Features

THE POST-WAR PERIOD AND INDEPENDENCE

Continued from last week

NU’s Career Advances

In May of 1942, a month after the Japanese attack, NU was promoted to a higher post within the Department of Commerce and Industries. He was also seconded to serve as Deputy Commissioner in the Department of Commodity Purchase, where he was placed in charge of arranging the supply of commodities such as desiccated coconut and copra to the Food Ministry in Britain. (Interestingly, NU had selected “The Oil Seed Trade with Specific Reference to Copra” as his special subject when he applied for his M.Sc. (Econ.) degree. Correspondence from his Personal Files show that, while NU was studying at the LSE, Professor Paish, who was one of his professors, recommended NU to a London merchant dealing in edible oils, to carry out a survey of “The Trade in Edible Oils… from Production, through Importation, Distribution and Marketing to Consumers’ Demand” (N.U. Jayawardena Personal Files).

In NU’s words:

As Deputy Commissioner of Commodity Purchase, it fell to my lot to plan out the organization of the department in the early stages, particularly in regard to the purchase schemes for copra, oil and plumbago. Later I was engaged in reorganizing the operative methods of the Department and, in this connection, compiled a comprehensive code of departmental instructions.

He listed the activities of the Department of Commodity Purchase, “which was run on business lines,” and described the strength of the staff:

[There were] 11 Staff Officers including a full-time Commissioner and myself as Deputy, a store personnel of 112, and a clerical establishment of 117, while the annual turnover of the transactions of the Department exceeds Rs. 50 million. (N.U. Jayawardena Personal Files)

The Department of Commodity Purchase was based in the Bristol Hotel, which was located opposite the Cargill’s store, in the Colombo Fort. The Director of the Department was L.J.B. Turner, for whom NU had earlier worked at the Registrar General’s Office. In his rapid career ascent, NU would begin to catch up with and overtake persons for whom he had worked earlier. In 1946, he was appointed Acting Commissioner of War Risks Insurance to fill in for F. Leach, who had left the country. One may recall that it was F. Leach who had tried to appoint a Mudaliyar’s son over NU when he had applied for his first government job as a junior clerk of the District Road Committee in Hambantota (see Chapter 5).

Another Career Landmark

In June of 1946, NU was seconded to serve in the newly created post of Additional Controller of Finance and Supplies (Economics), in addition to the other posts he held. This was the first posting in the Treasury Department and it would have brought him much satisfaction, as the Treasury Department was considered to be the pinnacle of the civil service. Such a swift ascent was bound to create problems. The ‘mandarins’ of the Civil Service did not take kindly to the promotions which NU, the outsider, was given by the time he was 38, and to the multiple posts he held. Their resentment was all the more because the salary he received from these combined posts was ‘somewhat in excess of two Officers of State, one of whom was [his] superior authority’ (N.U. Jayawardena, 11 May 1987, p.3).

NU had risen on proven merit, rather than by passing the Civil Service examination, and as head of four separate departments, he received an income equal to a Class 1, Grade II official of the Ceylon Civil Service – even though he was not a member. This led the

Ceylon Civil Service Association to lodge a strong protest against NU. ( There is a letter addressed to NU in his Personal Files, dated 18 November 1946, in which the Chief Secretary wrote to inform him of his provisional appointment, to act “in addition to your own duties… as Additional Commissioner, Commodity Purchase, and Commissioner, War Risks Insurance, pending receipt of the advice of the Public Services Commission” (emphasis added). In this connection, NU described in detail a revealing episode involving the Acting Financial Secretary, C.E. Jones, which clearly exemplifies the phenomenon of the dethroning of the old guard elite – the “cultivated gentlemen” – by specialist technocrats who succeeded on merit (mentioned in the previous chapter):

There was, before [the Acting Financial Secretary] a rather bulky file containing dispatches from the Secretary of State on a highly complex subject of Economic Relations, which it fell to my lot to study, analyse and present in the form of a comprehensive report to… the Governor… to be signed by the Financial Secretary, together with a lengthy dispatch to the Secretary of State. [This was] a subject he did not know, [and] on which he could rely without reservation on my analysis and presentation. He then handed them the file with the request that if they or their colleagues felt they could do a better job than I had done, they were free to identify such a person to take over my position and other positions I held, and also receive the aggregate emoluments I was paid. (Apart from being dependent on NU to get through his work, it is interesting to speculate whether C.E. Jones’ sympathies with NU may have been strengthened due to the fact that Jones, too, had graduated from the London University (BSc.), unlike many of the senior members of the Ceylon Civil Service who were mostly products of Cambridge and Oxfor (ibid)

Following this interview with Jones, the representatives of the Civil Service Association left NU – as he triumphantly termed it – “severely alone.” Whether he was disturbed or not by the episode, NU was not slow to see its moral. Though he noted that it spoke volumes for the Association’s sense of ‘fair play’ and ‘merit,’ it no doubt made NU aware of the pitfalls and hazards of holding important positions in public life. Chapter 10 can read online on https://island.lk/nu-at-the-london-school-of-economics/

In regard to finance, my government intends to seek expert advice with regard to changes in our financial structure which may be necessitated by the transition from a colonial to a free, national economy.

