Business

SriLankan Airlines elevates Ground Handling with State-of-the-Art equipment upgrade

SriLankan Airlines, the exclusive ground operator at Bandaranaike International Airport (BIA), has initiated a phased upgrade of airport ground support equipment to accommodate the rising influx of flights and travellers transiting through the airport. Recently, the airline acquired three state-of-the-art passenger apron coaches, ensuring optimal comfort for passengers during transfers between the terminal and remote stands.

With airport traffic steadily increasing and nearing pre-pandemic levels, acquiring modern ground support equipment has become an urgent priority for SriLankan Airlines. This investment aims to ensure a seamless end-to-end travel experience for customers.

“It is an exciting time for Sri Lanka’s tourism industry; the number of visitors has doubled over the past year. We are delighted to introduce these modern apron coaches, along with other new ground support equipment, to our services at Colombo airport during this pivotal point. Our commitment to providing our passengers and the passengers of our customer airlines with a reliable and effortless travel experience remains steadfast, as does our dedication to supporting the national tourism strategy. With these incremental advancements, we anticipate substantial transformation in our operations,” stated Senior Manager Airport and Ground Services of SriLankan Airlines, Deepal Pallegangoda.

The passenger apron coaches, and ground support equipment were procured following a comprehensive and transparent competitive bidding procedure, consistent with all procurement exercises of the airline. The coaches, sourced from China International Marine Containers, represent the latest in comfort and technology. These operational enhancements will empower SriLankan Airlines to elevate both the standard of ground support services and the comfort of passengers at the airport.

Business

‘Seylan Bank records impressive Profit After Tax of LKR 2.29 Bn in Q1 2024’

-

Profit before Tax increased 115% to LKR 3,704 Mn

-

Profit after Tax grew 102% to LKR 2,295 Mn

-

Overall Statutory Liquid Assets Ratio (SLAR) at 39.42%

Seylan Bank has announced an impressive growth in its Q1 2024 financial results as at 31 March 2024, with a Profit Before Tax (PBT) of LKR 3,704 Mn, marking a 115% increase compared to Q1 2023. The Bank’s Profit After Tax (PAT) also witnessed a remarkable growth of 102%, standing at LKR 2,295 Mn. Despite a challenging environment, Seylan Bank has reported a strong financial performance.

The Bank’s Net Interest Income decreased by 17.71%, from LKR 11,388 Mn to LKR 9,371 Mn over the previous year. While the Net Interest Margin also recorded a reduction from 5.76% in 2023 to 5.24% in Q1 2024. The Bank’s Net Fee-based Income recorded a growth of 3.62%, mainly due to an increase in Card Related Income, Commission on Guarantees, and Income from Trade.

The Bank’s Total Operating Income was at LKR 11,707 Mn, a decrease of 12.51% compared to the corresponding period of 2023, driven mainly by a reduction in Net Interest Income. However, other income captions comprising of net gains from trading activities, net gains from de-recognition of financial assets, and net other operating income, reflected an overall increase of 127.22% compared to the corresponding period of 2023.

The Bank recorded an impairment charge of LKR 1,555 Mn in Q1 2024, a reduction of 75.57% over the corresponding period mainly due to enhanced credit quality and strengthening of recovery initiatives.

Total Operating Expenses recorded an increase of 15.42% from LKR 4,441 Mn to LKR 5,126 Mn for the 3 months ended 31st March 2024. Personnel expenses increased by 21.49% from LKR 2,237 Mn to LKR 2,718 Mn mainly due to increases in staff benefits based on the recently concluded collective agreement. Other Operating Expenses and Depreciation and Amortization expenses also increased by 9.25% due to increase prices in consumables and services over the period demonstrating the Bank’s continued measures to curtail costs through various cost reduction initiatives.

Income tax expenses surged 140.67% to LKR 1,409 Mn from LKR 585 Mn in the comparative period due to higher profits. Value Added Tax on Financial Services increased by 57.77% from LKR 735 million to LKR 1,160 Mn for the first three months of 2024. Additionally, Social Security Contribution Levy rose by 37.35% from LKR 117 Mn to LKR 161 million during the same period.

The Bank’s Total Assets were recorded at LKR 712 Bn as of 31st March 2024. Loans and Advances net of Impairment were recorded at LKR 427 Bn. Deposits reflected a marginal reduction to LKR 590 Bn. Local currency deposits increased by LKR 15.46 Bn, while foreign currency deposits contracted by LKR 16.61 Bn mainly due to local currency appreciation.

The Bank’s performance metrics have also showed improvement during the period under review. The Bank’s Asset Quality Ratios indicated an Impaired Loan (Stage 3) Ratio of 3.89% and an Impairment (Stage 3) to Stage 3 Loans Ratio of 66.75%. Return on Equity (ROE) stood at 14.94% compared to 10.88% in 2023, while Earnings per Share for Q1 2004 increased to LKR 3.61 from LKR 1.79 in Q1 2023.

Key financial ratios and indicators of Seylan Bank PLC remained sound as of 31st March 2024. The capital adequacy ratios were well above the regulatory minimum requirements and recorded 12.69% as Common Equity Tier 1 Capital Ratio and Total Tier 1 Capital Ratio and 15.84% as the Total Capital Ratio.

