Business

“Seeing is Believing” featuring multiple collaborators

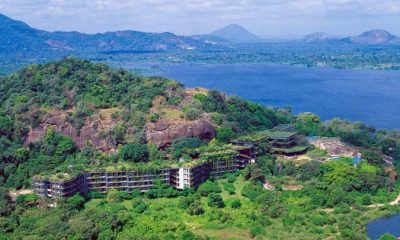

With the objective of accelerating the tourism arrivals from India, leading hospitality and travel entities in the island including Cinnamon Hotels and Resorts, Walker’s Tours, Aitken Spence Hotels, Aitken Spence Travels, Jetwing Hotels, and Jetwing Travels, have joined forces with the Sri Lanka Tourism Promotions Bureau and National Carrier SriLankan Airlines to unveil a groundbreaking influencer campaign titled “Seeing is Believing.” This strategic collaboration aims to showcase the beauty and wonders of Sri Lanka as an unrivaled travel destination for Indian tourists.

The “Seeing is Believing” campaign represents a powerful synergy between industry leaders who recognize the immense potential of influencer marketing in the digital age. By harnessing the popularity and reach of Indian influencers, this campaign seeks to capture the attention of millions of potential travellers and ignite their desire to experience the enchanting sights and experiences Sri Lanka has to offer.

A total of 50 influencers/content creators are scheduled to tour the island in batches during the year, on specially curated itineraries, to suit their travel interests and followership. These influencers were selected by Sri Lanka Tourism Promotion Bureau through a stringent process from among 150 potential influencers.

Sri Lanka has long been renowned for its diverse landscapes, captivating heritage, and warm hospitality. The “Seeing is Believing” campaign aims to highlight these unique attributes through the lens of influential Indian personalities across various social media platforms. These influencers will embark on an immersive journey, sharing their authentic experiences as they explore Sri Lanka’s iconic landmarks, rich culture, tantalizing cuisine, and breathtaking natural beauty.

This unprecedented collaboration signifies a collective commitment to drive tourism growth in Sri Lanka by targeting the Indian market. India has consistently been one of the largest sources of visitors to Sri Lanka, and this campaign aims to further strengthen the ties between the two nations while creating unforgettable memories for Indian travelers. Accordingly, all partner entities will provide complimentary accommodation, ground transportation and air tickets with the only aim of creating destination visibility.

Harin Fernando, Minister of Tourism and Lands, expressed his excitement about the campaign, stating, “We are thrilled to receive such a proposal from heads of such esteemed organizations with the objective of promoting Sri Lanka as a dream destination for Indian travelers. It is commendable that National carrier and private sector is coming forward with this campaign to solely promote Sri Lanka. Through ‘Seeing is Believing,’ we hope to showcase the hidden gems, extraordinary experiences, and warm Sri Lankan hospitality that awaits them. This campaign is a testament to our collective efforts to reignite tourism and foster stronger ties between India and Sri Lanka and will be an excellent model to carry forward with rest of the partners. “

“As the National carrier, we have always supported destination promotional endeavors and we are happy to collaborate with all the like-minded entities in the latest initiative, ‘Seeing is Believing’ campaign. India is our single largest market with 9 connecting points and we have always valued its stature as a leading tourism generating market for Sri Lanka. We are hopeful that a program of this scale would have immense positive impact in positioning Sri Lanka as a viable short haul destination to Indian leisure travelers.” stated Richard Nuttall, the Chief Executive Officer of SriLankan Airlines.

The “Seeing is Believing” influencer campaign is expected to generate substantial buzz and engagement among Indian audiences, inspiring them to embark on their own adventures in Sri Lanka. The campaign will unfold across various digital platforms, including social media channels, travel blogs, and video-sharing platforms, ensuring a broad reach and captivating storytelling to entice potential travelers.

Business

Beyond the Fashion Value Chain: MAS Leads Global Biodiversity Restoration

Sri Lanka is one of the world’s richest biodiversity hotspots, with nature deeply intertwined with community life. Reflecting this connection, across the island, small-scale conservation efforts have always thrived in pockets. For MAS Holdings, the urgency of the environmental crisis made it clear that scattered initiatives were not enough- it was time to bring them together into an impactful, long-term approach. Employees have also welcomed the chance to be part of projects that protect nature, finding meaning in contributing to something that benefits both their communities and the environment.

Recognising this, apparel-tech conglomerate MAS Holdings has made biodiversity restoration central to its sustainability roadmap, the MAS Plan for Change 2030. Building on its commitments for 2025, the company has pledged to reforest and restore biodiversity across an area 100 times larger than its global operational footprint.

For an organization that spans 15 countries- across North America, Europe, Asia and Africa, this amounts to more than 31,700 acres of land. According to Nemanthie Kooragamage, Director – Group Sustainable Business at MAS Holdings, achieving reforestation on such an ambitious scale demands bold and innovative approaches.

“Well-planned restoration can do far more than replace lost trees,” she explains. “It can reconnect fragmented landscapes, stabilise soils, improve freshwater quality, rebuild coastal and mangrove nurseries, and create wildlife corridors- benefits that safeguard nature and the long-term resilience of apparel supply chains and communities.”

Building a Scalable Goal

The roots of MAS’ biodiversity goal trace back to 2017, when it pledged to restore 250 acres of land, equivalent to its operational footprint at the time. By the end of the initiative, the company had doubled its target and restored 500 acres of land.

Even then, MAS recognised that planting trees alone was not enough. As it pursued this goal, it became clear that landscapes face different pressures, from invasive species to degraded soils, and therefore require tailored interventions. And so, MAS developed its six-model framework for restoration: Conservation, Reforestation, Invasive Removal, Afforestation, Analog Forests, and Forest Gardens.

This framework later underpinned the biodiversity target set under Plan for Change 2025, which scaled up the 2017 pledge to restore 100 times MAS’ operational footprint at the time, a total of 25,000 acres.

Applying the Six-Model Approach

Over the last five years, the six-model framework has been put into practice, with projects demonstrating how different contexts required different interventions.

Conservation was at the heart of the Panama In-Situ Turtle Conservation Project, launched in partnership with two corporates and the Wildlife and Ocean Resources Conservation Society. Protecting a three to ten-kilometre stretch of coastline, the project has safeguarded 272 nests and released over 17,000 hatchlings since October 2023, directly supporting the survival of endangered sea turtle species.

Reforestation included the restoration of 10 acres of mangroves in Trincomalee, where MAS achieved an 81% sapling survival rate. Meanwhile, the Ittapana Mangrove Forest Reforestation Project, undertaken with the University of Sri Jayawardenepura and local communities, planted 500 saplings with a 94% survival rate. Beyond ecological restoration, it enhanced local fisheries, improved water quality, and engaged students and residents, ensuring long-term community impact.

To restore large, inaccessible degraded terrains, MAS partnered with the Sri Lanka Air Force to disperse seed bombs. This aerial reforestation method restored 275 acres and achieved a 45% survival rate, demonstrating an efficient solution for landscapes that could not be rehabilitated through conventional means.

Invasive Alien Species (IAS) removal was another critical strand, with programmes carried out in national parks in partnership with the Department of Wildlife Conservation. At Horton Plains, MAS removed Ulex europaeus from 82% of the affected areas and restored 244 acres of sensitive ecosystem. At Udawalawe and Lunugamwehera, the manual removal of Lantana camara supported the regeneration of grasslands vital for elephants, leopards, and sloth bears.

“We tested different approaches in Sri Lanka, from coastal conservation to seed bombing and invasive species removal, and they proved effective in their own contexts. With the scale of our biodiversity goals and our global operational footprint, the next step was to take these learnings beyond Sri Lanka and apply them internationally,” said Uvini Athukorala, Manager – Environmental Sustainability.

Expanding Globally

As part of its Plan for Change 2025 biodiversity conservation efforts, MAS extended projects beyond Sri Lanka to countries where it also has manufacturing operations. This ensured that the company’s restoration work addressed the landscapes and communities directly connected to its business footprint.

In Central Java, Indonesia, the Blora Ngawi Biodiversity Restoration Project has restored over 12,601 acres since 2023. The initiative planted more than half a million trees and established a multi-stakeholder forest management model that combines forest protection, land rehabilitation, and habitat enrichment.

In Kenya, MAS launched its largest conservation project to date, protecting 8,275 acres within the Nairobi National Park, in partnership with The Wildlife Foundation. The project secured wildlife corridors critical for elephants, lions, and cheetahs, reduced human-wildlife conflict, and created conservation-linked livelihoods for more than 600 people, with women and youth playing a central role.

These global projects demonstrated that the lessons learned in Sri Lanka, experimenting with diverse approaches and working hand in hand with local partners, could be successfully scaled in other contexts, while directly benefiting the communities where MAS operates.

Lessons for the Future

As the Plan for Change 2025 concludes, MAS has restored 25,058 acres toward its biodiversity conservation goal. The experience highlights two key lessons. First, that restoration must be context-specific. From mangrove reforestation in Trincomalee to invasive species removal in Horton Plains, or aerial reforestation of degraded terrain, each ecosystem required a different model to deliver meaningful results. Second, that collaboration is essential. Partnerships with government agencies, non-profits, universities, and local communities in Sri Lanka, Indonesia, and Kenya ensured both technical expertise and local ownership, making projects sustainable beyond their initial interventions.

Business

People’s Bank’s Commitment to Rebuilding the MSME Sector through Government-Backed Financing

How is People’s Bank ready to support the rebuilding of the MSME sector in Sri Lanka, not only in the post-crisis context but in general?

Micro, Small and Medium Enterprises (MSMEs) are the backbone of the Sri Lankan economy, playing a vital role in employment generation, regional development, and income distribution. At People’s Bank, supporting MSMEs is a long-term strategic priority aligned with our mandate as the country’s premier state-owned commercial bank.

Our approach extends beyond post-crisis recovery to support the full MSME life cycle, from start-ups and micro entrepreneurs to growing and established businesses, through tailored financing, advisory support, and sector-specific solutions. With our island-wide branch network and strong understanding of local economies, People’s Bank is well positioned to serve entrepreneurs across urban, rural, and underserved communities.

