Business

Has Sri Lanka’s crisis-driven import controls incentivised import substitution?

By Dr Asanka Wijesinghe and Nilupulee Rathnayake

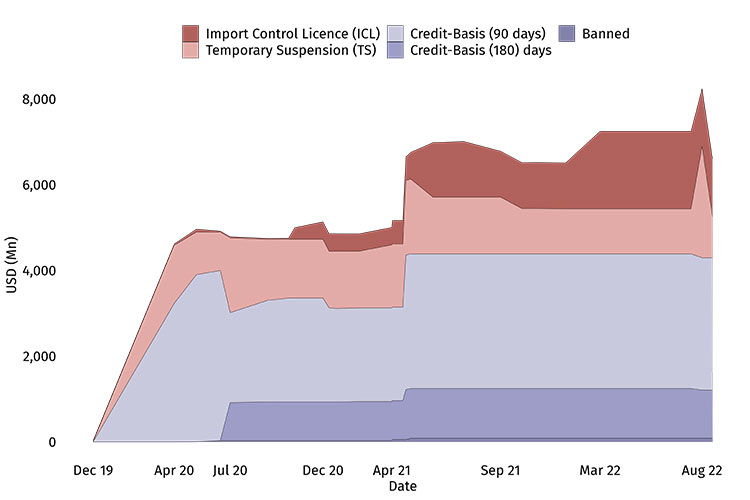

In response to the economic crisis, Sri Lanka implemented import controls that expanded significantly by the end of 2022, accounting for approximately 30% of the country’s total import value (Figure 1). The controls affected various categories, including consumption goods (46%), intermediate goods (31%), and capital goods (24%). As Sri Lanka gradually eases these controls, questions arise about the necessity of this strategy and its impact on economic growth.

Was implementing import controls a necessary strategy or the easiest option available to the government?

Were import controls applied optimally to limit damaging effects on growth?

Did they distort incentives, thereby promoting domestic production of substitutable products?

To shed light on these concerns, a comprehensive analysis was conducted using a unique dataset comprising eight waves of import controls. These controls encompassed quantitative and price restrictions at a disaggregated product level using a range of Gazette notifications issued between April 2020 to September 2022.

To shed light on these concerns, a comprehensive analysis was conducted using a unique dataset comprising eight waves of import controls. These controls encompassed quantitative and price restrictions at a disaggregated product level using a range of Gazette notifications issued between April 2020 to September 2022.

Were Import Controls Necessary? Unravelling the Policy Objectives

The objective behind the successive rounds of controls remains unclear, with the government declaring different goals at different times. These ranged from reducing foreign currency outflows to promoting domestic production as import substitutes. As such, assessing their longer-term impacts in distorting the incentive structures is crucial. Interestingly, implementing import controls may have inadvertently encouraged import substitution, even without a protectionist intent. The complexity of the measures employed, including credit-based requirements, import licenses, suspensions, and bans, highlights the intricacies of controlling imports.

Several hypotheses prevail in determining the government’s import control preferences.

Sri Lanka’s heavy reliance on imported intermediate and capital goods for domestic consumption and export-oriented production means that these are more likely to be exempted from minimising adverse impacts on domestic production.

The large agricultural labour force has significant electoral importance, and to gain political support, the government may seize the opportunity to protect domestic food production.

If import substitution is the goal, the government will prioritise less complex products, which are easily substitutable given resource endowments and technical know-how. Thus, food items, for instance, are more likely to face import controls over highly complex products. It is worth noting that if subsequent rounds of import controls consistently include less complex food products without exemptions, it could indicate an underlying incentive structure that promotes import substitution.

Even without a protectionist motive, the import control design could inadvertently incentivise import substitution.

Our analysis revealed that the government’s import control policy preference favoured less complex products, consumer goods, and food items. This unintentionally created an incentive structure for import substitution, even without a protectionist intent. Persistent import controls on food products and low-tech manufacturing products like consumer electronics inflate domestic prices and create opportunities for higher profit margins. As these products are within the set of products that are easily substitutable for a country like Sri Lanka, which has a comparative advantage in low-tech manufacturing and a significant labour force in agriculture, import substitution might happen even without a policy intent.

Our analysis revealed that the government’s import control policy preference favoured less complex products, consumer goods, and food items. This unintentionally created an incentive structure for import substitution, even without a protectionist intent. Persistent import controls on food products and low-tech manufacturing products like consumer electronics inflate domestic prices and create opportunities for higher profit margins. As these products are within the set of products that are easily substitutable for a country like Sri Lanka, which has a comparative advantage in low-tech manufacturing and a significant labour force in agriculture, import substitution might happen even without a policy intent.

The quantitative analysis identified eight waves of import controls, which tightened over time and increased in coverage. The government’s targeting of food products, consumption goods, and less complex items was not always successful, particularly in the later waves of import controls. This can be attributed to a shrinking choice set available as control measures progressed. In some import control waves, the government extended import controls to encompass more intermediate and capital goods.

The process of import substitution typically follows a sequential pattern, starting with substituting easily replaceable products before moving on to more complex ones. Therefore, irrespective of the policy objective, the distortions introduced to the incentive structure align with observations from import substitution scenarios seen in countries like Sri Lanka.

Recommendations for Prioritising Import Control Revisions

As Sri Lanka gradually eases the import controls implemented during the economic crisis, it becomes crucial to prioritise the revision process. The deciding factors may be influenced by lobbying from industries reliant on restricted imports and feedback from industry and consumers. Our analysis suggests that revisions appear to prioritise intermediate and exempted food products, reflecting a policy preference for exempting intermediate imports .

To foster innovation and enable participation in global value chains, it is economically sensible to phase out import controls on intermediate goods. However, revisions should also target consumption goods, including food. Import controls inflate domestic prices, leading to the production of less complex consumer goods and food items for domestic consumption. This diverts resources away from export industries, impeding the country’s growth in the vital export sector.

To be Continued

Business

First Capital Holdings records Rs. 3.23Bn Total Comprehensive Income for 9M FY2025/26

First Capital Holdings PLC, a subsidiary of JXG (Janashakthi Group) and a pioneering force in Sri Lanka’s investment bank landscape recorded a Total Comprehensive Income of Rs. 3.23Bn for the nine months ended 31 December 2025, compared to Rs. 4.53Bn in the corresponding period of the previous year. For the third quarter of 2025/26, the Group reported a Total Comprehensive Loss of Rs. 0.17Bn, after accounting for a dividend tax expense of Rs. 0.41Bn.

The Group’s Net Income before Operating Expenses for the nine months of 2025/26 amounted to Rs.6.33Bn compared to Rs. 7.69Bn reported in the corresponding period of the previous year. Trading income was primarily driven by the Primary Dealer and Corporate Dealing Securities divisions, reinforcing the Group’s positioning across fixed income and equity market segments.

The Primary Dealer division reported a Profit after Tax of Rs. 1.64Bn for the nine months ended 31 December 2025 (1st nine months of 2024/25 – Profit after Tax of Rs. 2.45Bn). The results include trading gains on the government securities portfolio of Rs. 1.66Bn and net interest income of Rs. 1.41Bn (1st nine months of 2024/25 – trading gains of Rs. 3.18Bn and net interest income of Rs. 1.31Bn), reflecting movements in yields and trading conditions during the period.

The Corporate Finance Advisory and Dealing Securities division recorded a Profit after Tax of Rs. 1.86Bn for the nine months ended 31 December 2025 (1st nine months of 2024/25 – Profit after Tax of Rs. 1.94Bn). The business unit reported total trading gains of Rs. 2.33Bn on its equity portfolio, compared to Rs. 2.23Bn in the corresponding period of the previous year, supported by market participation and portfolio positioning.

The Wealth Management division reported a Profit after Tax of Rs. 78.1Mn for the nine months ended 31 December 2025 (1st nine months of 2024/25 – Profit after Tax of Rs. 90.1Mn). Assets under Management stood at Rs. 96.4Bn as at 31 December 2025, compared to Rs. 115.9Bn as at 31 March 2025, reflecting market conditions and client portfolio adjustments.

The Stock Brokering division recorded a Profit after Tax of Rs. 166.3Mn for the nine months ended 31 December 2025, compared to Rs. 39.5Mn reported in the corresponding period of the previous year, supported by increased trading activities.

Commenting on the Group’s performance, Rajendra Theagarajah, Chairman of First Capital Holdings PLC, stated, “The operating environment during the period was shaped by shifts in interest rates, capital market activities, and fiscal adjustments. Against this backdrop, the Group’s performance reflects the structural strength of its capital markets platform and its ability to generate income across multiple market cycles while maintaining financial discipline.”

Dilshan Wirasekara, Managing Director / CEO of First Capital Holdings PLC, said, “Our priority during the period was to manage each business line with a clear focus on risk, liquidity and execution. Improved performance in stock brokering and consistent contributions from corporate finance reflect our ability to respond to market conditions while aligning capital deployment with client and market opportunities.”

Business

Keells Nexus introduces an all new Loyalty App

Keells is set to usher a new chapter in customer experience with the relaunch of Keells Nexus with the introduction of its all-new loyalty app on 13th February. For 25 years, Keells Nexus has been at the heart of Sri Lankan retail, pioneering coalition loyalty and even introducing mobile-based loyalty as early as 2014. The loyalty program is building on this legacy, combining state-of-the-art technology with richer, more personalized rewards and seamless integration across the Keells ecosystem with an intuitive mobile experience.

