News

TISL takes CIABOC to task for unwarranted redacting of asset declarations

Transparency International Sri Lanka has flayed the Commission to Investigate Allegations of Bribery or Corruption (CIABOC) over the latter’s decision to withhold information that should be freely available to the public.

The text of the TISL statement: The asset declarations of over 100 persons who are obligated to submit their asset and liabilities declarations, including top officials and the President, are now publicly accessible on the Asset Declarations webpage of the Commission to Investigate Allegations of Bribery or Corruption (CIABOC). This is an interim measure to make asset declarations public under the Anti-Corruption Act No. 09 of 2023 (ACA), while CIABOC establishes a centralized electronic system in compliance with the law. While this step towards public transparency is a welcome move, concerns have emerged regarding the extent of information being made available.

TISL expresses deep concern over a significant amount of crucial information that has been arbitrarily and unnecessarily redacted. Information such as bank balances and the dates on which accounts were opened are not revealed, raising serious concerns as to the transparency and effectiveness of these declarations.

According to Section 88(1) of the Anti-Corruption Act, only specific information in the asset declarations shall be redacted:

a. The address of the residence of the declarant or of any other person, whose assets are declared by the declarant;

b. Full address/es of declared real estate except information pertaining to the ward and district in which the real estate is situated;

c. Date of birth, National Identity Card Number, Passport Number or any other number recognized by the relevant authorities for the purpose of identification of individuals mentioned in the declaration

d. Bank account numbers; or

e. Any other deposit details

It appears the authority has taken a very broad approach of interpretation to redact crucial information such as bank balances and dates, in complete disregard of the spirit and intention of the law, thereby defeating the purpose of making asset declarations publicly available. The provision in ACA 88(1)(e) stating “any other deposit details” appears to be misinterpreted. The intention of this provision, seemingly, is to refer to ‘any other’ deposit types that are not bank accounts following the mentioning of ‘bank accounts’ specifically in 88(1)(d). Had the provision intended to include bank account balances, Section 88(1)(d) would have provided for ‘bank account balances and numbers’.

Such arbitrary misinterpretation of the Act undermines the purpose of the asset declaration system and public access to the same, rendering its implementation ineffective. This potential creation of a loophole to skirt the law by public officials and responsible institutions is deeply concerning, and breeds mistrust in the CIABOC’s commitment to effective implementation of the anti-corruption law.

Furthermore, the ACA mandates the CIABOC to verify the identity of individuals requesting redacted asset declarations, which could be done through the collection of the name, National Identity Card number and telephone number. Despite this, CIABOC has introduced a mandatory email address requirement, which is not necessary for identity verification, particularly when essential identifiers are already required. TISL is concerned that this unnecessary and unmandated requirement creates an additional barrier, restricting access to asset declarations to a large number of the public across the island.

Making asset declarations public is a recommendation by the International Monetary Fund that is now an element in the Government Action Plan for implementation. One of the objectives is to enable the public to monitor potential unjust enrichment by public officials, which is undermined by the actions of CIABOC with its unnecessary extent of redaction. For public access to be meaningful in the current reform process, TISL urges the CIABOC to reconsider the extent of the current redactions in the spirit of fully implementing the law, ensuring that crucial and sufficient information is available for citizens in holding public officials accountable. Swift action needs to be taken, considering the effective utilisation of such publicly accessible asset declarations, especially in implementing upcoming laws on Proceeds of Crime and Beneficial Ownership.

News

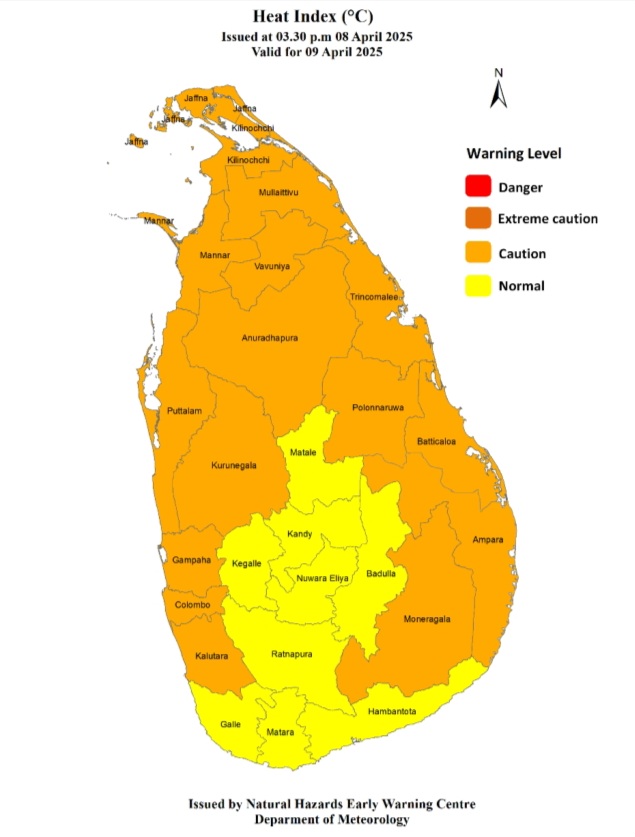

Heat index at ‘Caution level’ in Northern, North-central, Eastern, North-western, Western provinces and Monaragala district today [09]

The Natural Hazards Early Warning Centre of the Department of Meteorology has issued a Warm Weather Advisory for 09 April 2025

The public are warned that the Heat index, the temperature felt on human body is likely to increase up to ‘Caution level’ at some places in Northern, North-central, Eastern, North-western, and Western provinces and in Monaragala district.

