Business

New tax bill: Sri Lanka’s corporates wary about ‘subtle’ non-deductions

Say draconian powers drafted to be given to Inland Revenue Chief

Calls for independent body to get a fair hearing

By Sanath Nanayakkare

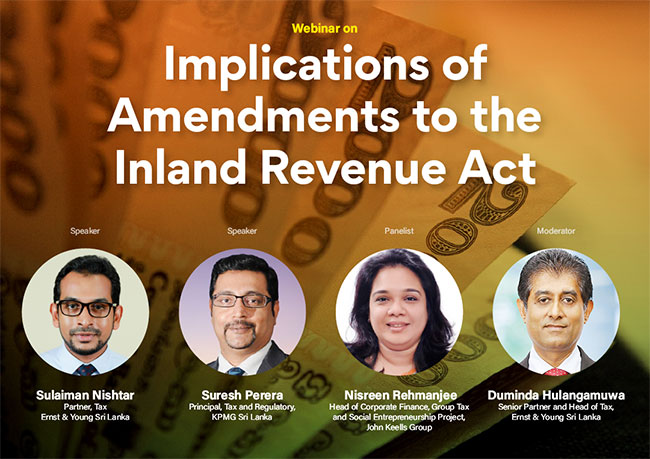

The new tax bill is one that demotivates taxpayers from being compliant and one that restricts existing taxpayers from their legitimate deductions, Nisreen Rehmanjee, head of corporate finance, group tax and social entrepreneurship project, John Keells Group said on Tuesday.

She said so at a webinar hosted by the Ceylon Chamber of Commerce (CCC) titled,” Implications of Amendments to the Inland Revenue Act.”

Predominantly taking a corporate view of the bill, she said,” Considering the financial situation of the country, I think that everyone has to pay more tax. That is a policy issue and I don’t have any problems with that. But we are concerned about proposed provisions on deductions, tax administration and taxpayer rights. The bill is attempting to collect taxes from those who are already paying and deny legitimate deductions that are incurred in the production of income. For example, in terms of new provisions, interest is considered to be a revenue expense and it is not a capital expense because it is basically what you pay for use of money for a year; and so it’s revenue. When it comes to capital assets it bears a condition that it has to be in use. I think that they have actually restricted this because interest is not a capital expense; it is not something you need to capitalize on because the new law recognises it as a revenue expense under section 12 and allows you a deduction. So I think it is a more restrictive deduction than an enabling provision.”

Further speaking she said,” There is a lot of significant uncertainty right now as to how exchange rate gains and losses are taxed. If one had losses why not allow those losses against gains and allow taxes to be paid on a net amount considering the very high rate of tax? The corporates are very concerned about such subtle non-deductions.”

“You should put your effort into actually broad-basing the tax net, but you are going after the people who are paying taxes. Shouldn’t that time and effort be actually spent on looking at people who are not paying taxes and who don’t have files?”

“Going to the Inland revenue Department and getting an estimate is a very judgmental call now. If you are saying that my profits this year are going to be lesser than last year, and therefore, I am estimating lower. If the assessor disputes that and the taxpayer has to go to the Tax Appeals Commission, it is an additional burden on a compliant taxpayer. We are getting crazy kind of assessments which are not defendable. IRD has a period of 30 months to make an assessment, but the tax payer is given only 14 days to analyse it, do the legal consulting and draft the appeal and submit it. That is very unfair. If the process is to be tightened then let’s reduce the time given to IRD to dispute the tax return to 18 months and make it more efficient. I think taxpayers need an independent body where they can go to and get a fair hearing before they go to the Tax Appeals Commission,” she said.

Sulaiman Nisthar, partner-tax, Ernst & Young said that agro farming, agro- processing and agro manufacturing would continue to enjoy tax concessions, but the definitions of these wordings need to be carefully evaluated.

Suresh Perera, principal of the tax and regulatory division of KPMG Sri Lanka said,” A particular provision of the bill gives draconian powers to the Commissioner General of IRD to come up with an estimate and there is no provision for it to be challenged. You have to pay taxes according to that estimate and if you don’t pay, then it is considered non-compliance. You don’t have a holdover relief position. In such a situation, you get only an extension period of six months to pay that amount. This is going to be a methodology for Commissioner General to collect taxes; just make any estimate that he wants which can’t be challenged. This is something that you need to act now and not later on because once this becomes law under article 88(3) of the Constitution, it will be too late to do anything about it.”

Duminda Hulangamuwa, senior partner and head of tax, Ernst Young & Sri Lanka said, “We made representations to the President, the Governor of the Central Bank and the Treasury Secretary on behalf of middle income individuals who are liable to pay high taxes when the new bill becomes law, but the message we got from them was they also didn’t like to increase taxes, but they were left with no other choice given the current economic realities and discussions with the IMF.”

Business

HNB Finance bags 2 CMA Reporting Awards 2025

HNB Finance PLC has been honoured with two prestigious accolades at the CMA Excellence in Integrated Reporting Awards 2025, reaffirming the company’s commitment to transparency, good governance, and integrated business performance.

At this year’s ceremony, HNB Finance PLC was awarded Second Runner Up – joint in the category of “Best Integrated Report , Finance and Leasing Sector”, and also received a Merit Award in recognition of its continued efforts to enhance reporting quality and strengthen stakeholder communication.

The CMA Excellence in Integrated Reporting Awards, organised annually by the Institute of Certified Management Accountants (CMA) of Sri Lanka, acknowledge organisations that demonstrate superior financial reporting standards aligned with global best practices. Winners are assessed on key criteria such as financial performance and strategic management, corporate governance and compliance, innovation and digital transformation, sustainability practices, and professional excellence.

Chaminda Prabhath, Managing Director/CEO of HNB Finance PLC, commented on the recognition, “These awards reaffirm our commitment to upholding the highest standards of integrated reporting and transparent financial disclosure. At HNB Finance, we remain focused on delivering sustainable long-term value through robust governance frameworks, prudent financial management, and continuous innovation. The acknowledgement by CMA Sri Lanka reflects the disciplined efforts of our teams across the organization and motivates us to further enhance our reporting quality, strengthen ESG integration, and reinforce our stakeholder centric approach.”

Business

ComBank joins ‘Liya Shakthi’ scheme to further empower women-led enterprises

The Commercial Bank of Ceylon has reaffirmed its long-standing commitment to advancing women’s empowerment and financial inclusion, by partnering with the National Credit Guarantee Institution Limited (NCGIL) as a Participating Shareholder Institution (PSI) in the newly introduced ‘Liya Shakthi’ credit guarantee scheme, designed to support women-led enterprises across Sri Lanka.

The operational launch of the scheme was marked by the handover of the first loan registration at Commercial Bank’s Head Office recently, symbolising a key step in broadening access to finance for women entrepreneurs.

Representing Commercial Bank at the event were Mithila Shyamini, Assistant General Manager – Personal Banking, Malika De Silva, Senior Manager – Development Credit Department, and Chathura Dilshan, Executive Officer of the Department. The National Credit Guarantee Institution was represented by Jude Fernando, Chief Executive Officer, and Eranjana Chandradasa, Manager-Guarantee Administration.

‘Liya Shakthi’ is a credit guarantee product introduced by the NCGIL to facilitate greater access to financing for women-led Micro, Small, and Medium Enterprises (MSMEs) that possess viable business models and sound repayment capacity but lack adequate collateral to secure traditional bank loans. Through NCGIL’s credit guarantee mechanism, Commercial Bank will be able to extend credit to a wider segment of women entrepreneurs, furthering its mission to drive inclusive economic growth.

Business

Prima Group Sri Lanka supports national flood relief efforts with over Rs. 300 Mn in dry rations

Prima Group Sri Lanka has pledged assistance valued at over Rs. 300 million, providing essential Prima food products to support communities affected by the recent floods across the island. This relief initiative is being coordinated through the Ministry of Defence to ensure the timely and effective distribution of aid to impacted families.

As part of this commitment, Prima Group Sri Lanka donated a significant stock of Prima dry rations to the Government of Sri Lanka on 30 November. The consignment will be distributed across multiple severely impacted districts. These supplies will support families facing disruptions to daily life, ensuring they receive assistance as recovery efforts continue.

The handover took place at the Ministry, where the donation was received by the Secretary of Defence, Air Vice Marshal (Retired) Sampath Thuyacontha. Representing Prima Group Sri Lanka, Sajith Gunaratne – General Manager of Ceylon Agro Industries Limited, and Sanjeeva Perera – General Manager of Ceylon Grain Elevators PLC, officially presented the donation.

Prima Group has been standing with the people of Sri Lanka for over 40 years, and this donation reflects its broader commitment to the nation during challenging times. As relief operations continue across the island, the company remains focused on helping families rebuild their lives and supporting the ongoing recovery process in collaboration with the Government Authorities.

-

News5 days ago

Lunuwila tragedy not caused by those videoing Bell 212: SLAF

-

News4 days ago

News4 days agoLevel III landslide early warning continue to be in force in the districts of Kandy, Kegalle, Kurunegala and Matale

-

Latest News6 days ago

Latest News6 days agoLevel III landslide early warnings issued to the districts of Badulla, Kandy, Kegalle, Kurunegala, Matale and Nuwara-Eliya

-

Features6 days ago

Features6 days agoDitwah: An unusual cyclone

-

Latest News7 days ago

Latest News7 days agoUpdated Payment Instructions for Disaster Relief Contributions

-

News2 days ago

News2 days agoCPC delegation meets JVP for talks on disaster response

-

Business2 days ago

Business2 days agoLOLC Finance Factoring powers business growth

-

News2 days ago

News2 days agoA 6th Year Accolade: The Eternal Opulence of My Fair Lady