(Throne Speech, Sir Henry Monck-Mason Moore, Governor, 25 Nov. 1947)

The post-war period presented the country with a series of further economic hardships and challenges. The burdens of inflation, shortages of food and other imported items, as well as rationing and a series of controls, increased in the war’s aftermath. The State continued to play an interventionist role in the market, stepping up its regulatory controls, due to the continuing shortages of essential goods and the scarcity of exchange with which to buy these goods. Stanley Wickramaratne has aptly described, the “plethora of controls” regulating the supply of goods and services, and in general the free mobility of its citizens during and after the Second World War, which

… were departmentalized by the State and named Food Control, Textile Control, Rubber Control, Tea Control, Milk Food Control, Petrol Control, Poonac Control, Price Control and Import-Export and Exchange Control…

[After] Independence these control mechanisms gradually ceased to function except the last two mentioned. (Wickramaratne, 2002)

Sri Lanka was adversely impacted by factors associated with the worldwide economic and physical destruction caused by the war and had to hold its own in a world reeling from economic breakdown. Competing for access to markets and limited resources from a weak position, Sri Lanka had few options and was held hostage to the vagaries of the international market. As a small nation with an undiversified economy, it relied heavily on the export of a few agricultural commodities – primarily tea and rubber – for a large part of its revenue. (According to Das Gupta (1949, p.9), Sri Lanka produced “only a few things, but produces them almost entirely for export,” and derived about 60% of

its income from agricultural exports, producing only a quarter to a third of its total rice requirements.) Furthermore, it was not self-sufficient in the production of essential goods and was disadvantaged by an undeveloped banking system and capital market, as well as the lack of an industrial base. Thus, Sri Lanka had next to no recourse to internal financing that could help provide a financial cushion to tide over this period, nor the means to provide the investment capital to step up local production of essential goods to replace costly imports.

There was much that needed to be worked out and negotiated, and new institutions had to be set up to help meet the needs of the soon-to-be independent Sri Lanka and the challenges of the evolving post-war economic order. In addition, financial and trade arrangements had to be planned to bridge the immediate needs of the nation. After independence, Sri Lanka would be faced with the additional challenge of asserting itself as an independent sovereign nation.

NU described his work during this period of transition as a time when he “performed the functions of the principal financial and economic adviser to the Ceylon Government” (N.U. Jayawardena Personal Files). Over the four-year period, which stretched from 1946 to 1950, NU attended and assisted in several international conferences and negotiations. On the eve of national independence, NU would rise from his position as Controller of Finance and Supplies (Economics) to become both Controller of Exchange and Controller of Imports and Exports, and would set up the machinery for the operations of exchange control.

Declining Terms of Trade

By the war’s end, Sri Lanka had managed to accumulate substantial foreign-exchange surpluses, which were largely due to increased earnings from stepped-up rubber production, a reduction in imports during wartime as well as payments for basing the British South East Asia Command in Sri Lanka. However, as pointed out by Das Gupta (1949, p.31), these surpluses were “a measure not so much of prosperity but of privation,” since during the war, these could not be utilized as desired to purchase essential imports, and consumption had to be curtailed at great hardship to the population. Furthermore, following the war, these hard-earned savings actually lost value in real terms as the prices of imports rose sharply and the rise in the export price of rubber – Sri Lanka’s major export – did not keep pace. The restoration of Malaysian and Indonesian rubber stocks to the world market, and consequent increase in supply, had a somewhat dampening effect on the world price of rubber.

Sri Lanka’s foreign-exchange surpluses were quickly depleted, even though consumption continued to be restricted by the government to meet this dilemma. Ironically, by the year 1947, although imports were reduced to about the same level they had been in 1938, the economy experienced a balance-of-payments crisis, owing to a decline in the terms of trade. The case of rice imports starkly illustrates the economic dilemma Sri Lanka faced. According to Das Gupta, in 1947, Sri Lanka imported half the quantity of rice it had in 1938, but the bill for this was about two and a half times what it had been in 1938 (ibid, pp.90-91).

NU’s Link with Oliver Goonetilleke

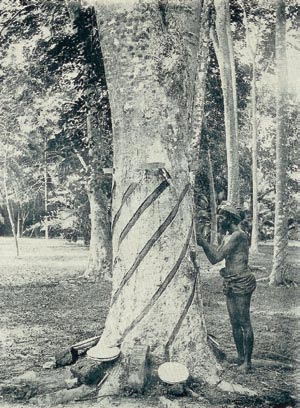

In 1945, Oliver Goonetilleke (OEG) was appointed to the prestigious post of Financial Secretary – one of the three Officers of State – as the first (and last) Sri Lankan to hold this position. NU would now work more closely with him. In 1946, on one of his first high-level visits abroad, NU accompanied OEG to the UK to assist him in the negotiations with the British government on “post-war financial issues affecting Sri Lanka” (Ceylon Civil List, 1950, p.86). According to Jeffries, during this period one of the chief areas of negotiation involved “the continual struggle to secure an economic price for Ceylon rubber” (1969, p.106). When Indonesia and Malaysia fell under Japanese control during the war, both Britain and its allies relied heavily on Sri Lanka to step up production to meet the shortfall in this critical war material. At the war’s end, Sri Lanka’s rubber yields were adversely affected due to the wartime “slaughtertapping” (over-tapping) of its rubber trees. ( Das Gupta stated that at least one-quarter of all the rubber trees in Sri Lanka had been slaughter-tapped during the war.) According to Jeffries:

The [Sri Lankan rubber] industry had already sacrificed its interest in order that the war might be won, but now Ceylon was being expected to compete on equal terms in the market with Malaya and Indonesia whose plantations were in full production after the enforced wartime rest. (Jeffries, 1969, p.106) ( Sri Lanka’s strong reliance on rubber for its revenue continued into the early 1950s. In 1952 R.G. Senanayake, who was Minister of Trade and Commerce, negotiated a Rubber-Rice Pact with the People’s Republic of China, in which the former agreed to purchase Sri Lanka’s entire annual output of rubber for five years at a premium, in exchange for rice supplied at a price well below the world market price (see de Silva & Wriggins, 1988, pp.269-71).)

