Business

Sampath Bank maintains a strong value proposition to all its stakeholders amidst ongoing economic challenges

Sampath Bank continued to reinforce its commitment to all stakeholders notwithstanding the ongoing economic challenges. Stepping in to support the customers affected by the prolonged economic downturn, the Bank continued to offer tailormade options and alternative repayment plans to help its customers sustain their businesses while staying true to its ethos of customer value creation. Similarly, the interests of another stakeholder group of the Bank, the shareholders, were kept in mind by paying the industry’s highest cash dividend of Rs 3.45 per share and a further Rs 1.15 per share in the form of scrip dividend.

The Bank also continues to honor its commitments towards the community via the “Weweta Jeewayak” tank restoration initiative as well as the Oceanic Ecosystem Restoration initiative titled “A Breath to the Ocean” which includes coral restoration, mangrove planting, and turtle conservation programs. The Bank continues to honour its commitment towards the community by focusing on environmental sustainability and towards that end completed the restoration of the Halgahawala forest reserve which it will continue to support even after the project’s conclusion.

The Bank succeeded in raising Rs 10 Bn in Tier 2 capital via a debenture issue in February 2023. Despite the depressing economic outlook in the Country, the issue was oversubscribed – a testament to the investor confidence placed in Sampath Bank and widespread acceptance of the stability and prudent governance of the Bank. The newly obtained capital will enable the Bank to rise above and prevail as one of the Country’s pre-eminent Bank.

Sampath Bank registered a profit before tax (PBT) of Rs 4.5 Bn and a profit after tax (PAT) of Rs 2.6 Bn for the three months ended 31st March 2023, indicating a decline of 30.5% and 44.3% respectively from the figures reported in 1Q 2022. This decline was mainly attributed to the exchange losses recorded during the quarter as a result of the appreciation of LKR by Rs 39 against the USD on its foreign currency reserves. All other income lines recorded performance well above the previous period.

Key highlights of financial results declared by Sampath Bank and the Group for 1Q 2023 compared to 1Q 2022:

* Strong NII buttressed by the higher AWPLR.

* 19% increase in net fee and commission income driven by trade-related operations

* As a result of the appreciation of LKR against USD by Rs 39 in 1Q 2023 vs depreciation of Rs 93.75 in 1Q 2022, the exchange income declined by Rs 10.9 Bn.

* 27% increase in impairment provision on loans and advances.

* The high inflationary conditions resulting in 22% increase in operational expenses.

* The upward revision in Income Tax rate and the introduction of SSCL resulting in higher tax expenses.

* Group’s PBT and PAT for 1Q 2023 was Rs 5 Bn and Rs 3 Bn respectively, reflecting a decline of 27% and 38% respectively.

Impairment charge on loans and advances: In the first quarter of 2023, the impairment charge for loans and advances increased by 27% compared to the same period in the previous year.

Impairment on Individually Significant Loan (ISL) Customers:

During the first quarter of 2023, the Bank evaluated a substantial portion of its loans and advances under the ISL category, taking into account both their financial strength and external macroeconomic pressures. Consequently, Rs 4.6 Bn was charged as impairment provisions against ISL customers in the first three months of 2023, an increase of Rs 1.3 Bn compared to the same period in 2022.

Even though a slow recovery was witnessed in some vulnerable industries, the Bank prudently maintained the previous level of impairment provisioning against ISL customers in these industries as it did not deem that the industry risk had significantly declined.

Collective Impairment: Impairment models used in 2022 were continued in 1Q 2023 to ensure adequate buffers were in place to absorb any potential credit risk that could arise in future. This cautious strategy was in response to the uncertain economic conditions witnessed both locally and globally. The Bank continued to maintain in 2023, the allowance for overlay which it applied in 2022. The probability weightage applied to the worst-case economic scenario remained unchanged during the reporting period.

During the period under review, the Bank also proceeded to reclassify customers from Stage 1 to Stage 2 considering their potential credit risk. Meanwhile customers operating in Risk Elevated Industries were also reclassified under Stage 2, with additional provisions recognized against them.

