marina Resort Apartments & Villas, Negombo

-

Best Lifestyle Developer – Home Lands Skyline (Private) Limited

Speaking on yet another historic achievement, Mr. Nalin Herath, Chairman – Home Lands Group, stated:

Speaking on yet another historic achievement, Mr. Nalin Herath, Chairman – Home Lands Group, stated:

“Securing the Best Developer title for the third consecutive year, along with being named the Best Lifestyle Developer in Asia, is a proud moment not just for Home Lands but for Sri Lanka. We sincerely thank our customers for their trust and support, which inspires us to continually raise the bar. These wins reflect our unwavering commitment to building with trust, innovation, and excellence, and we will continue to create exceptional living environments while elevating Sri Lanka’s presence in the international real estate arena.

With over 3,400 residential units delivered and over 2,300 units currently under construction across eight ongoing futuristic mega residential complexes, Home Lands continues to drive the evolution of modern living in Sri Lanka. Beyond developing homes, the company has consistently reshaped the lifestyles of Sri Lankans by introducing globally inspired, amenity-rich, resort-style living experiences.

Among its flagship projects, Canterbury Golf Resort Apartments & Villas stands as a testament to this vision — Sri Lanka’s Largest Residential Development, spanning over 55 acres of land, and the country’s first Victorian-style golf resort apartments and villas. Featuring a signature day & night golf course and an unparalleled collection of lifestyle amenities, this iconic development has redefined modern living standards, setting a new benchmark for integrated, resort-style residential environments in Sri Lanka.

Supported by a fully integrated group of 13 companies, including a CS2-graded construction arm certified by CIDA, Home Lands ensures world-class quality and seamless execution from design to delivery. With a growing global presence and offices in Australia and Dubai, the company continues to strengthen international investor confidence in Sri Lanka’s residential property sector.

According to the latest RIU Brand Health Survey 2025, Home Lands remains the undisputed market leader in the country’s real estate industry.

Business

Unlocking Sri Lanka’s hidden wealth: A $2 billion mineral opportunity awaits

Sri Lanka stands on the brink of an economic transformation, powered not by traditional exports, but by the vast, untapped mineral wealth lying beneath its soil and off its shores. According to a comprehensive new business report launched by the Pathfinder Foundation in collaboration with the Australian Trade and Investment Commission, on 17th December in Colombo, the island’s mineral sector holds a staggering unrealised export potential of up to USD 2 billion.

Currently, Sri Lanka exports most of its high-purity minerals including world-renowned vein graphite, rare earth elements (REEs), and mineral sands in raw or semi-processed form, capturing only a fraction of their true value. The report reveals that while current exports to top destinations total about USD 389 million, the achievable potential is estimated at USD 778 million, with the full downstream value-add opportunity reaching several times that figure.

“Sri Lanka has great potential for exports,” stated Australian High Commissioner Matthew Duckworth at the report’s launch. “It is not only about mining but also about refining – moving up the value chain to get significantly higher export earnings.”

The nation is endowed with critical resources essential for global clean energy and high-tech supply chains. This includes an estimated 5 million tonnes of graphite (with purity up to 99.9%), over 600 million tonnes of mineral sands containing REEs like neodymium, and the massive Eppawala phosphate deposit, which alone holds 60 million tonnes of phosphate-bearing material. Experts believe even these numbers may be conservative due to a lack of island-wide surveys, pointing to major exploration opportunities.

However, realising this potential requires urgent action. The report identifies systemic barriers: a fragmented regulatory framework involving over 18 agencies, slow licensing, infrastructure gaps, and outdated mining methods. These challenges have discouraged investment and prevented value addition.

The path forward is clear. The government is already moving to modernise the approval process via a unified digital platform and is crafting a national critical minerals strategy. The report emphasises that success hinges on attracting foreign expertise and investment, particularly in downstream processing – turning graphite into battery-grade material, refining rare earths, and processing mineral sands domestically.

Australia, with its global leadership in sustainable mining and technology, is positioned as a key partner. Australian METS (Mining Equipment, Technology, and Services) companies can bring advanced technology, ESG-compliant practices, and training, potentially reducing operational costs by 30-40% while improving recovery rates.

“For Sri Lanka, the stakes are high. Developing a modern, sustainable mineral sector can diversify the economy, create high-value jobs, build resilience, and integrate the nation into strategic global supply chains,” the Australian High Commissioner noted. The message from the report is one of urgent optimism: the resources are here, the international partners are ready, and the roadmap is laid out. Now is the time for policymakers, investors, and stakeholders to come together to unlock this buried treasure for the benefit of all Sri Lankans.

