Business

IMF promises Pakistan ‘immediate’ release of $1.1bn loan after key meet

Cash-strapped Pakistan is poised to receive a $1.1bn loan tranche from the International Monetary Fund (IMF) after a key meeting of the international lender’s executive board on Monday, even as economists have warned that the country needs deep reforms to reduce its dependence on overseas financial assistance.

Late on Monday night, Pakistan’s Ministry of Finance and the IMF confirmed that the lender had approved the ‘immediate disbursement’ of a $1.1bn tranche that completes a total loan of $3bn agreed to under a deal inked last year.

But the approval came with firm words from the IMF. “To move Pakistan from stabilization to a strong and sustainable recovery the authorities need to continue their policy and reform efforts, including strict adherence to fiscal targets while protecting the vulnerable; a market-determined exchange rate to absorb external shocks; and broadening of structural reforms to support stronger and more inclusive growth,” the organisation said in a statement.

The bailout followed a meeting between Pakistani Prime Minister Shehbaz Sharif and IMF Managing Director Kristalina Georgieva, on the sidelines of the World Economic Forum meeting in Riyadh on Sunday.

Sharif’s government had sought a new IMF deal after the current $3bn standby arrangements (SBA) with the global lender expired on April 11.

Hours after the IMF approved the funding, Sharif on Tuesday said disbursement will bring increased economic stability to Pakistan. The bailout from the IMF proved important to save the country from default, the country’s state broadcaster quoted the prime minister as saying.

Pakistan has been reeling from a severe economic crisis for more than two years, with its inflation at one point shooting up to nearly 38 percent and its foreign currency reserves depleted to $3bn in February 2023, enough to cover less than five weeks of imports.

In June last year, Sharif was able to avoid a sovereign default when he secured the IMF bailout, pushing the current forex reserves to almost $8bn, according to the latest central bank data.

Khaqan Najeeb, a former adviser to the Finance Ministry, told Al Jazeera the performance of Pakistan’s $350bn economy in the past nine months has shown that the country’s meagre foreign reserves have increased and that inflation which was at 20 percent in March, has reduced, though slowly.

“Broadly, we can define Pakistan’s economic situation as macro-stabilisation, which is a consequent effect of adjustment policies, but it also means that growth is expected to remain slow and hover around 2 percent,” he said.

Leading Pakistani economist Kaiser Bengali, however, had reservations about the economic outlook as he questioned the sustainability of the current policies, wanting to see more structural reforms.

Bengali called the current economic indicators a “mirage”, adding that the perceived stability was due to the prospect of more loans coming in.

“If the so-called stability was due to a rise in exports or better inflow of dollars, that would have been meaningful but that is not happening. What we are seeing right now is a temporary situation, where the market is responding to day-to-day information,” he told Al Jazeera.

“The economy cannot run on merely an inflow of loans. How will we repay all our [existing] loans?”

Pakistan’s external debt obligations currently stand at more than $130bn, with Lahore-based economist Hina Shaikh fearing the current policy of using more debt to address fiscal deficit will create more inflation.

“Without a commitment to initiate reforms that rationalise expenditures and expand the tax net to increase tax revenues, the macroeconomic situation will not change much. Unless more goods are produced and there is real growth – that is exports see a boost, manufacturing takes place, there are productive employment opportunities – inflation will remain on the rise,” she told Al Jazeera.

Bengali said recent Pakistani governments had a single-point agenda of figuring out “where to get new loans to pay the past loans”.

“Public sector development has been left behind. In the last four decades, there has barely been any major project for health, education or housing,” he said.

Najeeb, the former government adviser, said the main challenge for the country in the coming days was to put together a framework that could result in growth “based on productivity and investment”.

“We must remember that Pakistan already owes them [IMF] $7bn,” he added.

Bengali signed off with a warning: Even the IMF could be reluctant to put in large sums of money to help Pakistan come out of its financial crisis.

“No bank will give you loans indefinitely, especially when they see a deteriorating balance sheet,” he said.

(Aljazeera)

Business

NDB reports all-time high earnings; doubles PAT on a normalised basis

National Development Bank PLC (hereinafter ‘the Bank’) announced its results for the financial year ended December 31, 2025 to the Colombo Stock Exchange recently. Full year results tabled by the Bank showcase a strong growth across all business lines with Net Banking Revenue increasing by a 45.2% on a comparable basis.

Like most other peers, the Bank’s 2024 financial performance was positively impacted following the successful conclusion of the ISB debt restructure with a one-off impact on interest income, fee income and net impairments amounting to LKR 1.4 billion, LKR 0.7 billion and LKR 9.4 billion, respectively for the said year.

Fund based income

Net interest income (NII), which accounts for close to 75.0% of Bank’s total operating income, grew by 6.5% on a normalised basis. Despite pressure on interest-earning assets arising from the lower interest rate environment, the Bank’s disciplined margin management helped stabilise Net Interest Margin (NIM) at 4.0% for the year. On a comparable basis, excluding one-off exceptional items, NIM stood at 4.2%, compared to 4.3% for both scenarios in 2024. By the end of the year, the Bank had close to LKR 29.3 billion in Loans and Deposits under a special arrangement with its customer(s) with a netting-off feature (end 2024: LKR 19.6 billion).