Impairment charge on other financial instruments:

The impairment charge on other financial instruments amounted to Rs 0.4 Bn for 1Q 2023, a 95% reduction compared to Rs 6.7 Bn reported in the corresponding period of the previous year. In 1Q 2022, the Bank recognised a substantial impairment charge against FCY denominated government securities in response to the downgrade of Sri Lanka’s sovereign rating in April 2022 and the announcement by the Government of Sri Lanka (GoSL) on the restructuring of the country’s external debt through an IMF-supported economic adjustment program. No such provisioning was deemed necessary in 1Q 2023 as substantial provisioning had already been recognized against the said instruments as at 31st December 2022.

Operating Expenses.

Operating expenses in 1Q 2023 showed a 22% increase in comparison to the first quarter of 2022. The 41% increase in other expenses could be attributed to the prevailing inflationary conditions and other factors such as LKR depreciation, increased taxes and import restriction. Personnel costs too grew by 7.4% in 2023 mainly owing to annual salary increases.

Tax Expenses

Total effective tax rate of the Bank increased to 57% in 1Q 2023 from 42% reported in 1Q 2022, owing to the combined effect of the newly introduced Social Security Contribution Levy (SSCL) and the increase in income tax rate.

Key Ratios

The Return on Average Shareholders’ Equity (after tax) decreased to 8.37% as at 31st March 2023 from 10.95% reported at the end of the year 2022. Return on Average Assets (before tax) stood at 1.38% as at 31st March 2023 as against the 1.16% reported as at 31st December 2022.

Capital Ratios

The Bank’s latest capital adequacy ratios improved further in 1Q 2023 from the figures reported in the previous quarter in addition to their being well above the regulatory minimum requirements. As at 31st March 2023, Sampath Bank’s CET 1, Tier 1 and total capital ratios were at 12.51%, 12.51% and 16.12% compared to 11.92%, 11.92% and 14.27% respectively at the end of 2022. These increases are attributed to two main reasons – Rs 10 Bn worth of Tier 2 capital infusion in February 2023 and decline in risk weighted assets resulting from the LKR appreciation.

Assets and Liabilities

Total assets of the Bank declined by Rs 18 Bn (by 1.4%) from Rs 1.32 Tn as at 31st December 2022 to Rs 1.31 Tn as at 31st March 2023. This decline was mainly the result of the Rupee value reduction in foreign currency denominated assets on the back of the LKR appreciation against the USD.

Similarly, the total Advances declined by Rs 22 Bn (by 2.4%) in the first three months of 2023 from Rs 920 Bn as at 31st December 2022 to Rs 898 Bn at the end of the reporting period due to the LKR appreciation against the USD.

Sampath Bank’s total deposit book declined from Rs 1.1 Tn reported at the end of 31st December 2022 to Rs 1.07 Tn at the end of 31st March 2023, a decline of Rs 32 Bn (by 2.9%). The CASA ratio at the end of 1Q 2023 was 32.8% compared to 32.7% reported at the end of 2022.

Dividend

The Shareholders of Sampath Bank at the Annual General Meeting held on 30th March 2023 approved the final Cash Dividend of Rs 3.45 per share and Scrip Dividend of Rs 1.15 per share for the financial year 2022. In its 1Q 2023 Financial Statements, the Bank made a provision of Rs 5.3 Bn to facilitate the payment of the approved final dividend, while Rs 1.1 Bn was capitalized for the purpose of creating shares under scrip dividend. The Bank paid the dividend in April 2023.

Business

Embedding human rights, equity and integrity into business leadership

At its 2026 Social Sustainability Programme Kick-Off, the UN Global Compact Network Sri Lanka convened business leaders to advance the translation of global ambition into practical corporate action on inclusion, integrity and human rights.

On 24 February 2026, the UN Global Compact Network Sri Lanka (Network Sri Lanka) convened business leaders at Barefoot Garden Café for its 2026 Social Sustainability Programme Kick-Off, delivered in collaboration with Good Life X.

The gathering did more than introduce a calendar of events. It positioned Sri Lanka’s corporate community within the broader direction of the UN Global Compact’s 2026–2030 global strategy — a strategy anchored in three imperatives: equipping companies to act, catalyzing collective action, and advancing the business case for responsible leadership.

At its core, the 2026 Social Sustainability agenda is designed to move companies from commitment to capability.

Within the Diversity & Inclusion Working Group, this means building practical pathways toward equal pay for equal work and strengthening male allyship as a governance issue rather than a cultural afterthought. It means examining sexual and reproductive health, disability inclusion, and mental health not as employee benefits, but as structural determinants of productivity and retention. It means sharpening strategic communications so inclusion is embedded in brand integrity. It also means applying science-based behavioural change approaches to shift organizational culture in measurable ways.