OEG, who had a reputation as an astute negotiator, would have reminded the British government of Sri Lanka’s loyal support and sacrifices made during the war and of Britain’s moral obligation towards Sri Lanka. His skills of persuasion were legendary both in Sri Lanka and in Britain. A British government official was said to have woefully remarked that, “after shaking hands with him, it was advisable to check that all one’s fingers were there” (ibid, p.82). OEG once described himself as “no chicken in either strategy or in tactics” (ibid, p.74); and NU characterized him as someone who was “uncommonly intelligent,” and “highly imaginative… astute to the point of being uncanny, and an able negotiator” (quoted in de Zoysa manuscript, p.15).

Negotiations in London took place over a period of three and a half months from the end of July to mid-November 1946. An interesting side note to this episode is that during this time, NU visited his professors at the London School of Economics to inquire into the possibilities of resuming studies for his interrupted M.Sc. degree. He apparently had not abandoned hopes of completing his studies for a postgraduate degree. Although records show that his professors were amenable to this proposition, NU’s career again overtook him and he never completed this degree (LSE Student Records on N.U. Jayawardena).

Independence

Earlier in 1942, when the British government entered into discussions with India on the question of its independence, the Sri Lankan leadership also began to place pressure on the British regarding the same issue. According to Charles Jeffries, the Civil Defence Department

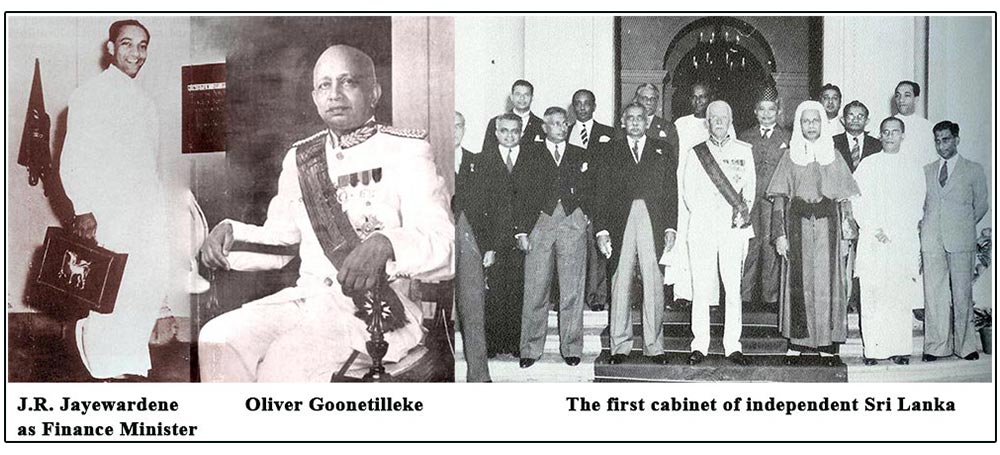

became the regular meeting place for “the triumvirate” of D.S. Senanayake, Oliver Goonetilleke and Ivor Jennings, who planned and worked out the negotiating points and strategies that would be undertaken towards this goal (Jeffries, pp.68-69). By 1943, this group had managed to wrest preliminary terms of agreement from the colonial government. In December 1944, a Commission composed of Lord Soulbury, Sir Frederick Rees and Frederick Burrows visited the island, and the resulting Soulbury Constitution (1947) introduced to the country a parliamentary government with a cabinet system for the first time. Elections were held under this constitution in August and September 1947, and the newly founded United National Party (UNP) formed the government. Its leader, D.S. Senanayake became the first Prime Minister of Sri Lanka and J.R. Jayewardene (JR) was appointed Finance Minister.

Working with J.R. Jayewardene

NU worked with JR in various official capacities over a period of nearly six years. He first came to know JR in 1946, when NU was appointed, along with his colleague K. Williams, to the Treasury in the newly created positions of Controller of Finance and Supply (Economics) – a year before JR assumed office as Finance Minister. NU was to work for him successively in his capacities as Controller of Exchange, Deputy Governor and Governor of the Central Bank.

NU found JR to be an unassuming and courteous Minister, who was never “intellectually stubborn or arrogant,” and who possessed a “fine sense of humour.” He found him “more ready to learn than to talk” and felt he “brought to bear a trained… [and] legal mind”

(N.U. Jayawardena, c.1985, p.59). According to NU:

JR wanted facts and their analysis, but would not accept any rendering of analysis unless he was convinced of its validity… He was thus more concerned with the substance and less with the detail… JR was quick to perceive and was not slow to decide, which he did with deliberation but once he had decided he remained unshakeable unless new facts or new situations emerged to justify the review of decisions taken. (ibid)

For NU, working for JR was “both a demanding duty and an intellectual pleasure” (ibid). He found in JR an eagerness to learn – a quality which NU himself valued and shared. JR, a lawyer by profession, felt he needed a grounding in economics. NU worked closely

with him, explaining the economic realities to the Minister – as did Professor B.B. Das Gupta of the Economics Department of the University, whom JR consulted on economic issues. The new Finance Minister had to absorb his lessons quickly, as he had to contend with several technically complex issues and crises during this period, including the international negotiations that led to two Sterling Assets Agreements with the UK, setting up the exchange control machinery required to ensure the success of these agreements, as well as laying the groundwork for the creation of a Central Bank. NU would be centrally involved in all of these areas.

