Business

Sri Lanka’s Debt Restructuring Roadmap: Following the evidence

By Dr Dushni Weerakoon

Debt restructuring is fundamentally about allocating the associated economic costs to someone. The onus is typically on the debtor country to secure participation from its creditors, applying comparable treatment to all. As with all negotiations, the level and modalities of relief will always be subject to some degree of controversy. Sri Lanka’s recently gazetted domestic debt restructuring (DDR) exercise too has drawn expressions of both support and criticism. Overall though, negotiations have to be framed within certain desired outcomes to minimise costs to the economy. To this end, Sri Lanka’s negotiating stance dovetails neatly with crucial research evidence.

A restructuring process, whether pre-emptive or post-default, imposes significant output costs. For a debtor country to minimise these, some notable findings are:

A restructuring process, whether pre-emptive or post-default, imposes significant output costs. For a debtor country to minimise these, some notable findings are:

Output losses are higher in post-default restructuring.

When defaults are accompanied by a banking crisis, the fall in output is particularly large.

Even in a post-default setting, output costs can be reduced the quicker the debtor country is able to reach an agreement with its creditors.

The size of creditor losses (haircuts) is among the best predictors of participation rates on bond restructuring.

To begin with, there was no real appetite to include a DDR in Sri Lanka’s case, especially in view of the substantial real erosion in value to debt holders as inflation spiralled. But, as opening gambits commenced with external creditors, the bondholder group’s request that ‘domestic debt is reorganised in a manner that both ensures debt sustainability and safeguards financial stability’ could not be ignored if only to avoid an impasse. Sri Lanka has limited room to circumvent a DDR altogether. As a middle-income country, the inclusion of domestic debt optimisation is implicitly encouraged in the IMF’s debt sustainability framework (DSF) for market-access countries. It focuses on the total stock of public debt but is avoided by low-income countries where the applicable DSF focuses only on external public debt.

Having opened the door to a DDR, there would have been very real concerns that the combination of skyrocketing inflation and financial fragility would test the banking sector’s resilience to deal with a DDR. Figures on capital adequacy and asset quality (with the non-performing loan ratio on stage 3 loans rising from 5.2% in 2020 to 11.3% in 2022) and exposure to restructuring the country’s international sovereign bonds (ISBs) meant the stakes were high. When times are uncertain, a herd mentality will rule, and this is to be avoided at all costs.

Another element in a DDR is that there are negative externalities that need to be internalised – i.e. there may be direct costs to a country’s financial sector from a DDR, such as recapitalisation and these have to be taken on board. This is particularly so where there is a strong link between the sovereign and its financial system. In setting aside resources to ensure financial system stability, the anticipated fiscal benefits of a DDR can potentially reduce. Thus, on both counts, ringfencing the banking sector to avert a far more damaging economic crisis and deeper output losses has been the first step in Sri Lanka’s approach.

Having left out the banking sector, the economic cost appears to have been disproportionately directed at the savings of workers contributing to pension funds. Private bondholders have been exempted denying ‘comparable treatment’ while the captive nature of the Employers Provident Fund (EPF), managed by the Central Bank of Sri Lanka (CBSL), means there has been no attempt to ‘secure participation’.

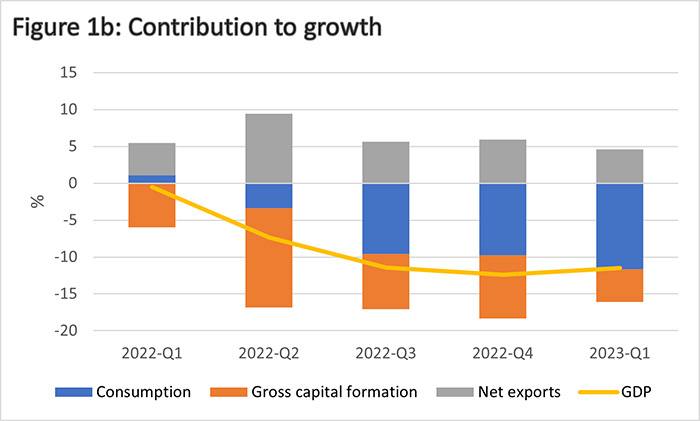

Sri Lanka’s DDR treatment in effect is an example of the considerable degree of influence that a sovereign can exert over domestic legal and regulatory frameworks, unlike that of an external debt restructuring (EDR). Under the terms, pension funds are required to opt for a 30% haircut or be liable for higher taxation at 30% instead of the prevailing 14%. For EPF savers, there is the only assurance of receiving a 9% return in the long-term for a fund that has often performed below par even against the simplest alternative instrument that an average saver may look at, such as one-year fixed deposits (Figure 1a). Where there has been a substantial erosion of real savings from a crisis-induced economic environment, this is scant consolation for workers. The premise of a return to single-digit inflation merely means that price increases have slowed from the previous exorbitant high levels, but the erosion of the value of savings remains very real.

