Business

SLT-MOBITEL reports marginal growth in Q1 2024 amidst cost optimization efforts

SLT-MOBITEL has reported a flat growth in Q1 2024 ending March 31, 2024, amidst a challenging business environment. However, the company’s proactive cost management initiatives have resulted in significant operational cost savings, enabling it to maintain profitability.

For the quarter, the SLT Group has recorded consolidated revenue of LKR 26.93 billion, reflecting a marginal 1.4% year-on-year increase.

However, compared to the fourth quarter of the previous year, i.e., Q4 2023, there was a modest increase of 3.7% in revenue, driven by enterprise and broadband revenues.

The Company has successfully implemented cost-saving measures, resulting in a decrease of 0.6% in operational expenditure (excluding depreciation and amortization) compared to Q1 2023. This was partly due to the decrease in dollar-denominated expenses such as Annual Maintenance Cost (AMC), international settlement, and internet backbone charges due to the rupee appreciation.

The first quarter of 2024 presented a volatile business landscape, with macroeconomic factors impacting the topline performance. However, SLT-MOBITEL swiftly implemented strategic cost optimization measures, which enabled the company to realize significant operational cost savings of 2.7% at the Group level.

SLT-MOBITEL’s cost-saving efforts comprised various initiatives, including rationalizing annual maintenance costs, vehicle hiring charges, international settlement charges, and repair and maintenance expenses. These measures contributed to an EBITDA increase of 10.3% year-on-year, showcasing the company’s commitment to operational efficiency.

Despite the increase in EBITDA, the Group’s operating profit declined by 1.9% due to higher depreciation expenses resulting from substantial investments in capital expenditure programmes. The company’s net Profit after Tax also experienced a year-on-year decrease, primarily influenced by lower operating profit and reduced interest income due to declining interest rates.

On a positive note, SLT-MOBITEL witnessed an increase in Profit after Tax when compared to the previous quarter (Q4 2023), driven by improved EBITDA and operating profit, as well as forex gains and reduced interest costs.

During the quarter, SLT-MOBITEL also made substantial contributions to the government through taxes, levies, and dividends, demonstrating its commitment to supporting the nation’s economic development.

Business

National Anti-Corruption Action Plan launched with focus on economic recovery

In a decisive move to stabilize Sri Lanka’s economy and rebuild investor confidence, the Commission to Investigate Allegations of Bribery and Corruption (CIABOC) yesterday launched the National Anti-Corruption Action Plan (NACAP) 2025–2029, with a clear focus on promoting transparency, accountability and economic governance.

Developed with the support of the United Nations Development Programme (UNDP) and funded by the government of Japan—contributing nearly USD 900,000—the initiative aims to address corruption as a critical economic barrier.

The launch, attended by President Anura Kumara Dissanayake, Chief Justice Murudu Fernando PC, and high-level diplomatic and institutional representatives, signals a shift in Sri Lanka’s economic reform narrative. The NACAP is seen not just as a governance tool but as an economic recovery strategy designed to attract foreign investment, improve public finance management and rebuild public trust.

R.S.A. Dissanayake, Director General of CIABOC, noted that corruption, “is more than a legal issue—it is an economic cancer that stifles innovation, distorts markets and deters foreign direct investment.” The establishment of Internal Affairs Units (IAUs) within government institutions is expected to bring internal oversight to public spending and performance, improving the efficiency of state services.

Japanese ambassador Akio Isomata stressed that eliminating corruption is essential for Sri Lanka to regain global investor confidence. “Transparency and good governance are fundamental pillars for sustainable economic development, he said. “For Sri Lanka to attract foreign investment and achieve long-term growth, the effective implementation of this Action Plan is crucial.”

Echoing this, UNDP Resident Representative Azusa Kubota highlighted the importance of aligning governance with economic goals. “The NACAP is a roadmap for transforming Sri Lanka’s economic governance, she said. “It will make corruption visible, measurable, and actionable.”

The NACAP is built on four strategic pillars—Preventive Measures, Institutional Strengthening & Enforcement, Education, and Law & Policy Reform—targeting nine priority areas. These include streamlining state enterprise management, modernizing financial crimes investigation and integrating anti-corruption education into economic policymaking.

The implementation timeline is designed with a phased approach: short-term stabilization, medium-term reform and long-term transformation—ensuring consistent progress toward a more accountable and economically resilient state.

“Corruption ends here. The responsibility of eradicating bribery and corruption will not be passed on to the next generation — it will be resolved by our government today, President Anura Kumara Dissanayake said.