Controller of Exchange

NU was appointed Controller of Exchange in April 1947. This was a prestigious post in which he was the implementer of some “purely central banking functions,” including “the determination of foreign exchange rates, control of foreign exchange holdings of commercial banks, and arrangements for forward cover” (N.U. Jayawardena, 1950, p.11). Exchange control originally came into operation in Sri Lanka upon the outbreak of war in Europe in September 1939, and was initially restricted to financial transactions in the non-sterling area. NU started out with a “skeleton staff” of nine members, working from an office on the first floor of the De Mel Building on Chatham Street (N.U. Jayawardena, 1949, p.29).

Near the end of 1947, Sri Lanka suffered a severe drain on its “overseas balances,” which was also causing “serious financial difficulties” to Britain. This crisis resulted in the government’s tentative decision to extend exchange control to include the sterling area – in other words, it would now cover “all financial transactions between Ceylon and the outside world” (ibid, p.10; and N.U. Jayawardena, 1950, p.3). Before undertaking this step, NU was sent to spend a “short but useful period” at the Reserve Bank of India in Mumbai to study the exchange control operations of that institution.( . A couple of months earlier, in September 1947, India had already extended her controls to cover the sterling area, due to similar circumstances (N.U. Jayawardena, 1949, p.10). He later spent additional time studying the exchange control operations at the Bank of England to obtain further technical training. When exchange control was extended to cover the sterling areas in June 1948, NU was appointed full-time Controller of Exchange and relieved of his other duties to enable him to devote his full energies and attention to exchange control (ibid, p.12).

This extension of controls “multiplied the volume of work manifold,” demanding “a new orientation of policy on principles which bore little relationship to the practices pertaining to non-sterling area transactions” (The increased scale of operations can be put into perspective if one bears in mind that at that time, 60% of all imports and 70% of all exports were transacted with sterling-area countries (see de Silva & Wriggins, p.220).

Also, earlier, exchange control was limited to a few but not all countries in the non-sterling area, and these “transactions were mainly derived from instructions received from the Secretary of State for the Colonies” (N.U. Jayawardena, 1949, p.11). (ibid, p.11). With the introduction of extended controls, every transaction involving foreign trade or foreign remittances had to pass through the Exchange Control Department and therefore required close coordination with other government departments such as Customs, the Post Office, Import and Export Control, and Food Control. In addition, an advisory committee, which included the heads of the main banks such as the Bank of Ceylon and the Imperial Bank, was formed to give advice to the Controller.

A comprehensive manual was drawn up and distributed to banks and authorized exchange dealers as well. A large number of staff members had to be recruited to carry out the expanded operations, requiring the Department to locate to more spacious quarters on York Street. ( The extent and rate of increase in staff numbers gives some indication of the onerous nature of exchange control operations. After relocating to York Street, by the end of 1948, a mere one and a half years after NU took over as Exchange Controller, the staff would increase to 191 members. “Congested conditions” later necessitated a further move to more spacious quarters in Echelon Barracks, some time in 1950 (N.U. Jayawardena, 1949, p.32).

In spite of the recruitment of additional staff, NU noted that: “it was still necessary to work long hours at a stretch to keep the machinery of control working and to avoid delays and inconvenience to the… public.”

Another challenge during the first year of operations was to train the staff, who initially did not have the technical knowledge required to carry out these controls. According to NU, it was “to their credit that they overcame this handicap in a short time” (N.U. Jayawardena,

1949, p.11). In his Administrative Report for the year 1949, NU described the year as a “trying and strenuous year” for his staff. He proudly noted that it gave him “no little pleasure to record that the Department of Exchange Control has, on the whole, maintained a high

reputation… an achievement of which every member of the staff should justly be proud” (N.U. Jayawardena, 1950, p.22). NU described exchange control as “an irksome restriction,” however, noting that it was a necessity at that time to promote a “more equitable distribution of goods in short supply.” Nonetheless, NU’s firm belief in the superiority of the market mechanism clearly comes out in this report, when he speculates about alternatives to exchange control, asking whether its ends could not be better served by:

methods based on the alternative principle of regulating the demand for foreign currencies at a stable exchange rate through the price mechanism. This is undoubtedly a question with many implications, administrative, economic and financial… It… deserves close study… by everyone who naturally resents the irksome restrictions of control. (ibid, p. 23, emphasis added)

A Passion for Work

There was no cutting back on his working hours when NU reached the position of Controller of Exchange. As before, a twelve-hour workday was the rule – with eighteen hours not being unusual. His daughter Neiliya recalls how NU would often ask her mother to

bring her for a drive and to pick him up in office:

I remember my mother and myself going to the Exchange Controller’s office, and sitting in the car for an hour or more waiting for my father to finish work. But he always kept us waiting. His assistant would bring bundles and bundles of files when he finally came down and put them in the luggage boot. This was always after 7:30 or 8 p.m.

Neiliya recalls how at other times:

I would have my dinner and go with my mother and pick him up. I would be given an ice-cream cone on the way home. He would go home and have a shower, have dinner and sit with his files from about 10 p.m. and work until around 2 a.m. He would then get up at 5 a.m., work until 7.30 a.m. and we would see him at his desk on our way out to school.

To be continued

(Excerpted from N.U. JAYAWARDENA The first five decades)

By Kumari Jayawardena and Jennifer Moragoda ✍️

Features

Indian Ocean Security: Strategies for Sri Lanka

During a recent panel discussion titled “Security Environment in the Indo-Pacific and Sri Lankan Diplomacy”, organised by the Embassy of Japan in collaboration with Dr. George I. H. Cooke, Senior Lecturer and initiator of the Awarelogue Initiative, the keynote address was delivered by Prof Ken Jimbo of Kelo University, Japan (Ceylon Today, February 15, 2026).

The report on the above states: “Prof. Jimbo discussed the evolving role of the Indo-Pacific and the emergence of its latest strategic outlook among shifting dynamics. He highlighted how changing geopolitical realities are reshaping the region’s security architecture and influencing diplomatic priorities”.

“He also addressed Sri Lanka’s position within this evolving framework, emphasising that non-alignment today does not mean isolation, but rather, diversified engagement. Such an approach, he noted, requires the careful and strategic management of dependencies to preserve national autonomy while maintaining strategic international partnerships” (Ibid).

Despite the fact that Non-Alignment and Neutrality, which incidentally is Sri Lanka’s current Foreign Policy, are often used interchangeably, both do not mean isolation. Instead, as the report states, it means multi-engagement. Therefore, as Prof. Jimbo states, it is imperative that Sri Lanka manages its relationships strategically if it is to retain its strategic autonomy and preserve its security. In this regard the Policy of Neutrality offers Rule Based obligations for Sri Lanka to observe, and protection from the Community of Nations to respect the territorial integrity of Sri Lanka, unlike Non-Alignment. The Policy of Neutrality served Sri Lanka well, when it declared to stay Neutral on the recent security breakdown between India and Pakistan.

Also participating in the panel discussion was Prof. Terney Pradeep Kumara – Director General of Coast Conservation and Coastal Resources Management, Ministry of Environment and Professor of Oceanography in the University of Ruhuna.

He stated: “In Sri Lanka’s case before speaking of superpower dynamics in the Indo-Pacific, the country must first establish its own identity within the Indian Ocean region given its strategically significant location”.

“He underlined the importance of developing the ‘Sea of Lanka concept’ which extends from the country’s coastline to its 200nauticalmile Exclusive Economic Zone (EEZ). Without firmly establishing this concept, it would be difficult to meaningfully engage with the broader Indian Ocean region”.

“He further stated that the Indian Ocean should be regarded as a zone of peace. From a defence perspective, Sri Lanka must remain neutral. However, from a scientific and resource perspective, the country must remain active given its location and the resources available in its maritime domain” (Ibid).

Perhaps influenced by his academic background, he goes on to state:” In that context Sri Lanka can work with countries in the Indian Ocean region and globally, including India, China, Australia and South Africa. The country must remain open to such cooperation” (Ibid).

Such a recommendation reflects a poor assessment of reality relating to current major power rivalry. This rivalry was addressed by me in an article titled “US – CHINA Rivalry: Maintaining Sri Lanka’s autonomy” ( 12.19. 2025) which stated: “However, there is a strong possibility for the US–China Rivalry to manifest itself engulfing India as well regarding resources in Sri Lanka’s Exclusive Economic Zone. While China has already made attempts to conduct research activities in and around Sri Lanka, objections raised by India have caused Sri Lanka to adopt measures to curtail Chinese activities presumably for the present. The report that the US and India are interested in conducting hydrographic surveys is bound to revive Chinese interests. In the light of such developments it is best that Sri Lanka conveys well in advance that its Policy of Neutrality requires Sri Lanka to prevent Exploration or Exploitation within its Exclusive Economic Zone under the principle of the Inviolability of territory by any country” ( https://island.lk/us- china-rivalry-maintaining-sri-lankas-autonomy/). Unless such measures are adopted, Sri Lanka’s Exclusive Economic Zone would end up becoming the theater for major power rivalry, with negative consequences outweighing possible economic gains.

The most startling feature in the recommendation is the exclusion of the USA from the list of countries with which to cooperate, notwithstanding the Independence Day message by the US Secretary of State which stated: “… our countries have developed a strong and mutually beneficial partnership built on the cornerstone of our people-to-people ties and shared democratic values. In the year ahead, we look forward to increasing trade and investment between our countries and strengthening our security cooperation to advance stability and prosperity throughout the Indo-Pacific region (NEWS, U.S. & Sri Lanka)

Such exclusions would inevitably result in the US imposing drastic tariffs to cripple Sri Lanka’s economy. Furthermore, the inclusion of India and China in the list of countries with whom Sri Lanka is to cooperate, ignores the objections raised by India about the presence of Chinese research vessels in Sri Lankan waters to the point that Sri Lanka was compelled to impose a moratorium on all such vessels.