What government-funded facilities are currently available through People’s Bank?

People’s Bank actively participates in several government-funded and concessionary loan schemes, offering lower interest rates compared to market rates, medium to long-term tenures, loan amounts based on project viability and eligibility criteria defined by sector, purpose, and enterprise size.

Government funded loan products are made available at People’s Bank branches for the sectors in line with government policy directives in MSME sector, as shown in the Table 1.

Can you briefly summarize the MSME loan products offered by People’s Bank?

People’s Bank offers a wide range of bank-funded MSME loan products, including working capital loans to support day-to-day business operations, term loans for machinery, equipment, expansion, and modernization, trade finance facilities including import, export, and local trade support, overdrafts and revolving credit to manage cash flow fluctuations and sector-specific loans tailored for agriculture, manufacturing, tourism, construction, logistics, and services.

Loan amounts, interest rates, and tenures vary depending on the business profile, purpose of the loan, and credit evaluation, with repayment periods extending up to several years for long-term investments whereas the MSME definition introduced by Ministry of Industries for categorization of concerned businesses.

People’s Bank offers a range of bank-funded loan schemes in MSME sector as follows and the interest rates are varies from 7.0% p.a to 12.0% p.a.

The Small and Medium Enterprises Development (SMED) Scheme

The Business Power Loan Scheme

The Solar Power Generation Loan Scheme

The Green Power Loan

The People’s SPARK Loan Scheme

The NCGIL Loan Scheme

People’s Power Loan Scheme

Vanitha Saviya Loan Scheme

Aswenna Loan Scheme

Pledge Loan Scheme (Bank-Funded Variant)

How should customers approach People’s Bank to access these facilities?

Customers are encouraged to visit their nearest People’s Bank branch, which serves as the primary access point for MSME financing. Branch Managers and Credit Officers will assess customer needs, recommend suitable bank-funded or government-funded facilities, and provide guidance on eligibility and documentation, ensuring personalized support throughout the process.

This branch-based approach ensures transparency, sound advisory support, and efficient decision-making. People’s Bank remains committed to empowering Sri Lanka’s MSME sector as a long-term national responsibility, delivering inclusive and sustainable financial solutions through both its own resources and government-backed initiatives.

(This article is based on an interview with People’s Bank Deputy General Manager (SME, Development & Micro Finance), Wickrama Narayana)

Business

Shangri-La Group extends humanitarian support for Cyclone Ditwah relief efforts

In response to the humanitarian needs arising from Cyclone Ditwah, Shangri-La Group has extended financial assistance to support national relief efforts through the Sri Lanka Red Cross Society, under the leadership of Secretary General Dr. Mahesh Gunasekara.

The contribution will be directed towards critical, life-sustaining interventions in some of the most affected communities across the country. According to the Sri Lanka Red Cross, medical services in 25 major hospitals have been severely disrupted by the cyclone. Part of the assistance will therefore support the deployment of mobile medical camps, ensuring timely and accessible healthcare for vulnerable populations.

Recognising the urgent need for safe drinking water in flood-affected areas, the initiative will also focus on restoring natural water sources, including wells and springs, helping communities regain access to clean and reliable water. In addition, a portion of the funds will be allocated to psychosocial support programmes for children residing in temporary camps, offering care, comfort, and emotional reassurance during a deeply unsettling time.

“At Shangri-La, our commitment goes beyond the walls of our hotels. In moments like these, it is about standing alongside communities with empathy, responsibility and care. We hope this support brings not only practical relief, but also comfort and reassurance to families – especially children – who are navigating an incredibly difficult time,” said Shangri-La Sri Lanka Director of Human Resources, Madusha Pihilladeniya. “Our hearts are with every community affected, and we remain united in the belief that compassion, when shared, can help restore hope.”

This initiative reflects Shangri-La’s ethos of Heartfelt Hospitality – a philosophy rooted in empathy, responsibility, and solidarity. It stands as a quiet yet powerful reminder that, beyond hospitality, Shangri-La remains committed to standing with communities when care is needed most and hopes this brings comfort, together with practical assistance to communities affected during this challenging time.

-

News23 hours ago

News23 hours agoSajith: Ashoka Chakra replaces Dharmachakra in Buddhism textbook

-

News6 days ago

News6 days agoInterception of SL fishing craft by Seychelles: Trawler owners demand international investigation

-

Business24 hours ago

Business24 hours agoDialog and UnionPay International Join Forces to Elevate Sri Lanka’s Digital Payment Landscape

-

Features23 hours ago

Features23 hours agoThe Paradox of Trump Power: Contested Authoritarian at Home, Uncontested Bully Abroad

-

News6 days ago

News6 days agoBroad support emerges for Faiszer’s sweeping proposals on long- delayed divorce and personal law reforms

-

Features24 hours ago

Features24 hours agoSubject:Whatever happened to (my) three million dollars?

-

News23 hours ago

News23 hours ago65 withdrawn cases re-filed by Govt, PM tells Parliament

-

Opinion3 days ago

Opinion3 days agoThe minstrel monk and Rafiki, the old mandrill in The Lion King – II