News

Lanka should aim for revenues of 12-pct of GDP, avoid shortfalls: IMF

Sri Lanka should aim to get state revenues more than 12 percent of gross domestic product and avoid revenue shortfalls next year, International Monetary Fund Senior Mission Chief Peter Breuer said.

Sri Lanka projected revenues (including non-tax) of 3,408 billion rupee (11.3 -pct of GDP) and the IMF 3,286 billion rupees (about 10.9-pct).Up to July revenues were up 39 percent and tax revenues were up 43 percent, but IMF expects year end revenues to be 15 percent below target.

“Clearly the objective is not to let it happen next year and make up for that shortfall,” Breuer told reporters after Sri Lanka and the IMF reached a staff level agreement incorporating the next set of targets and reforms.

“So, one of the objectives is to get revenue that exceeds 12 percent of GDP and accordingly measures will have to be implemented to achieve that objective.”

Sri Lanka has met all quantitative targets, except for the June indicative revenue target, and most structural benchmarks required up to June have been completed, Breuer said. The new staff level agreement will set the targets and reforms for the next phase of the program.

In 2020 in the worst deployment of macro-economic policy by the country’s official economists and their advisors from the private sector, taxes were also cut on top of rates, eventually driving the country to external default. Revnues collapsed from 11.9 percent in 2019 to about 8.5 percent of GDP by 2021.

As forex shortages build up, Sri Lanka’s economic bureaucrats also ban vehicle and non-essential imports, hitting revenues and further worsening the fiscal picture, in an cascading policy error that repeats often, an economic observer said.

Car imports are still banned

Sri Lanka has now slammed high rates of progressive income tax which are hitting employed workers in the corporate sector, triggering a brain drain, particularly of professionals with young children who cannot make ends meet and keep paying housing loans. There are no exemptions for dependents.

A steep currency collapse has also hit alcohol consumption, with industry officials indicating a 40 percent drop from pre-crisis levels, though some firms are said to be avoiding paying collected taxes amid corrupt practices.

The IMF has recommended a series of reforms in a governance diagnostic report including for revenue authorities. Sri Lanka will have to implement “compensating measures” and improve tax administration to get more revenues, the IMF team said.

In the first stabilization year after rate cuts trigger a currency crisis, revenues are difficult to raise due to the slowdown. This year the economy is contracting and revenues are driven partly by inflation, analysts note.

Latest News

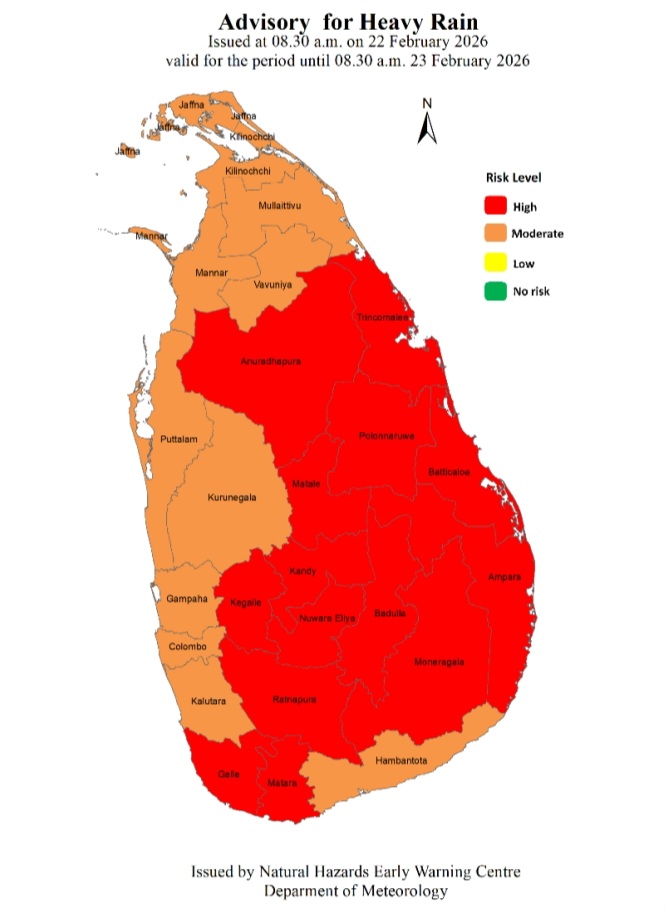

Advisory for Heavy Rain issued for the Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts

Advisory for Heavy Rain Issued by the Natural Hazards Early Warning Centre at 08.30 a.m. on 22 February 2026 valid for the period until 08.30 a.m. 23 February 2026

Due to the influence of the low level atmospheric disturbance in the vicinity of Sri Lanka, Heavy showers above 100 mm are likely at some places in Central, Uva, Sabaragamuwa, Eastern and North-central provinces and in Galle and Matara districts.