Across the Business & Human Rights Working Group, equipping companies takes the form of deepened engagement on decent work and living wage implementation, strengthening human rights due diligence processes, and addressing emerging risk areas such as AI and digital rights. It extends to reinforcing business integrity and anti-corruption frameworks, understanding the social dimensions of a just transition, and recognizing the link between child rights, nutrition, and workforce productivity.

Business

Union Bank to raise LKR 3 Bn via Basel III Compliant Debenture Issue

Union Bank of Colombo PLC announced its proposed Debenture Issue 2026, a strategic move aimed at raising up to LKR 3 billion. This issue is designed to bolster the Bank’s Tier II capital base and provide a robust financial foundation for its upcoming growth initiatives.

The offering consists of Basel III compliant, listed, rated, unsecured, subordinated, redeemable high-yield debentures with Non-Viability Conversion. The instrument has been assigned a rating of BB (lka) by Fitch Ratings (Lanka) Ltd, reflecting the bank’s creditworthiness and the structured nature of the subordinated debt.

Investors can choose from three distinct interest structures starting from a high-yield 13% fixed rate per annum (Type A). This option is paid annually, while Type B offers a 12.5% fixed rate paid semi-annually (12.89% AER). For those seeking market-linked returns, Type C provides a floating rate of the 182-days Treasury Bill rate plus a 400-basis point margin, also paid semi-annually.

The debentures are priced at LKR 100 per unit with a 5-year tenure (2026–2031). The initial issue size is set at 20,000,000 debentures with an option to raise 10,000,000 at the discretion of the Bank and is scheduled to open on 10 March 2026.

Shanka Abeywardene, Chief Financial Officer of Union Bank stated “This debenture issue marks a significant step in the Bank’s journey towards enhanced financial stability. By strengthening its capital adequacy, Union Bank is well-positioned to navigate evolving market conditions while fuelling its long-term strategic objectives for sustainable growth”

Business

Sanjay Kulatunga appointed to WindForce Board

WindForce PLC announced the appointment of Sanjay Kulatunga as an Independent, Non-Executive Director to its Board with effect from 03rd March 2026, following the resignation of Dilshan Hettiaratchi. The appointment further strengthens the Company’s governance framework, strategic oversight, and long-term decision-making capabilities.

Kulatunga brings an established track record as a founder, entrepreneur, and senior executive across financial services and export-oriented industries. He is the Chief Executive Officer and Co-Founder of LYNEAR Wealth Management, a boutique investment firm established in 2013, which has since grown to become one of Sri Lanka’s largest private wealth management institutions, serving high-net-worth individuals as well as local and international institutional clients.

Prior to founding LYNEAR, Kulatunga played a pivotal role in the establishment of Amba Research, an investment research offshoring firm rooted in Sri Lanka and now operating as part of Acuity Analytics.

Over the years, he has contributed extensively to several key national institutions. His previous appointments include serving on the Financial Sector Stability Consultative Committee of the Central Bank of Sri Lanka, as well as the Board of Investment of Sri Lanka and the Securities and Exchange Commission of Sri Lanka.

-

Features3 days ago

Features3 days agoBrilliant Navy officer no more

-

Opinion6 days ago

Opinion6 days agoJamming and re-setting the world: What is the role of Donald Trump?

-

Features6 days ago

Features6 days agoAn innocent bystander or a passive onlooker?

-

Opinion3 days ago

Opinion3 days agoSri Lanka – world’s worst facilities for cricket fans

-

Business6 days ago

Business6 days agoAn efficacious strategy to boost exports of Sri Lanka in medium term

-

Features4 days ago

Features4 days agoOverseas visits to drum up foreign assistance for Sri Lanka

-

Features4 days ago

Features4 days agoSri Lanka to Host First-Ever World Congress on Snakes in Landmark Scientific Milestone

-

Features3 days ago

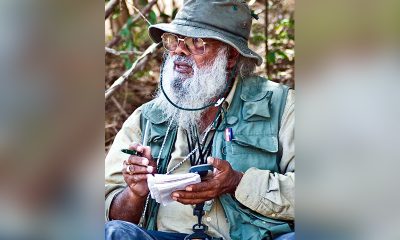

Features3 days agoA life in colour and song: Rajika Gamage’s new bird guide captures Sri Lanka’s avian soul