The second step of the negotiating process is to bring as many of Sri Lanka’s external creditors on board as quickly as possible. Having complied with the bondholder group’s request on including a DDR, comparable treatment is being offered by way of a 30% haircut on EDR too. As a bilateral creditor, China’s preference globally is for deferral rather than reduction. But merely pushing repayments down the line with maturity extensions (and some coupon adjustments) still leaves Sri Lanka at the risk of being permanently illiquid and, therefore, vulnerable to repeat short-term crises. Clearly, the deeper the haircut, the more sustainable the debt becomes, but negotiations will likely drag on. A complex creditor group and geo-political wrangling add to these risks. Ecuador, a middle-income country, came to an agreement with its bondholders to a haircut of 9% on USD 17.4 billion in 2020, with a high 98% of bondholders agreeing to the deal. China persisted with maturity extensions and coupon adjustments.

Corralling in the bilateral creditors will require more diplomatic persuasion than economic analysis. China’s recently concluded deal with Zambia to restructure USD 4.2 billion of loans under an initiative driven by the G20 Framework for low-income countries pushed back repayments and accommodated interest rate cuts. This follows on from its deal with Ecuador a year earlier that included maturity extensions and interest rate adjustments on debts worth USD 4.4 billion. There are two key arguments put forward by China for not taking losses in debt restructurings: first, that its loans are development-oriented, tied to projects that generate revenues for the recipients, and second, that multilateral banks should also participate, instead of the current preferred status of having their loans repaid in full. In many ways, Sri Lanka will be a test case on these issues.

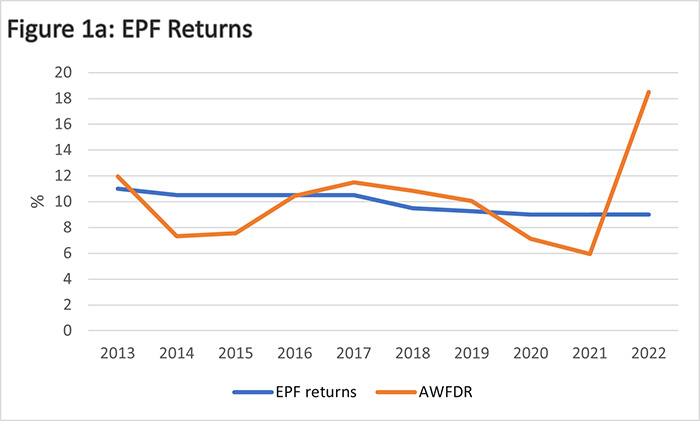

The expected deceleration in the contraction of Sri Lanka’s economic output in the coming months is only the start to claw back lost output. This too is under threat. As domestic consumption faltered, net exports were the only positive driver of growth in recent quarters, but there are concerning signs of a slowdown (Figure 1b). In the event, it is even more probable that the allocation of costs associated with debt negotiations will be weighed and measured against the need to get an overall deal done as quickly as possible to support Sri Lanka’s slow-burn economic recovery.

Link to blog: https://www.ips.lk/talkingeconomics/2023/07/18/sri-lankas-debt-restructuring-roadmap-following-the-evidence/

Business

Sarvodaya Development Finance joins Global Banking Alliance, set to host annual board meeting in Sri Lanka

Remarking a new milestone in its pledged journey towards sustainable financing and inclusive financing,

Sarvodaya Development Finance PLC (SDF) has secured the full membership in the Global Alliance for Banking on Values (GABV), an international network of banks working to build a more sustainable and inclusive financial system.

Through this membership, Sarvodaya Development Finance PLC aims to strengthen its ability to create social and environmental impacts by expanding access to ethical financial tools, supporting community-led development, and promoting environmentally responsible lending. The alliance provides opportunities to engage with global peers, share practical knowledge, and adopt approaches that have worked in similar contexts around the world. It also allows Sarvodaya Development Finance PLC to align more closely with international standards on sustainable finance, build relationships with mission-aligned investors, and stay informed on evolving policy and regulatory trends. As part of this engagement, Sarvodaya Development Finance PLC will host the Asia Pacific Conference and the GABV Annual Board Meeting in Colombo on October 15–16, 2025, bringing together CEOs from over 12 countries to collaborate on advancing values-based banking across the region.

