Business

SL clinches deal with IMF for 4-year EFF of $ 2.9 billion subject to debt restructuring and prior actions

By Hiran H.Senewiratne

The International Monetary Fund said it had reached a deal with Sri Lanka for a 4-year 2.9 billion US dollar extended fund facility subject to debt restructuring and prior actions.Under the program the Sri Lankan budget will have to generate a primary surplus (debt before interest) of 2.3 per cent by 2024. The 2022 expected primary deficit is 4 per cent of GDP, the IMF senior mission led by Peter Breuer said.

“These reforms include making personal income tax more progressive and broadening the tax base for corporate income tax and VAT. The program aims to reach a primary surplus of 2.3 per cent of GDP by 2024, Breuer said at a media conference at the Central Bank head office in Colombo yesterday. Breuer together with Masahiro Nozaki and other members of the IMF delegation visited Sri Lanka from August 24 to September 1 to continue discussions on IMF support for Sri Lanka and the local authorities’ comprehensive economic reform program.

Breuer added: ‘The 2022 primary deficit was projected by the government at -4.0 per cent of GDP. Sri Lanka will also have to negotiate with creditors to restructure debt.

“The agreement is subject to the approval by the IMF management and the Executive Board in the period ahead, contingent on the implementation by the authorities of prior actions and on receiving financing assurances from Sri Lanka’s official creditors and making a good faith effort to reach a collaborative agreement with private creditors.

“Debt relief from Sri Lanka’s creditors and additional financing from multilateral partners will be required to help ensure debt sustainability and to close financing gaps.

“The Central Bank will also have to stop printing money (monetary financing) and bring down inflation.’’

The full IMF statement is reproduced below:

“The Sri Lankan authorities and the IMF team have reached staff-level agreement to support the authorities’ economic adjustment and reform policies with a new 48-month Extended Fund Facility (EFF) with a requested access of about SDR 2.2 billion (equivalent to US$2.9 billion).

“The new EFF arrangement will support Sri Lanka’s program to restore macroeconomic stability and debt sustainability, while safeguarding financial stability, reducing corruption vulnerabilities and unlocking Sri Lanka’s growth potential.

“The agreement is subject to the approval by IMF management and the Executive Board in the period ahead, contingent on the implementation by the authorities of prior actions, and on receiving financing assurances from Sri Lanka’s official creditors and making a good faith effort to reach a collaborative agreement with private creditors. Debt relief from Sri Lanka’s creditors and additional financing from multilateral partners will be required to help ensure debt sustainability and close financing gaps.

“Sri Lanka has been facing an acute crisis. Vulnerabilities have grown owing to inadequate external buffers and an unsustainable public debt dynamic. The April debt moratorium led to Sri Lanka defaulting on its external obligations, and a critically low level of foreign reserves has hampered the import of essential goods, including fuel, further impeding economic activity. The economy is expected to contract by 8.7 per cent in 2022 and inflation recently exceeded 60 per cent. The impact has been disproportionately borne by the poor and vulnerable.

“Against this backdrop, the authorities’ program, supported by the Fund, would aim to stabilize the economy, protect the livelihoods of the Sri Lankan people, and prepare the ground for economic recovery and promoting sustainable and inclusive growth.

Key elements of the program are:

Raising fiscal revenue to support fiscal consolidation. Starting from one of the lowest revenue levels in the world, the program will implement major tax reforms. These reforms include making personal income tax more progressive and broadening the tax base for corporate income tax and VAT. The program aims to reach a primary surplus of 2.3 per cent of GDP by 2024.

Introducing cost-recovery based pricing for fuel and electricity to minimize fiscal risks arising from state-owned enterprises. The team welcomed the authorities’ already announced substantial revenue measures and energy pricing reforms;

Mitigating the impact of the current crisis on the poor and vulnerable by raising social spending, and improving the coverage and targeting of social safety net programs;

Restoring price stability through data-driven monetary policy action, fiscal consolidation, phasing out monetary financing, and stronger Central Bank autonomy that allow pursuing a flexible inflation targeting regime. A new Central Bank Act is a cornerstone of this strategy;

Rebuilding foreign reserves through restoring a market-determined and flexible exchange rate, supported by the comprehensive policy package under the program;

Safeguarding financial stability by ensuring a healthy and adequately capitalized banking system, and by upgrading financial sector safety nets and regulatory standards with a revised Banking Act; and Reducing corruption vulnerabilities through improving fiscal transparency and public financial management, introducing a stronger anti-corruption legal framework, and conducting an in-depth governance diagnostic, supported by IMF technical assistance.