Non-fund based income

Net fee and commission income reached LKR 8.1 billion for the year – representing a growth of 14.3% from LKR 7.1 billion in 2024 excluding ISB restructuring related fees. Key growth drivers for the current year were trade finance, credit and lending, digital banking and credit and debit cards.

Credit and operating costs

Credit costs for the year amounted to LKR 5.7 billion, reflecting a substantial reduction of 57.1% compared to LKR 13.2 billion in 2024, a testament to the Bank’s strong credit underwriting practices and focused efforts on collections and recoveries. The Bank’s success on account of the latter is best reflected in notably improved stage 2 and 3 loan stock which stood at 7.9% and 10.8% respectively at end 2025 as compared with 16.6% and 14.0% at end 2024. Stage 3 provision coverage also saw further improvement to 59.1% from 54.5% during 2024 showcasing the Bank’s prudent management of credit risk.

Operating expenses closed at LKR 19.0 billion for the year, marking a 13.1% YoY increase. This increase was primarily driven by routine staff-related increments and necessary market realignments, along with higher investments in IT infrastructure and business development undertaken during the year.(NDB)

Business

PMF Finance appoints Nishani Perera as Non-Executive Independent Director

PMF Finance PLC has announced the appointment of Ms. Nishani Perera as a Non-Executive Independent Director, further strengthening the Company’s strategic oversight, governance framework, and board-level expertise as it continues to advance its transformation and long-term growth agenda.

Ms. Perera is a Fellow Member of the Institute of Chartered Accountants of Sri Lanka and brings over 19 years of experience across audit, assurance, advisory, risk management, and corporate governance. She currently serves as Partner – Audit & Assurance at Moore Aiyar and as Director of Moore Consulting (Pvt) Ltd.

Over the course of her career, Ms. Perera has gained substantial exposure to listed companies, banks, finance companies, and other regulated entities. Her areas of expertise include financial reporting under SLFRS/LKAS, audit and risk oversight, regulatory compliance, and the implementation of quality management standards. She has worked closely with Boards of Directors and Audit Committees on matters relating to financial reporting integrity, internal control frameworks, enterprise risk governance, and adherence to evolving regulatory requirements.

Ms. Perera holds a Master of Laws (LL.M.) from Cardiff Metropolitan University in the United Kingdom and a Bachelor of Science in Business Administration (Special) from the University of Sri Jayewardenepura. She is also an Associate Member of ACCA and CMA Sri Lanka, and a Fellow Member of AAT Sri Lanka.

Business

Capital Alliance deepens capital market presence with third Closed-End Fund Listing at the CSE

The units of the “CAL Three Year Closed End Fund” were officially listed on the Colombo Stock Exchange (CSE) recently. Accordingly, a total of 841,263,375 units of the ‘CAL Three Year Closed End Fund’ were listed by Capital Alliance Investments Ltd (CALI), a member of the Capital Alliance Ltd Group (CAL Group). The listing was commemorated by way of a special bell ringing ceremony on the CSE trading floor.

CSE CEO Rajeeva Bandaranaike speaking at the occasion remarked upon the rising demand for Unit Trusts: “When you look at funds, particularly unit trusts in today’s active capital market, we see a lot of domestic interest in the market with more investors entering. Funds, not only fixed income funds but also growth and balanced funds, can be the ideal vehicle through which new investors can enter the market. We see this interest reflected in the success of CAL’s Three Year Closed End Fund. More people are seeking to invest their money through professional fund managers.”

-

Features4 days ago

Features4 days agoWhy does the state threaten Its people with yet another anti-terror law?

-

Features4 days ago

Features4 days agoReconciliation, Mood of the Nation and the NPP Government

-

Features4 days ago

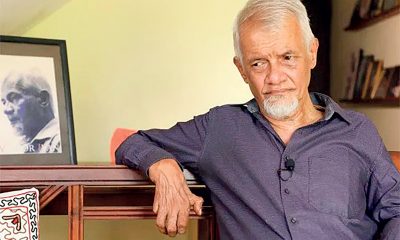

Features4 days agoVictor Melder turns 90: Railwayman and bibliophile extraordinary

-

Features3 days ago

Features3 days agoLOVEABLE BUT LETHAL: When four-legged stars remind us of a silent killer

-

Features4 days ago

Features4 days agoVictor, the Friend of the Foreign Press

-

Latest News5 days ago

Latest News5 days agoNew Zealand meet familiar opponents Pakistan at spin-friendly Premadasa

-

Latest News5 days ago

Latest News5 days agoTariffs ruling is major blow to Trump’s second-term agenda

-

Latest News6 days ago

Latest News6 days agoECB push back at Pakistan ‘shadow-ban’ reports ahead of Hundred auction