The 17th Annual Meeting of the Global Alliance for Banking on Values was held in Kampala, Uganda, under the theme “Building Resilient Futures.” The event brought leaders from over 70 member banks across more than 45 countries to the GABV network to discuss how values-based banks can respond to global challenges such as climate change, economic inequality, and digital transformation. Channa De Silva – the Chairman and the Nilantha Jayanetti – the Chief Executive Officer of Sarvodaya Development Finance PLC have represented the Company at this event.

Business

Sanjiv Hulugalle appointed CEO and General Manager of Cinnamon Life at City of Dreams Sri Lanka

A Global Hospitality Visionary Returns Home to Lead Sri Lanka’s Most Ambitious Integrated Resort

Cinnamon Life announces the appointment of Sanjiv Hulugalle as the Chief Executive Officer and General Manager of Cinnamon Life at City of Dreams Sri Lanka, marking a pivotal moment in the evolution of Sri Lanka’s hospitality landscape.

With a career that spans over three decades and 12 countries across five continents, Hulugalle brings to Cinnamon Life an unparalleled legacy in luxury hospitality, real estate development, and transformative leadership. From the Maldives to Canada, China to the UAE, he has been at the helm of some of the world’s most prestigious hospitality and real estate ventures.

Previously the Group President of Hospitality & Real Estate at KOHLER Co., Hulugalle drove innovation and strategic growth across a diverse portfolio. At Auberge Resorts Collection, he led the ambitious repositioning of a $210 million development. His 24-year tenure with Four Seasons saw him lead top-tier teams and deliver award-winning results across the globe.

But this latest chapter is deeply personal.

Having been semi-retired, Hulugalle’s return to Sri Lanka was sparked not by circumstance, but by calling and purpose. “This is not just a role,” says Hulugalle. “It’s a way of giving back to the country that raised me—with its gracious hospitality, boundless warmth, and vibrant soul.”

“Sri Lankan hospitality is naturally gracious and kind,” he reflects. “It’s in our DNA. My mother would’ve wanted me to return and give back.”

Redefining Colombo as a City of Dreams

With Hulugalle at the helm, Cinnamon Life is set to emerge not just as a landmark development in Colombo—but as a destination, that captures the imagination of the world. Under his leadership, City of Dreams will embody the essence of modern Sri Lanka: rooted in culture, rich in character, and radiating with opportunity.

In addition to his work in hospitality, Hulugalle is also an active investor in AI-led technologies, residential real estate, and wellness-driven consumer brands, always seeking to blend strategic foresight with heartfelt service.

Business

Empowering SMEs on capital raising through listing

The Colombo Stock Exchange (CSE), in collaboration with the Securities and Exchange Commission of Sri Lanka (SEC), hosted an Issuer Forum in Gampaha aimed at supporting small and medium-sized enterprises (SMEs) in exploring avenues for capital raising through listing on the Colombo Stock Exchange.

The forum, titled “Redefining the Trajectory of Your Business”, provided guidance on exploring effective capital-raising avenues, specifically through listing on the Empower and Diri Savi Boards. These boards offer dedicated listing platforms for SMEs, focusing on sectors such as agribusiness, livestock, energy generation, ICT, and tourism-related ventures. Attracting over 70 participants, the forum offered valuable insights that were well received.

The main presentation of the evening, delivered by Mr. Nikila Darmadasa, Senior Management Associate of the Corporate Advisory Division at NDB Investment Bank Limited, educated the participants on the benefits of capital generation and mobilization through listing on the CSE, outlining the processes and advantages for businesses ready to grow beyond traditional financing models.

A panel discussion on “The Journey Towards Listing and Life After Listing” featured Manuri Weerasignhe, Director, Corporate Affairs, SEC; Rajeeva Bandaranaike, CEO, CSE; Nikila Darmadasa, and J.F. Fernandopulle, Managing Director and CEO, Mahaweli Coconut Plantations PLC. The session was moderated by Ms. Punyamali Saparamadu, Senior Vice President, Commercial, CSE. The panel offered practical perspectives on preparing for a listing, regulatory expectations, and the business journey post-listing.

This initiative reflects the continued commitment of the SEC and CSE to broaden access to capital market opportunities for SMEs across Sri Lanka, enabling them to scale sustainably while contributing meaningfully to the national economy.

-

Business5 days ago

Business5 days agoColombo Coffee wins coveted management awards

-

Features6 days ago

Features6 days agoStarlink in the Global South

-

Features3 days ago

Features3 days agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part III

-

Features6 days ago

Features6 days agoModi’s Sri Lanka Sojourn

-

Midweek Review3 days ago

Midweek Review3 days agoInequality is killing the Middle Class

-

Features5 days ago

Features5 days agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part I

-

Features4 days ago

Features4 days agoA brighter future …

-

Business2 days ago

Business2 days agoNational Anti-Corruption Action Plan launched with focus on economic recovery