CONCLUSION

During a panel discussion titled “Security Environment in the Indo-Pacific and Sri Lankan Diplomacy” supported by the Embassy of Japan, Prof. Ken Jimbo of Keio University, Japan emphasized that “… non-alignment today does not mean isolation”. Such an approach, he noted, requires the careful and strategic management of dependencies to preserve national autonomy while maintaining strategic international partnerships”. Perhaps Prof. Jimbo was not aware or made aware that Sri Lanka’s Foreign Policy is Neutral; a fact declared by successive Governments since 2019 and practiced by the current Government in the position taken in respect of the recent hostilities between India and Pakistan.

Although both Non-Alignment and Neutrality are often mistakenly used interchangeably, they both do NOT mean isolation. The difference is that Non-Alignment is NOT a Policy but only a Strategy, similar to Balancing, adopted by decolonized countries in the context of a by-polar world, while Neutrality is an Internationally recognised Rule Based Policy, with obligations to be observed by Neutral States and by the Community of Nations. However, Neutrality in today’s context of geopolitical rivalries resulting from the fluidity of changing dynamics offers greater protection in respect of security because it is Rule Based and strengthened by “the UN adoption of the Indian Ocean as a Zone of peace”, with the freedom to exercise its autonomy and engage with States in pursuit of its National Interests.

Apart from the positive comments “that the Indian Ocean should be regarded as a Zone of Peace” and that “from a defence perspective, Sri Lanka must remain neutral”, the second panelist, Professor of Oceanography at the University of Ruhuna, Terney Pradeep Kumara, also advocated that “from a Scientific and resource perspective (in the Exclusive Economic Zone) the country must remain active, given its location and the resources available in its maritime domain”. He went further and identified that Sri Lanka can work with countries such as India, China, Australia and South Africa.

For Sri Lanka to work together with India and China who already are geopolitical rivals made evident by the fact that India has already objected to the presence of China in the “Sea of Lanka”, questions the practicality of the suggestion. Furthermore, the fact that Prof. Kumara has excluded the US, notwithstanding the US Secretary of State’s expectations cited above, reflects unawareness of the geopolitical landscape in which the US, India and China are all actively known to search for minerals. In such a context, Sri Lanka should accept its limitations in respect of its lack of Diplomatic sophistication to “work with” such superpower rivals who are known to adopt unprecedented measures such as tariffs, if Sri Lanka is to avoid the fate of Milos during the Peloponnesian Wars.

Under the circumstances, it is in Sri Lanka’s best interest to lay aside its economic gains for security, and live by its proclaimed principles and policies of Neutrality and the concept of the Indian Ocean as a Zone of Peace by not permitting its EEC to be Explored and/or Exploited by anyone in its “maritime domain”. Since Sri Lanka is already blessed with minerals on land that is awaiting exploitation, participating in the extraction of minerals at the expense of security is not only imprudent but also an environmental contribution given the fact that the Sea and its resources is the Planet’s Last Frontier.

by Neville Ladduwahetty

Features

Protecting the ocean before it’s too late: What Sri Lankans think about deep seabed mining

Far beneath the waters surrounding Sri Lanka lies a largely unseen frontier, a deep seabed that may contain cobalt, nickel and rare earth elements essential to modern technologies, from smartphones to electric vehicles. Around the world, governments and corporations are accelerating efforts to tap these minerals, presenting deep-sea mining as the next chapter of the global “blue economy.”

For an island nation whose ocean territory far exceeds its landmass, the question is no longer abstract. Sri Lanka has already demonstrated its commitment to ocean governance by ratifying the United Nations High Seas Treaty (BBNJ Agreement) in September 2025, becoming one of the early countries to help trigger its entry into force. The treaty strengthens biodiversity conservation beyond national jurisdiction and promotes fair access to marine genetic resources.

Yet as interest grows in seabed minerals, a critical debate is emerging: Can Sri Lanka pursue deep-sea mining ambitions without compromising marine ecosystems, fisheries and long-term sustainability?

Speaking to The Island, Prof. Lahiru Udayanga, Dr. Menuka Udugama and Ms. Nethini Ganepola of the Department of Agribusiness Management, Faculty of Agriculture & Plantation Management, together with Sudarsha De Silva, Co-founder of EarthLanka Youth Network and Sri Lanka Hub Leader for the Sustainable Ocean Alliance, shared findings from their newly published research examining how Sri Lankans perceive deep-sea mineral extraction.

The study, published in the journal Sustainability and presented at the International Symposium on Disaster Resilience and Sustainable Development in Thailand, offers rare empirical insight into public attitudes toward deep-sea mining in Sri Lanka.

Limited Public Inclusion

“Our study shows that public inclusion in decision-making around deep-sea mining remains quite limited,” Ms. Nethini Ganepola told The Island. “Nearly three-quarters of respondents said the issue is rarely covered in the media or discussed in public forums. Many feel that decisions about marine resources are made mainly at higher political or institutional levels without adequate consultation.”

The nationwide survey, conducted across ten districts, used structured questionnaires combined with a Discrete Choice Experiment — a method widely applied in environmental economics to measure how people value trade-offs between development and conservation.

Ganepola noted that awareness of seabed mining remains low. However, once respondents were informed about potential impacts — including habitat destruction, sediment plumes, declining fish stocks and biodiversity loss — concern rose sharply.

“This suggests the problem is not a lack of public interest,” she told The Island. “It is a lack of accessible information and meaningful opportunities for participation.”

