Business

Teejay Lanka 3-month group revenue up 119% to Rs. 10.4 billion

Teejay Lanka PLC has made an encouraging start to FY 2021-22 with solid top and bottom line growth in the three months ending 30th June 2021, shrugging off the pandemic-imposed shackles that retarded Q1 growth last year and overcoming the impact of the third wave of COVID-19 on the industry.

Sri Lanka’s largest textile manufacturer more than doubled revenue to Rs 10.4 billion at Group level for the three months posting growth of 119%, achieved a 27-fold improvement in its profit before tax of Rs 385 million, and converted last year’s Q1 net loss of Rs 31.5 million into a post-tax profit of Rs 310.5 million in Q1, 2021-22, the Group’s third consecutive quarter of profit growth.

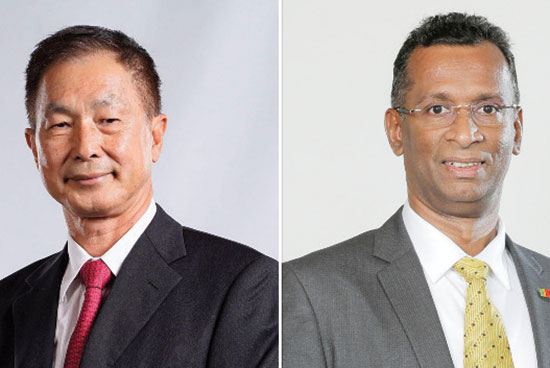

Teejay Lanka Chairman Bill Lam welcomed the positive start to the new financial year but cautioned that raw material prices and the new dynamics brought about by the global pandemic would continue to pose challenges to the business. He attributed the growth in turnover to the Group’s success in maintaining uninterrupted operations at all three manufacturing plants despite the third wave of COVID-19, additional revenue from outsourced operations in Sri Lanka and the depreciation of the Rupee in the review period. The turnaround in Q1 profits was achieved through increased volumes, a strong order book, strategic management of yarn price increases and stringent control of costs, he said.

At Company level, Teejay Lanka reported profit before tax of Rs 347 million for the three months, reflecting growth of 40%, while net profit improved by 50% to Rs 315 million on revenue of Rs 6.2 billion, up 65% over the corresponding quarter of the previous year.

Based on these results, Teejay Lanka PLC has proposed an interim dividend of Rs 1.15 per share in respect of the quarter reviewed. The Group has continued its strong debt-free balance sheet from the previous year with a net cash balance of Rs 4.8 billion.

Teejay Lanka CEO Pubudu De Silva said raw materials and cotton prices are at a peak level while the global market remains competitive with changing dynamics. “The Group foresaw these challenges during the last financial year and strategically approached its customers to minimise the impact on profits and margins,” he said, adding that “Our operational excellence journey has enabled the Group to increase productivity while reducing overheads and wastage to reduce the impact on margins.”

Business

Dr RAD Jeewantha named most innovative dentist of the year

Dr. R. A. D. Jeewantha was honoured as the Most Innovative Dentist of the Year at the Business World International Awards, 2025. Organised by the Business World International Organisation, the award ceremony was held recently at the Mount Lavinia Hotel. A graduate of the Faculty of Dental Sciences, University of Peradeniya, Dr. Jeewantha has built a reputation as one of Sri Lanka’s most respected and forward-thinking dental surgeons. After gaining vital experience in Government hospitals, including the Teaching Hospital in Karapitiya, he also served at a leading private hospital before launching his own practice—Doctor J Premium Dental Care in Delkanda, Nugegoda.

His dental clinic is known for offering advanced, patient-focused treatments in restorative dentistry, cosmetic procedures, and implantology, using state-of-the-art technology. Dr. Jeewantha is especially skilled in dental implants, having completed the American Residency Course in Dental Implantology at Roseman University, accredited by the American Academy of Implant Dentistry. Dr. Jeewantha holds fellowships from the International College of Continuing Dental Education (FICCDE) and the Pierre Fauchard Academy (USA). His advanced skills include modern root canal treatments using Mineral Trioxide Aggregate (MTA) for both surgical and non-surgical procedures.

He has completed international trainings in digital dentistry, full-arch implantology techniques like All-on-Four and Zygomatic Systems, and smile design using digital 3D scans. He has participated in global dental events such as the Asia-Pacific Dental Congress and completed training at institutions including the University of Manchester and North Western State Medical University in Russia. His courses have covered everything from intraoral scanning to managing tooth wear. He has previously received many local and international awards. Dr. Jeewantha also serves the community as a Justice of the Peace for All Island.

Business

IIHS Foundation in Biological Studies offers fast-track route to global health careers

The Foundation in Biological Studies at IIHS provides a unique alternative for students looking to fast-track their health careers after their Ordinary Level (O/L) exams. This programme offers a direct route to global health careers, bypassing traditional A/Ls. With over 1,000 students already advancing to universities in Australia, the UK, and Finland, IIHS has positioned the course as a reliable launchpad for careers in fields like medicine, nursing, biomedical sciences, and digital health. “This programme is a game-changer, offering a transformative journey into global healthcare education,” said IIHS CEO Dr. Kithsiri Edirisinghe.

Business

Seylan Bank Reports Strong Growth in Q1 2025 Financials

Seylan Bank has recorded a Profit before Tax (PBT) of LKR 4,199 million in Q1 2025, marking a 13.36% growth compared to LKR 3,704 million in Q1 2024. Profit after Tax (PAT) rose by 20.29%, reaching LKR 2,761 million, up from LKR 2,295 million in the corresponding period of 2024.

Despite a decrease in net interest income by 8.37% due to market interest rate reductions, the bank’s net fee-based income grew by 13.83%, driven by fees from loans, cards, remittances, and other services. Total operating income for the quarter was LKR 11,258 million, a 3.83% decrease from the previous year, while operating expenses rose by 4.62%, largely due to increased personnel and other operating costs.

Impairment charges were significantly reduced by 83.17%, totaling LKR 262 million, reflecting the bank’s solid credit quality and proactive provisions. The bank’s impaired loan ratio improved to 1.98% from 2.10% in Q1 2024, with a provision cover ratio of 80.74%.

Seylan Bank’s total assets grew to LKR 785 billion, with loans and advances reaching LKR 469 billion and deposits totaling LKR 647 billion. The bank’s capital adequacy ratios remained strong, with the Common Equity Tier 1 Capital Ratio at 13.67% and Total Capital Ratio at 17.64%.

In addition to its financial performance, Seylan Bank continued its commitment to education, opening 16 more “Seylan Pahasara Libraries,” bringing the total to 281 libraries across the island.Fitch Ratings upgraded Seylan Bank’s National Long-Term Rating to ‘A+(lka)’ with a Stable Outlook in January 2025, further underscoring the bank’s financial stability and growth trajectory.

-

Features5 days ago

Features5 days agoRuGoesWild: Taking science into the wild — and into the hearts of Sri Lankans

-

News5 days ago

News5 days agoOrders under the provisions of the Prevention of Corruptions Act No. 9 of 2023 for concurrence of parliament

-

Features6 days ago

Features6 days agoNew species of Bronzeback snake, discovered in Sri Lanka

-

News4 days ago

News4 days agoProf. Rambukwella passes away

-

News6 days ago

News6 days agoPhoto of Sacred tooth relic: CID launches probe

-

Opinion5 days ago

Opinion5 days agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part IX

-

Features6 days ago

Features6 days agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part VIII

-

Features2 days ago

Features2 days agoThe Truth will set us free – I