Business

Sierra Cables’ share sale bolsters bourse; indices wax positive

The CSE yesterday was somewhat active because Sierra Cables contributed more than half of the turnover. The company sold its shares at a price 24 percent lower than the previous price level. Market sources revealed that an LOLC Group company purchased 146 million Sierra Cables shares at a market price of Rs 12.30 per share, amounting to Rs 1.8 billion.

This gave some impetus to the market and the All Share Price Index also became positive. Sierra Cable’s previous price was Rs 15.50. Consequently, the All Share Price Index went up by 256.7 points, while S and P SL20 rose by 98.3 points. Turnover stood at Rs 3.67 billion with four crossings.

Those crossings were reported in Citizens Developments Business Finance, where two million shares crossed to the tune of Rs 464 million; its shares traded at Rs 232, HNB 295,000 shares crossed for Rs 90 million; its shares traded at Rs 305, JKH, 4 million shares crossed to the tune of Rs 80.8 million; its shares traded at Rs 20.20 and TJ Lanka 900,000 shares crossed for Rs 44.6 million; its shares traded at Rs 49.50.

In the retail market top six companies that mainly contributed to the turnover were; Sierra Cables Rs 1.8 billion (146 million shares traded), CCS Rs 168 million (2.2 million shares traded), JKH Rs 79.5 million (3.9 million shares traded), Sampath Bank Rs 67.8 million (562,000 shares traded), TJ Lanka Rs 60 million (1.2 million shares traded) and Vallibel One Rs 58.4 million (one million shares traded). During the day 197 million share volumes changed hands in 11468 transactions.

It is said that manufacturing sector entities were the main contributors to the turnover, especially with Sierra Cables and JKH, while banking sector counters were the second highest contributor to the market turnover.

Yesterday, the rupee was quoted at Rs 296.45/65 to the US dollar in the spot market, weaker from 296.30/40 the previous day, dealers said, while bond yields were slightly down.

A bond maturing on 01.07.2028 was quoted at 9.75/85 percent, down from 9.84/90 percent. A bond maturing on 15.09.2029 was quoted at 10.08/15 percent, down from 10.14/20 percent. A bond maturing on 15.10.2030 was quoted at 10.25/34 percent, down from 10.25/38 percent. A bond maturing on 15.12.2032 was quoted at 10.75/85 percent, down from 10.85/97 percent.

By Hiran H. Senewiratne

Business

Stepped-up bid to attract more young talent to the world of hospitality

The clink of cutlery, youthful laughter and the unmistakable energy of ambition filled the SLIIT Campus in Malabe as the Colombo Academy of Hospitality Management (CAHM) officially unveiled CAHM-7 Star Junior Chef Season 1, a pioneering national culinary competition designed to ignite the dreams of Sri Lanka’s next generation of chefs.

Speaking at the media briefing, CAHM chairman Errol Weerasinghe said the initiative was born out of a pressing need to attract young talent into what he described as the fastest-growing industry in the world of hospitality.

“We really want kids to get involved in this industry. We need the young generation,” Weerasinghe said, noting that this would be Sri Lanka’s first corporate-backed seven-star junior chef competition.

The programme will kick off in the Western Province, with plans to expand islandwide in phases, reaching schools directly and gauging student interest in culinary careers at an early age.

Weerasinghe also took pride in CAHM’s rapid growth over the past 13 years, highlighting that the academy has become Sri Lanka’s largest private hospitality education provider in a remarkably short time.

He added: “We have produced over 3,000 graduates, and I’m proud to say every single one of them is employed.” Adding that’s the key, real opportunities and real careers.

Adding strong corporate backing to the initiative, Vijay Sharma, Chief Executive Officer of Serendib Flour Mills Pvt Ltd, said the programme resonated deeply with the company’s core philosophy of “nourishing the nation.”

“We don’t just produce and sell flour, Sharma said. “Our responsibility is much larger. We want to nourish the body, the mind, the emotions and even traditions.”

He noted that supporting young minds at a formative age was essential for shaping how they perceive their future.

Sharma recalled how traditional career expectations once limited choices. “In those days, you were expected to become either a doctor or a teacher, he said. “Hospitality was rarely seen as a profession. Today, that has changed completely. This industry offers global opportunities, dignity and growth.”

Organisers said CAHM-7 Star Junior Chef is built around a simple but powerful idea, the best dish often starts in the smallest kitchen.

The competition gives young chefs aged 13 to 16 a platform to transform passion into purpose through exposure to real kitchens, professional chefs and structured mentorship.

Nilantha Rupasinghe, Head of the Organising Committee and Assistant Director at CAHM, said while the age group presents challenges, it is also where lasting inspiration begins.

He added:”We want to recognise talent early, motivate them and guide them towards becoming future culinary experts.”

Applications open from January 23, both online and through printed forms, and close on February 15.

Organisers expect more than 1,500 applications. From these, 200 participants will be selected for live cooking competitions scheduled for March 7 and 8 at CAHM’s professional kitchens.

From there, 100 contestants will advance, followed by 30 semi-finalists who will receive hands-on training, demonstration sessions and exposure visits to leading hotels and food production facilities, including flour mills.

The semi-finals on April 4 will lead to a grand finale on May 9, with winners receiving scholarships, cash awards and prestigious recognition.

All ingredients, equipment and utensils will be provided, ensuring every child competes on equal footing.

With the support of the Ministry of Education, media partners and industry leaders, CAHM-7 Star Junior Chef Season 1 is shaping up to be more than a competition — it is a bold investment in Sri Lanka’s culinary future, where young dreams are nurtured, one dish at a time.

By Ifham Nizam

Business

Sri Lanka’s economic comeback faces its first test as debt fears rekindle

First Capital Holdings PLC, a subsidiary of JXG (Janashakthi Group) and a pioneering leader in Sri Lanka’s investment landscape, successfully hosted the highly anticipated 12th Edition of its First Capital Investor Symposium on 22nd January, at Cinnamon Life, Colombo.

During the Symposium, First Capital presented its economic outlook for Sri Lanka in 2026, highlighting both growth prospects and plausible vulnerabilities. A central finding was the anticipated softening of Sri Lanka’s GDP growth, projected to decrease from 5.0% in 2025 to 3.0-4.0% in 2026. The main reason for this expected slowdown is the impact of the recent Cyclone Ditwah. The damage from the storm leads people to spend less, especially in areas beyond the main Western province, which affects the economy. While Sri Lanka’s fiscal resilience and fundamental discipline, a trend since 2023, are anticipated to remain robust, the need for higher capital expenditure in post-Ditwah revitalization efforts creates challenges. The main point of concern is that with slower economic growth, it could become more challenging for Sri Lanka to continue making good progress on managing its national debt.

Concurrently, the symposium’s discussion spanned interest rate movements, exchange rate trends, and bond market developments. The event also provided a unique platform for investors, industry leaders, and experts to engage in critical discussions on the market forces that are shaping Sri Lanka’s economic future. Drawing over 300 invitees and 400 participants online, the event proved to be one of the largest and most influential investor gatherings in the country, further consolidating First Capital Holdings’ leadership in fostering economic discourse and empowering investors with strategic insights.

Business

LOLC Finance launches short-term fixed deposits

LOLC Finance, Sri Lanka announces the launch of its Exclusive Short-Term Fixed Deposits, offering 4-month and 7-month maturity options at some of the most attractive and competitive interest rates in the market. Designed especially for Sri Lankans who work tirelessly to build and protect their savings, this new product delivers a powerful combination of stability, security, and stronger returns, backed by the most trusted financial entity in the industry.

As the country’s leading NBFI, LOLC Finance continues to demonstrate strength, resilience, and proven expertise in managing customer wealth responsibly. For the FY 2024/25, the company recorded a Profit After Tax (PAT) of Rs.25.1 billion and has already achieved Rs.14 billion PAT in the first half of FY 2025/26, a remarkable 72% year-on-year growth, indicating that the company is on track to surpass last year’s performance well before the financial year ends. Reinforcing this exceptional trajectory, LOLC Finance maintains a gross lending portfolio of Rs.360.2 billion, while customer deposits have grown to Rs.238.6 billion as at 30th September 2025.

The company’s financial strength reflects the consistent, unbroken trust and loyalty of its customers, a testament to the strong brand equity LOLC Finance has built over its two decades of leadership within Sri Lanka’s financial services landscape. With 30.3% of total industry equity, 20.6% of industry assets, and 36.3% of total industry profits, LOLC Finance stands firmly at the top of Sri Lanka’s NBFI sector, not just as the largest player, but as the most reliable partner for communities striving to safeguard and grow their hard-earned money. LOLC Finance is rated A+ (Stable) by Lanka Rating Agency, reaffirming its financial stability, robust governance, and its commitment to managing customer funds with integrity and reliability.

-

Business2 days ago

Business2 days agoComBank, UnionPay launch SplendorPlus Card for travelers to China

-

Business3 days ago

Business3 days agoComBank advances ForwardTogether agenda with event on sustainable business transformation

-

Opinion6 days ago

Opinion6 days agoRemembering Cedric, who helped neutralise LTTE terrorism

-

Business6 days ago

Business6 days agoCORALL Conservation Trust Fund – a historic first for SL

-

Opinion3 days ago

Opinion3 days agoConference “Microfinance and Credit Regulatory Authority Bill: Neither Here, Nor There”

-

Opinion5 days ago

Opinion5 days agoA puppet show?

-

Opinion2 days ago

Opinion2 days agoLuck knocks at your door every day

-

Features7 days ago

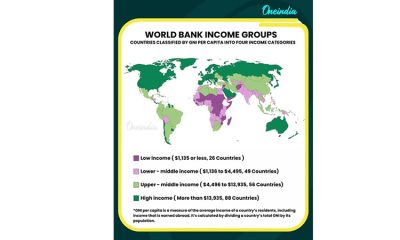

Features7 days agoThe middle-class money trap: Why looking rich keeps Sri Lankans poor