Ecology Before Extraction

Dr. Menuka Udugama said the research was inspired by Sri Lanka’s growing attention to seabed resources within the wider blue economy discourse — and by concern that extraction could carry long-lasting ecological and livelihood risks if safeguards are weak.

“Deep-sea mining is often presented as an economic opportunity because of global demand for critical minerals,” Dr. Udugama told The Island. “But scientific evidence on cumulative impacts and ecosystem recovery remains limited, especially for deep habitats that regenerate very slowly. For an island nation, this uncertainty matters.”

She stressed that marine ecosystems underpin fisheries, tourism and coastal well-being, meaning decisions taken about the seabed can have far-reaching consequences beyond the mining site itself.

Prof. Lahiru Udayanga echoed this concern.

“People tended to view deep-sea mining primarily through an environmental-risk lens rather than as a neutral industrial activity,” Prof. Udayanga told The Island. “Biodiversity loss was the most frequently identified concern, followed by physical damage to the seabed and long-term resource depletion.”

About two-thirds of respondents identified biodiversity loss as their greatest fear — a striking finding for an issue that many had only recently learned about.

A Measurable Value for Conservation

Perhaps the most significant finding was the public’s willingness to pay for protection.

“On average, households indicated a willingness to pay around LKR 3,532 per year to protect seabed ecosystems,” Prof. Udayanga told The Island. “From an economic perspective, that represents the social value people attach to marine conservation.”

The study’s advanced statistical analysis — using Conditional Logit and Random Parameter Logit models — confirmed strong and consistent support for policy options that reduce mineral extraction, limit environmental damage and strengthen monitoring and regulation.

The research also revealed demographic variations. Younger and more educated respondents expressed stronger pro-conservation preferences, while higher-income households were willing to contribute more financially.

At the same time, many respondents expressed concern that government agencies and the media have not done enough to raise awareness or enforce safeguards — indicating a trust gap that policymakers must address.

“Regulations and monitoring systems require social acceptance to be workable over time,” Dr. Udugama told The Island. “Understanding public perception strengthens accountability and clarifies the conditions under which deep-sea mining proposals would be evaluated.”

Youth and Community Engagement

Ganepola emphasised that engagement must begin with transparency and early consultation.

“Decisions about deep-sea mining should not remain limited to technical experts,” she told The Island. “Coastal communities — especially fishers — must be consulted from the beginning, as they are directly affected. Youth engagement is equally important because young people will inherit the long-term consequences of today’s decisions.”

She called for stronger media communication, public hearings, stakeholder workshops and greater integration of marine conservation into school and university curricula.

“Inclusive and transparent engagement will build trust and reduce conflict,” she said.

A Regional Milestone

Sudarsha De Silva described the study as a milestone for Sri Lanka and the wider Asian region.

“When you consider research publications on this topic in Asia, they are extremely limited,” De Silva told The Island. “This is one of the first comprehensive studies in Sri Lanka examining public perception of deep-sea mining. Organizations like the Sustainable Ocean Alliance stepping forward to collaborate with Sri Lankan academics is a great achievement.”

He also acknowledged the contribution of youth research assistants from EarthLanka — Malsha Keshani, Fathima Shamla and Sachini Wijebandara — for their support in executing the study.

A Defining Choice

As Sri Lanka charts its blue economy future, the message from citizens appears unmistakable.

Development is not rejected. But it must not come at the cost of irreversible ecological damage.

The ocean’s true wealth, respondents suggest, lies not merely in minerals beneath the seabed, but in the living systems above it — systems that sustain fisheries, tourism and coastal communities.

For policymakers weighing the promise of mineral wealth against ecological risk, the findings shared with The Island offer a clear signal: sustainable governance and biodiversity protection align more closely with public expectations than unchecked extraction.

In the end, protecting the ocean may prove to be not only an environmental responsibility — but the most prudent long-term investment Sri Lanka can make.

By Ifham Nizam

Features

How Black Civil Rights leaders strengthen democracy in the US

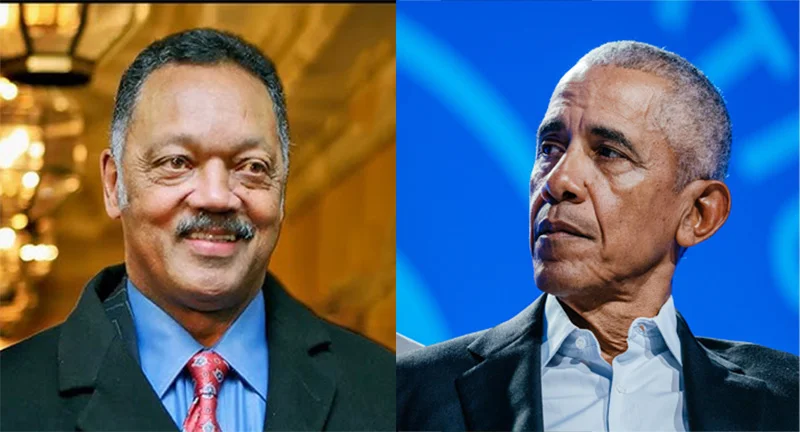

On being elected US President in 2008, Barack Obama famously stated: ‘Change has come to America’. Considering the questions continuing to grow out of the status of minority rights in particular in the US, this declaration by the former US President could come to be seen as somewhat premature by some. However, there could be no doubt that the election of Barack Obama to the US presidency proved that democracy in the US is to a considerable degree inclusive and accommodating.