The President stressed it marks a turning point in Sri Lanka’s history. “With the launch of the National Anti-Corruption Action Plan 2025–2029, we are drawing a bold line in the sand. No longer will the fight against corruption be tangled in politics or postponed for the future. Public officials now have six months to bring transparency and integrity to their institutions. After May, the law will act decisively and without exception. This is not just policy — it’s a promise. A new era of accountability has begun and it begins with us.”

By Ifham Nizam

Business

Verdant Capital doubles down: $13.5m now powering LOLC Africa’s MSME expansion

Verdant Capital invests $4.5M more in LOLC Africa, expanding MSME lending across 10 countries and deepening financial inclusion efforts continent-wide.

Verdant Capital has announced that its Verdant Capital Hybrid Fund (the “Fund”) has completed an additional investment of USD 4.5 million in LOLC Africa Singapore Limited (“LOLC Africa”). This investment brings the total investment in LOLC Africa to USD 13.5 million. This follows the initial investment of USD 9 million in LOLC Africa, completed in June 2023. Both investments are structured as holding company loans, and they are being directed towards LOLC Africa’s operating lending subsidiaries in Zambia, Rwanda, Egypt, Kenya, Tanzania, Nigeria, Malawi, Zimbabwe, Ghana, and the Democratic Republic of Congo.

Founded in 1980 in Sri Lanka, LOLC entered the African continent in 2018. Verdant Capital Hybrid Fund is the first external investor in LOLC Africa’s operations, reflecting the Fund’s catalytic investment approach. These investments are driving the expansion of LOLC Africa’s micro, small and medium enterprises (MSMEs) financing footprint across the continent. Additionally, the Fund’s Technical Assistance Facility (TAF), has offered financial support for LOLC Africa’s Social Ratings and Client Protection Pre-Certifications for its subsidiaries in Zambia and Egypt, with further Technical Assistance initiatives in the pipeline.

Business

HNBA’s advisor & partnership channels drive 26% growth

HNB Assurance PLC (HNBA) delivered another year of outstanding financial performance, securing a 7.5% market share and moving a step closer to achieving its ambitious target of 10% market share by 2026. This success was a result of the company’s well-structured strategies, focused on sustainable growth in an increasingly competitive landscape, which yielded impressive results, with its Gross Written Premium (GWP) growing by 26% compared to the previous year.

Over the past four years, HNBA has maintained an average growth rate of 26%, consistently outperforming the industry. A key element of HNBA’s approach has been prioritizing distinctive, value-driven products over high-volume, lower-margin offerings. This strategy has allowed the company to cater to a broader customer base, ensuring inclusivity while maintaining the competitiveness and relevance of its product portfolio

In terms of growth, HNBA’s proactive investment strategy resulted in an 8% growth in investment income, reaching Rs. 6.9 Bn, while Funds Under Management saw a 26% increase. HNBA paid net benefits and claims totaling Rs. 2.9 Bn. The total assets of the company expanded by 24% to Rs. 53.4 Bn, primarily driven by increased financial investments. Additionally, total Life Insurance contract liabilities grew by 25% to Rs. 38.6 Bn, following a surplus transfer of Rs. 1.3 Bn to shareholders.

-

Business3 days ago

Business3 days agoColombo Coffee wins coveted management awards

-

Business5 days ago

Business5 days agoDaraz Sri Lanka ushers in the New Year with 4.4 Avurudu Wasi Pro Max – Sri Lanka’s biggest online Avurudu sale

-

Features4 days ago

Features4 days agoStarlink in the Global South

-

Business6 days ago

Business6 days agoStrengthening SDG integration into provincial planning and development process

-

Business5 days ago

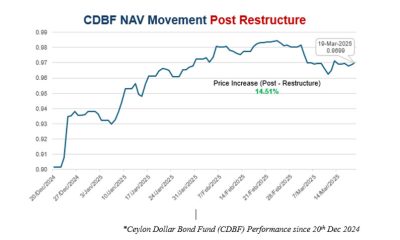

Business5 days agoNew SL Sovereign Bonds win foreign investor confidence

-

Features1 day ago

Features1 day agoSri Lanka’s Foreign Policy amid Geopolitical Transformations: 1990-2024 – Part III

-

Features4 days ago

Features4 days agoModi’s Sri Lanka Sojourn

-

Midweek Review1 day ago

Midweek Review1 day agoInequality is killing the Middle Class