By Sanath Nanayakkare

Business

Environmental damage now a direct threat to telecom operations, SLT chief warns at 2026 calendar launch

Environmental destruction is no longer an abstract environmental concern but a direct business risk, Sri Lanka Telecom/Mobitel Chairman Dr. Mothilal de Silva warned, as the national telecom giant launched its 2026 corporate calendar linking climate change, marine degradation and network stability.

Unveiling the calendar, Dr. de Silva said the initiative was not a ceremonial exercise but a corporate statement on responsibility and survival. “Today we are not just unveiling a calendar; we are sharing a story — a story of beauty, resilience and profound responsibility,” he said, stressing that environmental protection had become business-integral for SLT.

The 2026 SLT-Mobitel desk and digital calendar takes viewers beneath Sri Lanka’s seas, focusing on the intricate forms of marine shells and clams. Created by renowned artists Pulasthi Ediriweera and Nalin Jayarathna, the artworks portray seashells as both natural marvels of design and lasting symbols of fragile marine life.

“Each shell is a protective home — a permanent memorabilia left by gentle creatures,” Dr. de Silva said. “In their form and pattern, they send us a silent message about their presence and their urgent need for protection.”

Drawing a direct link between ecological degradation and recent climate-related disasters, Dr. de Silva rejected attempts to mask environmental realities. “You cannot cover this up with fake news. The destruction of forests, hill-country ecosystems, tea estates and irresponsible land use has created these calamities,” he said, referring to recent cyclonic events and flooding.

He warned that climate change and rising sea levels were already affecting SLT’s core infrastructure. Sri Lanka’s international connectivity depends on five subsea communication cables landing in Colombo and Matara. “Unusual sea-level rise and abnormal tides have already caused network outages. When the sea is disturbed, it directly affects the quality and reliability of our network,” he said.

Dr. de Silva said SLT and its international consortium partners follow strict environmental safeguards when laying, maintaining and even disposing of subsea cables. These include detailed environmental surveys, route planning to avoid sensitive marine ecosystems and specialised installation techniques. Cable repair operations based in Galle, he added, also adhere to stringent environmental standards.

“Our work is fundamentally about connection — connecting people, businesses and nations. But this connection must be built with care for the environment that hosts it,” he said, noting that sustainability was not merely a corporate social responsibility obligation but essential to business continuity.

Marine naturalist Dr. Malik Fernando, addressing the launch, highlighted Sri Lanka’s rich but inadequately studied seashell diversity. He said several marine and freshwater mollusc species were protected under existing laws, yet continued to appear in markets due to weak enforcement.

Some shells, including cone shells, are highly venomous and capable of causing human fatalities, Dr. Fernando noted, underscoring the risks posed by unregulated collection. While many mollusc species are widely dispersed due to larval movement, he said certain rare species recorded from limited locations could be near-endemic and vulnerable to extinction.

Dr. Fernando also pointed to the broader challenge of biodiversity research, noting that many species remain unidentified due to the lack of systematic field studies, despite improved access to global scientific resources through digital platforms.

In concluding remarks, Dr. de Silva called on the media to play a responsible role in conveying environmental truths to the public and suggested that the calendar be shared internationally, including at future UN climate conferences. “A digitally empowered Sri Lanka must go hand in hand with preserving its natural wonders,” he said. “This calendar is a reminder that protecting the environment is not optional — it is essential for our future.”

By Ifham Nizam

-

Features6 days ago

Features6 days agoWhy Sri Lanka Still Has No Doppler Radar – and Who Should Be Held Accountable

-

Midweek Review3 days ago

Midweek Review3 days agoHow massive Akuregoda defence complex was built with proceeds from sale of Galle Face land to Shangri-La

-

News2 days ago

News2 days agoPakistan hands over 200 tonnes of humanitarian aid to Lanka

-

News2 days ago

News2 days agoPope fires broadside: ‘The Holy See won’t be a silent bystander to the grave disparities, injustices, and fundamental human rights violations’

-

Latest News6 days ago

Latest News6 days agoLandslide early warnings in force in the Districts of Badulla, Kandy, Kegalle, Kurunegala, Matale, Nuwara Eliya and Ratnapura

-

News3 days ago

News3 days agoBurnt elephant dies after delayed rescue; activists demand arrests

-

Features6 days ago

Features6 days agoSrima Dissanayake runs for president and I get sidelined in the UNP

-

News7 days ago

News7 days agoGovt. okays postgraduate medical training for Maldivian medical officers and dental surgeons