The IMF team held meetings with President and Finance Minister Ranil Wickremesinghe, Prime Minister Dinesh Gunawardena, Central Bank of Sri Lanka Governor Dr. P. Nandalal Weerasinghe, Secretary to the Treasury K M Mahinda Siriwardana, and other senior government and CBSL officials. It also met with parliamentarians, representatives from the private sector, civil society organizations and development partners.

Business

A Historic Hat-Trick: Home Lands Crowned Best Developer Sri Lanka for Third Consecutive Year, Also Wins Best Lifestyle Developer Asia

Home Lands has once again solidified its position as Sri Lanka’s number one and most trusted real estate developer, achieving a historic milestone at the PropertyGuru Asia Property Awards 2025, held in Bangkok, Thailand on 12th December 2025. The company was crowned “Best Developer, Sri Lanka” for the third consecutive year, reaffirming its unmatched leadership in the nation’s real estate sector. Adding to the prestige, Home Lands was also honoured with the highly coveted “Best Lifestyle Developer, Asia” award, an extraordinary achievement for any Sri Lankan developer on the global stage.

The prestigious PropertyGuru Asia Property Awards, the ultimate hallmark of excellence in the Asian property sector was established in 2005 to recognise the region’s finest real estate. Over the years, the programme has become the most trusted and most sought-after awards platform in Asia. Upholding the highest levels of integrity, the Awards follow a professionally supervised, independent judging system, setting the gold standard for real estate recognition in the region.

In addition to its developer accolades, Home Lands’s landmark projects shone across multiple categories, bringing home several top honours:

-

Best Luxury Condo Development (Colombo) – Pentara Residencies, Thummulla Handiya – “The Address in Colombo”

-

Best Completed Condo Development – Santorini Resort Apartments & Residencies, Negombo

-

Best Waterfront Condo Development – Bayfonte Marina Resort Apartments & Villas, Negombo

-

Best Lifestyle Developer – Home Lands Skyline (Private) Limited

Speaking on yet another historic achievement, Mr. Nalin Herath, Chairman – Home Lands Group, stated:

Speaking on yet another historic achievement, Mr. Nalin Herath, Chairman – Home Lands Group, stated:

“Securing the Best Developer title for the third consecutive year, along with being named the Best Lifestyle Developer in Asia, is a proud moment not just for Home Lands but for Sri Lanka. We sincerely thank our customers for their trust and support, which inspires us to continually raise the bar. These wins reflect our unwavering commitment to building with trust, innovation, and excellence, and we will continue to create exceptional living environments while elevating Sri Lanka’s presence in the international real estate arena.

With over 3,400 residential units delivered and over 2,300 units currently under construction across eight ongoing futuristic mega residential complexes, Home Lands continues to drive the evolution of modern living in Sri Lanka. Beyond developing homes, the company has consistently reshaped the lifestyles of Sri Lankans by introducing globally inspired, amenity-rich, resort-style living experiences.

Among its flagship projects, Canterbury Golf Resort Apartments & Villas stands as a testament to this vision — Sri Lanka’s Largest Residential Development, spanning over 55 acres of land, and the country’s first Victorian-style golf resort apartments and villas. Featuring a signature day & night golf course and an unparalleled collection of lifestyle amenities, this iconic development has redefined modern living standards, setting a new benchmark for integrated, resort-style residential environments in Sri Lanka.

Supported by a fully integrated group of 13 companies, including a CS2-graded construction arm certified by CIDA, Home Lands ensures world-class quality and seamless execution from design to delivery. With a growing global presence and offices in Australia and Dubai, the company continues to strengthen international investor confidence in Sri Lanka’s residential property sector.