In addition to its financial achievements, Seylan Bank opened six (06) ‘Seylan Pahasara Libraries’ during the quarter, bringing the total number to 231 as of 31st March 2024.

(Seylan Bank)

Business

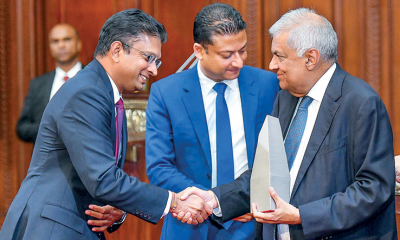

ABMCL bags National Quality Award 2022

Associated Battery Manufacturers (Ceylon) Limited, (a subsidiary of Exide Industries Limited) [ABMCL] the manufacturer of renowned automotive batteries, Exide, Lucas and Dagenite was honoured with the Sri Lanka National Quality Award under the Manufacturing – Medium Scale category organised by the Sri Lanka Standards Institution (SLSI), the National Standards Body of Sri Lanka, at the Monarch Imperial, Thalawathugoda recently.

This renowned event is held annually to acknowledge business excellence in local entities and to recognise Sri Lankan organisations that excel in quality management and achievement. The jury consisted of key industry experts selecting the winners on the criteria based on the standards used for the Malcolm Baldrige National Quality Award USA which include; leadership, strategic planning, customer focus, measurement, analysis and knowledge management, workforce focus, operational focus and results.

ABMCL, a joint venture of Exide Industries Limited [Exide] and Brown & Company PLC [Browns] established in 1960 is the first lead-acid battery manufacturer of Sri Lanka. Since its inception, ABMCL has been dedicated to meeting the requirements of customers in Sri Lanka and has consistently invested in technological advancements to provide high-quality products. Notably, ABMCL receives technical assistance from Exide which is South Asia’s largest manufacturer of lead acid batteries and provider of power storage solutions. ABMCL has consistently remained at the cutting edge of international battery technology and has introduced various pioneering products and power storage solutions in South Asia and global markets.

“This award not only celebrates ABMCL’s manufacturing prowess but also underscores the pivotal role played by Browns, the distinguished conglomerate with a remarkable legacy of almost 150 years and a commitment to the ‘Heritage of Trust,’ in building and nurturing the trust of consumers nationwide. Browns’ unwavering dedication aligns seamlessly with ABMCL’s mission for innovation and superior quality.” said Ajith de Silva, Chief Operating Officer, Automotive & Hardware Cluster – Browns Group.

Business

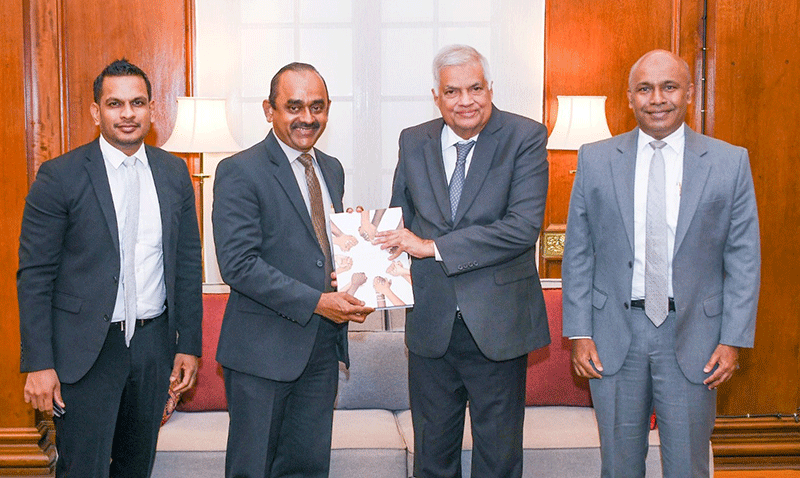

People’s Bank presents 2023 Annual Report to President

People’s Bank Chairman Sujeewa Rajapakse presented the People’s Bank’s Annual Report for the year 2023 to President Ranil Wickremasinghe at the Presidential Secretariat, Colombo 01 recently.

Also present at the event were People’s Bank Chief Executive Officer/General Manager Clive Fonseka and Head of Finance Azzam A. Ahamat.SLT-MOBITEL introduces ‘Snapchat Chill’ Social Combo plan for first time in Sri Lanka

-

News7 days ago

News7 days agoGerman research ship allowed Sri Lanka port call after Chinese-protest led clarification

-

Business4 days ago

Business4 days agoINSEE Ecocycle marks 21 years of environmental excellence with a city cleaning program in Anuradhapura

-

News7 days ago

News7 days agoSri Lankan Oil and Gas exploration grinds to a standstill amid protracted legal battle

-

Features5 days ago

Features5 days agoCalling applications for MBBS!

-

Sports4 days ago

Sports4 days agoUS visa issues deny Sri Lanka Olympic qualifying opportunity in Bahamas

-

Opinion7 days ago

Opinion7 days agoKD Somadasa’s contribution to Hugh Nevill’s work

-

Features2 days ago

Features2 days agoSearching for Dayan Jayatilleka

-

Business7 days ago

Business7 days agoDialog Axiata Recognised as the Largest FDI Contributor by BOI