Business

Teejay Lanka 3-month group revenue up 119% to Rs. 10.4 billion

Teejay Lanka PLC has made an encouraging start to FY 2021-22 with solid top and bottom line growth in the three months ending 30th June 2021, shrugging off the pandemic-imposed shackles that retarded Q1 growth last year and overcoming the impact of the third wave of COVID-19 on the industry.

Sri Lanka’s largest textile manufacturer more than doubled revenue to Rs 10.4 billion at Group level for the three months posting growth of 119%, achieved a 27-fold improvement in its profit before tax of Rs 385 million, and converted last year’s Q1 net loss of Rs 31.5 million into a post-tax profit of Rs 310.5 million in Q1, 2021-22, the Group’s third consecutive quarter of profit growth.

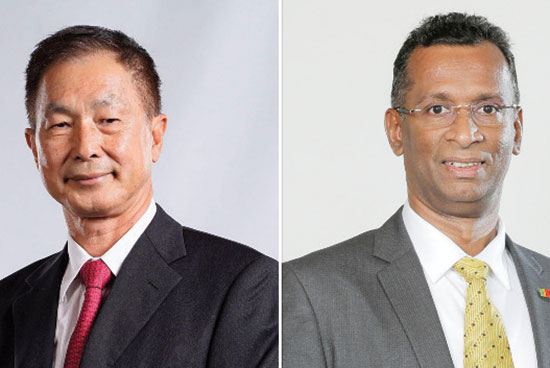

Teejay Lanka Chairman Bill Lam welcomed the positive start to the new financial year but cautioned that raw material prices and the new dynamics brought about by the global pandemic would continue to pose challenges to the business. He attributed the growth in turnover to the Group’s success in maintaining uninterrupted operations at all three manufacturing plants despite the third wave of COVID-19, additional revenue from outsourced operations in Sri Lanka and the depreciation of the Rupee in the review period. The turnaround in Q1 profits was achieved through increased volumes, a strong order book, strategic management of yarn price increases and stringent control of costs, he said.

At Company level, Teejay Lanka reported profit before tax of Rs 347 million for the three months, reflecting growth of 40%, while net profit improved by 50% to Rs 315 million on revenue of Rs 6.2 billion, up 65% over the corresponding quarter of the previous year.

Based on these results, Teejay Lanka PLC has proposed an interim dividend of Rs 1.15 per share in respect of the quarter reviewed. The Group has continued its strong debt-free balance sheet from the previous year with a net cash balance of Rs 4.8 billion.

Teejay Lanka CEO Pubudu De Silva said raw materials and cotton prices are at a peak level while the global market remains competitive with changing dynamics. “The Group foresaw these challenges during the last financial year and strategically approached its customers to minimise the impact on profits and margins,” he said, adding that “Our operational excellence journey has enabled the Group to increase productivity while reducing overheads and wastage to reduce the impact on margins.”