According to the latest RIU Brand Health Survey 2025, Home Lands remains the undisputed market leader in the country’s real estate industry.

Business

Unlocking Sri Lanka’s hidden wealth: A $2 billion mineral opportunity awaits

Sri Lanka stands on the brink of an economic transformation, powered not by traditional exports, but by the vast, untapped mineral wealth lying beneath its soil and off its shores. According to a comprehensive new business report launched by the Pathfinder Foundation in collaboration with the Australian Trade and Investment Commission, on 17th December in Colombo, the island’s mineral sector holds a staggering unrealised export potential of up to USD 2 billion.

Currently, Sri Lanka exports most of its high-purity minerals including world-renowned vein graphite, rare earth elements (REEs), and mineral sands in raw or semi-processed form, capturing only a fraction of their true value. The report reveals that while current exports to top destinations total about USD 389 million, the achievable potential is estimated at USD 778 million, with the full downstream value-add opportunity reaching several times that figure.

“Sri Lanka has great potential for exports,” stated Australian High Commissioner Matthew Duckworth at the report’s launch. “It is not only about mining but also about refining – moving up the value chain to get significantly higher export earnings.”

The nation is endowed with critical resources essential for global clean energy and high-tech supply chains. This includes an estimated 5 million tonnes of graphite (with purity up to 99.9%), over 600 million tonnes of mineral sands containing REEs like neodymium, and the massive Eppawala phosphate deposit, which alone holds 60 million tonnes of phosphate-bearing material. Experts believe even these numbers may be conservative due to a lack of island-wide surveys, pointing to major exploration opportunities.

However, realising this potential requires urgent action. The report identifies systemic barriers: a fragmented regulatory framework involving over 18 agencies, slow licensing, infrastructure gaps, and outdated mining methods. These challenges have discouraged investment and prevented value addition.

The path forward is clear. The government is already moving to modernise the approval process via a unified digital platform and is crafting a national critical minerals strategy. The report emphasises that success hinges on attracting foreign expertise and investment, particularly in downstream processing – turning graphite into battery-grade material, refining rare earths, and processing mineral sands domestically.

Australia, with its global leadership in sustainable mining and technology, is positioned as a key partner. Australian METS (Mining Equipment, Technology, and Services) companies can bring advanced technology, ESG-compliant practices, and training, potentially reducing operational costs by 30-40% while improving recovery rates.

“For Sri Lanka, the stakes are high. Developing a modern, sustainable mineral sector can diversify the economy, create high-value jobs, build resilience, and integrate the nation into strategic global supply chains,” the Australian High Commissioner noted. The message from the report is one of urgent optimism: the resources are here, the international partners are ready, and the roadmap is laid out. Now is the time for policymakers, investors, and stakeholders to come together to unlock this buried treasure for the benefit of all Sri Lankans.

By Sanath Nanayakkare

Business

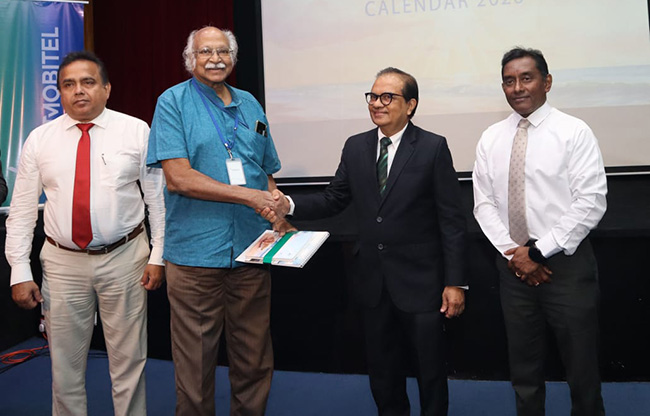

Environmental damage now a direct threat to telecom operations, SLT chief warns at 2026 calendar launch

Environmental destruction is no longer an abstract environmental concern but a direct business risk, Sri Lanka Telecom/Mobitel Chairman Dr. Mothilal de Silva warned, as the national telecom giant launched its 2026 corporate calendar linking climate change, marine degradation and network stability.

Unveiling the calendar, Dr. de Silva said the initiative was not a ceremonial exercise but a corporate statement on responsibility and survival. “Today we are not just unveiling a calendar; we are sharing a story — a story of beauty, resilience and profound responsibility,” he said, stressing that environmental protection had become business-integral for SLT.

The 2026 SLT-Mobitel desk and digital calendar takes viewers beneath Sri Lanka’s seas, focusing on the intricate forms of marine shells and clams. Created by renowned artists Pulasthi Ediriweera and Nalin Jayarathna, the artworks portray seashells as both natural marvels of design and lasting symbols of fragile marine life.

“Each shell is a protective home — a permanent memorabilia left by gentle creatures,” Dr. de Silva said. “In their form and pattern, they send us a silent message about their presence and their urgent need for protection.”

Drawing a direct link between ecological degradation and recent climate-related disasters, Dr. de Silva rejected attempts to mask environmental realities. “You cannot cover this up with fake news. The destruction of forests, hill-country ecosystems, tea estates and irresponsible land use has created these calamities,” he said, referring to recent cyclonic events and flooding.

He warned that climate change and rising sea levels were already affecting SLT’s core infrastructure. Sri Lanka’s international connectivity depends on five subsea communication cables landing in Colombo and Matara. “Unusual sea-level rise and abnormal tides have already caused network outages. When the sea is disturbed, it directly affects the quality and reliability of our network,” he said.

Dr. de Silva said SLT and its international consortium partners follow strict environmental safeguards when laying, maintaining and even disposing of subsea cables. These include detailed environmental surveys, route planning to avoid sensitive marine ecosystems and specialised installation techniques. Cable repair operations based in Galle, he added, also adhere to stringent environmental standards.

“Our work is fundamentally about connection — connecting people, businesses and nations. But this connection must be built with care for the environment that hosts it,” he said, noting that sustainability was not merely a corporate social responsibility obligation but essential to business continuity.

Marine naturalist Dr. Malik Fernando, addressing the launch, highlighted Sri Lanka’s rich but inadequately studied seashell diversity. He said several marine and freshwater mollusc species were protected under existing laws, yet continued to appear in markets due to weak enforcement.

Some shells, including cone shells, are highly venomous and capable of causing human fatalities, Dr. Fernando noted, underscoring the risks posed by unregulated collection. While many mollusc species are widely dispersed due to larval movement, he said certain rare species recorded from limited locations could be near-endemic and vulnerable to extinction.

Dr. Fernando also pointed to the broader challenge of biodiversity research, noting that many species remain unidentified due to the lack of systematic field studies, despite improved access to global scientific resources through digital platforms.

In concluding remarks, Dr. de Silva called on the media to play a responsible role in conveying environmental truths to the public and suggested that the calendar be shared internationally, including at future UN climate conferences. “A digitally empowered Sri Lanka must go hand in hand with preserving its natural wonders,” he said. “This calendar is a reminder that protecting the environment is not optional — it is essential for our future.”

By Ifham Nizam

-

Features6 days ago

Features6 days agoWhy Sri Lanka Still Has No Doppler Radar – and Who Should Be Held Accountable

-

Midweek Review3 days ago

Midweek Review3 days agoHow massive Akuregoda defence complex was built with proceeds from sale of Galle Face land to Shangri-La

-

News2 days ago

News2 days agoPakistan hands over 200 tonnes of humanitarian aid to Lanka

-

News2 days ago

News2 days agoPope fires broadside: ‘The Holy See won’t be a silent bystander to the grave disparities, injustices, and fundamental human rights violations’

-

Latest News6 days ago

Latest News6 days agoLandslide early warnings in force in the Districts of Badulla, Kandy, Kegalle, Kurunegala, Matale, Nuwara Eliya and Ratnapura

-

News3 days ago

News3 days agoBurnt elephant dies after delayed rescue; activists demand arrests

-

Features6 days ago

Features6 days agoSrima Dissanayake runs for president and I get sidelined in the UNP

-

News7 days ago

News7 days agoGovt. okays postgraduate medical training for Maldivian medical officers and dental surgeons