Business

Sri Lanka’s first carrier-neutral and high-density data center launches at Orion City IT Park

In a major step forward in Sri Lanka’s rapid transformation towards becoming a South Asian hub for IT and tech-enabled services, Digital Reality (Pvt) Ltd. launched the country’s first carrier-neutral, high-density data center built to TIA Tier-3 standards and a capacity over 200 racks at Orion City IT Park, Colombo 09 under the brand name OrionStellar.

The launch event featured Information and Communication Technology Agency of Sri Lanka (ICTA) Chairman, and Telecommunications Regulatory Commission of Sri Lanka (TRCSL) Director General, Oshada Senanayake as Chief Guest, in addition to attracting enthusiastic participation from numerous high-ranking representatives from Sri Lanka’s burgeoning IT, telco, and corporate sectors, as well as academia and key Government officials.

Addressing the gathering, Senanayake said: “Today’s launch of Sri Lanka’s first carrier-neutral data centre is part of an interesting paradigm shift that is already underway. So it is great to see entrepreneurs stepping into this vital space and taking up the challenge of establishing the vital infrastructure necessary for Sri Lanka to unleash its true potential. Particularly in the context of unprecedented volatility, technology has been a key enabler in Sri Lanka’s ambitious transformation towards a US$ 3 billion digital economy

“We have continuously and aggressively invested in the next generation of technologies, and today, many of the essential components – including 7 submarine cables that connect us to the rest of the world – are now in place for Sri Lanka to become one of the region’s most attractive destinations for data hosting. This in addition to digitizing Sri Lanka’s public and private sector. However, we cannot afford to be complacent. Other SAARC countries too are making bold advancements and we cannot afford to fall behind.

“We see immense growth potential for Sri Lanka through the embedding of artificial intelligence and machine learning into public and private sector operations. Together with the robust 5G capabilities that are being set in place today, we believe that Sri Lanka will be able to unleash hyper-growth. Today’s launch of a truly globally competitive data centre is a vitally important advancement in this direction,”

The newly launched high density data center is designed to offer world-class services to support the rapidly escalating demand for computing power in an increasingly digital Sri Lankan economy. It promises the highest energy efficiency and power density up to 15 kW per rack with a total power capacity of 1.5 MW.

“The launch of Sri Lanka’s first, and most power efficient high density data center and the impressive capabilities it offers represents a historic milestone in the development of the island’s IT infrastructure. It is also a momentous step in our mission to radically simplify digital infrastructure challenges for local and regional enterprises, and drastically improve the speed at which they conduct their business.” Digital Realty Chairman, Rajendra Theagarajah said.

“Sri Lanka enjoys several uniquely valuable natural and cultivated advantages which make it an ideal option for safely and reliably storing data at scale. Geographically, we are situated just offshore of one of the largest emerging IT economies and in close proximity to key markets in Asia,” Orion City Founder/Director and Digital Realty Managing Director, Jeevan Gnanam said.

“Our nation also possesses outstanding IT talent and adopts one of the most proactive stances in the region with IT and connected infrastructure. With our DC now online, we will be able to provide clients with best-in-class, globally competitive services to accelerate their digitalization journeys, rationalize core infrastructure costs, and establish stronger levels of security and redundancy, all while reducing energy costs and contributing towards a green and prosperous economy,” Gnanam added.

Built in compliance with the latest ISO 27001 standards and global data center standards (TIA-942 Rated 3), the new data center will deliver the highest levels of reliability, efficiency, and redundancy with 99.98% uptime. The center features power infrastructure with 2 (N+1) UPS systems with 30 minutes battery backup up time, and an N+1 generator system supported with 72-hour fuel bulk tanks ensuring reliable and uninterrupted power supply.

Notably, the facility was also designed with an unmatched focus on environmental sustainability enabled by an in-row cooling system with best-in-class efficiency ratings. As a result, OrionStellar guarantees the best power usage efficiency (PUE) with a design PUE of 1.4. This will translate to power savings up to 40% for clients migrating their IT loads to OrionStellar. The facility also features an unloading bay ready to receive customer inventory for hosting and a staging area to test equipment prior to entering the data hall.

OrionStellar is poised to offer an array of digital infrastructure solutions and value-added managed services to enterprises. It will support the rapidly escalating demand for computing power in an increasingly digital Sri Lankan economy and the region at large, with a special emphasis on providing highly cost-effective data offshoring services for regional enterprise powerhouses.

The long-term business purpose is to “simplify enterprise digital infrastructure challenges to accelerate digitalization and growth” according to COO of OrionStellar, Nalaka W. Bandara, a specialist in enterprise communication solutions and data center businesses with over 20 years of collective experience.

OrionStellar colocation solutions have been designed to meet the needs of different business segments with varying requirements. The facility has already designated white labeled space for telcos and larger MNCs, featuring dedicated cages with biometric access control for large enterprises. Individual racks with biometric or lockable doors and U level hosting for SME and startup hosting needs are among the product options complemented with “Remote Pair of Hands” service as a value addition.

Notably, each co-location space or rack will be individually monitored, even to U level, for power delivery and consumption to ensure that clients only pay for what they use, enabling cost visibility and control in their digital infrastructure investments.

Further, the OrionStellar data center offers an array of value-added services including storage as a service, back up as a service to secure mission critical enterprise data, disaster recovery solutions during unexpected downtime and cost-effective data center migration services with minimal disruption to core business functions.

Orion Towers at Orion City is equipped with state-of-the-art facilities and a full spectrum of services, offering prime workspace solutions ranging from custom-built, office spaces, dedicated seating space, shared seating and BCP Seating. OrionStellar client companies can conveniently co-locate their IT Network Operations Centers (NOCs) closest to the data center with convenient access to banks, shopping centers, recreational facilities, food-courts, and fine-dining restaurants.

“The OrionStellar data center is guaranteed to unleash a new wave of tech-enabled opportunities across the entire spectrum of local enterprises – from SMEs and tech-startups to large corporates and regional MNCs,” Jeevan Gnanam asserted. He further explained that “with the launch of this high-density data center, we aim to establish the most secure and scalable infrastructure to position Sri Lanka as a hub in this digital economy.”

Business

Industry and Entrepreneurship Development Minister Handunneththi’s visit to Lumala highlights key industrial concerns

With the aim of assesing the current challenges faced by local industrialists and explore avenues for government support, Minister of Industry and Entrepreneurship Development Hon. Sunil Handunneththi visited City Cycle Industries Manufacturing (Pvt.) Ltd., widely known as Lumala, on March 24 at its factory in Panadura.

During the visit, Minister Handunneththi engaged with senior officials and employees to understand their concerns and operational difficulties. In a statement shared on social media, the Minister acknowledged the pressing challenges affecting Sri Lanka’s manufacturing sector and emphasized the government’s commitment to providing swift and effective solutions.

Minister Handunneththi further reiterated the government’s intent to position local manufacturers as key stakeholders in Sri Lanka’s economy by addressing regulatory hurdles, market imbalances, and supply chain constraints.

The visit comes amid growing concerns from Lumala employees and management regarding the state of Sri Lanka’s bicycle manufacturing industry, in the backdrop of facing significant challenges, including an influx of imported bicycles and components that circumvent regulatory checks. In addition, the high taxes on raw materials used in local manufacturing has further exacerbated production costs, making it difficult for domestic manufacturers to remain competitive.

Earlier this year, Lumala employees called for urgent government intervention to address these challenges, warning that ongoing financial strain could lead to further shutdowns of critical production units, job losses, and setbacks to the broader industrial ecosystem. With a local value addition of 50-70 percent verified by the Ministry, its workforce remains hopeful that government action will help achieve an ethical manufacturing industry.

Lumala, a household name in Sri Lanka’s bicycle industry, has been a key player in sustainable mobility solutions for over 35 years. The company was recently honored with the Best National Industry Brand award under the Large-Scale Other Industry Sector category at the National Industry Brand Excellence Awards 2024.