Today, Keells Nexus stands at over 2 million registered members, a reflection of the trust customers place in Keells and the brand’s commitment to improving the quality of life for the nation. The launch further strengthens Keells’ long-standing focus on tech-enabled retail efficiency, following innovative retail experiences to customers such as self-checkout counters and retail technology that drives efficiency such as advanced inventory management systems.

The new app therefore is the next logical step in this journey, bringing together rewards, offers, and account visibility in one intuitive, streamlined interface. The new Keells Nexus app brings together all deals, savings and partner offers in one place, giving customers complete visibility and control. Members can track their points in real time, scan a QR code at checkout to earn rewards instantly, and enjoy a more personalised, more connected shopping experience.

“At the heart of Keells Nexus is a simple but powerful belief that life is better when we’re connected,” said Nilusha Fernando Head of Marketing, Keells Supermarkets & Senior Vice President, John Keells Group.

Business

IDL, Clouds by SOZO and the Rukmini Tissanayagam Trust partner with the HSBC Ceylon Literary & Arts Festival 2026

The HSBC Ceylon Literary & Arts Festival 2026, taking place from 13 to 15 February at Cinnamon Lakeside, Colombo, promises to be one of those rare cultural moments that linger long after the last session ends. It is a gathering not only of writers, artists and thinkers, but of ideas, shared, challenged and celebrated in spaces where curiosity feels welcome.

The HSBC Ceylon Literary & Arts Festival 2026 is supported by several organizations through non-promotional CSR initiatives, including Clouds by SOZO and the Rukmini Tissanayagam Trust. International Distillers Limited contributes in a strictly neutral CSR capacity, providing logistical and resource support for the event without any brand promotion or product visibility.

The Festival celebrates Sri Lanka’s creative voice by showcasing literature, arts, and cultural talent from across the country. All supporting organizations participate solely in a philanthropic and educational role, ensuring that the focus remains on artistic expression and community engagement.

The Rukmini Tissanayagam Trust brings to the Festival a deep and enduring commitment to nurturing literature and the arts as essential pillars of society. Its work is driven by the belief that creative spaces are not optional additions, but vital platforms that shape how communities think, feel and engage with the world around them.

Speaking on this collaboration, Indhu Selvaratnam, Director of SOZO Beverages and Trustee

of The Rukmini Tissanayagam Trust, stated, “The Rukmini Tissanayagam Trust is delighted to partner with the Ceylon Literary Festival for the second time. We are deeply committed to enriching Sri Lanka’s intellectual and cultural landscape and admire the festival’s evolution in embracing literature, art, music, and initiatives that nurture emerging local talent. These efforts align closely with the Trust’s mission to support creative expression, and we look forward to continuing our support as the festival strengthens Sri Lanka’s global cultural presence.”

Adding a complementary dimension to this partnership is Clouds by SOZO, Sri Lanka’s premium mountain spring water brand, whose ethos of purity, sustainability and thoughtful living aligns naturally with the spirit of the Festival. Sourced from a pristine spring in the Knuckles mountain range, Clouds represents a return to authenticity, an idea that resonates strongly within creative and cultural spaces.

Speaking on the partnership, Dushyantha De Silva, Founder of SOZO Beverages (Pvt) Ltd, said, “The arts invite us to slow down, to observe, and to think more deeply, and Clouds comes from that same place of intention. Supporting the HSBC Ceylon Literary & Arts Festival is about being part of a space where ideas flow freely and thoughtfully. It’s a privilege for us to align with a platform that values creativity, dialogue and conscious choices.”

The HSBC Ceylon Literary & Arts Festival 2026 offers something increasingly rare: three uninterrupted days of ideas. Of language and imagination. Of conversations that do not require a screen to feel alive. It is a reminder of the power of gathering, of listening, discovering and engaging with perspectives that challenge and inspire.

As February approaches, the hope is simple: that more people choose to attend, to listen, and to support Sri Lankan creativity in all its forms. Because when a country invests in its writers and artists, it is not merely celebrating talent, it is shaping how it remembers, how it questions, and how it evolves.

-

Features5 days ago

Features5 days agoMy experience in turning around the Merchant Bank of Sri Lanka (MBSL) – Episode 3

-

Business6 days ago

Business6 days agoZone24x7 enters 2026 with strong momentum, reinforcing its role as an enterprise AI and automation partner

-

Business5 days ago

Business5 days agoRemotely conducted Business Forum in Paris attracts reputed French companies

-

Business5 days ago

Business5 days agoFour runs, a thousand dreams: How a small-town school bowled its way into the record books

-

Business5 days ago

Business5 days agoComBank and Hayleys Mobility redefine sustainable mobility with flexible leasing solutions

-

Business2 days ago

Business2 days agoAutodoc 360 relocates to reinforce commitment to premium auto care

-

Business6 days ago

Business6 days agoHNB recognized among Top 10 Best Employers of 2025 at the EFC National Best Employer Awards

-

Midweek Review2 days ago

Midweek Review2 days agoA question of national pride