On being elected US President in 2008, Barack Obama famously stated: ‘Change has come to America’. Considering the questions continuing to grow out of the status of minority rights in particular in the US, this declaration by the former US President could come to be seen as somewhat premature by some. However, there could be no doubt that the election of Barack Obama to the US presidency proved that democracy in the US is to a considerable degree inclusive and accommodating.

If this were not so, Barack Obama, an Afro-American politician, would never have been elected President of the US. Obama was exceptionally capable, charismatic and eloquent but these qualities alone could not have paved the way for his victory. On careful reflection it could be said that the solid groundwork laid by indefatigable Black Civil Rights activists in the US of the likes of Martin Luther King (Jnr) and Jesse Jackson, who passed away just recently, went a great distance to enable Obama to come to power and that too for two terms. Obama is on record as owning to the profound influence these Civil Rights leaders had on his career.

The fact is that these Civil Rights activists and Obama himself spoke to the hearts and minds of most Americans and convinced them of the need for democratic inclusion in the US. They, in other words, made a convincing case for Black rights. Above all, their struggles were largely peaceful.

Their reasoning resonated well with the thinking sections of the US who saw them as subscribers to the Universal Declaration of Human Rights, for instance, which made a lucid case for mankind’s equal dignity. That is, ‘all human beings are equal in dignity.’

It may be recalled that Martin Luther King (Jnr.) famously declared: ‘I have a dream that one day this nation will rise up, live out the true meaning of its creed….We hold these truths to be self-evident, that all men are created equal.’

Jesse Jackson vied unsuccessfully to be a Democratic Party presidential candidate twice but his energetic campaigns helped to raise public awareness about the injustices and material hardships suffered by the black community in particular. Obama, we now know, worked hard at grass roots level in the run-up to his election. This experience proved invaluable in his efforts to sensitize the public to the harsh realities of the depressed sections of US society.

Cynics are bound to retort on reading the foregoing that all the good work done by the political personalities in question has come to nought in the US; currently administered by Republican hard line President Donald Trump. Needless to say, minority communities are now no longer welcome in the US and migrants are coming to be seen as virtual outcasts who need to be ‘shown the door’ . All this seems to be happening in so short a while since the Democrats were voted out of office at the last presidential election.

However, the last US presidential election was not free of controversy and the lesson is far too easily forgotten that democratic development is a process that needs to be persisted with. In a vital sense it is ‘a journey’ that encounters huge ups and downs. More so why it must be judiciously steered and in the absence of such foresighted managing the democratic process could very well run aground and this misfortune is overtaking the US to a notable extent.

The onus is on the Democratic Party and other sections supportive of democracy to halt the US’ steady slide into authoritarianism and white supremacist rule. They would need to demonstrate the foresight, dexterity and resourcefulness of the Black leaders in focus. In the absence of such dynamic political activism, the steady decline of the US as a major democracy cannot be prevented.

From the foregoing some important foreign policy issues crop-up for the global South in particular. The US’ prowess as the ‘world’s mightiest democracy’ could be called in question at present but none could doubt the flexibility of its governance system. The system’s inclusivity and accommodative nature remains and the possibility could not be ruled out of the system throwing up another leader of the stature of Barack Obama who could to a great extent rally the US public behind him in the direction of democratic development. In the event of the latter happening, the US could come to experience a democratic rejuvenation.

The latter possibilities need to be borne in mind by politicians of the South in particular. The latter have come to inherit a legacy of Non-alignment and this will stand them in good stead; particularly if their countries are bankrupt and helpless, as is Sri Lanka’s lot currently. They cannot afford to take sides rigorously in the foreign relations sphere but Non-alignment should not come to mean for them an unreserved alliance with the major powers of the South, such as China. Nor could they come under the dictates of Russia. For, both these major powers that have been deferentially treated by the South over the decades are essentially authoritarian in nature and a blind tie-up with them would not be in the best interests of the South, going forward.

However, while the South should not ruffle its ties with the big powers of the South it would need to ensure that its ties with the democracies of the West in particular remain intact in a flourishing condition. This is what Non-alignment, correctly understood, advises.

Accordingly, considering the US’ democratic resilience and its intrinsic strengths, the South would do well to be on cordial terms with the US as well. A Black presidency in the US has after all proved that the US is not predestined, so to speak, to be a country for only the jingoistic whites. It could genuinely be an all-inclusive, accommodative democracy and by virtue of these characteristics could be an inspiration for the South.

However, political leaders of the South would need to consider their development options very judiciously. The ‘neo-liberal’ ideology of the West need not necessarily be adopted but central planning and equity could be brought to the forefront of their talks with Western financial institutions. Dexterity in diplomacy would prove vital.

-

Life style6 days ago

Life style6 days agoMarriot new GM Suranga

-

Business5 days ago

Business5 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features6 days ago

Features6 days agoMonks’ march, in America and Sri Lanka

-

Features6 days ago

Features6 days agoThe Rise of Takaichi

-

Features6 days ago

Features6 days agoWetlands of Sri Lanka:

-

News6 days ago

News6 days agoThailand to recruit 10,000 Lankans under new labour pact

-

News6 days ago

News6 days agoMassive Sangha confab to address alleged injustices against monks

-

Sports1 day ago

Sports1 day agoOld and new at the SSC, just like Pakistan