With a production capacity of 2,000 bicycles per day and a workforce of 200, Lumala continues to cater to both domestic and international markets, producing a diverse range of bicycles, electric bikes and light electric vehicles. In line with Sri Lanka’s goal to expand forest cover to 32 percent by 2030 and cut GHG emissions by 14.5%, Lumala is actively contributing to this mission—both as a company and through its diverse range of products.

As Sri Lanka works towards strengthening its local manufacturing sector, Minister Handunneththi’s visit signals a crucial step toward addressing industrial concerns and reinforcing government support for sustainable and competitive domestic production.

Business

New SL Sovereign Bonds win foreign investor confidence

Sri Lanka’s country rating was upgraded from ‘Restricted Default’ to ‘CCC’ following the successful exchange for the new International Sovreign Bonds (SL ISBs) during December 2024. The three types (03) of exciting new sovereign bonds have restored foreign investor confidence.

The Central Bank of Sri Lanka (CBSL) has performed a remarkable role in guiding the economy out of default status and restored economic stability, and gained Sri Lanka a non-default Country Rating of ‘CCC’. Among the key achievements of CBSL, have been to reduce treasury interest rates under 9% and stabilize the currency while rebuilding foreign reserves to $ 6Bn.

SL offers four Macro Linked Bonds (MLBs) linked to GDP growth, a Governance Linked Bond (GLB) and a short term, Fixed Coupon Bond for unpaid Past Due Interest (PDI). The MLBs offer variable returns depending on SL’s GDP growth from 2024 to 2027, (e.g. haircuts can vary between 16% to 39%). The GLB interest can vary depending on meeting 15.3% and 15.4% of Total Revenue/ GDP thresholds in 2026 and 2027 respectively. The PDI bond offers a fixed coupon of 4% until 2028 and trades at around $94.

This combination of unique, variable returns offers global investors an exciting opportunity to capitalize on SL’s economic revival and US interest rate movements. Sri Lanka’s economic resurgence in 2024 was promising, with a 5% GDP growth rate. With improving investor confidence, SL ISB daily turnover now exceeds $10mn.

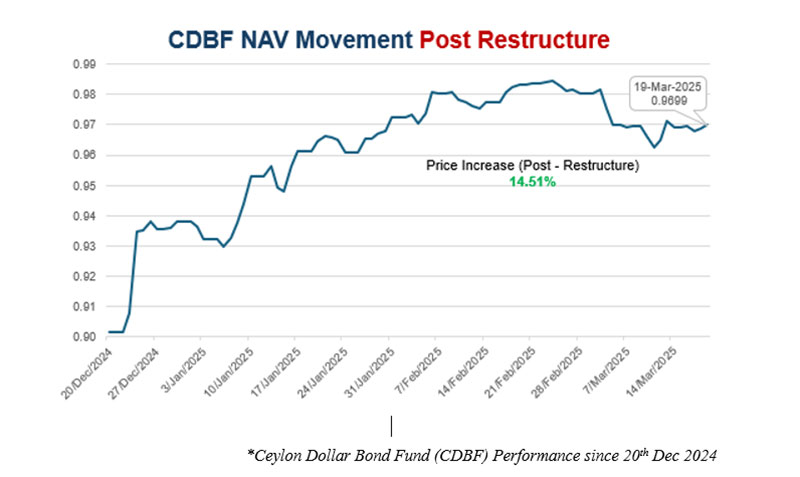

The Ceylon Dollar Bond Fund (CDBF) is the only USD Sovereign Bond Fund that is exclusively invested in SL ISBs with Deutsche Bank acting as the Trustee and Custodian Bank. The Fund reported returns of 53% in 2023 and 39% in 2024.

We invite foreign investors to enter CDBF while Sri Lanka is rated at ‘CCC’ and consider realizing their investment upon SL reaching a Country Rating of ‘B- ‘. Other advantages of CDBF are, the ability to withdraw anytime and being tax exempted.

Ceylon Asset Management (CAM), the Fund Manager, has commenced an advertising campaign to promote the CDBF to the Sri Lankan Diaspora, South Asian, Middle Eastern and Australian Investors. CAM is an Associate Company of Sri Lanka Insurance Corporation (SLIC) and licensed under the Securities and Exchange Commission of Sri Lanka Act, No. 19 of 2021.

Meanwhile, the Ceylon Financial Sector Fund managed by CAM emerged as the top performing rupee fund in Sri Lanka during 2024, with a return of 64%. Investors can find out more on www.ceylonassetmanagement.com or write to us on info@ceylonam.com.

Past performance is not an indicator of the future performance. Investors are advised to read and understand the contents of the KIID on www.ceylonam.com before investing. Among others investors shall consider the fees and charges involved.(CAM)

Business

Share market plunges steeply for second consecutive day in reaction to US tariffs

CSE plunged at open, falling for the second consecutive day yesterday, down over 300 points in mid- morning trade.US President Donald Trump has imposed a 44 percent tax on Sri Lanka’s exports in an executive order which he claimed, spelt out discounted reciprocal rates for about half the taxes and barriers imposed by the island on America.

As a result both indices showed a downward trend. The All Share Price Index dropped 300 points, or 2.32 percent, to 15,294.94, while the S&P SL20 dropped 101 points, or 2.71 percent, to 4,517.37.

Turnover stood at Rs 3.1 billion with six crossings. Those crossings were reported in Sampath Bank which crossed 1.6 million shares to the tune of Rs 181 million and its shares traded at 109, JKH 4.1 million shares crossed to the tune of 80.5 million and its shares sold at Rs 19.5.

Hemas Holdings 400,000 shares crossed for Rs 45.6 million; its shares traded at Rs 114, CTC 25000 shares crossed to the tune of Rs 32.2 million; its shares traded at Rs 1330, Commercial Bank 200,000 shares crossed for 27 million; its shares traded at Rs 135 and TJ Lanka 157,000 shares crossed for Rs 20 million; its shares traded at Rs 46.

In the retail market top six companies that have mainly contributed to the turnover were; Sampath Bank Rs 296 million (2.9 million shares traded), JKH Rs 220 million (11.2 million shares traded), Haylays Rs 195 million (142,000 shares traded), HNB Rs 151 million (519,000 shares traded), Commercial Bank Rs 138 million (1 million shares traded) and Central Finance Rs 129 million (735,000 shares traded). During the day 218 million shares volumes changed hands in 22000 transactions.

It is said the banking sector was the main contributor to the turnover, especially Sampath Bank, while manufacturing sector, especially JKH, was the second largest contributor.

Yesterday, the rupee opened at Rs 296.75/90 to the US dollar in the spot market, stronger from Rs 296.90/297.20 on the previous day, dealers said, while bond yields were up.

A bond maturing on 15.10.2028 was quoted at 10.35/40 percent, up from 10.25/30 percent.

A bond maturing on 15.09.2029 was quoted at 10.50/60 percent, up from 10.45/55 percent.

A bond maturing on 15.10.2030 was quoted at 10.60/70 percent, up from 10.30/65 percent.

By Hiran H Senewiratne

-

Business2 days ago

Business2 days agoStrengthening SDG integration into provincial planning and development process

-

News6 days ago

News6 days agoBid to include genocide allegation against Sri Lanka in Canada’s school curriculum thwarted

-

Sports7 days ago

Sports7 days agoSri Lanka’s eternal search for the elusive all-rounder

-

Business14 hours ago

Business14 hours agoNew SL Sovereign Bonds win foreign investor confidence

-

Sports3 days ago

Sports3 days agoTo play or not to play is Richmond’s decision

-

News7 days ago

News7 days agoComBank crowned Global Finance Best SME Bank in Sri Lanka for 3rd successive year

-

Features7 days ago

Features7 days agoSanctions by The Unpunished

-

Features7 days ago

Features7 days agoMore parliamentary giants I was privileged to know