The Heat Index Forecast is calculated by using relative humidity and maximum temperature and this is the condition that is felt on your body. This is not the forecast of maximum temperature. It is generated by the Department of Meteorology for the next day period and prepared by using global numerical weather prediction model data.

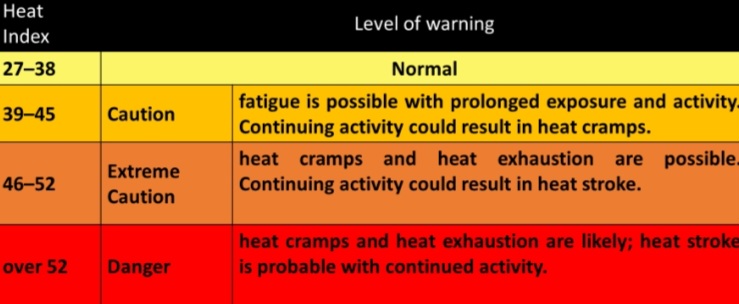

Effect of the heat index on human body is mentioned below is prepared on the advice of the Ministry of Health and Indigenous Medical Services.

ACTION REQUIRED

Job sites: Stay hydrated and takes breaks in the shade as often as possible.

Indoors: Check up on the elderly and the sick.

Vehicles: Never leave children unattended.

Outdoors: Limit strenuous outdoor activities, find shade and stay hydrated. Dress: Wear lightweight and white or light-colored clothing.

Note:

In addition, please refer to advisories issued by the Disaster Preparedness & Response Division, Ministry of Health in this regard as well. For further clarifications please contact 011-7446491.

News

Sajith asks govt. to submit its MoUs with India to Parliament

Prof. Jayasumana raises possibility of Lanka ending up with “Quad’

Opposition and SJB Leader Sajith Premadasa has said it is the responsibility of the NPP government to submit the MoUs/agreements that were recently signed with India to the respective Sectoral Oversight Committees (SOCs).

Premadasa said so when The Island raised the issue with him. He said that during his meeting with Premier Modi his focus had been on opening the Indian market for Sri Lankan garment exports.

The seven MoUs/agreements signed on 05 April included defence cooperation, energy, Eastern Province development and digitalisation.

Meanwhile, the Vice President of Sarvajana Balaya and former lawmaker Prof. Channa Jayasumana said that the government owed an explanation whether the recently signed MoU on defence cooperation directly or indirectly attached Sri Lanka to the Quad security alliance, consisting of the US, Australia, Japan and India.

The former SLPPer raised the issue at a meeting held at Boralesgamuwa on Monday (07) in support of Sarvajana Balaya candidates contesting the May 6 LG polls.

The former SLPPer raised the issue at a meeting held at Boralesgamuwa on Monday (07) in support of Sarvajana Balaya candidates contesting the May 6 LG polls.

Prof. Jayasumana urged that the MoU on Defence Cooperation be placed before Parliament, and the people, without further delay. The academic who served as State Health Minister during President Gotabaya Rajapaksa’s tenure said that President Anura Kumara Dissanayake’s foreign policy direction should be dealt with.

By Shamindra Ferdinando

News

Govt. won’t extend suspension of ‘parate executions’

The government would not extend the suspension of ‘parate executions’ that was now effective, Deputy Minister of Finance Harshana Suriyapperuma told Parliament yesterday.

Suriyapperuma said so in response to a question raised by Opposition Leader Sajith Premadasa, who asked about the government’s plans regarding a relief package to assist small and medium-scale enterprises (SMEs) struggling to repay loans.

Pointing out that about 263,000 SMEs had closed down, Premadasa asked what action the government would take to address the grievances of these SMEs.

He said that from 01 Jan., 2019, to 01 Dec., 31, 2023, licensed banks had collected Rs. 113.7 billion through 2,263 parate executions. As of 31 Dec., 2024, Rs. 1,380 billion had been recovered from Stage III defaulters.

The government has introduced loan schemes to assist SMEs impacted by the economic crisis. They included capital loans of up to Rs. 10 million, with a six-month grace period and a three-year repayment term at 8% interest, Suriyapperuma said. Additionally, another loan scheme under the consolidated fund aimed to help SMEs that werecurrently paying their loans. That scheme offered loans of up to Rs. 15 million, which must be repaid over ten years with a one-year grace period and a 7% interest rate. For SMEs that had defaulted on their loans, a loan of up to Rs. 5 million is available at 8% interest, with a six-month grace period and a five-year repayment term, Suriyapperuma said.

By Saman Indrajith

-

Business2 days ago

Business2 days agoColombo Coffee wins coveted management awards

-

Business4 days ago

Business4 days agoDaraz Sri Lanka ushers in the New Year with 4.4 Avurudu Wasi Pro Max – Sri Lanka’s biggest online Avurudu sale

-

Features3 days ago

Features3 days agoStarlink in the Global South

-

Business5 days ago

Business5 days agoStrengthening SDG integration into provincial planning and development process

-

Business4 days ago

Business4 days agoNew SL Sovereign Bonds win foreign investor confidence

-

Sports6 days ago

Sports6 days agoTo play or not to play is Richmond’s decision

-

Features3 days ago

Features3 days agoModi’s Sri Lanka Sojourn

-

Sports5 days ago

Sports5 days agoNew Zealand under 85kg rugby team set for historic tour of Sri Lanka