Therefore, general public is advised to take adequate precautions to minimize damages caused by heavy rain, strong winds and lightning during thundershowers

News

Matara Festival for the Arts’ inaugurated by the Prime Minister

The inaugural ceremony of the Matara Festival for the Arts, featuring a wide range of creations by local and international artists, was held on February 19 at the Old High Court premises of the Matara Fort, under the patronage of Prime Minister Dr. Harini Amarasuriya.

The festival, centred around the Old High Court premises in Matara and the auditorium of the Matara District Secretariat, will be open to the public from 20 to 23 of February. The festival will be featured by visual art exhibitions, short film screenings, Kala Pola, and a series of workshops conducted by experts.

The inaugural event was attended by the Minister of Women and Child Affairs, Ms. Saroja Paulraj, along with artists, guests, and a large number of schoolchildren.

(Prime Minister’s Media Division)

News

Only single MP refuses salary as Parliament details pays and allowances

Only one Member of Parliament has chosen not to receive the salaries and allowances entitled to MPs, Prime Minister Dr. Harini Amarasuriya revealed in Parliament last Thursday, shedding light on the financial perks enjoyed by members of the Tenth Parliament.

Speaking on Thursday (Feb. 19) in response to a question from SJB Badulla District MP Chaminda Wijesiri, the Prime Minister outlined the full range of pay and allowances provided to parliamentarians.

According to Dr. Amarasuriya, MPs receive a monthly allowance of Rs. 54,285, an entertainment allowance of Rs. 1,000, and a driver’s allowance of Rs. 3,500—though MPs provided with a driver through the Ministry of Public Security and Parliamentary Affairs are not eligible for the driver’s allowance.

Additional benefits include a telephone allowance of Rs. 50,000, a transport allowance of Rs. 15,000, and an office allowance of Rs. 100,000. MPs are also paid a daily sitting allowance of Rs. 2,500 for attending parliamentary sessions, with an additional Rs. 2,500 per day for participation in parliamentary sittings and Rs. 2,500 per day as a committee allowance.

Committee meetings held on non-parliament sitting days also attract Rs. 2,500 per day.

Fuel allowances are provided based on the distance between an MP’s electoral district and Parliament. National List MPs are entitled to a monthly allocation equivalent to 419.76 litres of diesel at the market price on the first day of each month.

Despite the comprehensive benefits, only SJB Badulla District MP Nayana Wasalathilaka has opted not to draw a salary or allowances. Dr. Amarasuriya said that in accordance with a written notification submitted by MP Wasalathilaka on August 20, 2025, payments have been suspended since that date.

The Prime Minister also confirmed that she, along with the Speaker, Deputy Speaker, committee chairs, ministers, deputy ministers, the Opposition Leader, and senior opposition whips, have all informed the Secretary-General of Parliament in writing that they will not claim the fuel allowance.

Challenging the ruling party’s voluntary pledge to forgo salaries, MP Wijesiri pointed out that all MPs except Wasalathilaka continue to receive their salaries and allowances. “On one hand you speak about the people’s mandate, which is good. But the mandate also included people who said they would voluntarily serve in this Parliament without salaries. Today we have been able to prove, Hon. Speaker, that except for one SJB MP, the other 224 Members are drawing parliamentary salaries,” he said.

The Prime Minister responded by defending the political culture and practice of allocating portions of MPs’ salaries to party funds. Referring to previous practices by the JVP and NPP, she said: “It is no secret to the country that the JVP has for a long time not personally taken MPs’ salaries or any allowances. I think the entire country knows that these go to a party fund. That is not new, nor is it something special to mention. The NPP operates in the same way. That too is not new; it is the culture of our political movement.”

When MP Wijesiri posed a supplementary question asking whether diverting salaries to party funds was an indirect method of taking care of MPs, Dr. Amarasuriya said: “There is no issue there. No question was raised; the Member made a statement. What we have seen throughout this week is an inability to understand our political culture and practice, and a clash with decisions taken by political movements that misused public funds. What is coming out is a certain mindset. That is why there is such an effort to find fault with the 159. None of these facts are new to people. He did not ask a question, so I have nothing to answer.”

The disclosures come days after the Government moved to abolish the parliamentary pension, a measure that has sparked renewed debate over MP compensation and the transparency of funds allocation.

-

Features24 hours ago

Features24 hours agoWhy does the state threaten Its people with yet another anti-terror law?

-

Business7 days ago

Business7 days agoMinistry of Brands to launch Sri Lanka’s first off-price retail destination

-

Features24 hours ago

Features24 hours agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features24 hours ago

Features24 hours agoReconciliation, Mood of the Nation and the NPP Government

-

Latest News2 days ago

Latest News2 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Features24 hours ago

Features24 hours agoVictor, the Friend of the Foreign Press

-

Latest News2 days ago

Latest News2 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News2 days ago

Latest News2 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction